Google today announced that it has signed up Verizon as the newest customer of its Google Cloud Contact Center AI service, which aims to bring natural language recognition to the often inscrutable phone menus that many companies still use today (disclaimer: TechCrunch is part of the Verizon Media Group). For Google, that’s a major win, but it’s also a chance for the Google Cloud team to highlight some of the work it has done in this area. It’s also worth noting that the Contact Center AI product is a good example of Google Cloud’s strategy of packaging up many of its disparate technologies into products that solve specific problems.

“A big part of our approach is that machine learning has enormous power but it’s hard for people,” Google Cloud CEO Thomas Kurian told me in an interview ahead of today’s announcement. “Instead of telling people, ‘well, ‘here’s our natural language processing tools, here is speech recognition, here is text-to-speech and speech-to-text — and why don’t you just write a big neural network of your own to process all that?’ Very few companies can do that well. We thought that we can take the collection of these things and bring that as a solution to people to solve a business problem. And it’s much easier for them when we do that and […] that it’s a big part of our strategy to take our expertise in machine intelligence and artificial intelligence and build domain-specific solutions for a number of customers.”

The company first announced Contact Center AI at its Cloud Next conference two years ago and it became generally available last November. The promise here is that it will allow businesses to build smarter contact center solutions that rely on speech recognition to provide customers with personalized support while it also allows human agents to focus on more complex issues. A lot of this is driven by Google Cloud’s Dialogflow tool for building conversational experiences across multiple channels.

“Our view is that AI technology has reached a stage of maturity where it can be meaningfully applied to solving business problems that customers face,” he said. “One of the most important things that companies need is to differentiate the customer experience through helpful and convenient service — and it has never been more important, especially during the period we’re all in.”

Not too long ago, bots — and especially text-based bots — went through the trough of disillusionment, but Kurian argues that we’ve reached a very different stage now and that these tools can now provide real business value. What’s different now is that a tool like Contact Center AI has more advanced natural language processing capabilities and is able to handle multiple questions at the same time and maintain the context of the conversation.

“The first generation of something called chatbots — they kind of did something but they didn’t really do much because they thought that all questions can be answered with one sentence and that human beings don’t have a conversation,” he noted and also added that Google’s tools are able to automatically create dialogs using a company’s existing database of voice calls and chats that have happened in the past.

When necessary, the Contact Center AI can automatically hand the call off to a human agent when it isn’t able to solve a problem but another interesting feature is its ability to essentially shadow the human agent and automatically provide real-time assistance.

“We have a capability called Agent Assist, where the technology is assisting the agent and that’s the central premise that we built — not to replace the agent but assist the agent.”

Because of the COVID-19 pandemic, more companies are now accelerating their digital transformation projects. Kurian said that this is also true for companies that want to modernize their contact centers, given that for many businesses, this has now become their main way to interact with their customers.

As for Verizon, Kurian noted that this was a very large project that has to handle very high call volumes and a large variety of incoming questions.

“We have worked with Verizon for many, many years in different contexts as Alphabet and so we’ve known the customer for a long time,” said Kurian. “They have started using our cloud. They also experimented with other technologies and so we sort of went in three phases. Phase One is to get a discussion with the customer around the use of our technology for chat, then the focus is on saying you shouldn’t just do chat, you should do chat and voice on a common platform to avoid the kind of thing where you get one response online and a different response when you call. And then we’ve had our engineers working with them — virtually obviously, not physically.”

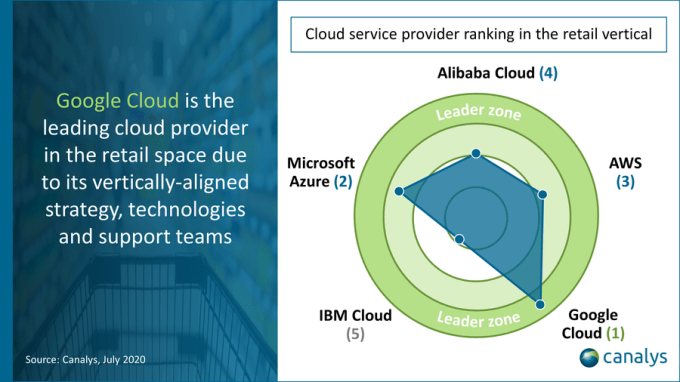

He noted that Google has seen quite a bit of success with Contact Center AI in the telco space, but also among government agencies, for example, especially in Europe and Asia. In some verticals like retail, he noted, Google Cloud’s customers are mostly focused on chat, while the company is seeing more voice usage among banks, for example. In the telco business, Google sees both across its customers, so it probably made sense for Verizon to bet on both voice and chat with its implementation.

“Verizon’s commitment to innovation extends to all aspects of the customer experience,” said Verizon global CIO and SVP Shankar Arumugavelu in today’s announcement. “These customer service enhancements, powered by the Verizon collaboration with Google Cloud, offer a faster and more personalized digital experience for our customers while empowering our customer support agents to provide a higher level of service.”