Dripos brings together point-of-sale, mobile payments, employee management and payroll, loyalty and marketing automation and administrative functions like accounting and banking.

© 2024 TechCrunch. All rights reserved. For personal use only.

Product Management Confabulation

What Product Managers are talking about.

Dripos brings together point-of-sale, mobile payments, employee management and payroll, loyalty and marketing automation and administrative functions like accounting and banking.

© 2024 TechCrunch. All rights reserved. For personal use only.

Product managers know that if we want to sell more of their product, we need to find ways to make the product more appealing to our customers. These days, that can be very difficult to do. One of the biggest problems that we are facing is that things change so quickly that it can be very hard to keep a product “current”. The features that we put into a product are great at the time; however, time moves on and all of sudden our customers are expecting better and more features. It turns out that when you are making cars, this can be especially difficult because of how long it takes to design and product cars. However, some car product managers think that they may have found a way to solve this problem.

Product managers who work for the global car companies are looking to give the global auto manufacturers a major tech upgrade. In order to do this, these product managers are going to have to hire thousands of software engineers and collaborate with the companies that make computer chips to develop semiconductors for their vehicles. The goal of the product managers is to deliver a new generation of technology-packed models that can be updated throughout their life cycle using downloadable software and with customizable features unique to each company’s different brands.

Over at the maker of the Jeep automobiles the product managers have a goal of generating US$22 billion of annual revenue by the end of the decade through selling software-led offerings and subscriptions related to the cars they make. The product managers at Jeep believe that software is the core of their product. There is no way they are going to consider that the software part of their product can be totally subcontracted to somebody else because it is that important to them. The product managers at Jeep realize that they can’t do this all by themselves. Instead, they are planning on leverage partnerships with BMW and Alphabet’s Waymo for autonomous driving offerings, and with the chipmaker Foxconn to make their next generation car’s so-called smart cockpits which is a revamp of the car’s dashboard designed for an ultra-connected vehicle.

The product managers at Jeep are the latest car company to reveal their revenue targets and revenue projections related to their future connected-car ambitions. What all of this means is that the battle with Silicon Valley is intensifying over what the future of the automobile will be. This market space is a crowded place with other car companies such as Ford and General Motors also moving quickly to develop future vehicles that come with built-in connectivity and downloadable features that can be beamed down to the car directly. The product manager’s goal is to make cars more like other consumer electronics today.

The product managers at Tesla have long led the industry on vehicle software and other tech features, integrating downloadable updates, similar to software upgrades on smartphones, as early as ten years ago. Product managers at other car companies have long tried to match Tesla’s capabilities, but they have only recently started to debut such features on their own vehicles. Another problem that the other product managers have been dealing with has been struggling to attract and retain the talent needed to develop the software expertise in house. They have found that they are often relying on tech partners to develop in-car apps and technologies.

The product managers at Jeep know that partnerships will be core to their tech strategy but they want to control more of the software value chain. In order to meet their goal, the product managers are planning on increasing the number of software engineers they employ to around 4,000 in two years, up from 1,500 today. They also plan to triple the number of cars that can generate revenue from software to 30 million in ten years. Over-the-air updates in many existing car models already allow users to download the latest version of a car’s navigation software, or even choose from entertainment or driving apps. In the future, on-demand services provided by product managers could include the ability to buy insurance based on a vehicle’s current use, or the option to add additional horsepower to a car’s electric motor ahead of a road trip that would take it through rough terrain.

The Jeep product managers want to be able to offer Jeep owners an off-grid trail navigation feature that will allow their drivers to connect with each other individually or in convoys, even if there is no network coverage. The product managers also want to use artificial intelligence to develop a more customizable media interface. The goal would be to allow the car to predict what a driver might need in terms of navigation and comfort. The reason that the product managers have become so interested in the software that goes into their cars is because many car makers are now betting that growth and profits will come less from building and selling cars and more from features such as connected car services and apps. Although software has been a part of gas-powered cars for years, the new shift to electric vehicles is starting to put computing at the heart of the car.

The world of cars is in the process of undergoing a major change. Car product managers used to compete based on a common set of car characteristics such as how fast a car could go, how many miles to the gallon it got, and what colors it came in. However, now that consumers have grown used to being able to transform their consumer electronics via over the air software updates that can make old phones into new phones, they are starting to want the same thing from their cars. This means that product managers are going to have to find ways to make automobiles become more like mobile phones.

Car product managers understand that they are going to have to hire a lot of software engineers in order to move their products into the future. They want to make it so that customers will have the ability to upgrade their cars over the air after they purchase them. The product managers at Jeep want to eventually be able to sell software subscriptions along with their cars. Product managers at all of the major car companies are trying to do the same thing. Tesla product managers have been able to do these things for a long time. The Jeep product managers plan on meeting their goals by hiring more engineers and producing more cars. Jeep product managers want to be able to offer their customers features long after they’ve purchased their car.

Car product managers are starting to investigate how they can change their long term relationship with their customers. They want to be able to use software to allow the cars that get purchased to be upgraded just like people do with their mobile phones. If they can create the ability to do this, then they may be able to keep selling new features to their customers long after their initial purchase. Software is going to change the world and car product managers want to be part of that world!

– Dr. Jim Anderson

Blue Elephant Consulting –

Your Source For Real World Product Management Skills

Question For You: How often do you think that people will be willing to allow their car’s software to be updated?

The post Car Product Managers Look To Software To Boost Their Revenue appeared first on The Accidental Product Manager.

Software testing is hard. Even with the right talent in place, it doesn’t always go as planned — particularly when executed at scale. In a 2020 survey from Electric Cloud, 58% of developers blamed software bugs on test infrastructure and process issues — not design defects. The market for software testing solutions is quite massive, […]

© 2024 TechCrunch. All rights reserved. For personal use only.

Haul247, a Nigerian end-to-end logistics platform connecting businesses to haulage and warehousing assets, has raised a $3 million seed round. Gender-lens investing fund Alitheia Capital provided the equity capital, with Investment One contributing $1 million in debt financing.

The logistics startup allows small businesses and large companies to book trucks and warehouses across multiple African geolocations. It has over 1,000 trucks on its platform and about 151,000 square meters of warehouse space across various locations, the company said in a statement.

Haul247’s proprietary software enables individuals, enterprises, manufacturers, and FMCGs to book logistics services by taking an order request from a shipper, attaching a quote, and then matching the request with the most suitable truck and warehouse for efficient fulfillment. Companies looking for warehouse facilities go through the same process, as the system allows shippers to track their goods’ status until they reach their destination.

CEO Sehinde Afolayan founded Haul247 after terrible logistics and warehousing services affected his previous agriculture business. And despite the presence of many logistics firms, Afolayan, buoyed by his 15 years of experience in the African supply chain business, decided to launch Haul247 with his co-founders Tobi Obasa and Akindele Phillips in 2020.

“At my former business, I wanted to buy about three trailer loads of soya beans and after agreeing on the price and paying for it, when I got there to where the grains were stored, I couldn’t access a trailer and most of the grains had turned to powder,” Afolayan narrated. “We figured we could use tech to solve problems like these for not only multinationals but also farmers.”

Afolayan believes that logistics platforms in Africa that do not solve warehousing challenges will be more “costly, inefficient, and risky” down the line. Therefore, Haul247, in its ambition to become “Africa’s Airbnb for trucks and warehouses,” says its distinct offering of comprehensive warehousing services, positioning itself as a one-stop logistics solution, sets it apart from other platforms. The startup actively participates in the overall logistics workflow’s primary and secondary distribution processes by employing a model that integrates haulage and warehousing. Larger upstarts in this market category include Kobo360 and Lori.

Haul247’s technology also manages internal processes, from tracking shipments to asset utilization. The company is working on introducing an electronic proof of delivery feature to replace the traditional physical copies typically exchanged between suppliers and truck owners.

“Right now, we’re trying to facilitate an alternative of physical proof of delivery that serves the same purpose, shortens the time to get paid and provides insights into transactions,” Tobi remarked. “Once we do that, we’ll be the first to introduce it in the market.”

Haul247 claims to have over 21 multinationals on its platform, with 16 active. The CEO says the three-year-old logistics firm, which records a 20% to 22% gross margin while growing 50% month-on-month in revenue, has reached positive unit economics. As a result, the company, whose asset utilization is as high as 95%, according to its executives, is projecting to close the year with $5 million in annual revenue.

Afolayan comments that with the new investment, Haul247 will be looking to capture more market share, to about 20%, and increase the number of multinationals on its platform to 50, easing its expansion into other African countries where they are present. Meanwhile, the founders pointed out that the timing of Haul247’s fundraising aligns with the critical importance of logistics for the success of The African Continental Free Trade Area (AfCFTA).

As experts worldwide recognize, logistics plays a vital role in driving development, and the World Economic Forum predicts a 28% increase in demand for intra-African freight by 2030, which Haul247 intends to play a part in. “We plan to take advantage of AFCTA, look at new African countries and create value for stakeholders, asset owners, warehouse and truck owners,” said the CEO.

Tokunboh Ishmael, managing partner at Alitheia Capital, speaking on the investment, said, “We are excited to be at the forefront of optimizing logistics service delivery in key African markets, as trade and commerce is a key lever for driving development. Our investment further enables Haul247 to provide a seamless logistics solution for transporting and storing goods across the continent in a way that unlocks value and amplifies impact for individuals and companies throughout the value chain.”

Nigeria’s Haul247 raises funding to scale its logistics platform by Tage Kene-Okafor originally published on TechCrunch

Welcome back to The Station, your central hub for all past, present and future means of moving people and packages from Point A to Point B.

Automakers have been struggling with software development for years now. But the stakes are higher than ever because all of these companies keep touting the coming of the “software-defined” car, in part, to compete with Tesla. It reminds me of the days when automakers (and others) called future cars “an iPhone on wheels.”

Making declarations around software is not the same as actually pulling it off. And automakers are figuring this out.

Software problems have led to an executive shakeup over at VW Group’s software arm Cariad, prompted Chinese regulators to recall 1.1 million Tesla vehicles, and caused Polestar and Volvo Cars to delay production of their respective EVs. Fisker has also reportedly struggled with software integration problems in its Ocean SUV. And that’s just this week.

Software is also leading automakers to beef up their internal teams, instead of going to suppliers. General Motors, for instance, hired Apple executive Mike Abbott to head up its software division.

The upshot: Software-defined vehicles are still a work in progress.

Oh and hey, I’m back with another Disrupt 2023 promo. But this time I’m here looking for early-stage startups! Apply to join the Startup Battlefield 200 cohort at TechCrunch Disrupt 2023. All finalists get expert training, VC networking, a booth at Disrupt, and the chance to compete for $100,000 in equity-free funds. Applications close May 15. Apply today.

Want to reach out with a tip, comment or complaint? Email me at kirsten.korosec@techcrunch.com. You also can send a direct message to @kirstenkorosec

Reminder that you can drop us a note at tips@techcrunch.com. If you prefer to remain anonymous, click here to contact us, which includes SecureDrop (instructions here) and various encrypted messaging apps.

France will spend 2 billion euros ($2.17 billion) through 2027 to improve cycle infrastructure and help people buy e-bikes. Bien joué!

Grant Sinclair’s enclosed electric trike is “designed to be safe like riding inside a large crash helmet.”

India’s Hop Electric delivered its first over-the-air update to its OXO electric motorcycle. The company used user-generated data to inform the changes it made, like improved acceleration and range-prediction.

Lime has asked a federal California court not to throw out a suit accusing Hertz of using trade secrets to build a new version of its mobile app within weeks of one of Lime’s top engineers leaving for the car rental company.

With the rise of e-bikes comes the rise of waste from e-bikes at the end of their lives. PeopleForBikes and Call2Recycle want to stop battery waste before it starts. The two launched their “Hungry for Batteries” e-bike recycling campaign to help simplify the process of recycling e-bike batteries.

Segway-Ninebot has unveiled its 2023 lineup of smart vehicles, including the Ninebot KickScooter F2 Series, the Ninebot KickScooter Max G2, the Segway eScooter E300SE and more. Segway says the F2 and Max G2 come with auto-class traction control systems, giving the rider max control on slippery conditions. Segway also partnered with Apple to integrate Find My technology into the F2 and Max G so users can find their scooters if stolen.

Swft released its 2023 lineup of e-bikes, including two mountain bikes, an all-terrain e-bike and a BMW-style e-bike.

VanMoof has refreshed its entry-level lineup with colorful new e-bikes. The X4 and S4, out this month, have the same frame and vibes of VanMoof’s previous X3 and S3, but less of the high-tech complexities.

Yamaha introduced the Booster e-bike with a top speed of 15 miles per hour and the Booster speed pedelec with a top speed of 28 miles per hour.

— Rebecca Bellan

As I mentioned last week, mobility SPACs are having a helluva time — and not in the fun party kind of way. EV SPACs like Arrival, Canoo, Faraday Future, Lordstown, Lucid and Nikola have seen their values annihilated in the past year. And yet, another company is voluntarily jumping into the SPAC fray.

You might recall that VinFast, the Vietnamese EV maker and arm of conglomerate Vingroup, filed in December 2022 for an initial public offering in the United States. The company is now taking a different path to the public market. On Friday, VinFast announced it would go public through a merger with SPAC (or blank-check) company Black Spade Acquisition Co.

Under the deal, VinFast will have an equity value of about $23 billion. Considering that VinFast’s VF8 EV has been widely criticized for just about everything from ride quality to literally failing to operate, this run for the public markets might not be the best idea. I guess we’ll see!

Other deals that got my attention this week …

CelLink, a California-based automotive wiring components startup, has received conditional commitment for a $362 million loan from the U.S. Department of Energy’s Advanced Technology Vehicles Manufacturing loan program. The funds will be used to help finance the construction of a factory in Texas.

Faraday Future plans to raise $100 million in debt, critical funds that will allow the company to start initial deliveries of its flagship FF 91 Futurist vehicle. And the struggling EV SPAC is going to need it. The company’s earnings report shows it had $33 million in cash and restricted cash at the end of the first quarter.

Getaround plans to acquire the assets of HyreCar, another car-sharing marketplace, for $9.45 million.

ProLogium Technology, a Taiwanese solid-state battery maker backed by Mercedes-Benz, is considering raising fresh funding at a valuation of about $2 billion, Bloomberg reported, citing unnamed sources.

Qualcomm plans to acquire Autotalks, a fabless chipmaker out of Israel that builds semiconductor and system-on-a-chip technology to aid in automotive safety; sources told TechCrunch that Qualcomm is paying between $350 million and $400 million for the startup.

UVeye, the automated vehicle inspection technology startup based in New Jersey and Tel Aviv, raised $100 million in a Series D funding round led by Hanaco VC. Existing investors GM Ventures, CarMax, W.R. Berkley Corporation, F.I.T. Ventures LP and Israeli institutional investors also participated in the round, which has pushed its valuation to about $800 million.

Wingcopter, a delivery drone startup based in Germany, picked up €40 million (close to $44 million) in financing from the European Investment Bank.

Porsche has partnered with Mobileye to bring hands-free automated assistance and navigation functions to future sports cars.

Nuro is laying off 30%, or about 340 employees, across the company as part of a restructuring meant to extend its capital runway. The company is also pausing plans to ramp up commercial operations this year and delay volume production of its Nuro bot — the third-generation, or R3, delivery robot designed to be the flagship of its commercial strategy.

Ouster was named the exclusive long-range lidar supplier through 2026 to Motional for its Ioniq 5 robotaxis.

Woof! There were a lot of earnings this week and many of the results were on the gloomy side of things. I can’t cover them all, but here are a few highlights.

Bird cuts costs in the first quarter, but the rest of its results, including ridership and revenue, were not so hot.

Gogoro reported first-quarter revenue of $79.3 million, down 16% year-over-year, while its net loss grew to $40.6 million — up from its net loss of $21.7 million in the same quarter last year. The company said that while revenue from its battery-swapping service was up YoY, sales of hardware and vehicle sales decreased compared to the same quarter last year.

Lucid’s first-quarter results show a company with widening losses and revenue that failed to meet Wall Street expectations. Lucid’s Q1 revenue was $149.4 million, up year-over-year, but lower than the $257.7 million it reported in the fourth quarter of 2022. Importantly, the company said it plans to produce more than 10,000 vehicles in 2023, which is on the lower end of its previous guidance.

Luminar beat its own guidance for Q1 and brought in $14.5 million in revenue, up 112% from the same period last year. That gain is on top of a net loss of $146.8 million, which was wider than expected. Luminar still has cash and cash equivalents of around $90 million. The lidar company said it’s on track to meet or beat its goal of adding at least $1 billion to its forward-looking order book in 2023 and expects its revenue to grow 100% in 2023.

Rivian was one of the few bright spots — although the company is still burning through cash. The company beat Wall Street expectations with $661 million in revenue in the first quarter, a nearly seven-fold increase from the same period last year when it was plagued by supply constraints and production woes that curbed deliveries. It also managed to narrow losses to $1.35 billion, or $1.45 per share, in the first quarter, down from the $1.59 billion, $1.77 per share, in losses in Q1 2022. Oh, and how could I forget — Rivian is sitting on $12 billion in cash.

TuSimple did not file a Q1 report, and that’s the problem. The company hasn’t filed an earnings report since the end of the third quarter in 2022. As a result, TuSimple received a delisting notice from the Nasdaq for failing to file its quarterly report on time. TuSimple shares may stop trading as early as May 15.

Fisker lowered its production target for the year to 32,000 EVs. The EV company also said it has partnered with Ample to bring the first Fisker Ocean SUV to market with swappable battery technology by Q1 2024. The companies intend to share revenue generated from the battery-swapping system.

Subaru is stepping up its EV plans. The company plans to add four EVs to its portfolio with an aim to produce 400,000 units by 2028.

Tesla officially broke ground on a Texas lithium refinery, making it the only U.S. automaker to refine its own lithium.

Volvo will call its upcoming small all-electric SUV the EX30.

Google unveiled a bunch of new auto-related features — like YouTube and conferencing coming to cars — at the company’s 2023 Google I/O developers conference. Auto tidbit of the event: By the end of the year, 200 million vehicles will be equipped with Android Auto.

Tesla is facing another lawsuit. This time, a group of Tesla Model S and Model X owners filed a proposed class-action lawsuit in the U.S. District Court in San Francisco alleging that automatic software updates decreased driving range or caused battery failures.

HopSkipDrive brought on a new executive team with backgrounds from Walmart, The Honest Company and Bird.

Vianova is working with French public transport operator RATP to analyze curb activities and sidewalk usage to prevent bus lane congestion and transform curb usage in Paris.

Zipline, the drone delivery startup, is expanding its U.S. customer base across healthcare, restaurant and retail verticals.

Vroom vroom! TechCrunch Disrupt 2023, taking place in San Francisco on September 19–21, is where you’ll get the inside scoop on the future of mobility. Come and hear from today’s leading mobility entrepreneurs on what it takes to build and innovate for a more sustainable future. Save up to $800 when you buy your pass now through May 15, and save 15% on top of that with promo code STATION. Learn more.

Software snafus abound, Nuro makes more cuts and VinFast takes the SPAC road by Kirsten Korosec originally published on TechCrunch

Builder.ai tapped into a new wave of businesses wanting their own native apps with a turnkey approach, accelerated by the rapid digitization of life during the pandemic. That led to led to a $100 million Series C funding round last year led by Insight Partners, taking the company’s total funding to $195 million.

It’s now landed a strategic collaboration with Microsoft, which includes an undisclosed equity investment in the startup. TechCrunch’s source’s indicate the investment was “significant”, though we couldn’t get anything more than that.

The collaboration will mean the two companies collaborating on AI solutions. Builder’s “Natasha” AI will be available to users of Teams, and made available when they are looking to build apps and software. Microsoft’s Q2 results showed Teams has hit more than 280 million monthly active users.

Builder.ai’s CEO Sachin Dev Duggal said in a statement: “From my first meeting with Microsoft to the moment we agreed to collaborate more strategically, one thing has been really clear-Microsoft’s commitment to helping everyone unlock their true potential.”

There will also be integrations across Azure OpenAI Service and other Azure Cognitive Services with Builder.ai’s software assembly line and adoption of the Microsoft Cloud and AI, alongside partnerships across the Microsoft Developer Platforms.

“We see Builder.ai creating an entirely new category that empowers everyone to be a developer and our new, deeper collaboration fuelled by Azure AI will bring the combined power of both companies to businesses around the world,” added Jon Tinter, Corporate Vice President, Business Development, Microsoft.

Microsoft makes strategic investment into Builder.ai, integrates its services into Teams by Mike Butcher originally published on TechCrunch

The car industry is in the midst of its biggest transformation since the first Model T rolled off the assembly line. And no, it’s not just about shifting to electric vehicles.

It’s about software, which goes hand-in-hand with the EV transition. Automakers are betting that apps designed to work natively with infotainment systems, over-the-air updates, in-car movies and gaming, and on-demand features will be major drivers of revenue in the future.

Hyundai is one of the automakers that wants to get there first. And not by charging subscription fees for features that drivers are accustomed to getting upfront, like heated seats. Instead, Hyundai wants to develop and launch new products and services that owners value, such as downloadable features for dog owners or sports fans.

The South Korean automaker has set a lofty target for software-driven features to make up 30% of future profits, one of the company’s top mobility executives in the U.S. told TechCrunch earlier this month at the New York International Auto Show.

Up until now, Hyundai has been most visibly trying to get ahead of competitors with hardware-driven features; hardware-driven features such as electric vehicles with more than 300 miles of range and the ability to charge household devices.

The interior of a Hyundai Kona N EV at 2023 New York International Auto Show. Image Credits: Stephanie Keith/Bloomberg / Getty Images.

Now, Hyundai’s shifting its resources and attention to software design as well as personalization and customization of the interior of the vehicle, Olabisi Boyle, who is vice president of product planning and mobility strategy for Hyundai Motor North America, said in a recent interview.

“That’s where some of the future profits are going to be, maybe up to 30% comes from that,” she said.

Boyle clarified that’s meant to be an additional 30% on top of what Hyundai reports now, not in place of another revenue stream. Many industry watchers speculate the coming crop of EVs could last longer on the roads than conventional cars and may drive less revenue from parts sales.

Last year, Hyundai Motor Group posted revenues of $107 billion (142.5 trillion KRW) and a record $6 billion (7.9 trillion KRW) in annual net profit.

The tricky part will be pinpointing which features customers actually want or value. A young adult driver will likely have different needs and preferences than a grandparent using the same family vehicle. If automakers want this to work, they may have to throw a lot of different ideas at the wall and see what sticks.

But getting buyers to wrap their heads around this at all could be tougher than Hyundai expects. Car owners are still more or less used to the same ownership experiences they’ve had for many decades. And with household budgets already stretched thin by inflation or the growing number of subscriptions to services like streaming services, prospective car buyers have repeatedly bristled at the idea of paying monthly for functions they once got up front.

A recent survey of intended new-car buyers by the marketing and research firm AutoPacific revealed fairly low interest in features like remote vehicle control, streaming video, internet browsing and in-car gaming if those options hypothetically cost $15 per month.

Interest in such features tends to be higher among EV and plug-in hybrid shoppers who need something to do while charging, and higher among younger consumers more used to subscription features.

Boyle, a 20-year auto industry veteran whose career included a run in connected commerce tech at Visa, seemed cognizant of this tension.

The goal for Hyundai’s subscription features, she said, is “not for stuff that you already used to have, like for heated seats, but for actual features that would make you more productive in the interior space of your car.”

That’s a not-so-veiled reference to BMW’s much-maligned Functions on Demand plan, which in several markets offered drivers access to certain features like heated seats for a monthly fee. News of that rollout sparked considerable online backlash last year. BMW responded by saying some U.S. models offer a subscription dash cam function and remote start, but that such offerings exist for now on a “small scale” here compared to other global markets. It’s likely BMW will find more ways to trial such features on future cars.

But lately, “heated seat subscription” has become a kind of shorthand for everything car owners could hate about the forthcoming software-driven cars.

Boyle said for this to work in Hyundai’s favor, the features have to become almost essential, not unlike the backup cameras that are now ubiquitous (and mandated) in new cars.

“These functions that we’re seeing, they’re new, and they’re not perfect in their consumer experience, but those are all going to improve,” Boyle said. “And then that’s just going to be a baseline for when there’s a use case for this or that.”

She added that the focus will be on “things you can download in the EV that you wouldn’t have expected.”

“If you keep a dog in the car, maybe it regulates the climate or rolls down the window or something,” she said. “Do you want to pay for that feature?”

Other examples Boyle suggested included downloadable engine sounds for EVs — automakers like Dodge are already working on ways to simulate the noises lost with internal combustion — or even sports team-themed displays inside. (The latter was mentioned repeatedly to TechCrunch by Hyundai Motor Group executives and product planners at the auto show, including with subsidiary Kia.)

“You need to have the tech stack available for these use cases,” Boyle said. “Let’s say you love the Boston Red Sox, or whatever the case may be. Not everybody wants that, but you can download it for your particular EV.”

Hyundai aims to be one of the first large automakers to make the transition to producing vehicles with the capability of wireless software updates and downloadable features that extend far beyond the infotainment system. It has said all of its cars will be capable of over-the-air software updates by 2025 and many updated models are rolling out with this ability right now, and that will include bug fixes, battery management and eventually a more advanced automated driving assistance system.

Almost every automaker will be racing toward “hyper-personalization” in the software era. In addition to seeing who can offer the most EV range, fastest charging times and best driving experience, the next few years will be a race to see who can offer the most features people want with the best software user experience.

Automakers are already going down this road. Arguably the highest-profile current example of this is Tesla’s so-called Full Self-Driving Beta, which can run up to $199 per month, or a total of $15,000. That gives owners a suite of advanced automated driving features that can be used to navigate city streets, though, despite its name, Tesla’s cars are not fully self-driving.

Hyundai too has been dipping its toes into this world with its Bluelink and now Bluelink+ subscription connectivity systems. Those services offer features like remote start, emergency roadside assistance and vehicle diagnostic checks for a monthly fee, not unlike General Motors’ long-running OnStar service. The new Bluelink+ service offers many of these features, but complimentary through the entire duration of ownership, with no trial period or subscription fees for new car owners. (Used car owners will have to pay for it after a trial ends.)

The auto industry’s next wave of subscription features could go much deeper. The Volkswagen Group, for example, is launching an in-car app store that will bring native experiences for Spotify, TikTok, Zoom and more. In-car movies and gaming are also expected to be major revenue drivers as EVs wait to juice up at charging stations. And as they (theoretically) become more automated in the future, passengers will need something to play and work on while being driven around.

Experts say that’s a long way off, if it ever happens at all. Car companies are still dedicated to automated driving. However, many, most notably Ford, are putting greater resources toward active driver assistance features like hands-off, eyes-off driving on highways. That includes Hyundai, too, which is working to commercialize autonomy with ventures like a robotaxi service in Las Vegas.

Boyle’s job is essentially future-proofing Hyundai. That also includes its big EV push and its investments in robotics, urban air mobility and hydrogen power.

“Fifteen years ago people would’ve said there’s no infrastructure for electric vehicles; why are you bothering with that stuff?” Boyle said. “But these are things you have to invest in early.”

Inside Hyundai’s plan to turn software into a profit machine by Patrick George originally published on TechCrunch

Tomer Greenwald, Uri Sarid and Ori Shoshan, software developers by trade, found themselves building and configuring software authentication and authorization mechanisms repeatedly — each time with a different tech stack. Frustrated with the process, they sought to create a platform that enables developers to focus on writing code rather than on constantly configuring server permissions.

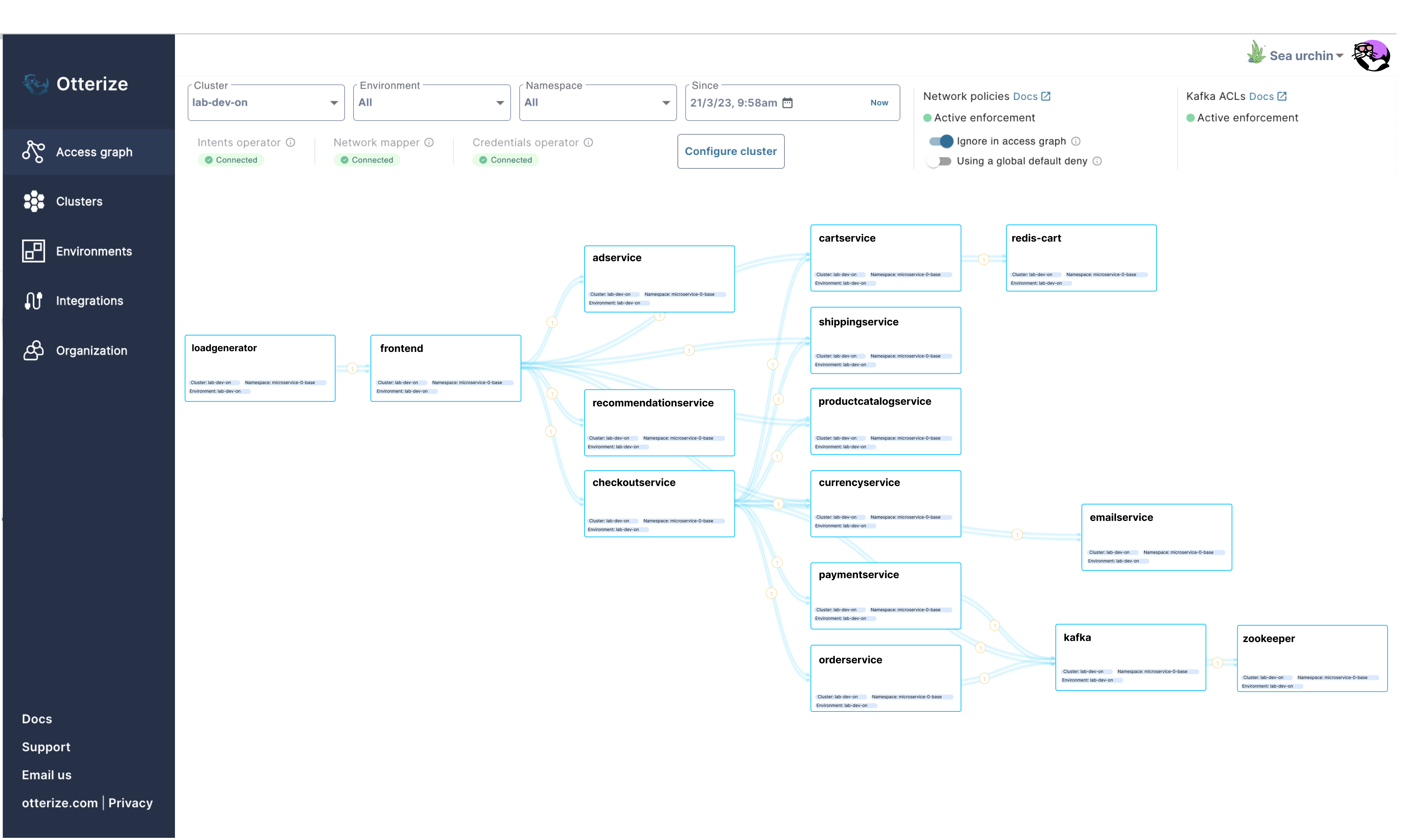

So Greenwald, Shoshan and Sarid, the former CTO of MuleSoft, founded Otterize, which aims to allow developers to securely connect different software services to each other and infrastructure by automatically configuring existing security controls. Otterize today raised $11.5 million in a seed funding round led by Index Ventures with participation from Dig Ventures and Vine Ventures, Jibe Ventures, Crew Capital and Operator Partners.

“Most software these days is composed of multiple services that call each other,” Greenwald told TechCrunch via email. “With Otterize, developers can make those calls securely by simply declaring, alongside their code, the calls their code intends to make.”

As Greenwald went on to explain to me, Otterize uses declarations to set access controls to allow intended calls — and block any unintended ones. If one service is compromised, it can’t be used to compromise other services it wasn’t intended to call. As an added benefit, Otterize provides a real-time map — Greenwald calls it an “access graph” — of all the services in the software app’s backend and how they’re calling each other, which certificates they’re using, how they’re protected and what remains to be secured.

Developers can embed Otterize’s open source solution in their development pipeline or opt for Otterize’s newly launched fully managed solution, Otterize Cloud.

Image Credits: Otterize”The way most access control mechanisms work, someone has to keep track of what services should be allowed to access another service, data source or API. That’s tedious, error-prone and requires being an expert at every technology used for authentication and authorization,” Greenwald said. “With Otterize, no knowledge is required from developers of how these technologies work, and maintenance happens automatically based on the one source of knowledge likely to always be correct and up to date: the developers of the code making those calls declare their need when they build it.”

Otterize currently isn’t generating revenue — it has only offered a free service until recently — and wasn’t willing to talk about its customer base. Asked about the broader slowdown in tech and headwinds like the Silicon Valley Bank collapse, Greenwald expressed confidence that Otterize’s focus on “responsible growth” and “prioritizing product-market fit” position the company well.

Time will tell. But one factor in Otterize’s favor is the heightened spending on cybersecurity, particularly in the enterprise. According to a 2021 survey from JumpCloud and ESG Research, 97% of security executives planned to expand or continue existing spend on identity and access management tools.

Beyond access management, 65% of organizations plan to increase spending on cybersecurity this year, an ESG Research poll found. Gartner predicts that global spending on security and risk management will grow by more than 11% in 2023, up to $188 billion from just $158 billion in 2021.

“By taking a measured approach to growth, we’re able to ensure that we’re providing value to our customers and building a sustainable business behind that value for the long-term,” Greenwald said. “Otterize is pioneering a new approach for access controls, automating the provision and maintenance of necessary access without human coordination, in so doing also securing the entire ecosystem of services based on least-privilege principles.”

Otterize raises $11.5M to help developers securely connect software services by Kyle Wiggers originally published on TechCrunch

Work software is seeing significant investments from VCs, reflecting the continued trend toward digital transformation and remote work.

In its Road to Next report released Tuesday, Deloitte found that even though overall investment in work software companies is down from the lofty heights it reached in 2021, the segment still accounted for 15% of total expansion-stage deal value in 2022 (per PitchBook). Venture-growth work software deals remained steady, barely dipping from $35.4 million in 2021 to $35 million in 2022.

“As market trends remain relatively dynamic, qualitative data shows the appetite for innovation among workforces is strong,” the Deloitte co-authors wrote.

The drivers of the resilience are “numerous,” according to the co-authors, but they highlight a few of the major ones in the report.

First, VCs haven’t given up on the idea, right or wrong, that work software can enhance productivity to increase overall return on investment — an attractive prospect during a period of economic malaise.

Second, poor macroeconomics — plus destabilizing recent events like the Silicon Valley Bank collapse — have encouraged VCs to turn toward more sustainable “growth trajectories,” which tend to be found among longer-lasting, ironclad business-to-business contracts for software tool suites.

There’s truth to that second point.

In an IDC poll earlier this year, 62% of corporate tech managers in the U.S. said that tech spending at their companies would be the same or increase compared with 2022. That’s despite the fact that 82% of them said that they expected a recession this year.

Gartner presented similar findings in a January forecast. The firm projected that worldwide enterprise spending on software would grow 9.3%, reaching nearly $1 trillion by the end of the year.

Tellingly, 2022 saw the most completed work software startup-related rounds in the $5 million to $10 million range in history, according to PitchBook (cited by Deloitte). And the median exit size via acquisition for work software companies in 2022 was $100 million.

“Work software providers are revamping their product and service offerings and reorganizing along novel lines that may turn out to be the workplace, workforce, organizational structure and operating models better suited for the future, thus enhancing overall productivity and well-being,” the Deloitte co-authors wrote.

But while the overall work software market remains strong, not every category is performing equally well.

VCs still think work software is a wise investment by Kyle Wiggers originally published on TechCrunch

For years, Phil George was the executive sponsor of a mentoring program at McMaster-Carr, an industrial hardware supplier, where he spent weeks trying to match program participants with only scant information about them to go on. Employees often requested resources while mentors asked for training, and mentees wanted more guidance on goals. And as the program progressed, there weren’t reliable methods in place to measure success.

“The program was highly inefficient, which made it impossible to scale to the rest of the company in order to leverage the benefits of mentoring across the organization,” George told TechCrunch in an email interview.

Informed by the experience at McMaster-Carr and mentorship conversations with other companies, George left his role in 2012 to team up with his brother, Andy George, and former colleague Miles Ulrich to found an employee mentoring software and white glove service startup. It came to be known as MentorcliQ, and — within a few years, with the pandemic as an accelerant — it grew its customer base to hundreds of companies.

MentorcliQ today closed an “over-$80 million” growth investment from PSG with participation from Rev1 Ventures and Plymouth Growth, bringing its total raised to more than $100 million. George says that the funding will be put toward product development and ramping up MentorcliQ’s customer acquisition efforts.

“MentorcliQ is a mentoring software platform that helps companies solve exceedingly common and expensive employee engagement, development and retention challenges,” George said. “Recent headlines tell a bleak story: quiet quitting, sweeping layoffs and falling short on DEI promises. All of this leads to employee disengagement for those left behind … MentorcliQ helps companies navigate these challenges by giving employees a way to develop their careers, hone their skills and build a community at work through mentoring.”

Image Credits: MentorcliQ

MentorcliQ occupies the increasingly crowded space of upskilling vendors, which VCs have patronized with great enthusiasm in light of the so-called Great Resignation. (From February 2021 to last February, investors have poured more than $2.1 billion into an assortment of companies in the skilling space, according to CrunchBase.) For example, GrowthSpace recently raised $25 million for its platform that leverages algorithms to match individual employees and groups of employees with experts for development sprints.

What sets MentorcliQ apart, George claims, is that it guides customers through the entire mentoring process. This includes designing and executing mentoring strategies, building and running mentoring programs, engaging mentoring participants and measuring the impact.

On the software side, MentorcliQ allows companies to run multiple mentoring programs from a single interface and control which users participate in the programs, as well as create participant profiles for each program. Companies can decide how mentor and mentee matches will be made in individual programs and see metrics like participation numbers, participant engagement and mentoring activity.

George drew attention to MentorcliQ’s matching algorithm, which he believes to be best-in-class. While most mentoring tools offer “bulk matching” options, which match all participants in a program at the same time, George explained, MentorcliQ’s algorithm attempts to optimize mentoring matches for an entire population of participants.

“MentorcliQ’s matching engine calculates match scores for every relationship combination while also factoring in matching rules, suggested matches, the timing of mentoring programs, employee turnover and new hires and other program-configurable variables,” George said. “The algorithm then looks at the landscape to find an optimal set of matches.”

While the tech industry’s outlook seems bleak, George — when asked about MentorcliQ’s growth strategy — said he believes companies will continue to invest in mentoring particularly as they search for cost-effective ways to leveraging existing talent.

He might be right. According to a recent study by Gartner and Capital Analytics, retention rates for mentees are 72% higher compared to 49% for employees who don’t participate in a mentorship program. Eighty-nine percent of mentees feel their colleagues value their work, moreover, versus 75% of employees without mentors, the same survey found.

“While companies often experience layoffs during times like these where there are economic headwinds, mentoring remains even more important to engage, develop and retain the employees who remain,” George said. “In tough times, it’s a feel-good ask of employees which leads to an incredibly high return on investment. Building culture while delivering return on investment is a winning combination during more challenging economic times.”

Signaling its expansion intentions, MentorcliQ recently hired a new chief revenue officer and plans to increase the size of its roughly 120-person team over the next 12 months.

MentorcliQ raises over $80 million to grow its employee mentoring software and services by Kyle Wiggers originally published on TechCrunch