Hello and welcome back to TechCrunch’s China roundup, a digest of recent events shaping the Chinese tech landscape and what they mean to people in the rest of the world.

The biggest news of the week again comes from Beijing’s ongoing effort to dampen the influence of the country’s tech giants. Regulators are now going after the exploitative use of algorithm-powered user recommendations. We also saw a few major acquisitions this week. Xiaomi is acquiring an autonomous vehicle startup called Deepmotion, and ByteDance is said to be buying virtual reality hardware startup Pico.

Algorithmic regulation

Beijing has unveiled the draft of a sweeping regulation to rein in how tech companies operating in China utilize algorithms, the engine of virtually all lucrative tech businesses today from short videos and news aggregation to ride-hailing, food delivery and e-commerce. My colleague Manish Singh wrote an overview of the policy, and here’s a closer look at the 30-point document proposed by China’s top cyberspace watchdog.

Beijing is clearly wary of how purely machine-recommended content can stray away from values propagated by the Communist Party and even lead to the detriment of national interests. In its mind, algorithms should strictly align with the interest of the nation:

Algorithmic recommendations should uphold mainstream values… and should not be used for endangering national security (Point 6).

Regulators want more transparency on companies’ algorithmic black boxes and are making them accountable for the consequences of their programming codes. For example:

Service providers should be responsible for the security of algorithms, create a system for… the review of published information, algorithmic mechanisms, security oversight… enact and publish relevant rules for algorithmic recommendations (Point 7).

Service providers… should not create algorithmic models that entice users into addiction, high-value consumption, or other behavior that disrupts public orders (Point 8).

The government is also clamping down on discriminative algorithms and putting some autonomy back in the hands of consumers:

Service providers… should not use illegal or harmful information as user interests to recommend content or create sexist or biased user tags (Point 10).

Service providers should inform users of the logic, purpose, and mechanisms of the algorithms in use (Point 14).

Service providers… should allow users to turn off algorithmic features (Point 15).

The regulators don’t want internet giants to influence public thinking or opinions. Though not laid out in the document, censorship control will no doubt remain in the hands of the authorities.

Service providers should not… use algorithms to censor information, make excessive recommendations, manipulate rankings or search results that lead to preferential treatment and unfair competition, influence online opinions, or shun regulatory oversight (Point 13).

Like many other aspects of the tech business, certain algorithms are to obtain approval from the government. Tech firms must also hand over their algorithms to the police in case of investigations.

Service providers should file with the government if their recommendation algorithms can affect public opinions or mobilize civilians (Point 20).

Service providers… should keep a record of their recommendation algorithms for at least six months and provide them to law enforcement departments for investigation purposes (Point 23).

If passed, the law will shake up the fundamental business logic of Chinese tech companies that rely on algorithms to make money. Programmers need to pore over these rules and be able to parse their codes for regulators. The proposed law seems to have even gone beyond the scope of the European Union’s data rules, but how the Chinese one will be enforced remains to be seen.

Lei Jun bets on autonomous cars

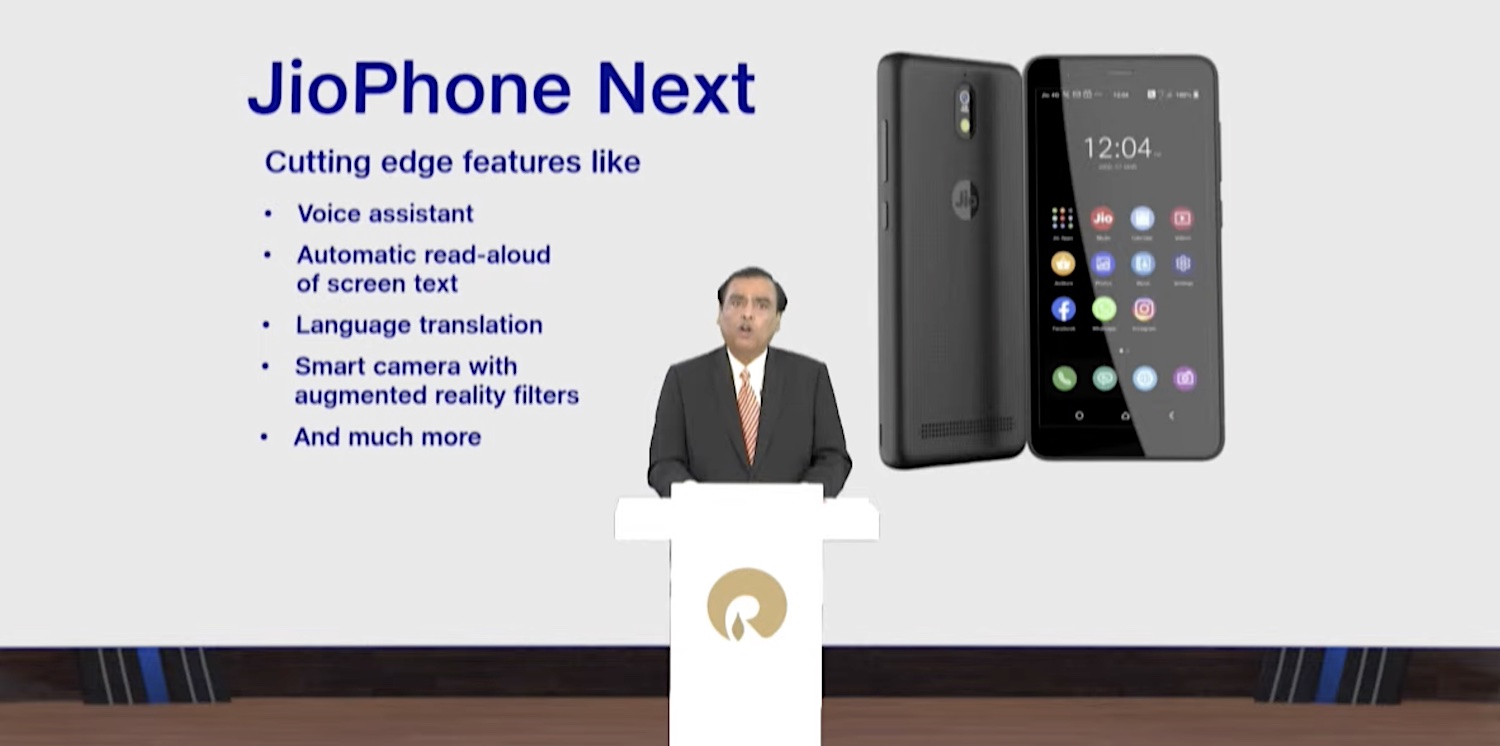

In Xiaomi’s latest earnings call, the smartphone maker said it will acquire DeepMotion, a Beijing-based autonomous driving startup, to aid its autonomous driving endeavor. The deal will cost Xiaomi about $77.3 million, and “a lot of that will be in terms of stock” and “a lot of these payments will be deferred until certain milestones are hit,” said Wang Xiang, Xiaomi president on the call.

Xiaomi’s founder Lei Jun earlier hinted at the firm’s plan to enter the crowded space. On July 28, Lei announced on Weibo, China’s Twitter equivalent, that the company is recruiting 500 autonomous driving experts across China.

Automation has become a selling point for China’s new generation of electric vehicle makers, often with companies conflating advanced driver-assistance systems (ADAS) with Level 4 autonomous driving. Such overstatements in marketing material mislead consumers and make one question the real technical capability of these nascent EV players.

Xiaomi has similarly unveiled plans to manufacture electric cars through a separate car-making subsidiary. The ADAS capabilities brought by DeepMotion are naturally a nice complement to Xiaomi’s future cars. As Wang explained:

We believe that there’s a lot of synergies with [DeepMotion’s ADAS] technology with our EV initiatives. So I think it tells you a couple of points. Number one is, we will roll out EV business. And I said in our prepared remarks, we’ve been very focused on hiring the right team for the EV business at this point in time, formulating our strategy, formulating our product strategy, et cetera, et cetera. But at the same time, we are not afraid to apply it and integrate other teams if we find that those will help us accelerate our plan right.

It’s noteworthy that DeepMotion, founded by Microsoft veterans, specializes in perception technologies and high-precision mapping, which puts it in the vision-driven autonomous driving camp. A number of major Chinese EV makers rely on consumer-grade lidar to automate their cars.

ByteDance goes virtual

ByteDance is said to be buying Beijing-based VR hardware maker Pico for 5 billion yuan ($770 million), according to Chinese VR news site Vrtuoluo. ByteDance could not be immediately reached for comment.

Advanced VR headsets are often expensive due to the cost of high-end processors. Experts observe that most VR hardware makers are yet to enter the mass consumer market. They are hemorrhaging cash and living off generous venture money and corporate deals.

ByteDance might be buying a money-losing business, but Pico, one of the major VR makers in China, provides a fast track for the TikTok parent to enter VR manufacturing. As the world’s largest short video distributor and an aggressive newcomer to video games, ByteDance has no shortage of creative talent. We will see how it works on producing virtual content if the Pico deal goes through.