Consumer spending on mobile apps reached $170 billion in 2021, according to App Annie’s newly released “State of Mobile 2022″ report, out today, which offers a comprehensive look at the app economy across iOS, Google Play and third-party Android app stores in China. That figure is up 19% year-over-year, which is down just one percentage point from the growth rate the firm reported in its prior annual report. Growth in app downloads, however, dipped a bit more. Though today’s consumers are installing more apps than ever — 230 billion were downloaded in 2021, setting another record — the growth rate itself is slowing.

In January 2021, App Annie reported year-over-year download growth of 7% during 2021, which has now dropped to just 5% in 2021.

Download growth today is being driven largely by emerging markets like India, as well as Pakistan, Peru, the Philippines, Vietnam, Indonesia and Egypt.

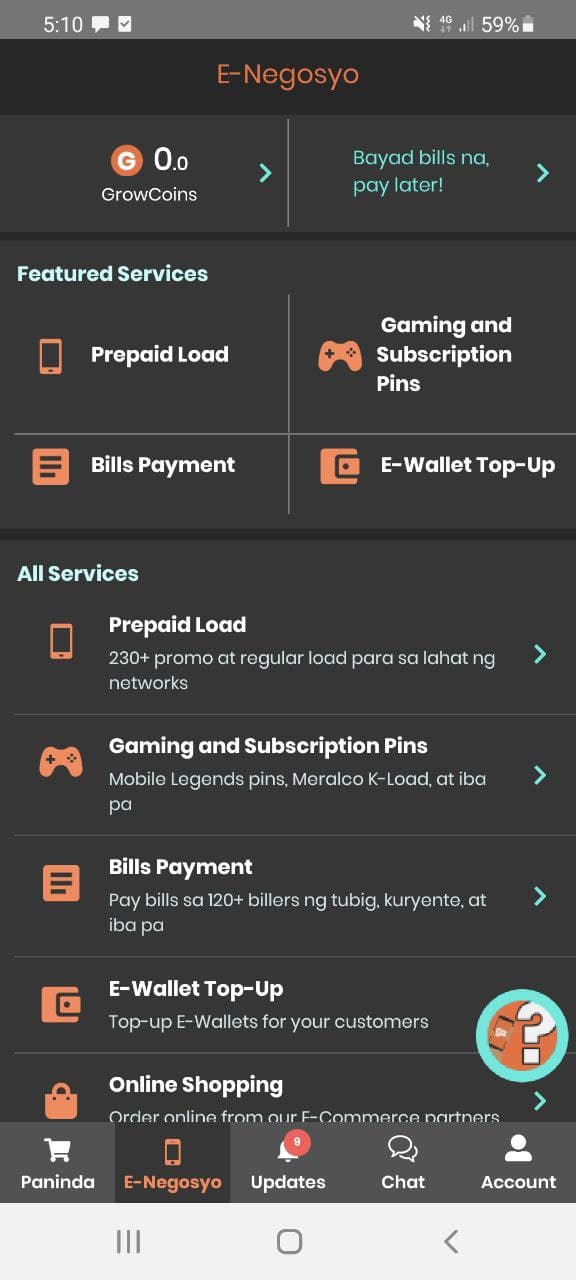

Image Credits: App Annie

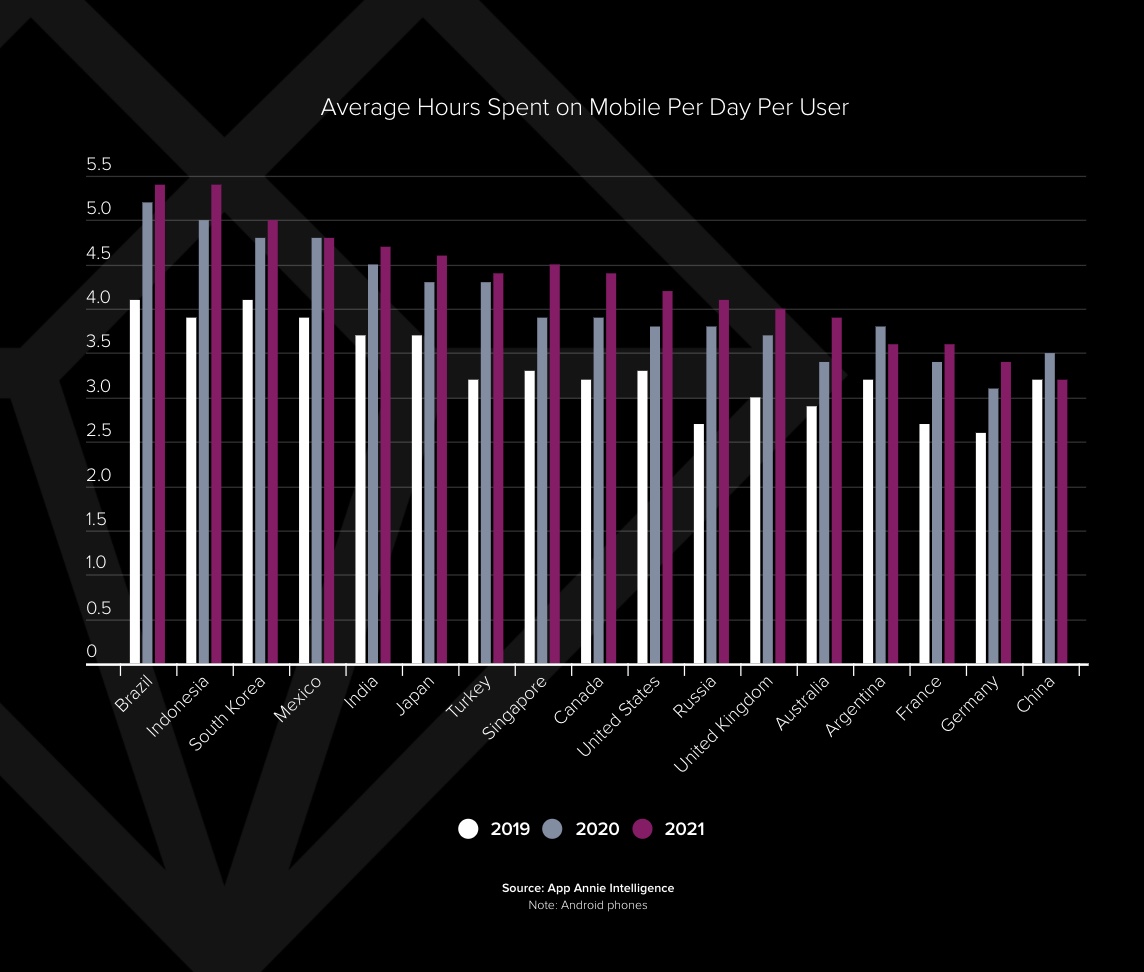

What’s also clear is that consumers are spending more time in apps — even topping the time they spend watching TV in some cases.

The report noted the average American watches 3.1 hours of TV per day, for example, but over the course of the past year, they spent 4.1 hours on their mobile device. And they’re not even the world’s heaviest mobile users. In markets like Brazil, Indonesia and South Korea, users surpassed 5 hours per day in mobile apps in 2021.

Across the top 10 markets analyzed in the study, the average time spent in apps topped 4 hours, 48 minutes in 2021 — up 30% from 2019. This included the averages from Brazil, Indonesia, South Korea, Mexico, India, Japan, Turkey, Singapore, Canada, the U.S., Russia, the U.K., Australia, Argentina, France, Germany and China combined.

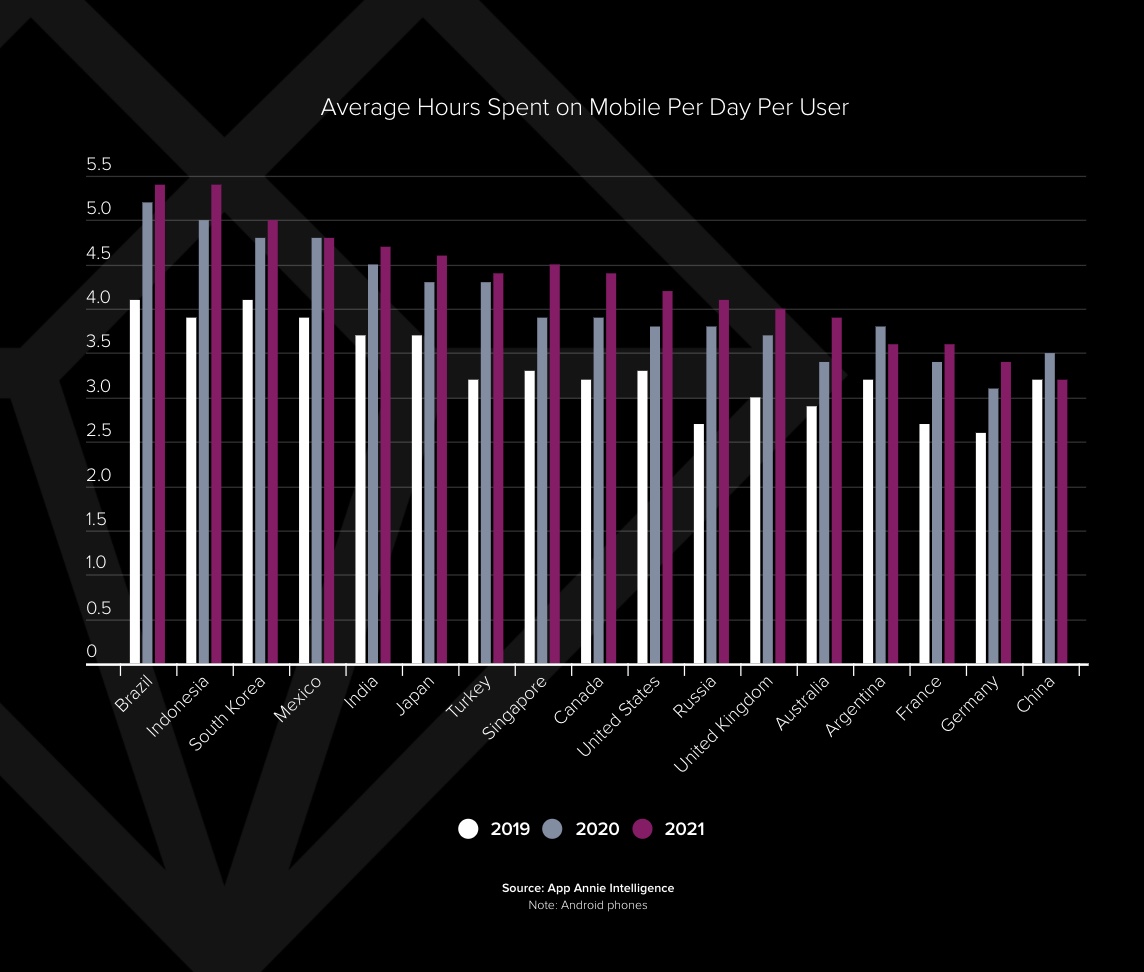

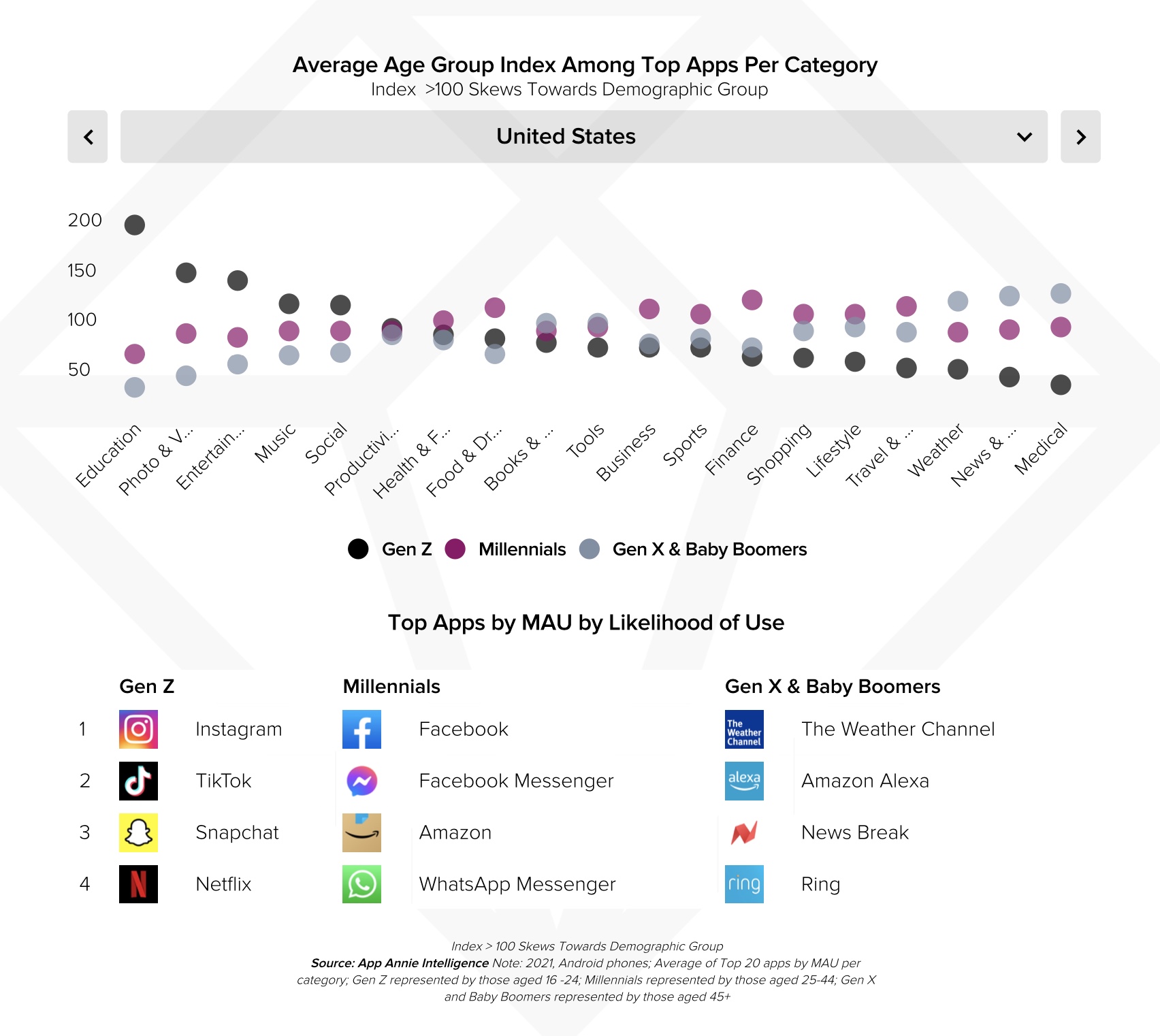

Much of this time was spent in social, photo and video apps, which accounted for 7 out of every 10 minutes spent on mobile in the past year. These categories, plus entertainment apps, also appeal to Gen Z users, particularly in the U.S.

Here in the U.S., Gen Z’s most-used apps included Instagram, TikTok, Snapchat and Netflix. Millennials meanwhile preferred Facebook, Messenger, Amazon and WhatsApp. Gen X, which has now been lumped into the Baby Boomer demographic (ack!), used The Weather Channel, Amazon Alexa, NewsBreak and Ring.

Image Credits: App Annie

This increased time spent in apps has had a direct impact on consumer spending. In the U.S., the COVID-19 pandemic’s lingering effects have forced users to shop, work, learn, game and entertain themselves from home over the past year. This led to “phenomenal” growth in consumer spending, App Annie said, as the market added $43 billion in 2021, or $10.4 billion more than 2020, equating to 30% year-over-year growth — higher than the global average.

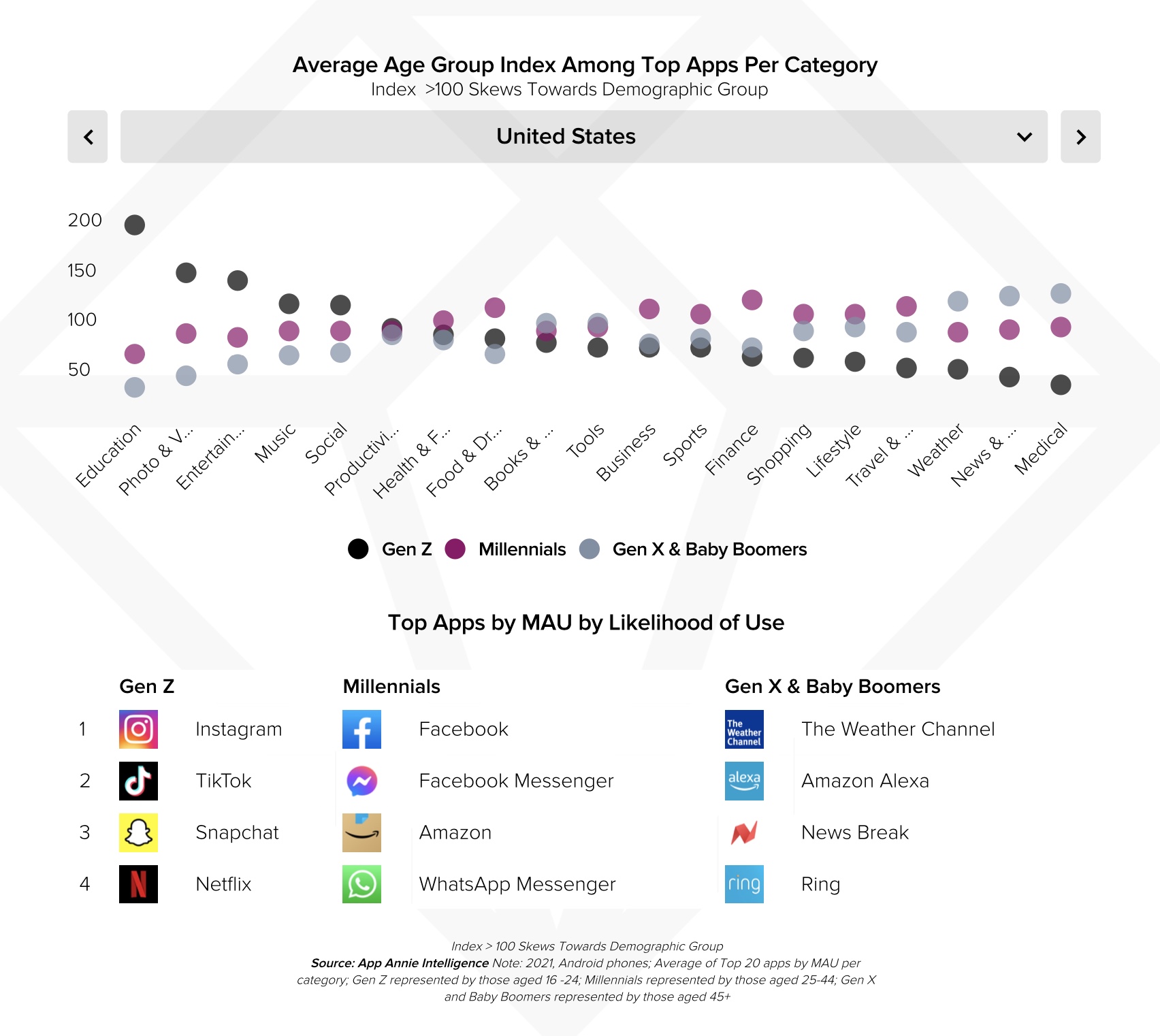

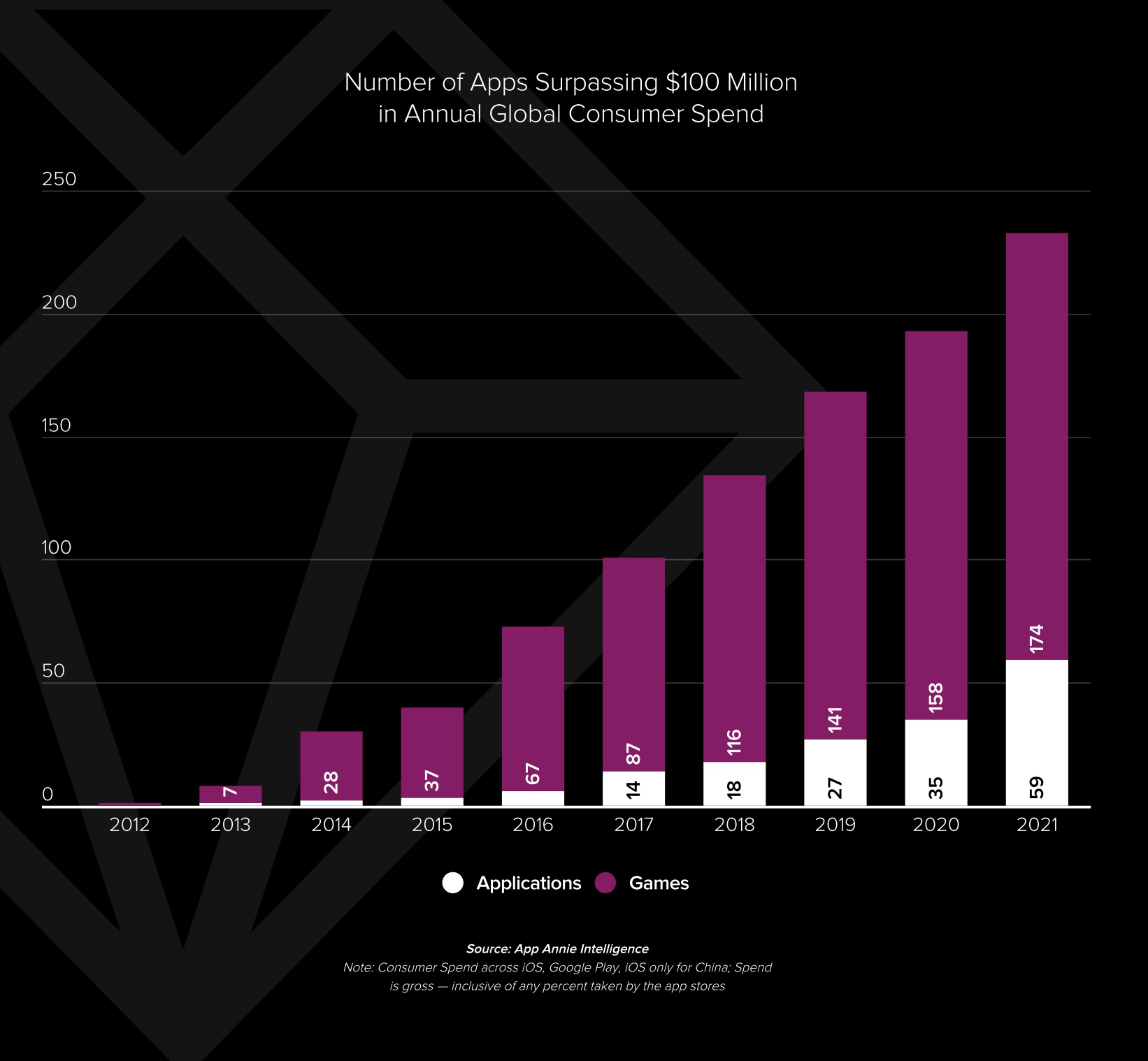

At the high end of consumer spending, there were 233 apps and games that pulled in more than $100 million in 2021, and 13 titles that generated over $1 billion. This is up 20% from 2020, when there were then 193 apps and games topping the $100 million mark, and only 8 titles making over $1 billion annually.

Image Credits: App Annie

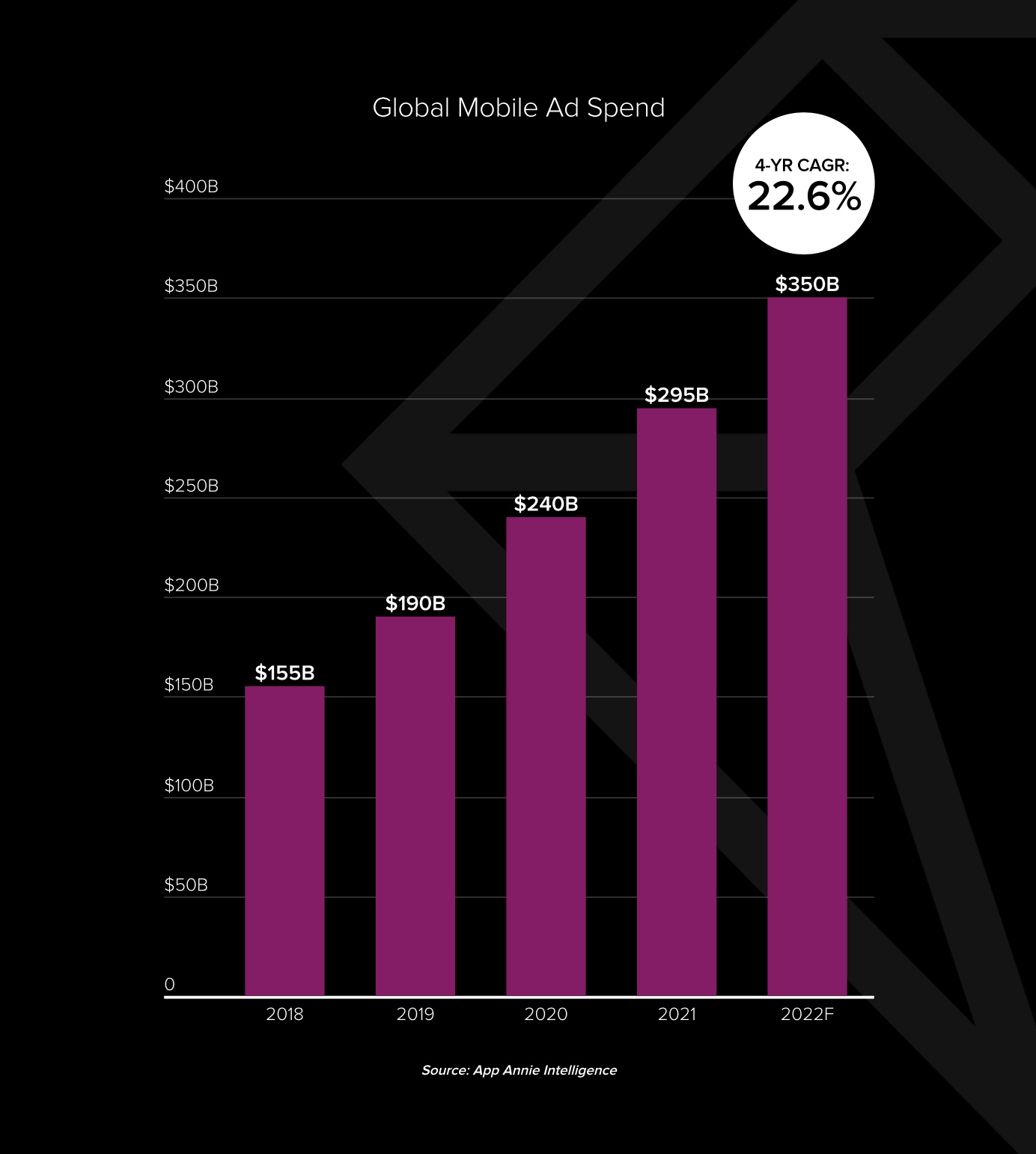

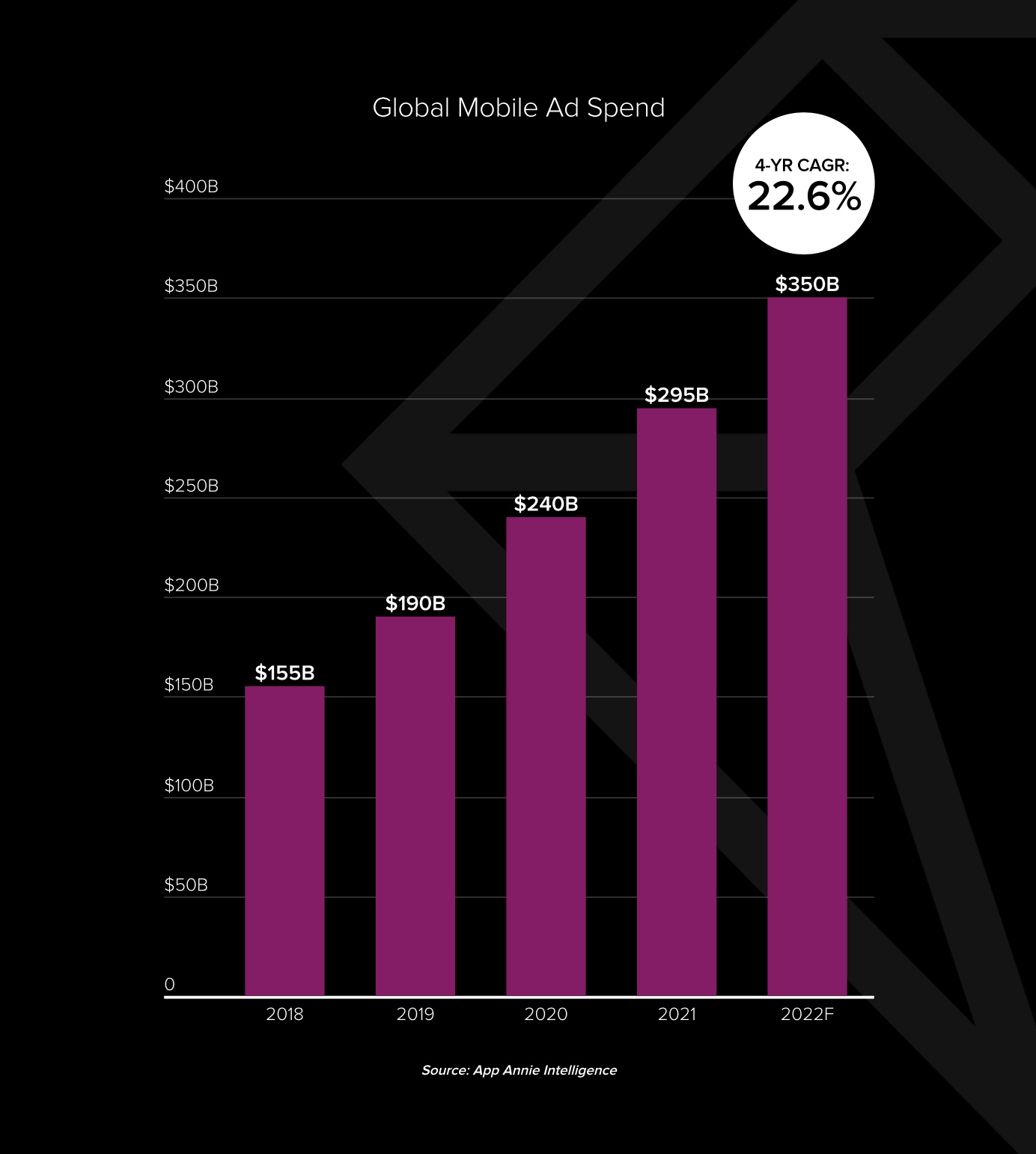

Outside the consumer spending that included paid apps, subscriptions and in-app purchases, the broader mobile app market topped $295 billion in 2021, up 23% year-over-year, despite fears from marketers over Apple’s privacy changes and IDFA crackdown. In 2022, the market is expected to grow to $350 billion, aided by big events including the Beijing Olympics and the U.S. mid-terms.

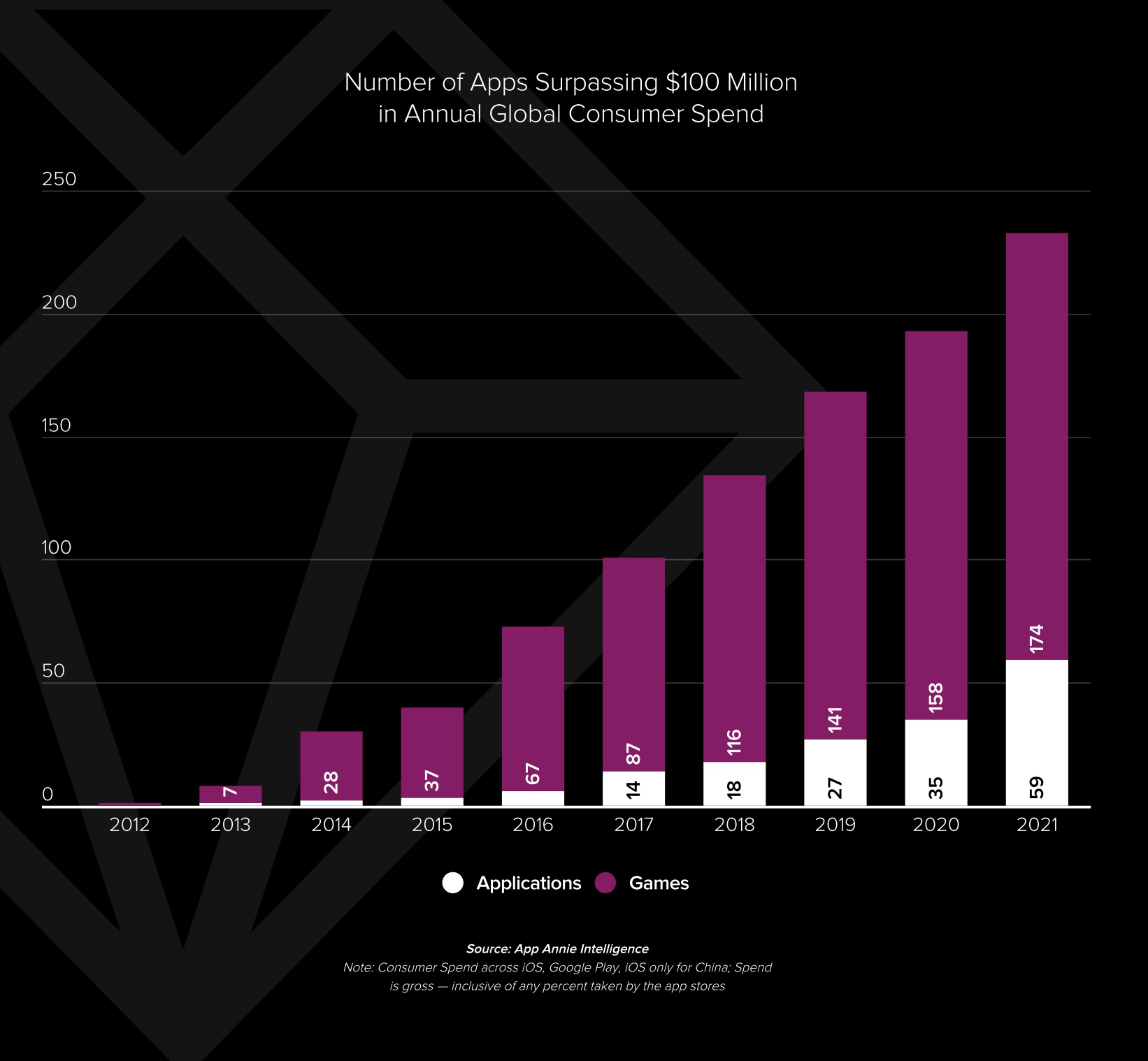

Image Credits: App Annie

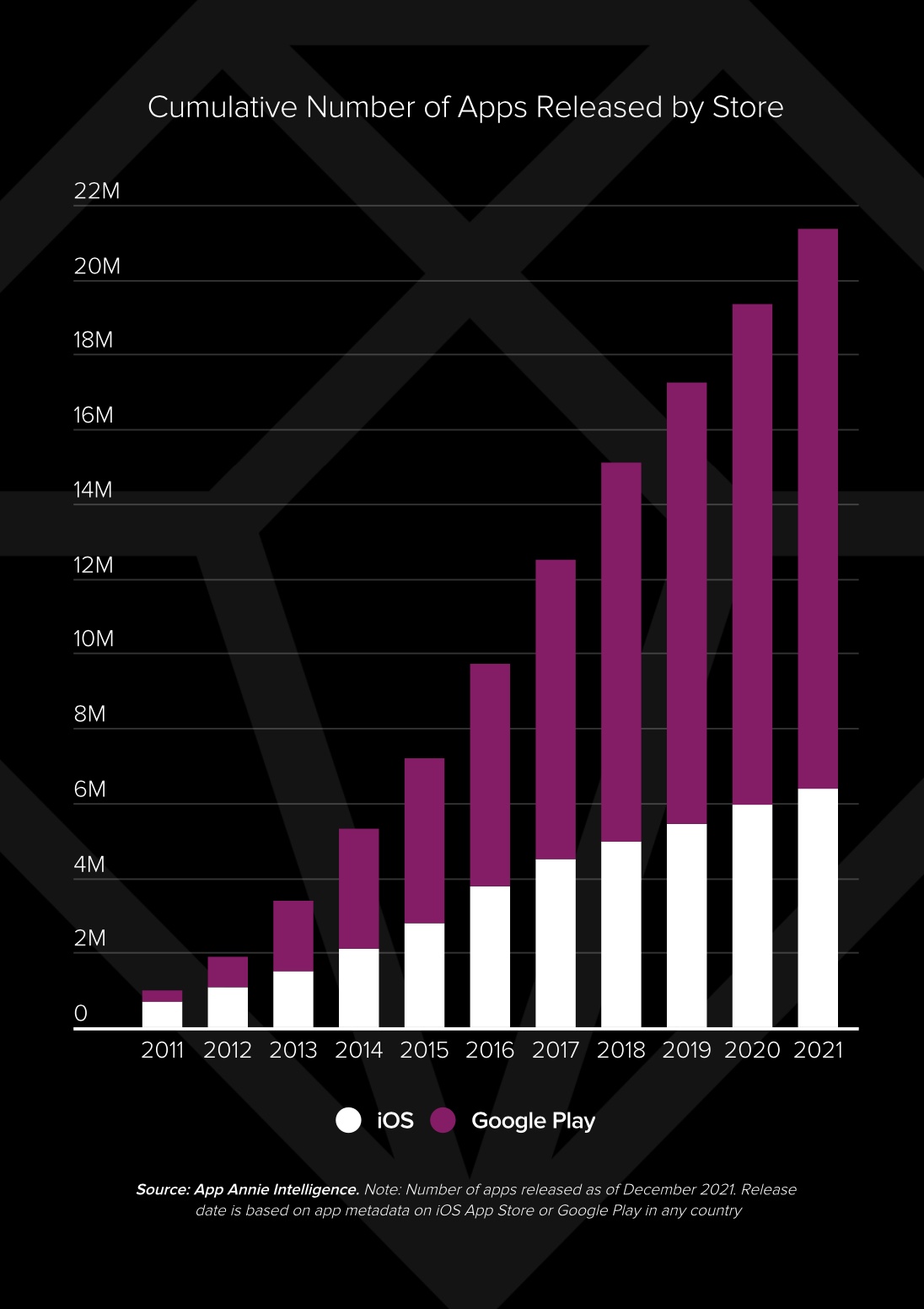

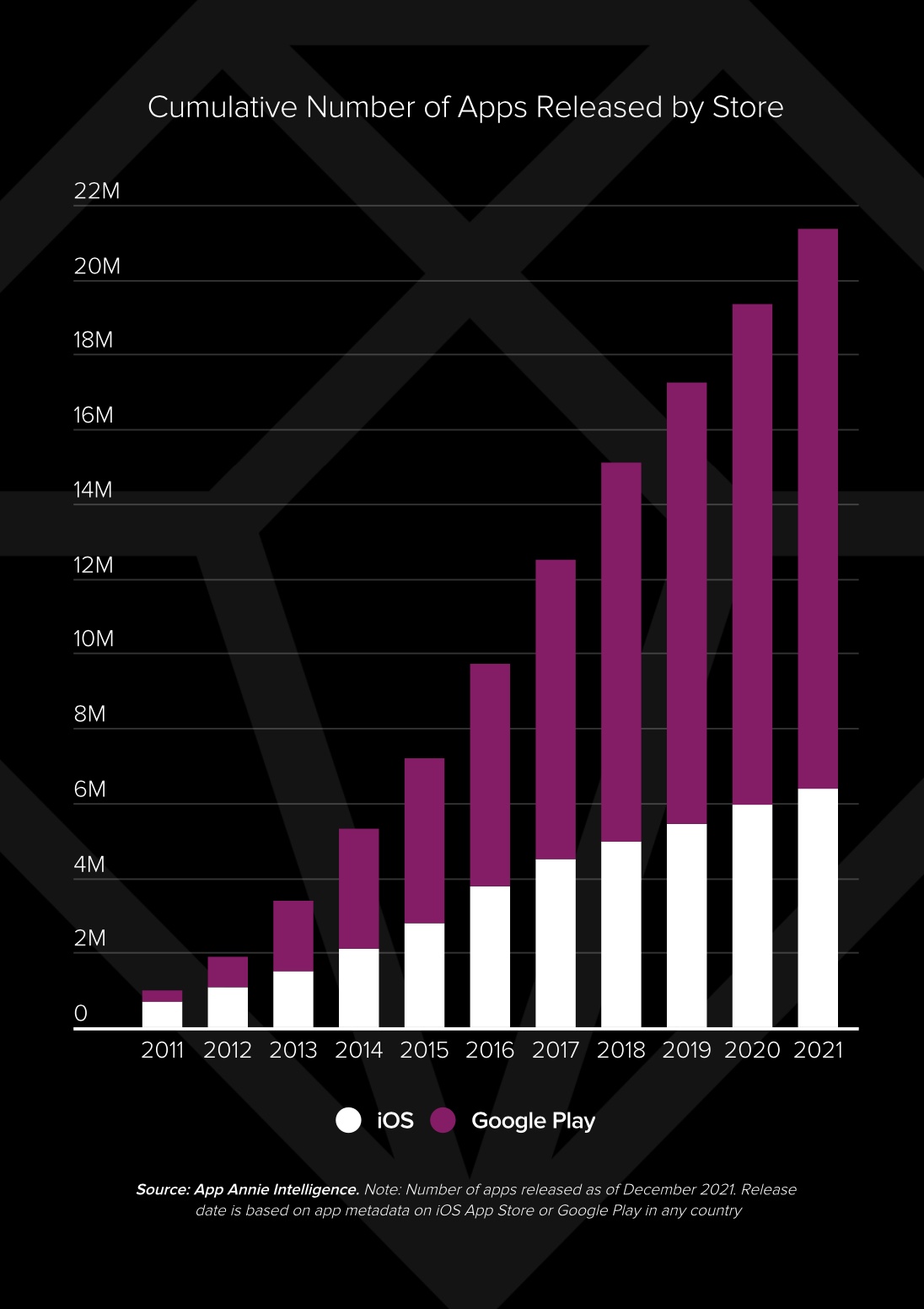

New mobile app releases also grew in 2021, as publishers launched 2 million new apps and games, bringing the total number of apps and games ever released across the App Store and Google Play to 21+ million. Of course, older apps and games have since been removed over the years either by the publishers themselves or the app stores during cleanups. Currently, there are 5.4 million “live” apps and games available on the app stores, 1.8 million of which are on iOS and 3.6 million on Google Play.

Google Play also accounted for 77% of all the new releases last year, while games made up 15% of all releases across both stores, the report noted.

Image Credits: App Annie

App Annie’s full report took a deep dive into individual app categories, as well, including gaming, finance, retail, video streaming, food & drink, health & fitness, social, travel, dating and more.

Among the highlights from its findings:

- Gaming: An additional $16 billion in gaming consumer spend was added in 2021, bringing the total spend to $116 billion.

- Finance: Finance app downloads in India topped 1 billion in 2021, driving the category’s 28% year-over-year increase in downloads to 5.9 billion worldwide.

- Shopping: Time in shopping apps reached over 100 billion hours spent globally in 2021, up 18% year-over-year. Countries with the fastest growth include Indonesia, Singapore and Brazil (52%, 46% and 45%, respectively).

- Video Streaming: Total hours spent watching video streaming apps grew 16% worldwide since pre-pandemic levels. But China saw declines as users shifted to short-form apps TikTok and Kwai. Netflix is on track to top 1 million downloads in more than 60 countries in 2022.

- Food & Drink: Sessions in food & drink apps reached 62 billion in 2021. Several regions drove growth in Q4, including the U.S. (42% year-over-year), Russia (154% YoY), Turkey (75% YoY) and Indonesia (over 9x growth).

- Health & Fitness: Worldwide downloads of health & fitness apps surpassed pre-COVID levels in 2021, despite a slight softening from a pandemic-induced high in 2020 in most countries. The top five meditation apps worldwide saw 27% year-over-year growth in consumer spending.

- Social: Time spent in the top 25 livestreaming apps outpaced the social market year-over-year by a factor of 9 — year-over-year growth of 40% compared to all social apps at 5%. Global spend in the top 25 livestreaming apps in 2021 grew 6.5x from 2018 and 55% year-over-year. TikTok saw year-over-year growth rates as high as 75%.

- Travel: Downloads of travel apps rebounded by 20% in H2 driven by sharp increases from July-December 2021. H2 downloads hit 1.95 billion globally, nearing pre-pandemic levels of 2.08 billion H2 2019.

- Dating: Worldwide consumer spending on dating apps topped $4 billion in 2021, a 95% increase since 2018. Growth was primarily driven by the U.S., Japan, China and the U.K. Tinder led the market with $1.35 billion in worldwide consumer spending in 2021.

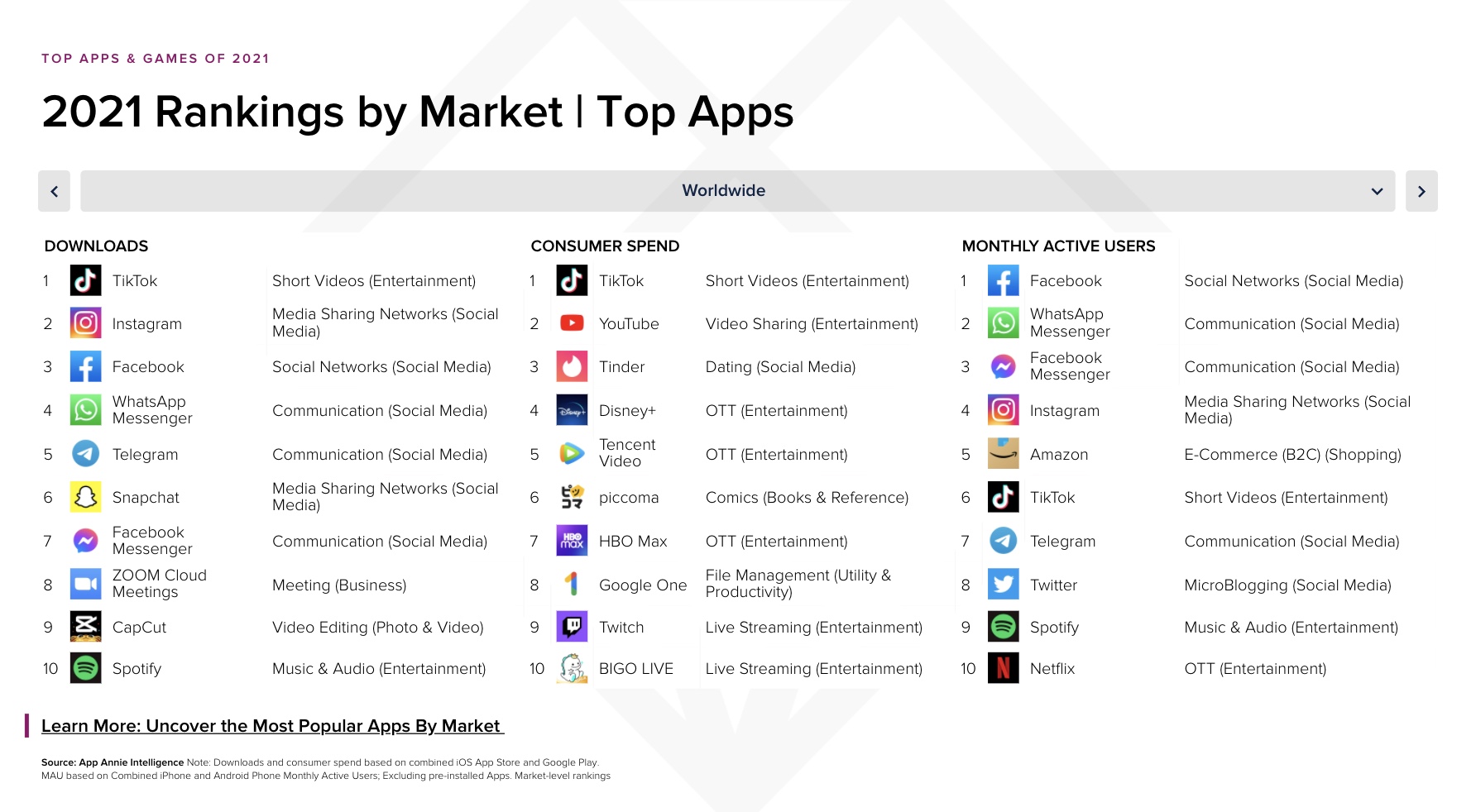

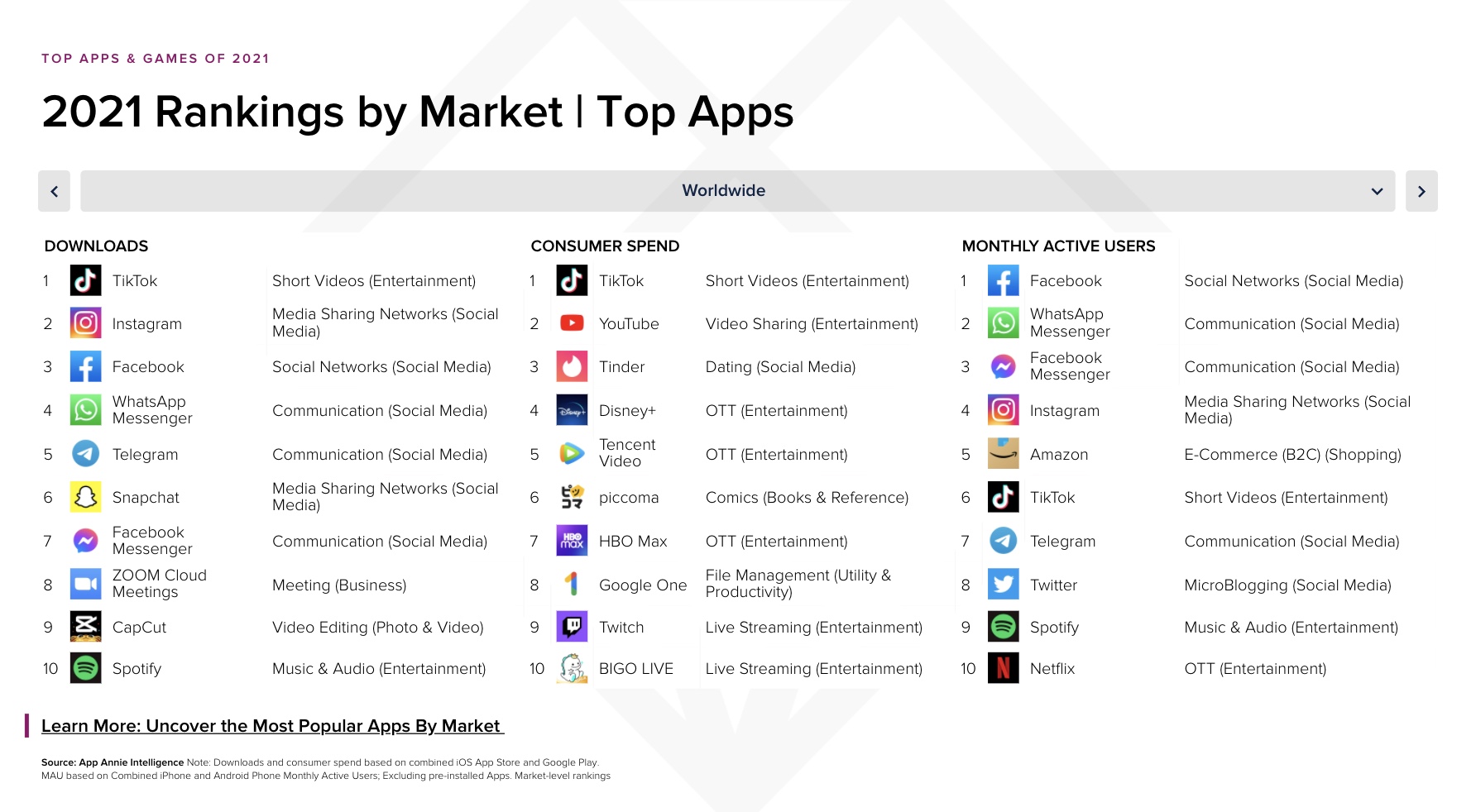

The report also listed the top apps and games worldwide and by individual countries by both downloads and consumer spending. Globally, the top five most downloaded apps in 2021 were Google Meet, Instagram, TikTok, Microsoft Teams and InShot. By consumer spend, the list was YouTube, Tinder, Tencent Video, Disney+ and TikTok.

Image Credits: App Annie

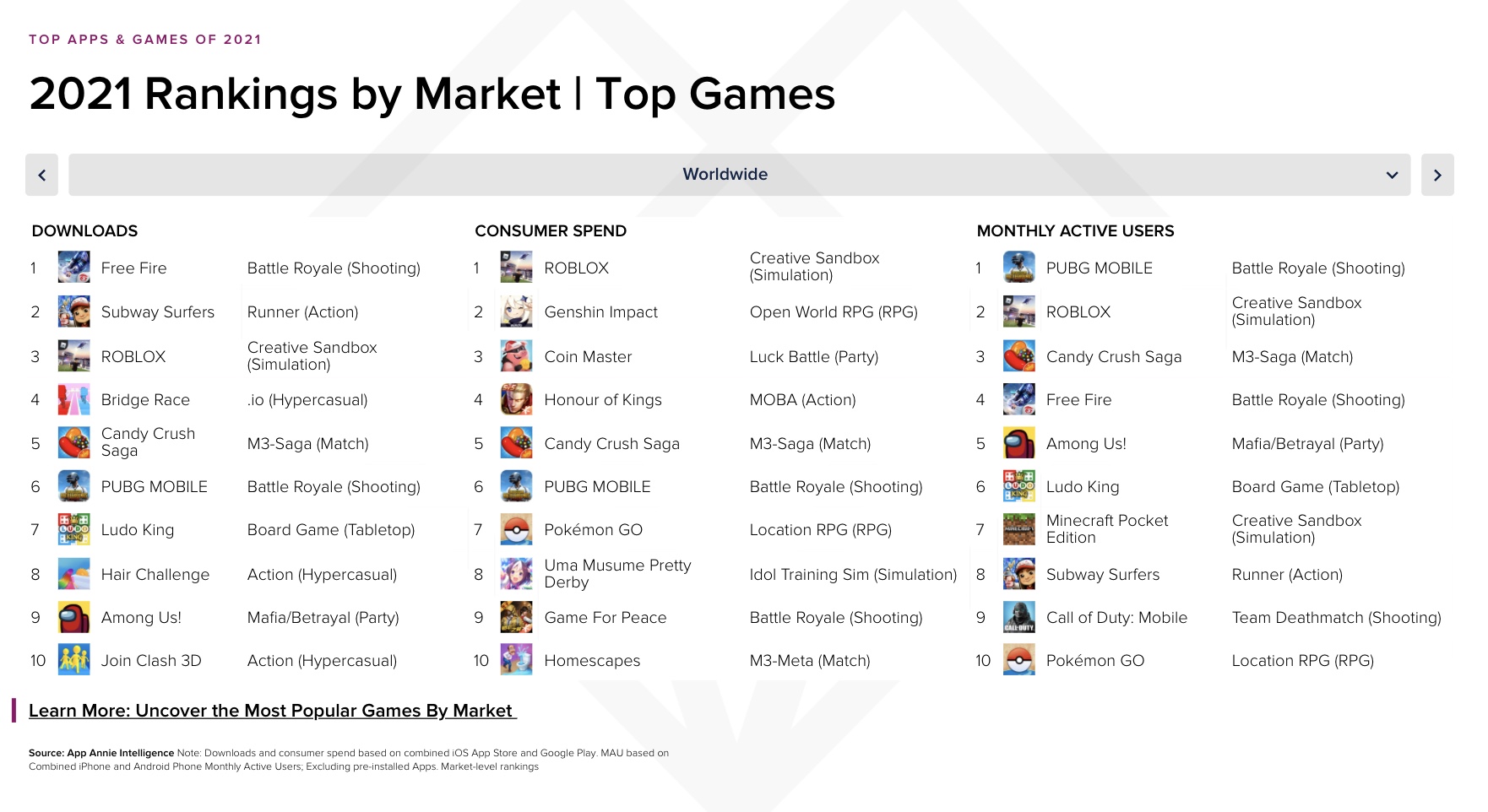

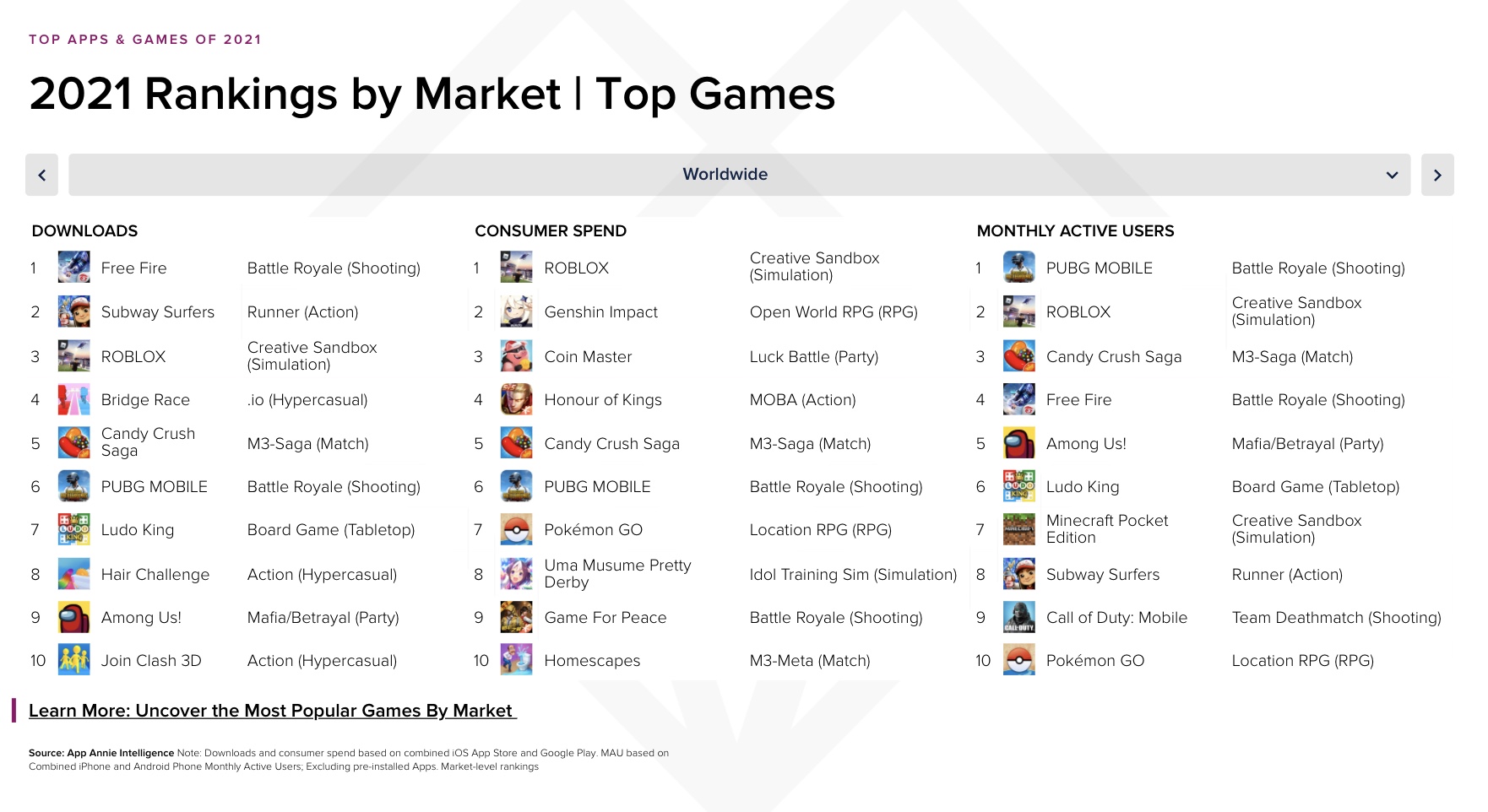

Top games by download included Project Makeover, acquapark.io, WormsZone.io, DOP 2: Delete One Part and Bridge Race. By spending, the list was led by Honour of Kings, Fantasy Westward Journey, Candy Crush Saga, Homescapes and Empires & Puzzles.

Image Credits: App Annie

The full report is here.