The World Health Organization in Africa is holding virtual hackathons and offering up to $20,000 in seed-funds to finalists with digital solutions to stem COVID-19.

The regional office of the UN agency completed its first challenge earlier this month and will host a second, for French speaking Africa, in coming weeks, WHO’s Technical Officer Moredeck Chibi told TechCrunch.

According to Dr. Chibi, the WHO-AFRO Digital Hackathon series aims to prompt tech applications — with specificity to Africa — to curb the spread and negative impact of COVID-19 — which began to spike on the continent in March.

For the first virtual challenge, WHO selected participants via an online application process and split them into teams via Zoom. Groups were tasked with developing scalable concepts aligned with WHO’s current COVID-19 response strategy, which includes infection prevention and control, case management, surveillance and continuity of health services.

The winning hackathon group, led by Ghanaian Entrepreneur Laud Basing, developed a screening tool concept — operable via mobile app or USSD code — that maps COVID-19 test cases, classifies them according to risk and provides data to national authorities to plan responses. The team will receive $10,000 from the WHO to pilot their concept, and support in locating additional funding and expertise.

Image Credits: World Health Organization Africa

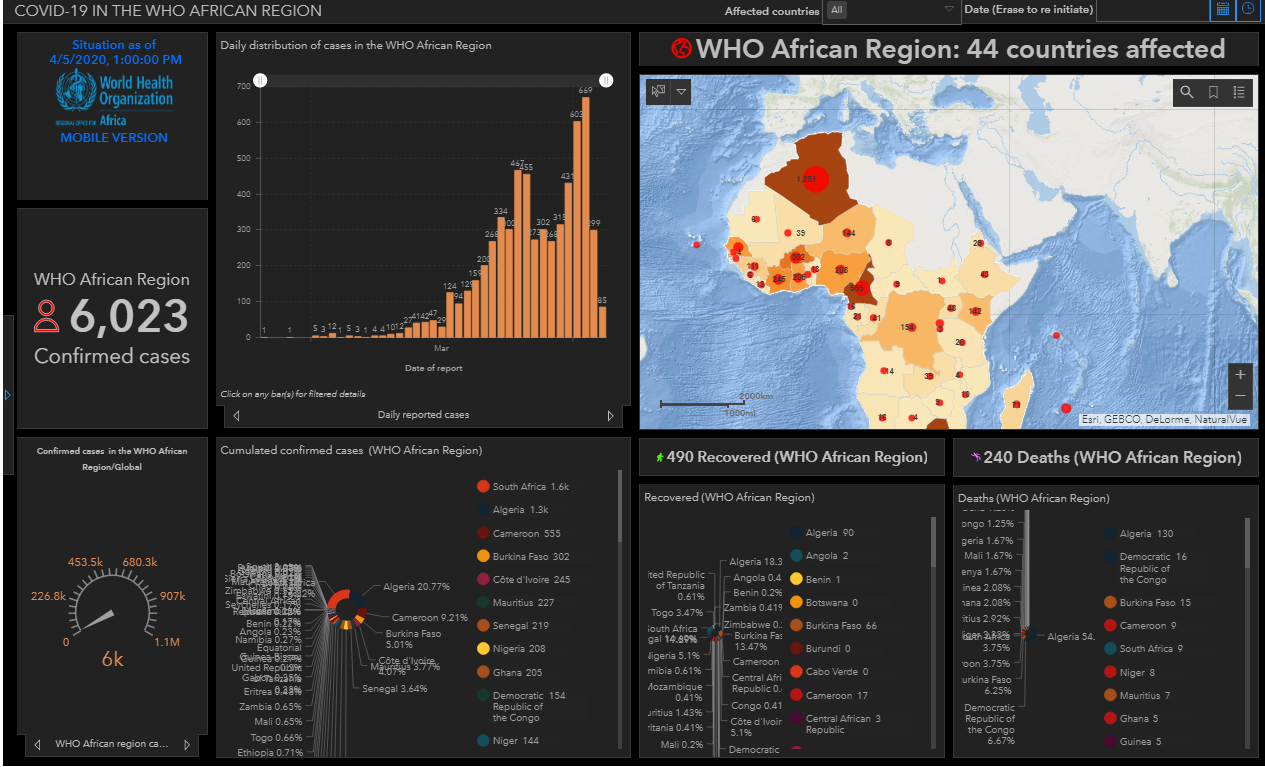

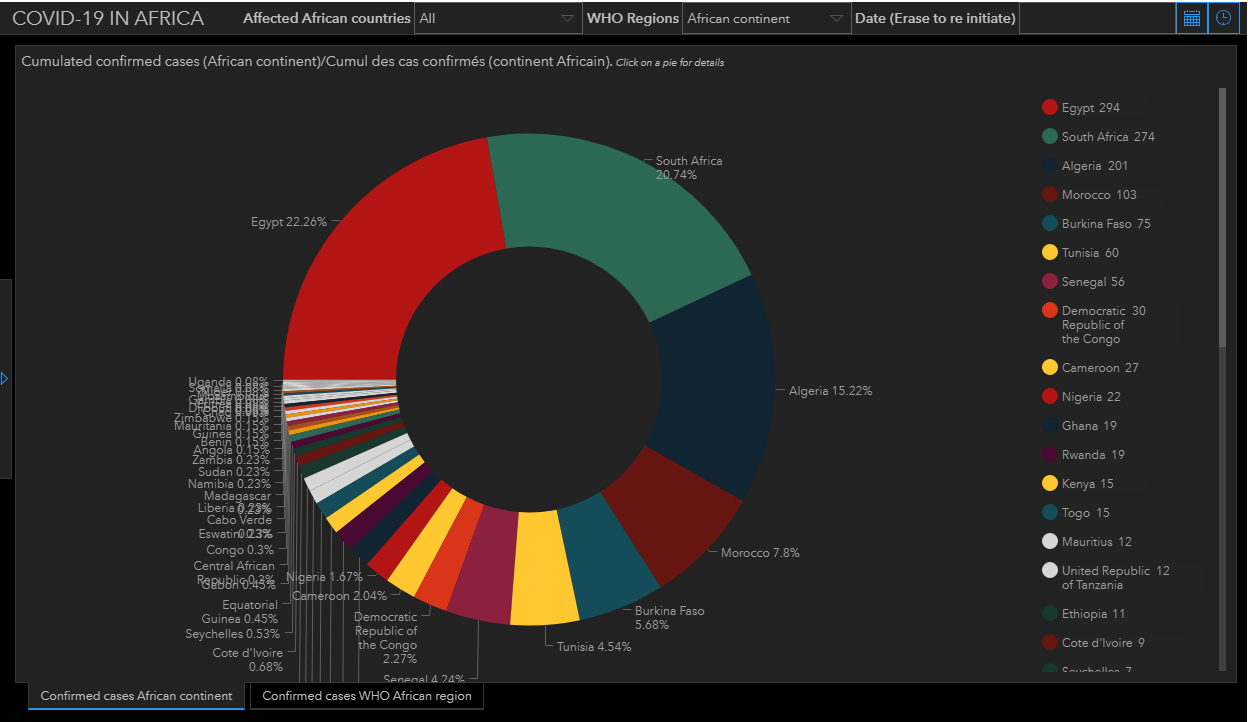

WHO aggregates coronavirus data on its Africa incident tracking database.

Early in March, the continent’s COVID-19 cases by country were in the single digits, but by mid-month those numbers had jumped — leading the WHO’s Regional Director for Africa Dr. Matshidiso Moeti to sound an alarm on the virus at a March 19 press conference. She noted at the beginning of March there were only five countries in Sub-Saharan Africa with cases. That had grown to 30 by mid-month and now stands at 44.

By the World Health Organization’s stats Monday there were 6023 COVID-19 cases in Sub-Saharan Africa and 240 confirmed deaths related to the virus, up from 463 cases and 8 deaths on March 18.

The hardest hit country so far, South Africa, has gone into a government enforced lockdown.

As COVID-19 spreads in Africa’s major economies, policy-makers and founders have looked to the continent’s tech sector to shapes responses.

The central banks of Ghana and Kenya have turned to mobile-money as a public-health tool, adopting measures to shift a greater volume of transactions toward digital payments and away from cash — which the World Health Organization flagged as a conduit for coronavirus.

Africa’s largest incubator, CcHub, launched a fund and open call for tech projects aimed at curbing COVID-19 and its social and economic impact.

And Pan-African e-commerce company Jumia has offered African governments use of its last-mile delivery network for distribution of supplies to healthcare facilities and workers.

The WHO’s COVID-19 related Africa hackathons aren’t the first time the organization has turned to the continent’s techies. In 2019, the Geneva based body launched the WHO Innovation Challenge — a competition to shape “home-grown innovations with potential to solve African health challenges”. It drew 2400 entries from 44 countries.

Those interested in pitching a solution to the World Health Organization’s next hackathon in response to COVID-19 can contact WHO’s regional Africa office.

For now, the information provided by Safaricom is a bit sparse on the why and how of the partnership between the American company and East African mobile, financial and ISP provider.

For now, the information provided by Safaricom is a bit sparse on the why and how of the partnership between the American company and East African mobile, financial and ISP provider.