Daloopa, a startup building AI to extract info from financial reports and investor presentations, has raised cash in a new funding round.

© 2024 TechCrunch. All rights reserved. For personal use only.

Product Management Confabulation

What Product Managers are talking about.

Daloopa, a startup building AI to extract info from financial reports and investor presentations, has raised cash in a new funding round.

© 2024 TechCrunch. All rights reserved. For personal use only.

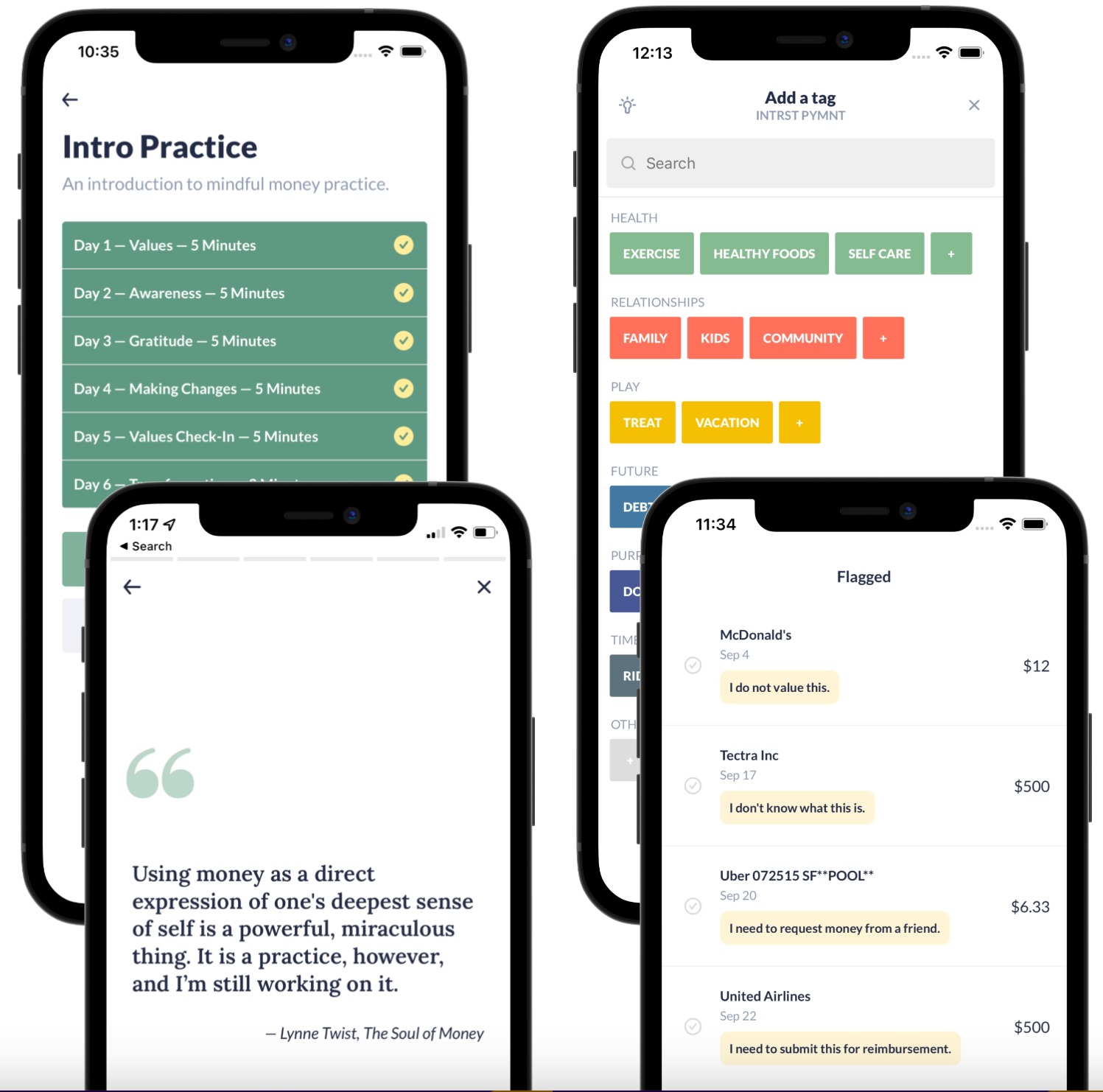

Allo, a new financial app that can be described as Headspace for personal finance, is aiming to help users meaningfully engage with their finances without becoming overwhelmed with numbers and spending. The idea behind Allo is to help users create a mindful money practice that allows them to approach their earnings, spending, saving, investing and giving with a sense of fulfillment.

Founded in 2021, Allo helps users focus on gratitude and the importance of being aware of not only your numbers, but also your values and priorities when it comes to personal finance.

Allo was founded by Will Choi and Paul Montoy-Wilson, who both previously founded Aviate, an intelligent homescreen startup that was acquired by TechCrunch parent company Yahoo in 2014. With over 15 years of experience in software, the duo wanted to build a company that helps people create positive habits with their finances.

Unlike budgeting apps that only focus on spending categories like bills, insurance and transportation, Allo includes categories like nature, family, giving, working out and healthy eating. Users can choose to have a daily, weekly or monthly check-in with the app in order to become aware of their finances.

Image Credits: Allo

“There are plenty of apps out there that will help optimize your net worth or help you save an extra dollar per month and tell you you overspent on a coffee,” Montoy-Wilson told TechCrunch in an interview. “If there’s a budgeting app out there that works for you, that’s great. We’re not trying to take users from budgeting apps that they love. But, the reality is that those budgeting apps don’t work for most people.”

Montoy-Wilson says budgeting apps can make people feel guilty, which can lead them to avoiding their finances altogether. He believes simply being aware of your finances is an important practice, which is why Allo makes it easier to do so in bite-sized chunks.

To get started with the app, users complete Allo’s introductory course and learn from experts on how to feel more peaceful, confident and grateful when it comes to money. The app will ask you to select a few values that you want to focus on, such as health, being generous, exercise and kids. You can then use the values to tag different transactions during your daily, weekly or monthly check-ins.

Once you have set up a check-in, the app focuses on two things when encouraging you to be aware of your transactions. First, the app will encourage you to look at the things you appreciate. You can reflect on the transactions that made you happy, such as the money you spent on your family or well-being.

Next, the app will encourage you to reflect on the transactions that you don’t feel great about and may want to follow up on. For instance, you may see a transaction for a subscription that you intended on canceling beforehand and make a note to do so. Or, you may come across a transaction where you spent a lot of money going out, and don’t see it as a good use of your earnings. By reflecting on this transaction, you could make a note about wanting to instead spend more money on something you actually care about, like your health.

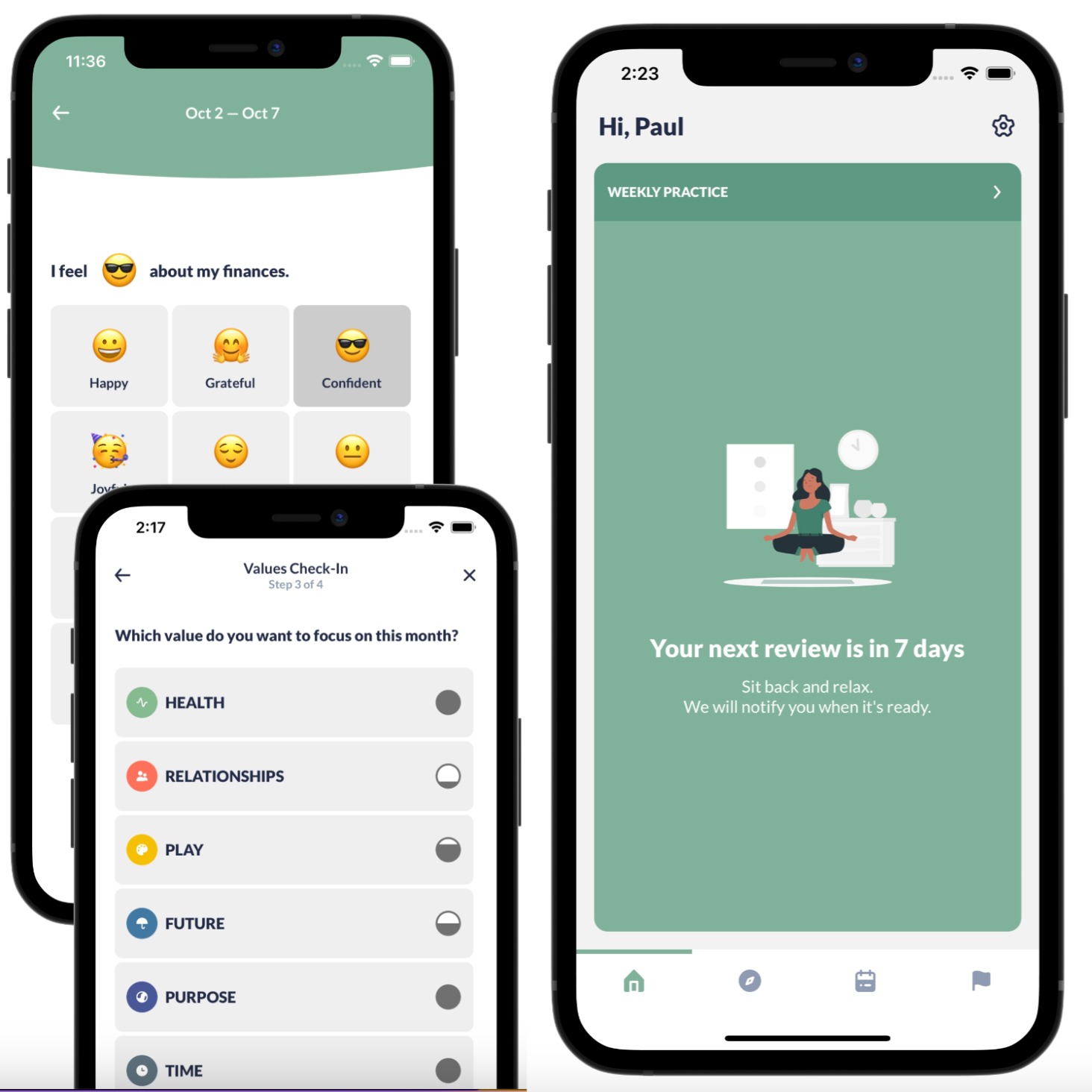

Image Credits: Allo

After you have finished looking through your transactions, the app will ask you to check in on your values and select which ones you want to focus on for your next batch of transactions. Say you want to focus on health, you can either decide to just pay more attention to your health-related transactions or actually spend more money in that area by doing things like eating healthier or working out more.

“A core principle of Allo is being aware of your numbers, but also being aware of your emotions,” Montoy-Wilson said. “What we’re trying to do with Allo is make it easier through bite-sized chunks to engage with your finances and start changing your relationship with money. And then making it easier to keep that practice going over and over again.”

Once you have completed your check-in, the app won’t surface anything else until your next one. Allo sees this as an “inbox zero” mentality that will help users set down their phone and not have to focus on their finances until their next check-in.

Over the past year, around 500 people across the United States have been testing Allo. The app is now available to download on the iOS App Store and the Google Play Store. The app offers a free 14-day trial and costs $6.99 per month. The company currently does not have any plans to expand beyond the United States.

Allo is self-funded and Montoy-Wilson says the goal to keep it independent. The company currently does not have any plans to raise funding.

The Avalanche Foundation is allocating up to $50 million to purchase tokenized assets created on its layer-1 blockchain, the company exclusively told TechCrunch.

The initiative, Avalanche Vista, aims to highlight the value of tokenization in different sectors like equity, credit, real estate and commodities.

Tokenization is the process of creating a digital representation of a real-world asset (RWA) on a blockchain. “It creates a faster, more efficient way for companies to issue assets, individuals to own them, and everyone to transfer value,” John Wu, president of Ava Labs, the firm that created Avalanche, told TechCrunch.

This isn’t the firm’s first rodeo in the asset tokenization space. In September, KKR, one of the biggest investment management firms in the U.S., tokenized a part of its private equity fund on Avalanche’s blockchain through digital assets securities firm Securitize.

“Our mission is to tokenize the world’s assets,” Wu said. “Vista is our next show of commitment to do that. It’s not just dollars involved, but commitment to help web2 players work with us and explain tokenization.”

Tokenization can provide a number of different benefits, but Wu said the focus is to provide operational efficiency, accessibility to new users and improved liquidity.

Unlike traditional financial rails, blockchain settlements can be done instantly, and investors can see where assets are stored on-chain because of its transparent nature.

“People are seeing that this concept of instant settlement doesn’t really exist in the real world,” Wu said. “Clearing in a traditional system takes a couple of days, and that’s trillions and billions locked up for a period of time. That can be done in a more efficient manner [on the blockchain] instantly.”

Blockchains can already provide operational efficiency by streamlining, automating workflows and removing intermediaries. Accessibility is still a work in progress, with initiatives on the rise like the KKR tokenization, bringing highly regulated entities into the space to allow for new investments, Wu said.

But the reality is, the hardest part of tokenization right now is liquidity, Wu said. “You have to prove the efficiency and accessibility at scale before liquidity happens.”

From the many deals Ava Labs has explored with traditional players, “the weakest link in that tripod was the liquidity aspect,” Wu said. So the company decided to invest $50 million, in line with what it sees in the pipeline and how much is needed to improve liquidity, he added.

Today, the most common tokenized asset types are equities and real estate, according to a recent Digital Asset Research report. Of the 41 centralized finance RWA organizations highlighted in the report, 26 have their own tokenized asset marketplaces and 30 support the fractionalization of RWA.

Wu sees tokenization of assets on the blockchain as one of the most impactful innovations of the next decade, and he is not alone in thinking that way.

Larry Fink, CEO of Blackrock, said in March, that “the next generation for markets, the next generation for securities, will be tokenization of securities.” Blackrock had $8.5 trillion in assets under management as of 2022, and while all of that won’t be tokenized, allocating even just 0.1% of that amount for tokenization would make up a whopping $850 million.

Last year, Tyrone Lobban, head of blockchain at JPMorgan’s Onyx, last year shared the bank’s plan to implement institutional-grade DeFi, saying he believes there’s significant value for tokenization of assets waiting on the sidelines.

“Over time, we think [of] tokenizing U.S. Treasurys or money market fund shares, for example, means these could all potentially be used as collateral in DeFi pools,” Lobban said. “The overall goal is to bring these trillions of dollars of assets into DeFi, so that we can use these new mechanisms for trading, borrowing [and] lending, but with the scale of institutional assets.”

There’s also potential for tokenization of non-financial assets to grow, Wu said, noting that loyalty reward points on blockchains are becoming popular. In April, Ava Labs partnered with Korean data management and marketing platform SK Planet to help it expand customer and merchant rewards, among other things, on Avalanche’s blockchain.

Going forward, there’s a “long pipeline of deals” with partners in the works to alleviate tokenization liquidity over the next 12 to 18 months, Wu said. “Tokenization is going to be adopted and now is the right time to do this.”

Building a fintech startup isn’t an easy task, as you have to deal with complex regulation and make sure that your service is extremely reliable because you’re handling money. That’s why we created the brand-new Fintech Stage at TechCrunch Disrupt and invited some of the brightest minds in fintech to learn how they pulled it off.

A few years ago, it was hard to imagine that finance would become one of the most innovative spaces in tech. And yet, the world of fintech is an ever-evolving one with entrepreneurs trying to modernize financial services, simplify payments and embed financial products everywhere.

With a dedicated Fintech Stage at TechCrunch Disrupt, we’ll have plenty of time to talk about the most interesting fintech topics at length. We’ll discuss the future of payments and see how it unlocks new business opportunities with global coverage, instant payouts, subscription-based billing and complex marketplace business types.

We will also host conversations about open banking and embedded finance. These are two major changes for the fintech industry that could potentially turn any startup into a fintech startup and bring financial products much closer to the end customer.

Some seasoned investors will join us as well to discuss all of the ups and downs that come with running a fintech startup. And it’s been a real roller coaster lately with valuation cuts and regulatory changes.

Here is your first peek at the agenda — but stay tuned for more to come!

TechCrunch Disrupt, our flagship startup event, returns to San Francisco on September 19–21, and we have a lot to talk about. We hope to see you there. Tickets are now on sale.

Plaid’s Zach Perret Opens up on Open Banking

with Zach Perret (Plaid)

Plaid has had a thousand lives. After a $5 billion acquisition deal with Visa that fell through due to regulatory concerns, the company didn’t hit the pause button. Instead, it has been relentlessly rolling out features and raising money to make the dream of open banking a reality. What if you could connect to your bank account from anywhere? What if sending money was as easy as sending a text message?

Making Money Move with Embedded Finance

with Peter Hazlehurst (Synctera), Laura Spiekerman (Alloy) and Amanda Swoverland (Unit)

Creating a bank account, storing money, receiving a payment card and lending money should be as easy as opening an account on a social network. Or at least, that’s the promise of embedded finance. That’s why a new wave of finance infrastructure companies are reinventing banking — and they could potentially turn any company into a fintech company.

The Future of Payments

with Céline Dufétel (Checkout.com)

Payments startup Checkout.com cashed in on the tech funding boom of 2021 and reached a valuation of $40 billion. Since then, both Stripe and Checkout.com had to lower their internal valuations. But Checkout.com president Céline Dufétel is here to prove that the payments company is still in growth mode and has big expectations for the U.S. in particular.

Building Up Blockchains for Mass Adoption

with Jesse Pollak (Coinbase), Grace Torrellas (Polygon) and speaker to be announced

As the crypto ecosystem gains more traction from developers, traditional institutions and big brands, it needs mainstream adoption to grow as well. In order to do that, blockchains need to be able to support greater — and faster — transactions per second, while keeping fees low. But what will it take to get to that next level? And what are major blockchains and crypto projects alike doing to help accelerate that mission?

a16z’s Arianna Simpson on the Promise of Web3 Investments

with Arianna Simpson (Andreessen Horowitz)

Yes, there are still crypto-focused investors out there doubling down their web3 strategies as other VCs look to other horizons (ahem, AI). Arianna Simpson is a general partner deploying capital for a16z’s multi-billion-dollar crypto fund(s). While other investors move away from the crypto industry amid the market downturn, we want to learn about why and how a16z is holding on, their strategy, how they view the investing landscape and more. We’ll also dive into what the regulatory landscape means for VCs and the projects they invest in.

Fintech Investing Is Not for the Faint of Heart

with Mark Fiorentino (Index Ventures), Emmalyn Shaw (Flourish Ventures), Jillian Williams (Cowboy Ventures)

Venture capitalists have poured billions into fintech companies in recent years, making it one of the most invested categories in the startup world. While the pace of funding has slowed, there are plenty of investors who are still bullish on the potential of financial technology. What sectors within fintech show the most promise? Which have seen too much hype? Which have proven to be resilient?

Disrupt 2023 runs September 19–21 in San Francisco. Buy your pass now! Seriously, what are you waiting for?

Is your company interested in sponsoring or exhibiting at TechCrunch Disrupt 2023? Contact our sponsorship sales team by filling out this form.

Announcing the Fintech Stage agenda at TechCrunch Disrupt by Romain Dillet originally published on TechCrunch

Finfra, an Indonesian startup that provides the tech infrastructure for online businesses that want to offer embedded finance products, has raised $1 million in new funding. The round included participation from DSX Ventures, Seedstars International Ventures, Cento Ventures, Fintech Nation, FirstPick, BADideas Fund and Hustle Fund.

The startup’s new funding will be used on product development and to grow Finfra’s engineering, data and finance teams. Finfra grew out of consumer financial services provider Danabijak, which is profitable and will continue operating as a subsidiary of Finfra.

Finfra is industry-agnostic, but it focuses on digital supply chain platforms, agritech companies and merchant e-commerce platforms, said co-founder and CEO Markus Prommik. It provides a loan management system so businesses can offer credit to clients through their platforms. The most popular way Finfra is used is by businesses who want to add invoice financing or purchase financing solutions. Finfra primarily serves B2B, but can also be used for B2C applications.

Prommik describes Finfra as a “one-stop shop to launch and scale white-labelled credit services,” explaining that without the startup, its clients would need to spend millions of dollars to develop the necessary tech and infrastructure, spend up to five years acquiring lending licenses and building a team. Instead, by using Finfra’s APIs, they can start offering embedded finance within weeks.

Finfra’s key value proposition is control over the customer experience. It integrates risk controls and data from clients’ platforms so they can extend affordable credit without taking on too much risk. Finfra also has portfolio analytics to help customers monitor performance and key lending KPIs.

Finfra’s team (left to right): Reinis Simanovskis, Dionysius Yogadhitya, Markus Prommik, Hilda Indriana, Varun Rathi

Prommik said that Finfra’s differentiator from other embedded finance platforms in payments, data and infrastructure is that they do not offer credit, even though it is the most in-demand financial service. Instead of seeing them as competitors, Finfra views those platforms as potential allies.

One thing that Finfra believes will bolster its growth is the Indonesian Financial Services Authority (OJK) to reach financial inclusion targets of 90% by 2024, up from 75% in 2019. Despite growth in online platforms in Indonesia, many people and small businesses still lack access to credit through traditional means, like banks and other financial institutions, and instead rely on alternatives, including embedded finance.

In a statement, Patricia Sosrodjojo, general partner at Seedstars International Ventures, said, “We’ve seen similar initiatives succeed in emerging markets where MSMEs face significant hurdles to accessing capital. Finfra’s approach not only aligns with national economic development goals but is well-positioned to take on the challenges of this rapidly growing market.”

Finfra lets Indonesian businesses add embedded finance to their platforms by Catherine Shu originally published on TechCrunch

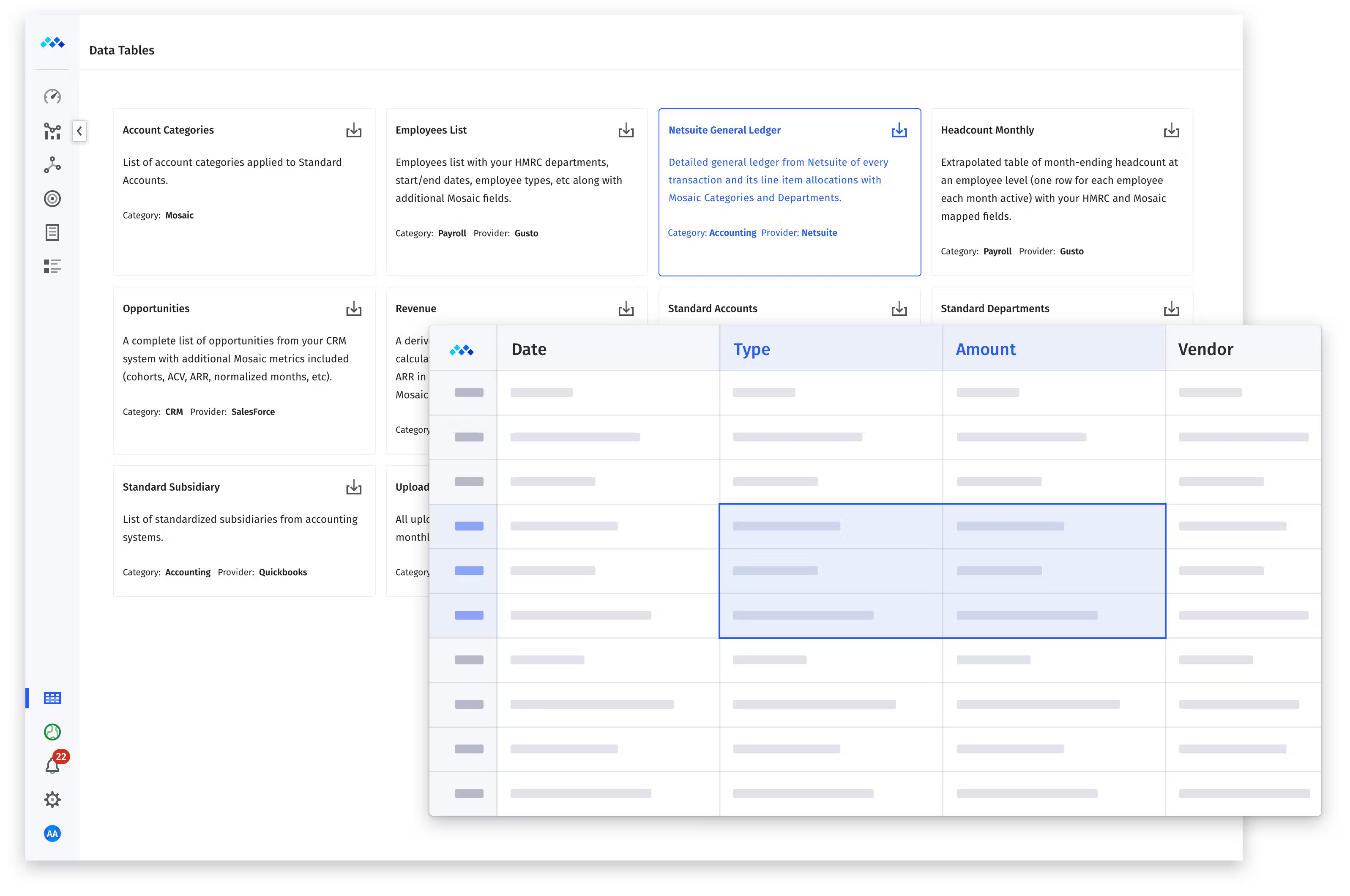

Typical financial planning and analysis teams spend the bulk of their time on data-gathering and administering processes. That’s because they often have to deal with cumbersome systems and software tools, leaving little time to focus on generating insights that might drive business growth.

At least, that’s according to Bijan Moallemi, the co-founder of Mosaic, a startup building a platform that attempts to centralize operational data from across an organization. Mosaic today announced that it raised $26 million in a Series C funding round led by OMERS Ventures with participation from Founders Fund, General Catalyst, and Friends and Family Capital, bringing its total raised to $73 million.

Moallemi co-launched Mosaic with Joe Garafalo and Brian Campbell, who he met in 2012 at Palantir, the big data analytics company, while helping to build Palantir’s finance team.

“Tasked with supporting business decisions for a company — Palantir — in hypergrowth, we were frustrated by the slow speed, high complexity and inefficiencies of existing tools in the market,” Moallemi told TechCrunch in an email interview. “Realizing that the role of the CFO had grown in scope, but our toolkit had not, we set out to build a platform that would address the technical challenges modern-day finance and business teams face.”

Moallemi describes Mosaic as a “real-time planning and analytics” platform. Stripping out all that marketing jargon, Mosaic provides dashboards, modeling and data visualization tools geared toward financial planning use cases, allowing users to quickly share insights with stakeholders.

Image Credits: Mosaic

With Mosaic, companies can gain a better sense of when to execute on their plans, Moallemi says, like when to expand their sales teams or raise another round of funding. Users can create department or executive views for due diligence and go-to-market analysis, providing a unified — but custom-tailored — source of truth.

“In the past, implementing a legacy FP&A platform took months, bogging down the IT department with significant demand for engineering resources,” Moallemi said. “We’ve architected Mosaic to eliminate the need for IT resources in implementation or maintenance … Instead of needing IT to respond to requests for data, business users can get real-time insight into the metrics that impact their daily activities.”

Mosaic, who counts Emerge, Sourcegraph and Drata among its customers, claims business has “tripled” each year since its founding in 2019 and that the burn rate — the rate at which it’s spending money in excess of income — is steadily decreasing. Moallemi credits the pandemic with the growth, in part, as well as the current general economic uncertainty.

There’s truth to what he says. According to a recent survey from Capterra, the majority (73%) of financial professionals plan to spend more on software this year than they did in 2022. They listed managing a hybrid workplace, security concerns and cyberattack risks as their top motivators.

“During the pandemic, the rise of remote work created more demand for collaborative workflows in finance,” Moallemi said. “Macro slowdowns require everyone to do more with less. And the answer to that is implementing technology that increases the amount of work people can do without forcing the company to add headcount.”

In the near term, Mosaic, which has 80 full-time employees, plans to build out the platform’s AI capabilities and introduce tools along the lines of its recently-launched Metric Builder, which lets customers create, analyze and plan custom financial metrics. Added Moallemi: “We’ll continue to expand our planning and analysis features while also making AI a core part of the platform to empower this generation of agile, strategic finance leaders.”

Mosaic raises $26M to help inform companies’ financial decisions by Kyle Wiggers originally published on TechCrunch

Shares of First Republic Bank are off 29% in early-morning trading as investors digest its first-quarter earnings results, which came out yesterday after the bell. The bank reported revenue and profit above analysts’ expectations, but for investors, other concerns outweighed the good results.

Chief among those concerns is a massive decline in the bank’s deposit base. Deposits help provide a foundation for banks to lend against and therefore derive net interest income on the difference collected on loaned capital and interest paid out to depositors.

Let’s take a look at how things have been at First Republic. The bank closed 2022 with $176.4 billion worth of deposits against $166.9 billion in loans, but by the end of Q1 2023, it had $104.5 billion in deposits against $173.3 billion in loans.

This massive decline in First Republic’s deposit base was triggered by the dramatic implosion of Silicon Valley Bank, which collapsed after a run on its own deposits, leaving the startup and venture capital worlds absolutely rattled.

First Republic came under pressure quickly afterwards, as its customers were concerned that it might follow SVB into receivership, and saw unusually large outflows from its own deposit base. The company’s share price was decimated in the process, falling from around $115 on March 8 (when SVB announced after-hours that it was making a series of financial moves, which helped precipitate the bank run) to $16 at the end of trading yesterday.

This morning, the bank’s shares are down to around $11.26 apiece.

First Republic’s results are proof that the SVB meltdown was brutal for smaller banks by Alex Wilhelm originally published on TechCrunch

It seems like, in very short order, we’ve moved away from a “growth over everything” mentality to one that focuses on operational efficiency, and this is true for startups and mature companies alike.

In truth, though, the shift probably happened slowly over time as the economy got shakier (or at least a growing belief that it was shakier) and companies decided to tighten the purse strings.

We’ve seen this play out in a number of ways. The most visible is the constant onslaught of tech layoffs in recent months, with Microsoft, Alphabet, Amazon and Salesforce all announcing big staff reductions. While the pace seems to have slowed some in February, more than 100,000 people were let go in January in a massive tech company purge.

Even though companies clearly overhired during the height of the pandemic, and there are still plenty of open tech jobs, the message is clear that cost cutting is taking precedence over growth investments.

We have even seen cloud infrastructure spending take a hit, an area that has been in constant growth mode for years. But things began to slow down in a big way at the end of last year, and AWS reported at its most recent earnings call that it was seeing growth drop into the teens in January.

As we reported at the end of the year, companies are still spending on tech, but they are looking at their expenditures much more closely. CIOs we spoke to were all taking a more controlled kind of growth, where each dollar spent is facing much more scrutiny.

They don’t want to shut the door on growth, but they want to look at things like operational efficiency and cutting back without adversely affecting the company’s core priorities.

The big question is how they do that, and do the financials suggest that they’re successfully balancing what could be seen as conflicting priorities between growth and efficiency?

The CIOs we spoke to certainly recognize there has been a shift, and as they look at their budget priorities, they want to be smart about spending. They all said they want to look at efficiencies where it makes sense, with the understanding that the tech budget drives growth, and you don’t want to overcorrect when it comes to budgeting.

As companies shift from growth to efficiency, what does it mean for tech budgets? by Ron Miller originally published on TechCrunch

It seems like, in very short order, we’ve moved away from a “growth over everything” mentality to one that focuses on operational efficiency, and this is true for startups and mature companies alike.

In truth, though, the shift probably happened slowly over time as the economy got shakier (or at least a growing belief that it was shakier) and companies decided to tighten the purse strings.

We’ve seen this play out in a number of ways. The most visible is the constant onslaught of tech layoffs in recent months, with Microsoft, Alphabet, Amazon and Salesforce all announcing big staff reductions. While the pace seems to have slowed some in February, more than 100,000 people were let go in January in a massive tech company purge.

Even though companies clearly overhired during the height of the pandemic, and there are still plenty of open tech jobs, the message is clear that cost cutting is taking precedence over growth investments.

We have even seen cloud infrastructure spending take a hit, an area that has been in constant growth mode for years. But things began to slow down in a big way at the end of last year, and AWS reported at its most recent earnings call that it was seeing growth drop into the teens in January.

As we reported at the end of the year, companies are still spending on tech, but they are looking at their expenditures much more closely. CIOs we spoke to were all taking a more controlled kind of growth, where each dollar spent is facing much more scrutiny.

They don’t want to shut the door on growth, but they want to look at things like operational efficiency and cutting back without adversely affecting the company’s core priorities.

The big question is how they do that, and do the financials suggest that they’re successfully balancing what could be seen as conflicting priorities between growth and efficiency?

The CIOs we spoke to certainly recognize there has been a shift, and as they look at their budget priorities, they want to be smart about spending. They all said they want to look at efficiencies where it makes sense, with the understanding that the tech budget drives growth, and you don’t want to overcorrect when it comes to budgeting.

As companies shift from growth to efficiency, what does it mean for tech budgets? by Ron Miller originally published on TechCrunch

Nasdaq on Friday hosted the New Voices Foundation and Essence Ventures, inviting some of the most prominent Black professionals within the venture and startup space behind the podium to help open the markets.

Though this isn’t the first time Nasdaq has honored Black History Month, some who were there commented that “history was made.” And indeed, this opening bell felt different. Shila Nieves Burney, the founder of Zane Capital, told TechCrunch that the day felt like all of the Black ancestors were looking down on them and saying, “Great work.” “We rang the bell for Zane and for all the other Black and brown people who built Wall Street but were denied access to the wealth.”

For investor Tiana Tukes, the experience felt bigger than just ringing the bell. “On the surface, Friday’s ceremony was about opening the Nasdaq, but for us, the experience symbolized the opening of doors for generations now and to come,” she told TechCrunch. “As the bell tolled, I imagined someone, somewhere, who looked like us, heard its call and knew they’d one day be next, and we’d be cheering for them.”

For Black founders and investors, ringing Nasdaq’s opening bell symbolizes progress by Dominic-Madori Davis originally published on TechCrunch