Discover strategies to increase product feature usage, improve customer retention, and drive growth through effective user engagement and education. Read more »

The post Overcoming the 20% feature usage challenge appeared first on Mind the Product.

What Product Managers are talking about.

Discover strategies to increase product feature usage, improve customer retention, and drive growth through effective user engagement and education. Read more »

The post Overcoming the 20% feature usage challenge appeared first on Mind the Product.

As a Product Manager, don’t you ever wish you could get inside your customers’ heads and pull out their pain points, desires, and needs surrounding your product?

Although you can’t jump inside the minds of your customers Inception-style, you can gather all their thoughts related to your product through a Customer Advisory Board (CAB).

Establishing a CAB gives you access to a hand-picked group of customers who can gift you with key insights into how they view your product. Customer Advisory Boards are a great way to capture useful data to drive innovations and improvements.

When you use a CAB, there’s far less guesswork about what your audience base wants you to do to push your product forward. That said, managing your Customer Advisory Board can be a little tricky.

Here are some tips on Customer Advisory Board best practices to help to turn your CAB into your ultimate weapon.

We’ll cover:

A Customer Advisory Board is a group of current customers that meet regularly to discuss your product. It’s made up of people who represent the varied demographics, firmographics and use cases of your customer base. This group will share how your product meets their needs and expectations and provide feedback on how the product can be improved.

As the Product Manager, you should engage with this group of customers in regularly scheduled meetings. These sessions are goldmines and can give you the highest quality, most valuable insights to inform your product planning and ensure that the product you’re developing perfectly matches what users want and need.

Every feature of your product should be created to benefit your customers. To do that, and to make sure you don’t become a Feature Factory churning out unneeded updates, you need a good understanding of what users need.

As a Product Manager, you don’t want to be shooting in the dark about what you think customers want. You know this right?

You probably have a bunch of different feedback channels right now. Maybe you have one of ProdPad’s Customer Feedback Portals, or you’re pulling in feedback from your support tool. Possibly you have a few in-app feedback prompts, or you join the odd customer call.

But a Customer Advisory Board can be one of the most valuable and fruitful feedback mechanisms available to you, especially when following Customer Advisory Board best practices. If you haven’t already established a CAB, we strongly recommend that you do!

But why are the thoughts of one small group of customers so valuable? Well, if you’ve followed Customer Advisory Board best practices, their feedback will be illustrative of your entire customer base. Addressing the concerns of those people in your CAB will likely appease your entire customer base too.

Simply put, having a Customer Advisory Board can seriously supercharge your feedback game and become a key part of your Customer Feedback Strategy.

We’ll be honest with you now. Putting together and maintaining an effective Customer Advisory Board is a lot of effort. That said, it’s well worth it.

When following Customer Advisory Board best practices, you’ll get:

Having easy access to in-depth customer feedback is the main reason Product Managers should have a Customer Advisory Board. A CAB is a direct channel that you can leverage throughout the year to get insights you can action.

Once recruited, you’ve got a reliable group of customers on standby who can give you a clear understanding of your product’s strengths and weaknesses.

You don’t even have to wait till your next meeting to get feedback. Once you’ve built up close relationships with your CAB members, one Customer advisory board best practice is to engage them with simple surveys and questionnaires, or just fire them a quick email to get answers to your burning questions. Nice.

Over time, the customers in your Customer Advisory Board will develop closer relationships with you. This makes them more invested in your product, increasing the chances that they become an advocate.

By demonstrating to key customers that their opinions matter, you’ll build loyalty which may be rewarded in word-of-mouth recommendations, referrals, and more.

When running a successful CAB, the members inside it can become a useful marketing channel, shouting about your product and helping you to drive the acquisition of new customers. You’re also likely to find that you’ll prevent customer churn from these members in particular, and reduce churn across the whole user base thanks to having a product that so tightly meets the needs of its users!

Learn more about Churn Prevention in our complete Product Manager’s Guide.

Not sure what product ideas and hypotheses will work? Instead of throwing Ideas against the wall to see what sticks, you can instead turn your CAB into a sounding board.

You can approach these group members with new ideas that you believe are worth exploring to see how real customers feel about them. This is a great way to test the worth of your ideas before sinking development time into them.

In a nutshell, running new ideas by CAB members stops you from wasting time and money on building the wrong things.

Let’s get this clear now: a Customer Advisory Board Meeting is not a sales pitch. You shouldn’t be trying to sell new features to your customers or encourage them to upgrade their current packages. Not directly in the meetings anyway.

But, what you can do – once you’ve got a strong relationship with your CAB members – is ask them about your value messaging and positioning.

Finding out what propositions best resonate with their pain points and challenges can help you build a more compelling sales pitch for the similar customers that each member represents.

And hey, you should make sure your Customer Advisory Board members are first to hear about new features and functionality. If you’ve done a good job of listening to their feedback and building the solutions accordingly, then you’ve got a high chance that they’ll be buying – you won’t need the hard sell.

A Customer Advisory Board is an invitation-only group of people. Think of it as a secret society, or your very own Justice League of customers.

When thinking about the people you want to invite to these ongoing sessions, consider what each person brings to the table. You want customers who are going to be open, responsive, honest, and engaged. They also need to have enough expertise in their organization and know its needs, which is why senior roles are often prioritized.

Once you’ve picked the people you want in your CAB, you just have the small matter of convincing them to join.

With a CAB, you’re asking customers to give up their time to help you make your product better. This can be a big ask. To help recruit for your Customer Advisory Board, you need to showcase what’s in it for them. Highlight some of the benefits of the Customer Advisory Board, such as:

If the people in your CAB are only there because you’ve promised them a goodie bag and free lunch, then it’s likely that they’re not going to be as invested in these discussions as they should be.

A CAB meeting allows participants to voice their opinions and make your product easier and more effective to use. The chance to influence your product development to suit their needs should be incentive enough.

Now this doesn’t mean you should strip back on your offerings. Just don’t focus on free coffee and gifts as the main way to attract customers to join the advisory board.

There’s no specific size your CAB should be. Each has its advantages and disadvantages, so the right one depends on your goals and capabilities.

Customer Advisory Boards with fewer participants are easier to manage and allow your customers to build stronger relationships with your organization. However, you run the risk of lacking diversity and perspectives.

Larger CABs allow you to access a wide range of perspectives and better represent your entire customer base. The challenge is that it can be super difficult to manage all these people and run meetings. Imagine trying to organize loads of people with everyone all trying to get their opinions across – a bit of a nightmare, right?

The sweet spot for most organizations hovers at around 10-20 members. This amount still allows you to get broad insight without losing control of the discussion.

Don’t invite any old average Joe to your Customer Advisory Board. The goal is to get specific insights representative of your entire customer base, so be tactical when sending your invites.

Focus on a wide range of customer types to get a deeper understanding of what the wider market thinks of your product.

For example, if your product has customers in the tech, healthcare, and construction industries, you won’t get a true reflection of your customer base if all your participants are tech-folk.

Similarly, if you only have representatives from large enterprises on your Customer Advisory Board, the feedback won’t represent the pain points of smaller businesses in your audience base.

Think carefully about your different types of users and try to enlist a varied set of people who can act as a flagbearer for each audience type.

Of course, don’t only add customers who are based close to you so that you can facilitate in-person CAB meetings, as this can lead to you excluding useful demographics.

It’s best practice for a Customer Advisory Board to meet in person, but we understand that might not be an option for some companies. You could have a global customer base, meaning that finding one central location that everyone can travel to is tricky, if not impossible.

In this case, don’t be put off from going virtual. When you do, think about ways to make this as comfortable and special an experience as possible. Think of ways to make the session feel different from your average Zoom call.

So you want to put together a Customer Advisory Board that’s up to snuff? Follow these Customer Advisory Board best practices to make sure you get the most out of these groups.

After you’ve selected the people you want in your CAB, stick with them. You don’t want members switching out for others, as this can damage group cohesion and impact the quality of insights.

By focusing on the same people, it’s easier to build continuity from previous meetings, and members will feel more comfortable with each other, stopping them from being guarded about their business needs and issues.

Before launching your CAB, establish clear objectives for what you want to achieve. By knowing what you want to find out, you’ll create focused and productive meetings. Some goals might include gathering product feedback, exploring market trends, or validating strategic initiatives.

To get the best feedback, you want your CAB members to be prepared. In the invite, send an agenda of what you propose you’ll discuss in the meetings. This ensures that participants are ready to go and helps prevent the meeting from going off-topic.

Before the meeting, send a questionnaire or survey to your CAB members to get initial statistics and feedback that you can discuss in more detail in the meeting. For example, you can ask simple questions about product usage and satisfaction, allowing you to get key statistics to spark a more nuanced discussion.

When scheduling in-person (or indeed virtual) CAB meetings, you want to make sure you get the cadence right. You don’t want infrequent meetings, yet you also don’t want to run them too often and burn your participants out.

It’s best practice for a Customer Advisory Board to have a meeting once a quarter, giving users enough time to prepare. To further your connection, you can also introduce more frequent calls or online surveys to help you gather insight all year round while keeping customers engaged but not overwhelmed.

Customer Advisory Board members are putting in a lot of their own time to provide feedback. Be sure to respect this. Make sure that the insights you’re looking to find require the dedicated time of the people involved. If it can be answered in a survey or questionnaire, it doesn’t merit being included in a CAB meeting.

Equally, if your goal for a CAB session is too far-reaching, you may struggle to hit your objective in the allotted time. You cannot let these sessions overrun! It’s just downright rude. So make sure what you’ve put on the agenda is realistically achievable in the time.

The topics should also resonate with the board. Asking them in advance what things they might like to cover can ensure that you’re talking about highly relevant topics for real-world customers.

So it’s meeting time. 10-20 customer representatives are getting ready to speak with you in person or virtually. They’ve taken time out of their busy schedules and they’re expecting a worthwhile experience that respects their time. No pressure.

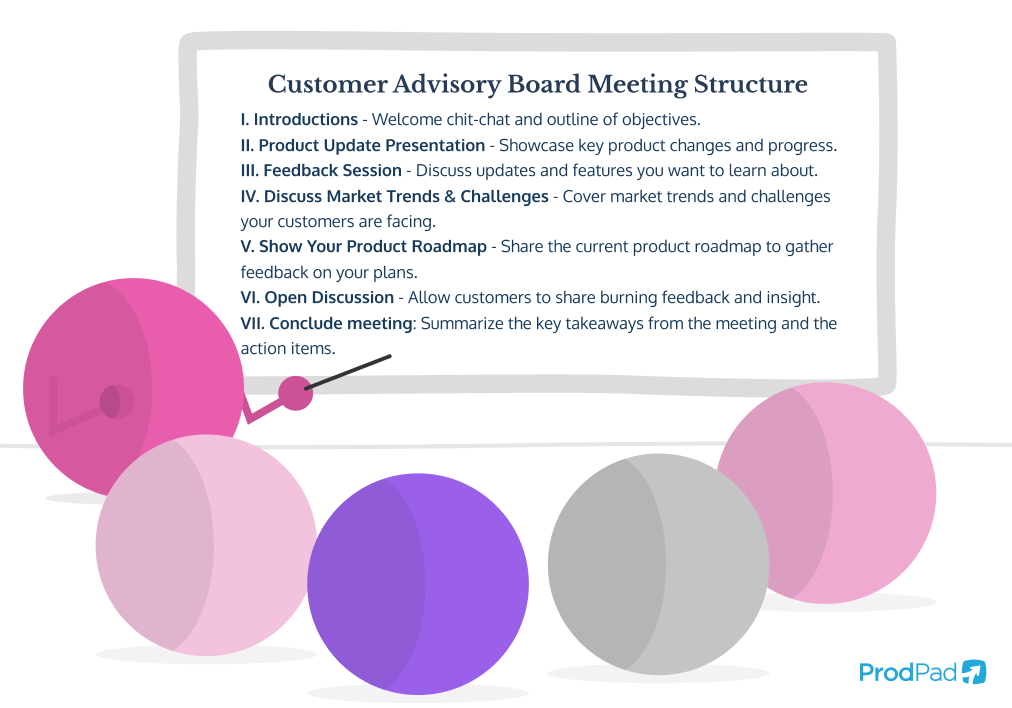

To make sure that the CAB meeting is effective for both you and your invited members, it’s a very good idea to have a pre-arranged structure in place to guide the session.

What you discuss in your meeting will differ each time, depending on the goals and pre-determined topics of the meeting gathered from your pre-meeting agenda and questionnaire/survey. That said, each meeting can follow the same flow to help you stick to your timings and expertly guide the discussions.

Here’s a comprehensive outline for an effective CAB meeting. Do play around with it and make changes to find something that best fits you.

Once everyone’s heading home or logging off, as the Product Manager, your work isn’t done. One of the first things to do after a Customer Advisory Board meeting is to get together with your product team for a post-mortem.

Here you should discuss key insights gleaned from this meeting while it’s still fresh in your mind. Focus on any top-priority discoveries and be sure to also assign action items so that everything is followed up on.

You’re probably going to want to tie specific feedback to certain product Ideas. Have a look at how you can do that in ProdPad.

Don’t just gather feedback. Tie it to your Ideas to build better products.

You can also review the success of the meeting to generate ideas on how you can improve it for next time, and also evaluate participants to make sure that everyone involved is still a good match going forward.

To prove to the participants that their feedback has been actioned and appreciated, create follow-up communication to showcase how you plan to use their insights. Share how their input affected your roadmap and influenced your decisions regarding new product ideas.

By now, we’re all clear that following Customer Advisory Board best practices are great ways for you to get feedback on your product through regular meetings. But what if we told you that you can leverage your Customer Advisory Board for far more? As we said, having direct access to your key customers is invaluable, so it’s best to squeeze as much juice out of it as possible.

If you’re looking for creative ways to leverage your CAB, here are some additional things you can try:

So you have a new, exciting product feature that looks like it’s ready to go. It’s been through rigorous alpha testing and now needs to be put through its paces in a real-life environment.

To get the most out of beta testing, you want people who actually use your product to give it a go. This is where you can utilize CAB members for a closed beta test. This benefits the customers as it gives them a first look at the new feature in action, and benefits you because it’ll help you find bugs and fix issues before it’s available to the wider market.

Case studies act as valuable trust signals, showcasing to prospective customers how your product is solving the issues and meeting the needs of businesses similar to them. When you have a Customer Advisory Board, you can ask them to provide detailed descriptions of how they use the product to turn into case studies.

Got customers in your CAB with a large amount of expertise in a specific area? Do you have people lining up to learn more about that subject? Then you should get them to be a guest in your company webinar or podcast.

Hosting a webinar with your Customer Advisory Board members helps position both your companies as thought leaders and also acts as great promotion and lead magnet material.

You can also use CAB members to help you create other content. Think about using CAB members as guest blog writers to share their knowledge on a relevant subject. You can also collaborate by sending them whitepapers and e-books to share on their websites.

If you scratch your customer’s back, they’re likely to scratch yours, so make sure to return the favor and produce content for them.

A great way to leverage Customer Advisory Boards is to get them involved in your product discovery process. Ask them some of your product discovery questions to get invaluable insight to build a more customer-centric solution.

Doing this will help you uncover the most valuable product concepts. Need help with your product discovery process? We’ve got a step-by-step guide.

So you’re designing a product or feature for a specific market – it’ll be good to get some insight about that market to guide you. Your CAB members are experts in the markets they operate in, so be sure to leverage them for market research.

Use CAB members to discuss industry trends and gather insights on competitors. CAB members can provide valuable perspectives on market shifts and emerging opportunities.

By adding CAB members to a preexisting online community, you’re providing them a place to network, interact, and share ideas. This helps to create a space to provide ongoing feedback and insight that can be valuable for you as a Product Manager. It provides continuous engagement and helps all members grow more invested in your product.

If you’re looking for product-focused Slack groups to join, check out our list of 17 Slack groups for Product Managers.

Customer feedback is essential for Product Managers to have any hope in hell of building a product that meets their needs. A CAB remains one of the best ways to get high-value, direct feedback from the customers you trust most, especially when following Customer Advisory Board best practices.

Of course, getting feedback is one thing, recording it and actioning it is a whole different kettle of fish. Wouldn’t it be nice to have a Product Management tool that comes with feedback management functionality?

Guess what, ProdPad offers exactly that!

Tie your customer feedback directly to the Ideas in your backlog for better products that solve the right problems for your customers. Have a look at how it works in our ProdPad sandbox.

Learn how to manage customer feedback and more in the ProdPad Sandbox.

The post Customer Advisory Board Best Practices: How to Unlock the Power of a CAB appeared first on ProdPad.

For the very first time this year, we’ll be hosting #mtpcon with our friends at Pendomonium! If you’re a product person looking to expand your network, connect with product leaders, and be inspired by everything you would expect from our keynote sessions at an #mtpcon event, then we’ve got the right place for you to Read more »

The post Three product leaders to learn from at #mtpcon inside Pendomonium appeared first on Mind the Product.

Discover key insights on the future of product management from industry leaders at Product Tank San Francisco's first panel discussion. Read more »

The post The future of product management: Insights from Product Tank San Francisco appeared first on Mind the Product.

Welcome to “POV: Product Oriented Voices,” where we explore whether the “less is more” approach is always the best strategy for product features. In this episode, our panel delves into the balance between simplicity and functionality in product design. We discuss how excessive features can overwhelm users, leading to decision paralysis, and why simplicity often leads to a better user experience. However, we also examine scenarios where complex, feature-rich products are necessary, such as in technical fields. Using real-world examples, including Apple’s design philosophy and user-specific products like connected pill bottles, we highlight how understanding your audience is key to determining the right level of complexity. Join us for an insightful conversation on achieving the perfect balance in product management.

In the panel discussion for the day discussing AI strategy, we were joined by a great range of product leaders: Denzil Naggan, Director of Product at Road, Hannah Gutkauf, Global Managing Partner at Manyone, Pooja Naidu, VP of Product at Mews, and Vidu Sharma, Group Product Manager for Generative AI at Adyen, moderated by Andrii Degeler, Head of Media at Read more »

The post AI in practice at Amsterdam’s leading companies – Pendomonium+#mtpcon roadshow: Amsterdam appeared first on Mind the Product.

In his keynote session at the Pendomonium+#mtpcon roadshow in Amsterdam, Brian Walsh, SVP of Product at Pendo, shares insights on the future of product management in 2024 and beyond. Read more »

The post The future of product management in 2024 and beyond (Brian Walsh, SVP Product, Pendo) appeared first on Mind the Product.

Discover how agile road mapping and flexible go-to-market strategies are essential for the success of machine learning-based products in this comprehensive guid Read more »

The post Why ML-based products require an agile approach to road mapping appeared first on Mind the Product.