Rent the Runway is expected to price its IPO later today and trade tomorrow morning, provided that all things go as planned. Udemy is also on the way to the public markets. Allbirds, too.

And this week, Sweetgreen threw its hat into the ring.

Sweetgreen is a food chain best known for salads that are popular with the office-lunching crew. I can safely say that as a longtime member of that cohort back when I worked in an office in a major city.

Why are we talking about a fast-casual restaurant chain here on TechCrunch? Because Sweetgreen raised hundreds of millions of dollars during its life as a private company, including myriad venture capital rounds — through a Series I in 2019 — along with capital from other investors.

It’s an incredibly well-backed unicorn, in other words. It just happens to make salads instead of, say, enterprise software.

So, let’s take a dive into its IPO filing, working to both understand the company’s business and its results. We’ll close with notes on how we have no idea how to price the company, a similar issue that we had with Rent the Runway.

The following days and weeks are going to prove illustrative in terms of the value of tech-enabled businesses, especially in contrast to more digital and hard-tech efforts. Yet again.

The fast-casual food game

Sweetgreen operates its 140 food spots in 13 U.S. states and Washington, D.C., with some 1.35 million customers placing at least one order in the 90 days concluding September 26, 2021. And for a technology angle, some 68% of Sweetgreen revenue was generated from digital orders for its fiscal year to date, which ended September 26.

As noted above, office culture has proved to be no small part of Sweetgreen’s growth. Per the company’s S-1 filing, observe how it discusses the impact of COVID-19 — which disrupted going to offices, period — on its business (emphasis: TechCrunch):

We experienced a decline in our In-Store Channel due to the COVID-19 pandemic in fiscal year 2020, particularly in central business districts, which was partially offset by strong sales in our suburban locations and strong off-premises digital sales across all markets. For our fiscal year to date through September 26, 2021, we experienced positive momentum across all of our channels, as COVID-19 vaccines became widely available and customers started to return to offices.

Sweetgreen has consistently expanded during its life, noting in the same filing that it had “119 restaurants as of the end of fiscal year 2020,” and 140 as of the end of September of this year. That growth has not been inexpensive, with Sweetgreen “targeting” an “average investment of approximately $1.2 million per new restaurant” in the future.

Powering Sweetgreen in the background are a few trends that the company views as accretive, including a consumer shift toward more plant-based eating and “rapid adoption of digital and delivery,” key channels for the food chain’s revenue growth.

Regardless of how you feel about Sweetgreen the brand, the company’s overall business plan appears sound on paper. People are eating healthier and ordering more via delivery. Salads transport well — they are not soup — and are as plant-based as you’d like. And because it is possible to make money selling food, why not Sweetgreen?

So, how has the company managed in business terms during its last few years of growth? Let’s take a look.

Does Sweetgreen’s business generate sweet amounts of green?

No, it does not.

In fact, Sweetgreen is rather unprofitable and doesn’t appear to be on the cusp of a rapid march toward profitability. Not that losing money is a sin, per se; many venture-backed companies run stiff deficits while they scale. That is the point of raising private capital, to invest it at the cost of near-term profitability and cash flow.

But Sweetgreen is no corporate child. It was founded in 2007, per Crunchbase data, making it nearly old enough to secure a learner’s permit to drive in the United States. If a human can get to the point of nigh-maturity in a time frame, surely corporations made up of adults and backed by mountains of private capital can manage the same?

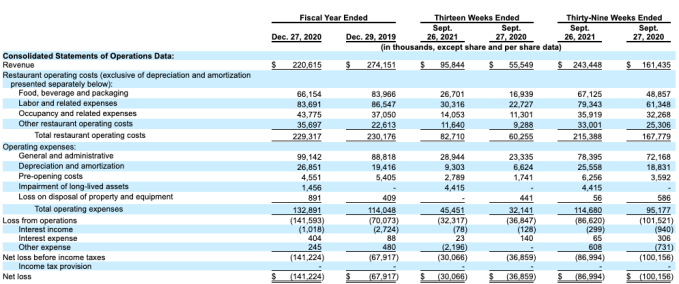

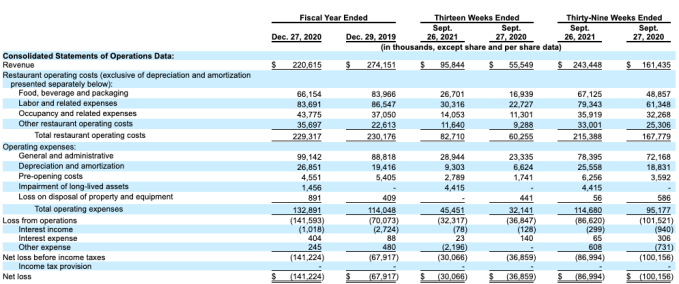

Here’s the data:

Image Credits: Sweetgreen S-1

Note that time flows east to west on this particular table, so the company’s most recent full fiscal year is on the far left.

As we can see from the two most recent fiscal years, 2020 was a pretty hard time for Sweetgreen, which saw its revenues decline from $274.2 million to $220.6 million, and its net losses double from $67.9 million to $141.2 million over the same time frame.