Xiaomi — the company that originally made its name as “the Apple of China” — broke out of its home market and became a household name in India shortly after its debut in 2014. Its initial, rapid success was with phones, but that gave Chinese company the velocity to take on other product categories, where it became a big player in wearables, smart TVs and IoT devices. Within two years, it was even investing in Indian startups and making a move into consumer lending services.

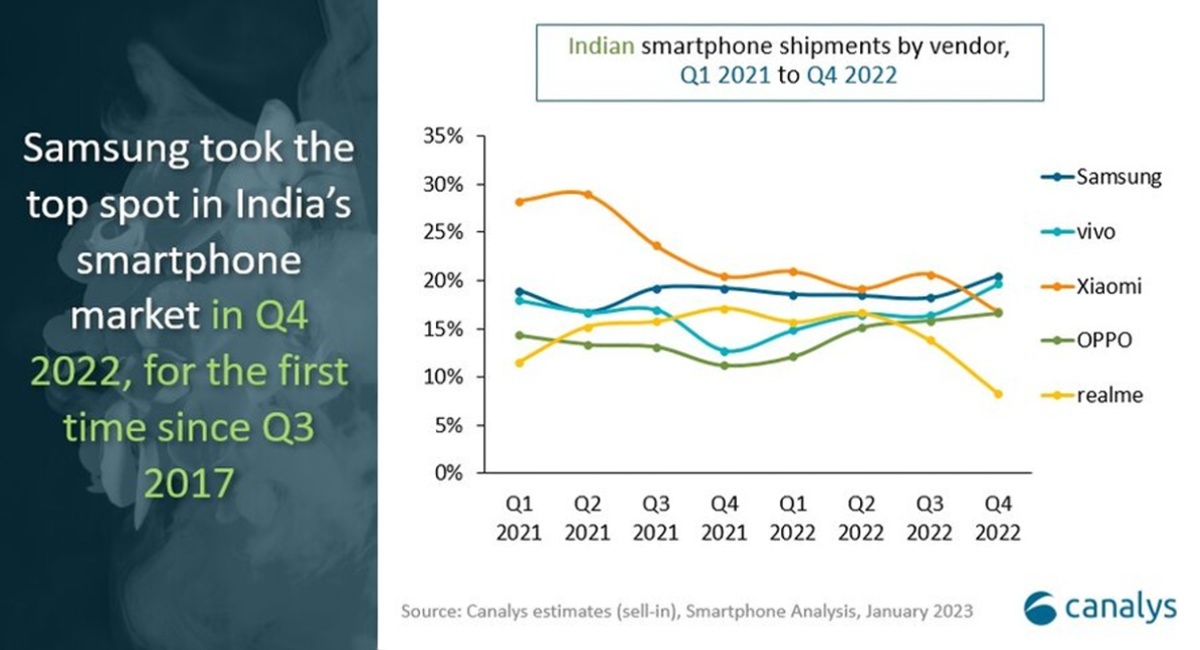

But now, as Beijing-based Xiaomi approaches its ninth year in the country with 200 million smartphones shipped, its earlier mover advantages are eroding: it lost its top position in smartphone shipments in Q4 2022; it faces regulatory pressure in the country amid growing economic tensions between China and India; and it’s wound down some of its newer business ventures. On top of all that, Xiaomi is seeing an exodus of executives in India.

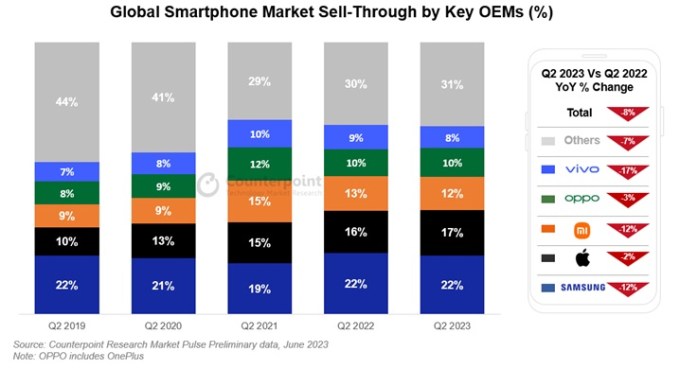

Counterpoint Research numbers from January show that Xiaomi’s India smartphone shipments in 2022 declined 24% year-on-year. It managed to keep its top position in 2022 overall, but signs are looking dicey for 2023: Xiaomi dropped to third place in Q4, behind Samsung and homegrown competitor Vivo.

Canalys also showed a similar drop, along with a 40% decline in Xiaomi’s annual growth in Q4. The company additionally saw a 26% drop in its annual growth in full-year 2022, per the analyst firm.

Xiaomi lost its leadership in smartphone shipments in Q4 2022 Image Credit: Canalys

IDC also showed a 38%+ dip in the company’s growth in Q4, though the research firm said that the smartphone maker maintained its lead in the market.

Xiaomi’s decline in India is not an isolated phenomenon. Other major smartphone vendors, excluding Samsung and Oppo, have also seen a drop in their shipments over the last couple of quarters. Market analysts attribute this trend mainly to low demand for entry-level smartphones, broader macroeconomic challenges such as high inflation and rising unemployment rates. The global smartphone market has also experienced a slowdown.

Despite these macro challenges, Xiaomi’s rise and fall and current hurdles are a unique story in the Indian market.

From launch fanfare to management overhaul and a tax investigation

In July 2014, Xiaomi entered India with a bang, a bold move at a time when it was largely known for its Apple-inspired products in China. The brand name is difficult to pronounce among local customers, but even so, the company quickly made a name for itself in the South Asian market.

The firm’s phones punched above their weight, and it managed to significantly undercut the incumbent’s offerings. And to save costs, Xiaomi opted to not spend on building its supply chain operations and instead partnered with Amazon India and Flipkart to leverage their distribution channels.

Added to this was the local economic climate: India was experiencing remarkable growth, moving away from being a massive market for feature phones with an increasing number of young, tech-savvy consumers with a new appetite for low-cost smartphone brands.

Oppo and others were also making moves, but Xiaomi rose to the top and stayed there, overtaking Samsung and local players Micromax, Karbonn Mobiles and Lava.

On the back of that, Xiaomi expanded its presence in India by introducing non-smartphone products and establishing brick-and-mortar stores, a crucial move in a market where offline retail still largely dominates.

That market entry was also buffered with a charismatic leader. In late 2013, Manu Kumar Jain, who had built his fashion e-commerce startup Jabong which was later sold to Flipkart, was looking to start a hardware startup. To raise money, he went to China, where he met Hugo Barra, Xiaomi’s then vice president, and learned about Xiaomi’s plan to enter the Indian market, according to a source familiar with the matter.

Barra — a flashy hire in his own right, coming from a high profile role at Google — was tasked with expanding Xiaomi beyond China. He saw great potential in India, which already had some Chinese players such as Oppo and Vivo — alongside local vendors. Jain was Xiaomi’s first executive in India.

In 2014, Barra and Jain led a launch event in New Delhi, playing a visible role in establishing Xiaomi’s foothold in a market. This was important not least because anti-China sentiments have long run high due to tensions with the neighboring nation.

But the company won over a loyal customer base, which it affectionately referred to as “Mi Fans.” Mi Fans eagerly participated in every new Xiaomi phone launch in the country and helped the company’s PR team by promoting its new online and offline releases.

Then in 2017, things started to shift.

Barra suddenly resigned from his position to join Facebook. The move disappointed Xiaomi’s loyal customers, but it meant even more prominence for Jain, who Xiaomi promoted to the role of managing director in 2018 to oversee the company’s operations in India.

Jain quickly filled the void left by Barra’s departure and became a poster boy for the company, interacting with local media, distributors, and fans, and serving as a bridge between the company’s top-level management in China and its counterpart in India.

Hugo Barra was a key face at Xiaomi launches in India and around the globe Image Credit: MONEY SHARMA/AFP via Getty Images

Yet in July 2021, Jain moved quietly from Bengaluru to Dubai, and the company changed Jain’s designation from managing director to director in November and appointed Muralikrishnan B, the then-chief operating officer, as a director, according to the regulatory filings. In February 2022, Jain resigned from his director position in India.

A few months later, other details started to emerge that spoke to deeper issues the company had in India.

In April 2022, Jain was summoned by India’s financial crime-fighting agency, the Enforcement Directorate. Xiaomi’s India office was also reportedly raided over an alleged tax evasion case in late 2021. The agency seized assets worth around $725 million from Xiaomi for violating the country’s foreign exchange laws. The company responded by stating that over 84% of the seized amount was royalty payments made to Qualcomm Group.

These events hit at the company’s image with customers, distributors and retailers. In response, Xiaomi’s board in India held an extraordinary general meeting, sources tell us, to declare its financial compliance with Indian authorities. Regulatory filings from the time show the company amended its legal incorporation and association documents to reflect that.

In June 2022, Xiaomi replaced Jain with Alvin Tse as the new India general manager. Tse was likely seen as a safe bet: most recently he had been leading operations in Indonesia but Tse had long familiarity with Xiaomi in India as one of the early architects of its strategy there, an investor in Indian startups, and a founding member of Xiaomi’s sub-brand Poco (later spun out as an independent business). The company also brought back Anuj Sharma — who’d been overseeing the operations at Poco India — as its CMO.

A Xiaomi India spokesperson told TechCrunch in a written response that the changes were “undertaken to streamline its focus areas and strategy.” In line with this, Muralikrishnan B. was also promoted as the president of India operations, the spokesperson said.

But the management changes did not help retain top talent. Key departures in 2022 included CMO Jaskaran Singh Kapany, offline sales operations director Sunil Baby, and chief business officer Raghu Reddy. Jain also eventually left the company in January, saying he would take some time off before considering his next move.

Grounds for top-level exits

Former employees said multiple factors pushed top-level executives to leave the company.

Xiaomi’s compensation in India is known to be poor relative to rivals. One former executive said the salaries of middle and senior management employees at Xiaomi are between 40-50% lower compared to Oppo, Vivo, OnePlus, and Samsung. That resulted in high attrition.

Despite that, Jain created a “startup culture” that still attracted strong talent.

Manu Kumar Jain became the poster boy for Xiaomi India Image Credit: Indranil Bhoumik/Mint via Getty Images

“Culturally, to me, Xiaomi was much, much higher than any organization I have known or worked with. Xiaomi was very clear about what they wanted to do, and maybe to a large extent because of Manu,” another former Xiaomi executive told TechCrunch, who did not want to be named.

But that also crashed after Jain left his position. Tse’s appointment was especially disappointing for top-level employees, who saw it as a sign that their career progression would be limited, one source said.

“Instead of just a horizontal movement, we could have looked into more vertical movement and [been] given more responsibilities,” the former executive said. “That would have played out differently.”

The Xiaomi India spokesperson responded to questions regarding the recent exits and said its attrition rate had been at par or lower than the industry average. The spokesperson also replied on the query about giving relatively low employee compensation by saying that the salaries offered to its employees were in line with industry benchmarks and competitive and “included a combination of fixed and variable pay along with other benefits.”

“At Xiaomi India, many of our senior executives and employees have been associated with us for a long time and have made valuable contributions to the company’s growth. That being said, there can be cases where people want to pursue fresh career adventures after many years,” the spokesperson said.

Anti-China sentiment made a dent, too

Barra and Jain managed to localize Xiaomi’s operations in India though ultimate control came from China. In 2015, the company started local manufacturing of its devices in partnership with Foxconn. It pronounced the local manufacturing as a move to support the Indian government’s Make in India initiative. This was used as a marketing strategy to convince customers who were avoiding Xiaomi devices due to its linkage with China, which had strained bilateral ties with India. Local manufacturing also helped the company cut import tariffs and stand for getting incentives for exporting locally-manufactured phones. The company later expanded the manufacturing to newer devices, locations and partners.

The recent supply chain challenges also did not impact Xiaomi in India as it sourced components from multiple suppliers. Additionally, the company effectively manages its stock keeping units (SKUs) by making minor design changes and selling similar models under different names.

It went all smoothly for Xiaomi until 2020 — shortly after the rise in anti-China sentiment in India over a skirmish between armies of the two nations in June. The Indian government then banned hundreds of China-linkage apps, which included Xiaomi’s Mi Community and Mi Browser apps. The company also disabled its Mi Community website.

Disabling Mi Community, which served as a one-stop destination for Xiaomi’s customers, impacted the company as it had millions of users from India who would directly engage with moderators and software teams assigned by the company. It also offered the company a space to talk about its marketing moves and communicate its product launch plans and software updates.

Alongside the ban on Mi Community, some Xiaomi stores received vandalism threats due to growing discontent. The company’s shipments coming from China were also halted at Indian ports for rigorous inspection.

Anti-China sentiment in India reached new heights in 2020 Image Credit: SAM PANTHAKY/AFP via Getty Images

The company also began to hide Xiaomi’s native ‘Mi’ branding from its stores with a banner carrying a “Made in India” label.

Xiaomi was not alone in facing criticism over its China connection. Other Chinese companies such as Vivo and Oppo also met similar behavior in the country. But as the biggest brand, Xiaomi got the most attention.

Understanding the pace of the market

In 2021, Xiaomi introduced as many as 17 smartphone models at different price points, and in 2022 it bumped that up to 18 models.

This was a major step change for Xiaomi. The company’s initial strategy was to launch one “super-hit” model every quarter to keep people buzzing about the company, said a former Xiaomi executive. The newer approach offering more choice, ironically, was a miscall. Inventory piled up.

“The biggest challenge for Xiaomi has been to understand the pace of the market,” said Tarun Pathak, research director for devices and ecosystems at Counterpoint Research. That includes better tracking and deals on its stock across its whole ecosystem of devices, but also more 5G models.

Xiaomi has smartwatches and other devices in its ecosystem Image Credit: Wang Gang / Costfoto/Future Publishing via Getty Images

Notably, the Xiaomi spokesperson said the company has a “cleaner portfolio” this year, a cornerstone to building back its position.

“2022 has been a challenging year in more ways than one,” admitted the spokesperson, but countered that its “strong brand” would help see this through. “We have kickstarted 2023 with an extremely successful launch of our most loved Redmi Note series. We will continue to delight our consumers with products that suit their requirements and enhance the overall experience.”

But high inventory issues will take a while to even out. Market analyst Ming-Chi Kuo estimated that the company’s smartphone shipments globally in 2023 would decrease by 8–10% year-on-year to 140 million.

“Xiaomi’s production plans for smartphones in 1Q23 and 2Q23 are still weak, with estimates of only 23–25 million and 20–23 million units, respectively. There are no signs of significant improvement in Xiaomi’s production plan for 3Q23,” he said, adding that its smartphone and component inventory was around 40–50 million, equivalent to 12–16 weeks, significantly more than six weeks, considered a healthy inventory level.

But even so, Navkendar Singh, associate vice president at IDC India, noted that it’s too soon to conclude that Xiaomi is losing ground in the country.

“It’s slightly premature to say that Xiaomi has thrown in the towel,” he said.

Is Xiaomi’s shine dimming in India? by Jagmeet Singh originally published on TechCrunch