To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here.

Guess who’s back? Back again? Well, me after a long weekend, but also Elon Musk is tweeting again, and he has lots of thoughts about socks. My partner in crime, Haje, remains in an undesirable newsletter time zone but will be back later this week. I want to call out some things going on with TechCrunch. One is that TechCrunch Live’s weekly event series is new and improved, so learn more and register. Most of us here at TechCrunch spend our days on WordPress, and the Found team spoke to Matt Mullenweg, CEO of its parent company Automattic, for the latest podcast. — Christine

The TechCrunch Top 3

- Just a Glance: Manish wrote two of our top stories. The first is a scoop he got related to Glance, which is reportedly launching its lock screen content platform for Android in the U.S. in the next couple of months. He also dug into Twitter’s lawsuit against the Indian government that was prompted by content takedown orders. This is just another in a long line of troubles the company has had in this country.

- No slowdown in climate tech: Paul reports on Climentum Capital’s philosophy behind its new $157 million fund that will go into European startups helping reduce CO2 emissions.

- We gotta figure out our ‘exit scratgety’: You’ll have to go way back into the SNL archives to find that reference, but this is the first of two Haje public announcements for our founder friends. He says you really don’t need that “exit plan” slide in your pitch deck — there are a lot of assumptions and predictions on a founder’s part, and it is hard to know who wants to buy your company, so just get rid of it.

Startups and VC

There are a number of very good TechCrunch+ stories today. I recommend starting with Alex’s item on raising sweet capital in a sour market, where essentially he says venture capital firms should put their money to use when they can get more out of it. Then follow with his story from yesterday that does a bit more diving into 2021 company valuations.

Speaking of putting capital to use in easier ways, some VC firms continue to raise funds, and Sequoia Capital has been very busy. Rita reports that Sequoia’s China unit took in $9 billion, coming at a time when, she writes, “global investors are reevaluating risks in China amid a COVID-hit economy and an ongoing regulatory crackdown on the country’s internet upstarts.” This complements a quick hit I did last week about Sequoia raising two funds stateside.

Meanwhile, Haje’s other public service announcement for today is a reminder that not all of us comprehend at the same level, so startup founders should work to attract more bees with simple honey sentences rather than big, complicated fly ones.

Here’s what else you might like today:

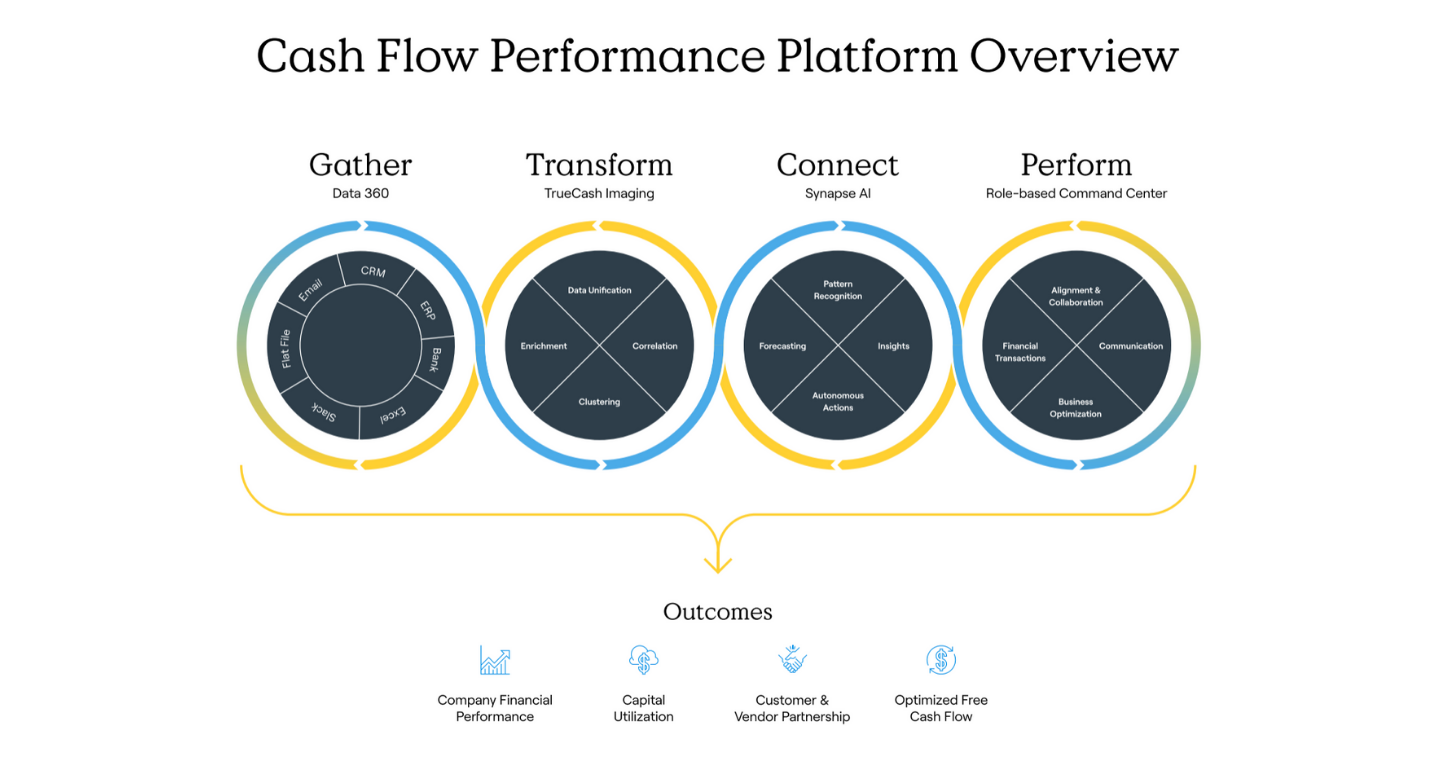

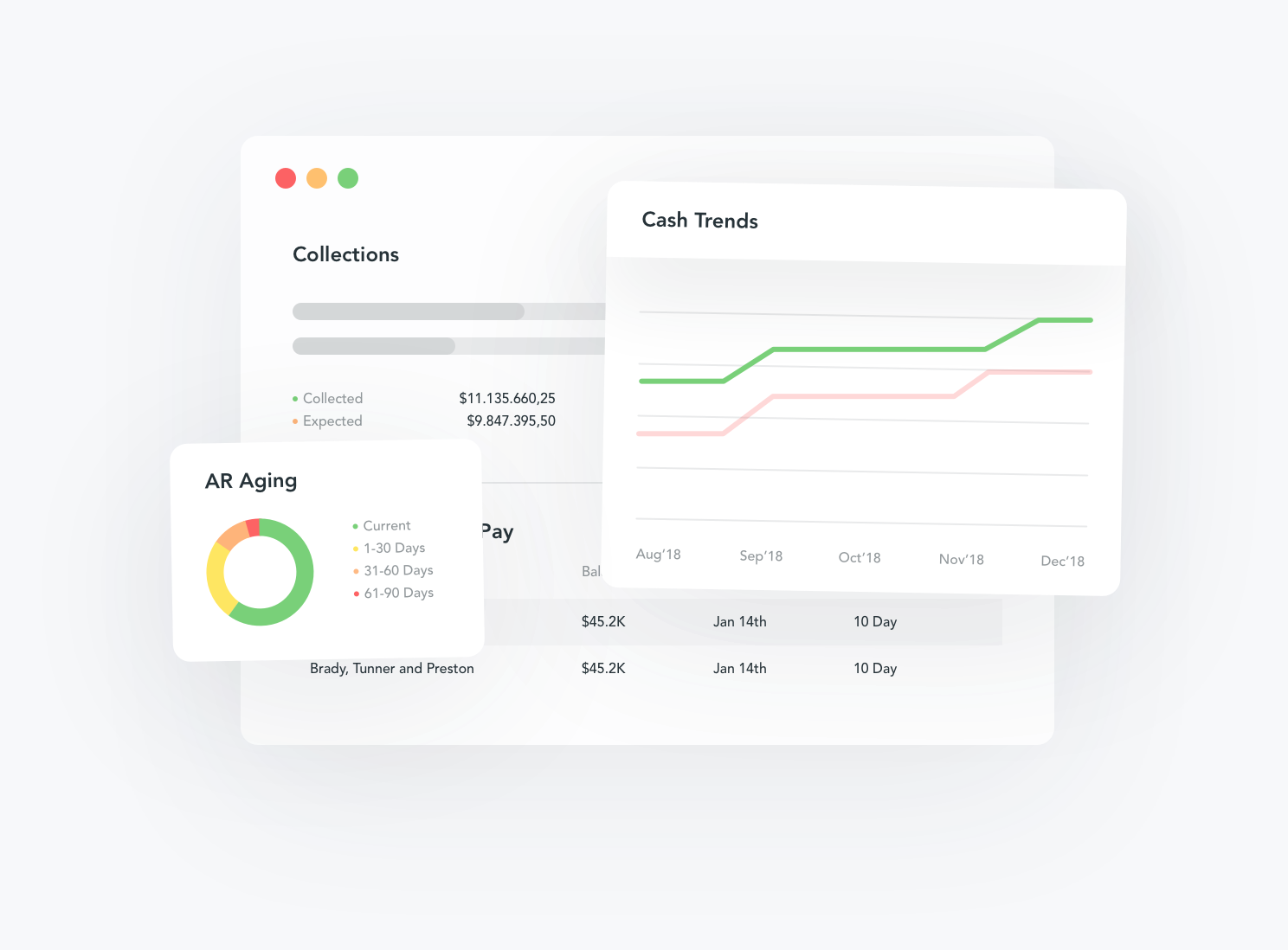

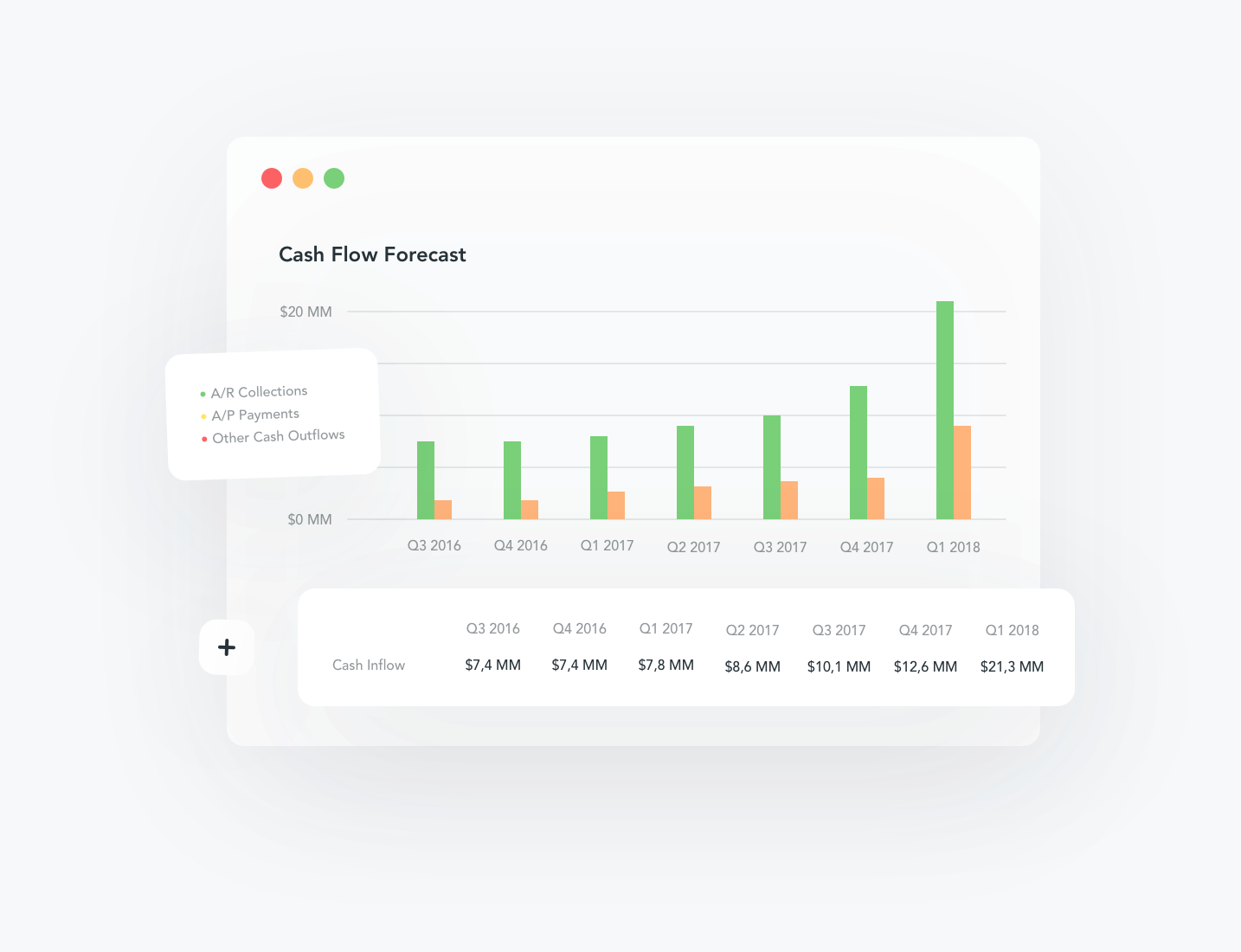

- Show me the money: Kyle reports on Tesorio, which closed on a $17 million Series B to continue developing tools to help businesses automate their payment collection process.

- The opposite of McHard is McEasy: In this case, McEasy is digitizing Indonesia’s logistics, transportation and supply chain industries, and Catherine writes about the company’s plans now that it has $6.5 million in new funding.

- Drink up: I reported on Maolac, an Israeli food tech company that is putting $3.2 million of new capital to work in its protein technology that is taking bovine colostrum and making a superfood for adults.

- If you like it, then you should have put a ring on it: Natasha takes us on a delightful journey looking at Ultrahuman’s new smart ring aimed at “decoding metabolic health.”

- A “Quantum Leap” indeed: Ingrid writes about the U.K.’s Oxford Quantum Circuits, which raised $47 million for its quantum-computing-as-a-service that runs a 3D processor architecture called Coaxmon.

- Drive time: Rebecca interviews Veo’s Candice Xie about the e-scooter company’s steady journey toward profitability.

Without a clear ask, your pitch deck is useless

Image Credits: Haje Jan Kamps (opens in a new window)

Fundraising is difficult because most people don’t have any experience asking strangers for money.

The “ask” slide where founders explain how they’ll spend investors’ money is particularly challenging. To break through the mental barrier, Haje recommends starting out with metrics and milestones.

How much will you increase MAU or lower CAC? What are your target dates for expanding in new markets?

“The more specific your goals are, the easier it is to know whether you’re trending toward them,” writes Haje.

(TechCrunch+ is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Big Tech Inc.

Some big news from yesterday was that Meta decided not to move forward with its crypto payments wallet, Novi, Natasha writes. The company isn’t getting rid of it completely, so stay tuned as to how it might be repurposed.

Meanwhile, Google is doing a little postponing of its own — with KakaoTalk updates on its Play Store. Kate reports this has something to do with the messaging app refusing to remove its own payment links. You might remember, but Google doesn’t like that.

Over in Europe, we have a trio of regulation stories. First is Natasha’s about the European Parliament giving its approval to a set of regulations regarding digital businesses. Then Paul writes about the U.K. pushing to make “foreign interference,” particularly Russian information, an offense under its proposed Online Safety Bill. Finally, Ingrid reports on the U.K. signing its first data-sharing deal since Brexit with South Korea.

Take a peek at some others:

- Those are some big lenses you have: If you like smartphones with giant camera lenses, then you will love Haje’s report on Xiaomi’s new phone.

- A marriage made in drone heaven: Brian writes about American Robotics’ owner acquiring Airobotics and why it’s a good fit.

- Talk about your front desk fail: WeWork India was found to have exposed the personal information and selfies of visitors, Zack writes.

- Fire up those engines: Rebecca listened in on Tata Motors’ shareholder meeting and found that the Indian automaker aims to sell 50,000 electric vehicles by March 31, 2023.

- Live commerce no more: TikTok is reportedly pulling the plug on plans to expand its live e-commerce unit, TikTok Shop, in the U.S. and some parts of Europe, Aisha writes. It will be interesting to see if live commerce ever does become a thing over in this part of the world.