India’s Directorate Of Revenue Intelligence, part of the country’s finance ministry, said on Wednesday phone-maker Oppo’s India unit evaded customs duty of $550 million, following similar probes into local units of other Chinese giants Xiaomi and Vivo that prompted Beijing to issue a warning earlier this month.

The finance ministry said it has found evidence that Oppo India “wilfully” wrongly declared description of certain items it imported in the nation, which allowed it to improperly avail duty exemption benefits of $374.3 million.

The ministry said it searched the offices of Oppo India and members of its management team who “accepted the submission of wrongful description before the Customs Authorities at the time of import.”

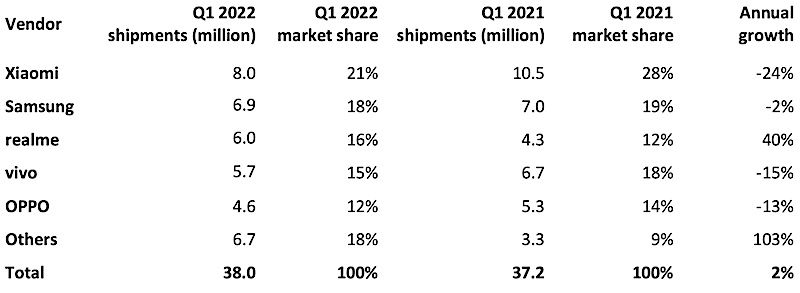

Oppo India also deals for other brands including OnePlus and Realme in the country, the ministry said. If the market share of all these units are to be combined, Oppo India is the largest smartphone vendor in the country.

It did not immediately responded to a request for comment.

“During the course of investigation, searches were conducted by DRI at the office premises of Oppo India and residences of its key management employees, which led to the recovery of incriminating evidence indicating wilful mis-declaration in the description of certain items imported by Oppo India for use in the manufacture of mobile phones,” the finance ministry said in a statement.

Additionally, Oppo India also made royalty and licence fee payments of over $176 million to other companies, including some in China, and did not disclose those transactions in the value of goods imported by them, violating the country’s Section 14 of the Customs Act, 1962, the ministry added.

Oppo India has “voluntarily deposited” about $56.5 million as partial differential customs duty, the ministry added.

Wednesday’s announcement follows the Enforcement Directorate, India’s anti-money laundering agency, raiding dozens of phone-maker Vivo’s operations and production sites across multiple states in the country.

The Enforcement Directorate said last week that a firm associated with Vivo used forged documentation at the time of incorporation in India. The agency seized 119 bank accounts with $58.7 million linked with Vivo India, it added.

The ED’s move prompted China’s embassy in India to criticize the Indian authorities last week. The embassy said such “frequent investigations” into local units of Chinese firms “impede the improvement of [the] business environment” in India and “chills the confidence and willingness” of other foreign nation’s businesses to invest and operate in the South Asian market.

The embassy said China always asks its firms to follow laws and regulations overseas and “wishes” that the Indian side provides a “fair, just and non-discriminatory business environment” to Chinese firms.

Tension between the two nuclear-armed neighboring nations escalated in 2020 after a skirmish at the border. India has since introduced several restrictions on Chinese firms (without ever naming China in its orders.)

In the past two years, New Delhi has banned hundreds of Chinese apps including TikTok, UC Browser and PUBG Mobile, citing national security concerns. India also amended its foreign direct investment policy in 2020 to require all neighboring nations with which it shares a boundary to seek approval from New Delhi for their future deals in the country. Previously, only Pakistan and Bangladesh were subjected to this requirement.

The ED also conducted an investigation into Xiaomi, another Chinese firm. The ED seized $725 million from Xiaomi India, accusing the company of violating the country’s foreign exchange laws. Executives of Xiaomi, which has refuted the charges and has legally challenged the ruling, faced threats of “physical violence” during their investigation, Reuters reported earlier.

Both Vivo and Xiaomi have denied any wrongdoing.

India Cellular and Electronics Association, a lobby group that represents several tech giants including Apple and Amazon, in May urged New Delhi to intervene and alleged ED of lacking understanding of just how royalty payments worked in the tech industry.