The COVID-19 pandemic has ushered in a wave of Chinese companies with manufacturing operations to produce virus-fighting equipment: Shenzhen-based electric vehicle giant BYD quickly moved to launch what it claims to be the world’s largest mask plant; Hangzhou-based voice intelligence startup Rokid is making thermal imaging glasses targeted at the US market; and many more.

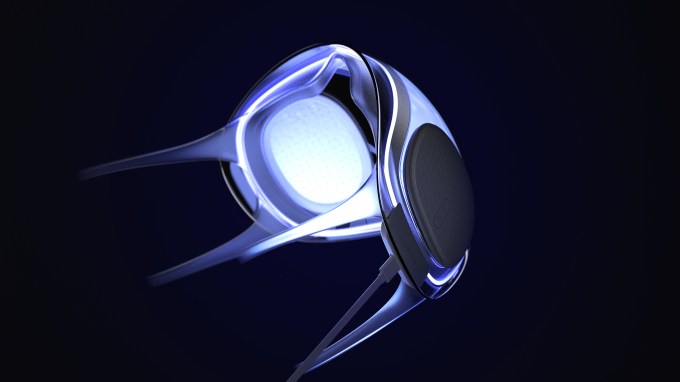

The latest of such efforts comes from Huami, the NASDAQ-listed wearables startup that makes Xiaomi’s Mi Bands and sells its own fitness tracking watches under the Amazfit brand in more than 70 countries. In a phone interview with TechCrunch, the firm said it is developing a see-through plastic mask with built-in ultraviolet lights that can disinfect filters within 10 minutes when connected to a power supply through a USB port.

The Aeri concept comes with built-in ultraviolet lights that can disinfect filters within 10 minutes when connected to a power supply through a USB port.

Called Aeri, the mask uses removable filters that are on par with N95 filtration capacity. If the concept materializes, each filter could last up to a month and a half, significantly longer than the average life of surgical masks and N95 respirators. The modular design allows for customized accessories such as a fan for breathable comfort, hence the mask’s name Aeri, a homophone of “airy”.

Aeri started from the premise that wearing masks could thwart the increasingly common adoption of facial recognition. That said, imaging companies have been working on biometric upgrades to allow analyses of other facial features such as irises or the tip of noses.

Aeri might still have a market appeal though, argued Pengtao Yu, vice president of industrial design at Huami. “Whether people need to unlock their phones or not, they want to see each other’s faces at social occasions,” said Yu, the California-based Chinese designer who had served clients including Nest Labs, Roku, GoPro and Huawei prior to joining Huami.

Huami’s U.S. operation, which focuses on research and development, opened in 2014 and now counts a dozen of employees.

Many companies turning to pandemic-fighting manufacturing have taken a hit from their core business, but Huami has managed to stay afloat. Its Q1 revenue was up 36% year-over-year to hit $154 million, although net income decreased to $2.7 million from $10.6 million. Its stocks have been declining, however, sliding from a high point of $16 in January to around $10 in mid-May.

Huami is in the process of prototyping the Aeri masks. In Shenzhen, which houses the wearables company’s headquarters, the development cycle for hardware products — from ideation to market rollout — takes as short as 6-12 months thanks to the city’s rich supply chain resources, said Yu.

Huami hasn’t priced Aeri at this early stage, but Yu admitted that the masks are targeting the “mass consumer market” around the world, not only for protection against viruses but also everyday air pollution, rather than appealing to medical workers. Given Huami’s history of making wearables at thin margins, it won’t be surprising that Aeri will be competitively priced.

The Aeri project is part of Huami’s pivot to enter the general health sector beyond pure fitness monitoring. The company has recently teamed up with a laboratory led by Dr. Zhong Nanshan, the public face of China’s fight against COVID-19, to track respiratory diseases using wearables. It’s also in talks with the German public health authority to collaborate on a smartwatch-powered virus monitoring app, the company told TechCrunch.