For all the talk about the criticality of data for businesses, enterprise data is commonly siloed, unreconciled and spread across disparate systems, making it challenging to use and analyze. According to a 2020 report from Seagate and IDC, enterprises collect only 56% of the data potentially available through their operations — 43% of which goes ultimately unleveraged. In its research, meanwhile, Accenture has found that only 32% of companies are able to realize “tangible and measurable” value from data, while only 27% derive “highly actionable” insights and recommendations.

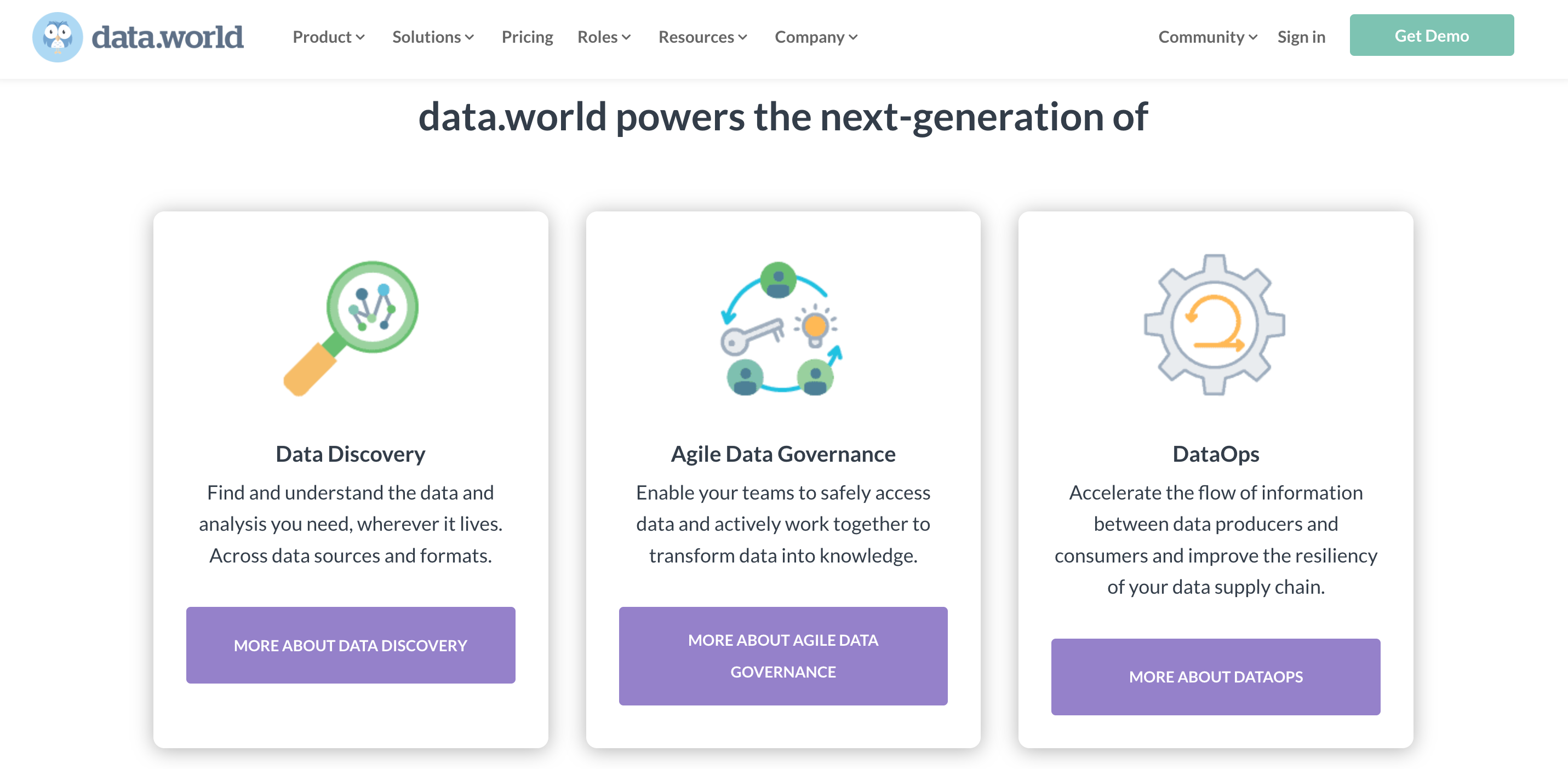

A single platform isn’t likely to solve all the data problems hamstringing the enterprise, but entrepreneur Brett Hurt believes his latest venture — Data.World — can affect at least some change. Data.World, which today announced that it raised $50 million in Series C funding led by Goldman Sachs, looks to leverage cloud-based tools to deliver data discovery, data governance and big data analytics features with a corporate focus. Hurt says that the mission is to create a collaborative community for data scientists, engineers and researchers, and, toward that end, he claims that Data.World now has more than 1.6 million members across customers including the Associated Press and Penguin Random House.

“From the beginning, we have been driven by the belief that data is the most transformative power in the enterprise and can create massive, positive change in business and beyond,” Hurt told TechCrunch in an interview conducted via email. “The siloing of data has historically forced IT teams into a ‘command and control’ posture. This produces a whole host of problems from overspending on attempts to centralize data to damaging the entire company culture around data. Data.World tackles these issues head-on by mapping siloed data to known business concepts so that everyone, whether you’re in the C-suite or the IT department, can understand and use knowledge.”

Making data actionable

Hurt cofounded Austin, Texas-based Data.World in 2015 alongside Bryon Jacob, Jon Loyens and Matt Laessig. Hurt got his start as a systems analyst at Deloitte before founding Coremetrics, a web analytics platform IBM later acquired for around $300 million. In 2005, he helped to launch the startup Bazaarvoice, which provides data about retail customers’ shopping habits.

Jacob was previously VP of technology at HomeAway.com, a vacation rental site, while Laessig — who’s cofounded several companies — served as VP of business development at Bazaarvoice. As for Loyens, he was the VP of engineering at Bazaarvoice before going on to lead engineering efforts at HomeAway.com

Data.World is an enterprise data catalog — an inventory of all data assets within an organization. It describes where data is stored, how to locate data sources, who can access the sources and who’s responsible for the data.

All data catalogs can help to scan, profile and index metadata while providing lineage across data sets (see Google Cloud Data Catalog, Alation Data Catalog, etc.). But Hurt claims that Data.World is unique in that it’s built on a knowledge graph, a collection of interlinked data concepts and entities that provides a “semantically-organized” view of an organization’s data and metadata.

“Knowledge graphs are the ideal architectural foundation for data catalogs, delivering value unattainable by relational and traditional graph datastores [and] bridging the gap between how data consumers understand their business world and how the company stores its data,” Hurt said. “Knowledge graphs offer greater flexibility, are more extensible, and have the capacity to serve as a launch pad for advanced data projects.”

Data.World’s “cloud-native,” software-as-a-service approach to development is another aspect that sets it apart from the competition, in Hurt’s mind. He points to the platform’s recently launched Kos, an open source metadata model and integration toolkit that’s designed to make it easier to model data consistently. A forthcoming product, following on the heels of user interface enhancements and “automated policy management” for sensitive data, will enable Data.World customers to use automations for certain metadata and governance tasks.

Image Credits: Data.World

When asked about security, Hurt is quick to highlight Data.World’s privacy tools, claiming the platform has the ability to mask, hide, or anonymize select rows or columns in databases. Data.World also provides monitoring for security and compliance, he says, and logs how specific data sets have been used or queried.

“Data.World is both cloud-first and security-first. All data transmitted over the internet is encrypted and all customer data stored on disk at rest is encrypted,” he added. “This includes files uploaded by customers, our application database, search indexes and any locally cached customer data … [The platform] extends beyond metadata governance into data access and exploration through secure data virtualization.”

Growth into the future

Hurt says that the latest funding round, which brings Data.World’s total raised to $132.2 million, will be put toward “global expansion, talent acquisition and product innovation.” The company aims to nearly double the size of its 100-person workforce in the next 12 to 18 months as it bolsters its public sector customer acquisition efforts. According to Hurt, Data.World currently counts states, counties and local government agencies among its customers.

“Enterprises are facing a potentially trillion-dollar data problem, and most just do not know where to start,” Hurt said, citing a NewVantage Partners survey from 2021 that found that only 24% of respondents believe their companies are actually data-driven. “We believe that leaders should view their data supply chain like their actual supply chain. This requires investment, but also a cultural shift around how enterprises view and collaborate around data.”

Beyond the usual suspects (e.g., Google, IBM, and Oracle), Data.World has rivals in startups like Stemma, which raised $4.8 million last June to build a managed data catalog platform. It also faces pushback from segments of the industry that aren’t convinced data catalogs are the right solution in today’s data-intensive world.

Investors like Goldman Sachs’ Mike Reilly are unsurprisingly unwavering in their convictions that the company has substantial runway, though. Both he and Hurt tout Data.World’s certified B Corporation and public benefit corporation statuses, which they say underline the company’s commitment to positive industry change. (It’s worth noting that B Corporations, a program administered by the nonprofit organization B Lab, is somewhat controversial, with some critics accusing it of ethics-washing.)

“Data.World sits at the intersection of several prevailing trends that are defining the future of data management,” Reilly said in a statement. “Given their positioning and product differentiation, we believe that they are best-positioned to capture extensive market share in the evolving, high-growth data catalog space.”

Prologis Ventures, Shasta Ventures, Vopak Ventures, Sandbox Insurtech Ventures, and individual investors Paul Albright, Zachary Karabell and Scott Stephenson also participated in Data.World’s Series C.