A Jio Financial unit plans to purchase customer premises equipment and telecom gear worth $4.32 billion from Reliance Retail.

© 2024 TechCrunch. All rights reserved. For personal use only.

Product Management Confabulation

What Product Managers are talking about.

A Jio Financial unit plans to purchase customer premises equipment and telecom gear worth $4.32 billion from Reliance Retail.

© 2024 TechCrunch. All rights reserved. For personal use only.

Glance, which operates a lockscreen platform targetting Android smartphones, is setting its sights on the U.S. market. The Indian startup recently commenced a pilot program in partnership with Motorola and Verizon in the U.S., with plans for a full launch in the country later this year, sources familiar with the matter told TechCrunch. The Bengaluru-headquartered […]

© 2024 TechCrunch. All rights reserved. For personal use only.

Jio Financial Services, the financial services unit of Mukesh Ambani-run Indian conglomerate Reliance Industries, plans to expand to merchant lending and insurance, Ambani said at Reliance’s annual general meeting in a speech that is likely to have a repercussions for countless startups.

“JFS will massively increase financial services penetration by transforming and modernising them with a digital-first approach that simplifies financial products, reduces cost of service, and expands reach to every citizen through easily accessible digital channels,” he said.

“For tens of thousands of SMEs, merchants, and self-employed entrepreneurs, ease of doing business must mean ease in borrowing, investments, and payment solutions. JFS plans to democratise financial services for 1.42 billion Indians, giving them access to simple, affordable, innovative, and intuitive products and services.”

TechCrunch reported last week that Reliance was testing a sound box payment system at its campus. Analysts believe that the real allure of the sound box extends beyond its auditory alerts — it provides invaluable insights into merchant behaviors, facilitating the offering of loans based on this data.

The company will also enter the insurance segment, offering “simple, yet smart life, general and health insurance products through a seamless digital interface.” Jio Financial Services will explore partnerships with global players, he said.

“It will use predictive data analytics to co-create contextual products with partners and cater to customer requirements in a truly unique way,” he said.

Ambani’s comments offer peek into the strategic trajectory of Jio Financial Services, mere days subsequent to the lackluster inauguration of the financial entity onto the public market. Reliance’s discussion about the future plans of Jio Financial Services has been somewhat limited so far, except for its earlier announcement of a joint venture with BlackRock.

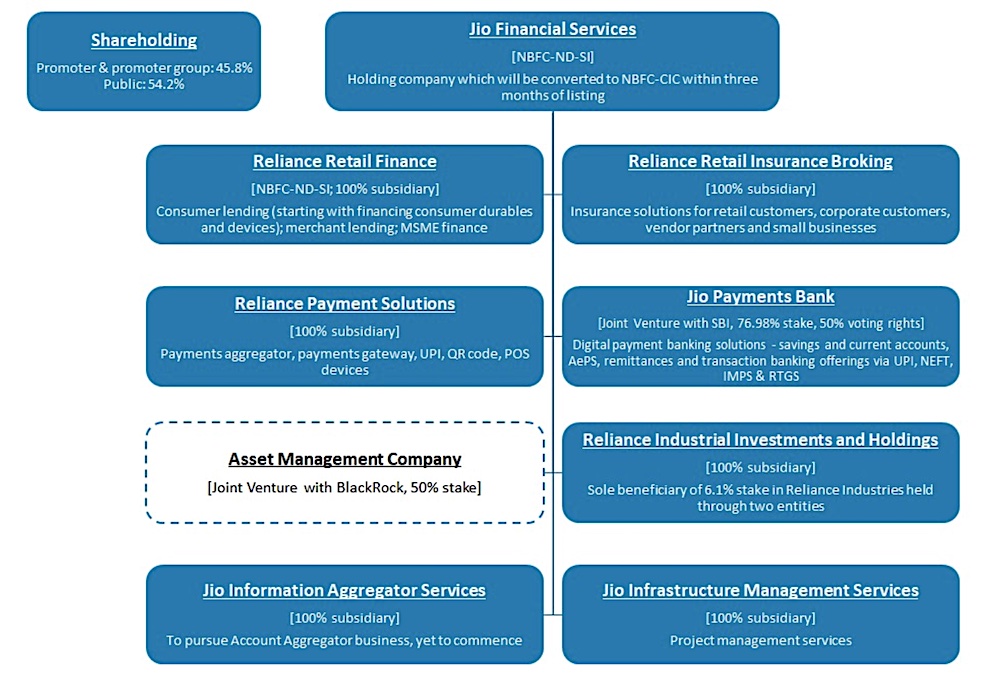

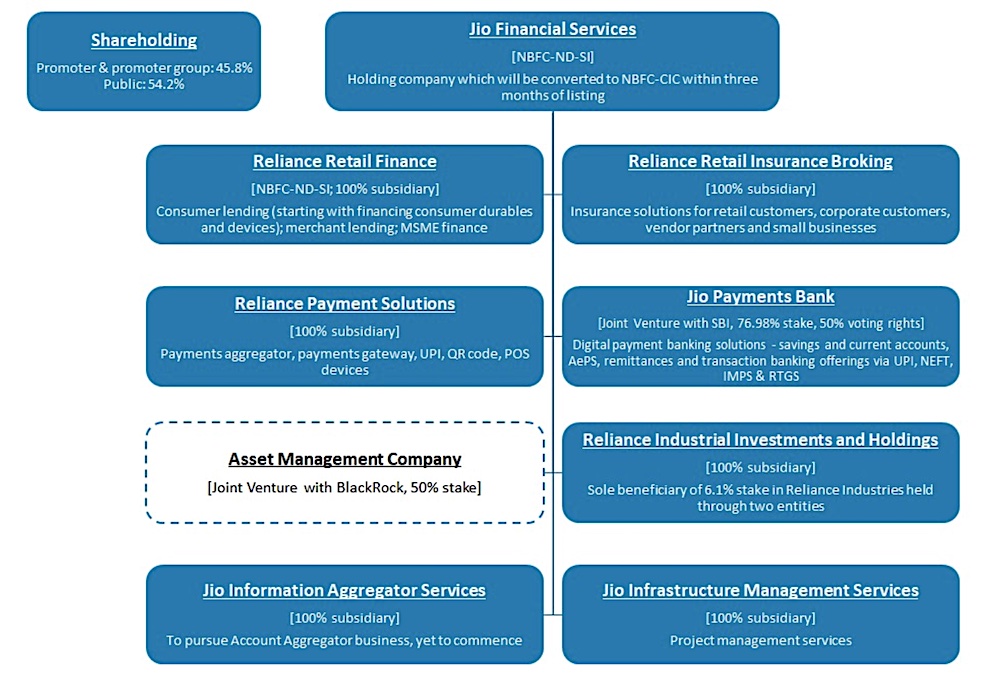

Jio Financial Services company structure (Image: Morgan Stanley)

Jio Financial Services owns 6.1% in Reliance. Ambani said JFS operates in a sector that is very capital intensive, and Reliance has made it one of the “world’s highest capitalised financial service platforms at inception.”

“There is unprecedented opportunity to transform the asset management industry by introducing a full-service tech-enabled asset manager with affordable and transparent investment products to meet the needs of every segment of society,” said Larry Fink, Chairman and chief executive of BlackRock, at Reliance’s event on Monday.

Jio Financial Services will also explore blockchain-based platforms and participation in central bank digital currency, he said.

Ambani added:

I have three reasons to be absolutely confident about JFS achieving tremendous success over the next few years.

1. The digital-first architecture of JFS will give it an unmatched head start to reach millions of Indians.

2. This is a highly capital-intensive business. Your Company has provided JFS with a strong capital foundation to build a best-in-class, trusted financial services enterprise and achieve rapid growth. Reliance has capitalised JFS with a net worth of Rs 1,20,000 crore to create one of the world’s highest capitalised financial service platforms at inception.

3. JFS is blessed with a very strong board, led by Shri K.V. Kamath, a veteran and most respected banker. A highly motivated leadership team is being built with a combination of financial industry experts and young leaders who are eager to take on big challenges.

Reliance Industries said Monday it has appointed the three children of billionaire Mukesh Ambani — Isha Ambani, Akash Ambani and Anant Ambani — to its board, the latest in the succession plan at the country’s largest company, which operates the nation’s largest telecom operator and retail chain.

Nita, Ambani’s wife, has resigned from the board, said the $202 billion oil-to-retail giant in a statement, published on the local stock exchange.

The early signs of the succession planning has been apparent in recent years with 66-year-old Ambani promoting his children to lead many of the empire’s businesses. Akash leads the digital business, Jio Platforms, whereas his twin sister Isha helms Reliance Retail. Anant leads the new energy business.

“Isha Ambani, Akash Ambani and Anant Ambani have been closely involved with and are leading and managing key businesses of RIL over the last few years including retail, digital services and energy and materials businesses,” the company said in a statement.

“They also serve on the boards of the key subsidiaries of RIL. Their appointment to the Board of RIL will enable RIL to gain from their insights and infuse new ideas, the Board opined.”

India’s Paytm introduced the innovative sound box, a pocket-sized speaker designed to instantly validate and announce successful payments to merchants. It has deployed million of these devices to the market, offering them to merchants at just above $1 monthly. India’s largest company is paying attention.

Reliance has been testing a sound box with employees at some of its stores in its campus in recent weeks, according to a person familiar with the matter.

The device uses Jio Pay as the reconciler, the person said, requesting anonymity speaking on nonpublic matters. The firm, run by Mukesh Ambani, has a tradition of internally testing new offerings with its staff before a public launch. But how soon, if at all, it plans to unveil the device remains unclear. It didn’t respond to a request for comment.

The sound box, whose bill of materials cost less than $20, is rapidly becoming an emblem of digital transactions in various Indian retail settings. Its audible confirmation feature is particularly popular in marketplaces and cacophonous street corners, instilling trust and confidence in both sellers and buyers regarding payments transactions.

Moreover, the sound box has evolved into a lucrative subscription model over time as companies like Paytm and the Walmart-backed PhonePe impose nominal subscription charges on merchants. The real allure of the sound box extends beyond its auditory alerts – it provides invaluable insights into merchant behaviors, facilitating the offering of loans based on this data.

No wonder then that scores of companies including large banks HDFC, ICICI and Google have launched or tested their own sound boxes in recent quarters.

Jio Financial Services maze (Image: Morgan Stanley)

Reliance’s interest in the business comes as a time when its financial services unit, Jio Financial Services, is looking to expand to more businesses. The firm, which currently offers no services but has unveiled plans to offer a wealth management service in partnership with BlackRock, plans to expand to merchant lending.

“The merchant lending business will provide trade credit, personal loans, store improvement loans, and unsecured business loans. The MSME finance business will offer working capital funding needs for suppliers and distributors. All three verticals will adopt a digital-first, tech-led business model,” Morgan Stanley analysts wrote in a report this week.

If Reliance ventures into the business, it has a distinct advantage: The company can access capital at more affordable rates than many of its Indian counterparts.

Reliance’s digital arm, Jio Platforms, has unveiled a new mobile handset and associated tariff plans, the latest in a series of years-long efforts from the top Indian telecom operator as it vies to convert users who remain entrenched in the country’s legacy 2G networks.

Named ‘Jio Bharat,’ the handset from Jio Platforms is 4G-enabled and offers a suite of modern features including mobile payments capabilities with UPI, and access to Jio’s own on-demand video and music streaming services, JioCinema and JioSaavn.

The phone is priced at 999 Indian rupees, or $12.2, Reliance said in a statement Monday. Jio Bharat is aimed at reaching about 250 million consumers in India who have not been able to afford switching to 4G networks, the Indian giant said. The handset is part of the offering, the other play is the new affordable tariff plan.

Jio Platform unveiled a new monthly plan that costs just 123 Indian rupees, or $1.5 that enables 14GB of data usage for the month and unlimited voice calls. For those subscribing for the year, the plan costs 1,234 Indian rupees, or $15.

Reliance said it will start offering the Jio Bharat to consumers starting July 7 as part of a “beta trial.” It said the trial is put in place to “ensure scalability of platform and processes for upgrading millions of feature phone users.”

“The new Jio Bharat phone is another step in that direction. It is at the centre of innovation, and it continues to demonstrate our focus on bringing disproportionate and true value for different segments of users with meaningful, real-life use cases,” said Akash Ambani, Chairman at Reliance Jio, in a statement.

More to follow.

India’s Reliance launches $12 4G-enabled phone to extend reach by Manish Singh originally published on TechCrunch

Reliance Industries, run by India’s richest man Mukesh Ambani, is gearing up to deploy a winning strategy from its past playbook for the fashion market: low-cost products.

Ajio, Reliance’s retail fashion arm, has quietly launched Ajio Street. The platform boasts a vast selection of clothing and accessories, starting from a price point as low as 199 Indian rupees ($2.4). According to Ajio’s website, Street guarantees the “lowest price” for its offerings, waives delivery charges, and promises a straightforward returns process.

The roll-out of Ajio Street, which has not been previously reported, coincides with a confirmation from Shein, a dominant player in the global budget fashion market hailing from China, that it has partnered with Reliance to reestablish a presence in the lucrative Indian market.

The emphasis on affordability is key in capturing market share in India’s fashion sector, analysts say, citing the region’s notoriously price-sensitive consumers.

Ajio Street website. (Screen capture)

The Indian newspaper Economic Times reported last month that Reliance plans to target consumers in smaller Indian cities and towns with Ajio Street. The newspaper also said that Street will operate on a zero-commission model, meaning sellers will not be paying any commission to the platform in a move to gain quick inroads.

Reliance’s plan also puts Ajio Street in direct competition with SoftBank and Prosus-backed Meesho, which specialises in selling low-cost longtail fashion and accessory items.

Ajio, launched in 2016, currently commands over 15% of the fashion e-commerce market in India, according to wealth management and research firm Bernstein. Flipkart, which owns fashion giant Myntra, dominates the category with over 60% market share, while Amazon is holding on to about 20% of the slice.

For Reliance, deploying an affordability-led approach to achieve market dominance has been a longstanding strategy. This was strikingly evident in the previous decade when the company dramatically shook the Indian wireless sector with the introduction of Jio – offering free voice calls and cutrate data rates. With a subscriber base now exceeding 430 million, Jio now dominates the telecommunications industry in the South Asian market.

Ambani’s Reliance targets Indian fashion e-commerce with low-cost model by Manish Singh originally published on TechCrunch

Mukesh Ambani’s Jio, the South Asian telecom powerhouse, has long sought to entice its customer base with a plethora of services aimed at boosting subscriber retention. Despite amassing over 425 million customers and claiming the mantle of India’s top network provider—due in large part to its aggressively competitive data pricing—Jio’s array of additional services has yet to gain significant traction.

With the highly anticipated Indian Premier League (IPL) cricket tournament starting later today, Ambani is eyeing this as the perfect opportunity to revamp Jio’s service adoption strategy.

Viacom18 – a venture between Ambani’s Reliance and Paramount – outbid Disney to secure five years of IPL’s streaming rights for the Indian subcontinent region with a sum of $3 billion. Unlike Disney’s Hotstar, which restricted access to IPL streaming to paid subscribers in recent seasons, Viacom18 is opening the floodgates for IPL games to everyone on the Jio network.

In a move that proved transformative, Star India executives Ajit Mohan and Uday Shankar’s strategic investment in cricket streaming nearly a decade ago catapulted Hotstar to prominence as a household name. The platform drew over 100 million digital viewers during the two-month-long event year after year, with cricket alone solidifying Hotstar’s position at the pinnacle of the market.

Star India’s Hotstar was a crown jewel in Fox’s large portfolio in the $71 billion acquisition by Disney, prompting the Mickey Mouse company to expand the service to many international markets.

However, Disney’s decision last year to relinquish digital streaming bids in favor of securing television broadcast rights under the leadership of former CEO Bob Chapek left many industry insiders perplexed. The company has also decided not to renew the licensing rights for HBO content in India in a move that has understandably frustrated many Hotstar subscribers.

In 2016, as Reliance prepared to launch Jio, the company emerged as the first telecom operator to believe in Hotstar’s vision and commit to collaboration, according to a source familiar with the discussions. Disney reaped significant benefits from Jio’s competitively priced data plans, which enabled tens of millions of Indian consumers to alter their internet consumption habits virtually overnight.

Now, it appears that Reliance is shifting gears and focusing on its own interests.

Jio has been assertively recruiting talent from Disney’s Hotstar, restructuring its infrastructure to accommodate a large user base. The company plans to provide 16 distinct feeds for IPL matches, featuring ultra-HD resolution – a first for cricket in India – and coverage in 12 languages.

Analyst group Media Partners Asia estimates that Jio Cinema, where Viacom18 plans to stream matches, will be able to drive sales of up to $350 million during the IPL season this year, up from $128 million in digital sales in 2022. The group marked down advertising sales on pay TV to $220 million, from $442 million last year.

“The US$550 mil. number across digital and pay-TV is marginally flat Y/Y and represents a steep loss against annualized 2023-27 IPL rights fees of US$1.2 bil. Subscription fees are expected to be very modest this year because of challenges on pay-TV distribution and the lack of a subscription fee on digital,” it wrote in a report.

Reliance has “promised” advertisers that cricket streaming on Jio Cinema will reach 400 million users, said Media Partners Asia. Jio Cinema has also promised a concurrent user base of 100 million, nearly four times of the current records, the analyst group added.

Nonetheless, this underscores a considerable leap for Jio Cinema, which currently boasts fewer than 30 million monthly active users, as per data from mobile intelligence firm Sensor Tower. This is despite the fact that over 400 million Jio subscribers are eligible to access Jio Cinema at no extra charge.

Numerous industry executives have expressed skepticism regarding the likelihood of such a significant number of users transitioning to streaming on their smartphones when they have the option of watching games on their satellite televisions.

Additionally, whether Jio Cinema can effectively manage the technical demands of tens of millions of viewers tuning in to cricket matches remains an open question for the time being.

Ambani bats for cricket glory as Disney scales back in India by Manish Singh originally published on TechCrunch

Reliance Retail, India’s largest retail chain, will start accepting retail payments in digital rupee in a move that could supercharge the adoption of the country’s recently launched CBDC.

The Mukesh Ambani-led firm said it has partnered with ICICI Bank, Kotak Mahindra Bank and Innoviti Technologies to launch the in-store support for digital rupee. Customers who wish to pay through the country’s CBDC (Central Bank Digital Currency), called e₹-R, will be provided with a dynamic digital rupee acceptance QR code for scanning at the store, the retail giant said Thursday.

Reliance Retail, part of the Indian conglomerate Reliance, said it has rolled out the support for CBDC at its gourmet store line Freshpik and will extend the feature across all its properties eventually. Thursday’s move makes Reliance the largest Indian firm to adopt the digital rupee.

“This historic initiative of pioneering the digital currency acceptance at our stores is in line with the company’s strategic vision of offering the power of choice to Indian consumers,” said V Subramaniam, Director, Reliance Retail, in a statement. “With more Indians willing to transact digitally, this initiative will help us provide yet another efficient and secure alternative payment method to customers at our stores.”

India’s central bank started to pilot the e₹-R in December for retail markets across select Indian cities.

Through e₹-R, the Reserve Bank of India hopes to lower the economy’s reliance on cash, enable cheaper and smoother international settlements and protect people from the volatility of private cryptocurrencies. Based on the test results of the ongoing pilot, the central bank plans to experiment with additional features and applications of the digital rupee.

India’s central bank has spent the last few years largely pushing to make its citizens avoid crypto trading. Despite a ruling from the country’s apex court, the central bank continues to force the hand of banks from engaging with crypto platforms in India, a move that has made on-ramp a nightmare for the firms involved, people with direct knowledge of the matter said.

“e₹ is a game-changer in the digital revolution unleashed in the country,” said Deepak Sharma, President and Chief Digital Officer at Kotak Mahindra Bank, in a statement. “All customers having e₹-R wallets will now be able to enjoy an effortless, safe and instant way of digital transactions at Reliance Retail stores.”

India’s retail giant Reliance to accept CBDC at stores by Manish Singh originally published on TechCrunch