Yesterday, at TechCrunch Berlin, we sat down with Sebastian Siemiatkowski, the cofounder and CEO of Klarna, a 15-year-old company that’s currently the most highly valued privately held fintech in Europe, following a $460 million investment that pegged the company’s worth at $5.5 billion back in August. (Asked yesterday to confirm that the company has raised $1.2 billion altogether from investors, Siemiatkowski joked — without confirming the amount — “It sounds like you know better than I do.”)

Siemiatkowski had come to the event largely to take the wraps off a new tech hub in Berlin that will house 500 employees in product and engineering. But we were far more interested in discussing the future of the company, which is best known for providing instant credit to online shoppers at the point of checkout and is growing fast, with nearly 3,000 employees across 17 countries. Klarna has also begun competing more aggressively in the U.S. — as well as fending off a against a growing spate of competitors, from publicly traded AfterPay to Max Levchin’s Affirm to Sezzle. a company in Minneapolis that seemingly appeared from the blue a few years ago.

Of course, the toughest competition of all may come from Amazon and Google, which are increasingly embedding their payment systems — Amazon Pay and and Google Pay — into their own massive platforms. We talked with Siemiatkowski about how Klarna survives as they gobble up more of the retail industry. We also asked about whether Amazon might be an acquirer, or whether Klarna might be eyeing an IPO in 2020 instead. You can check out our conversation below. It has been lightly edited for length and clarity.

TC: The last time we sat down together was four years or so ago, when Klarna was best known for its checkout product. What are some of the ways in which the company has evolved since then?

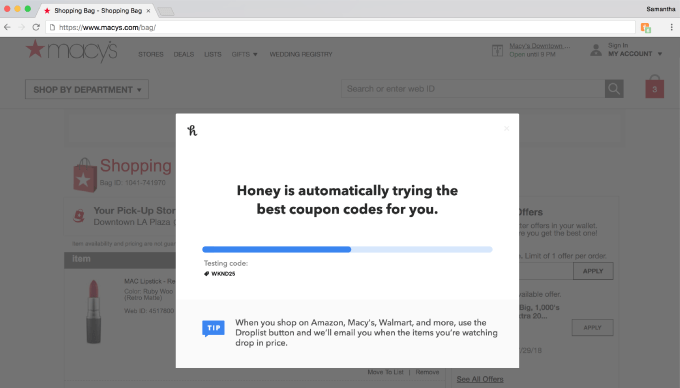

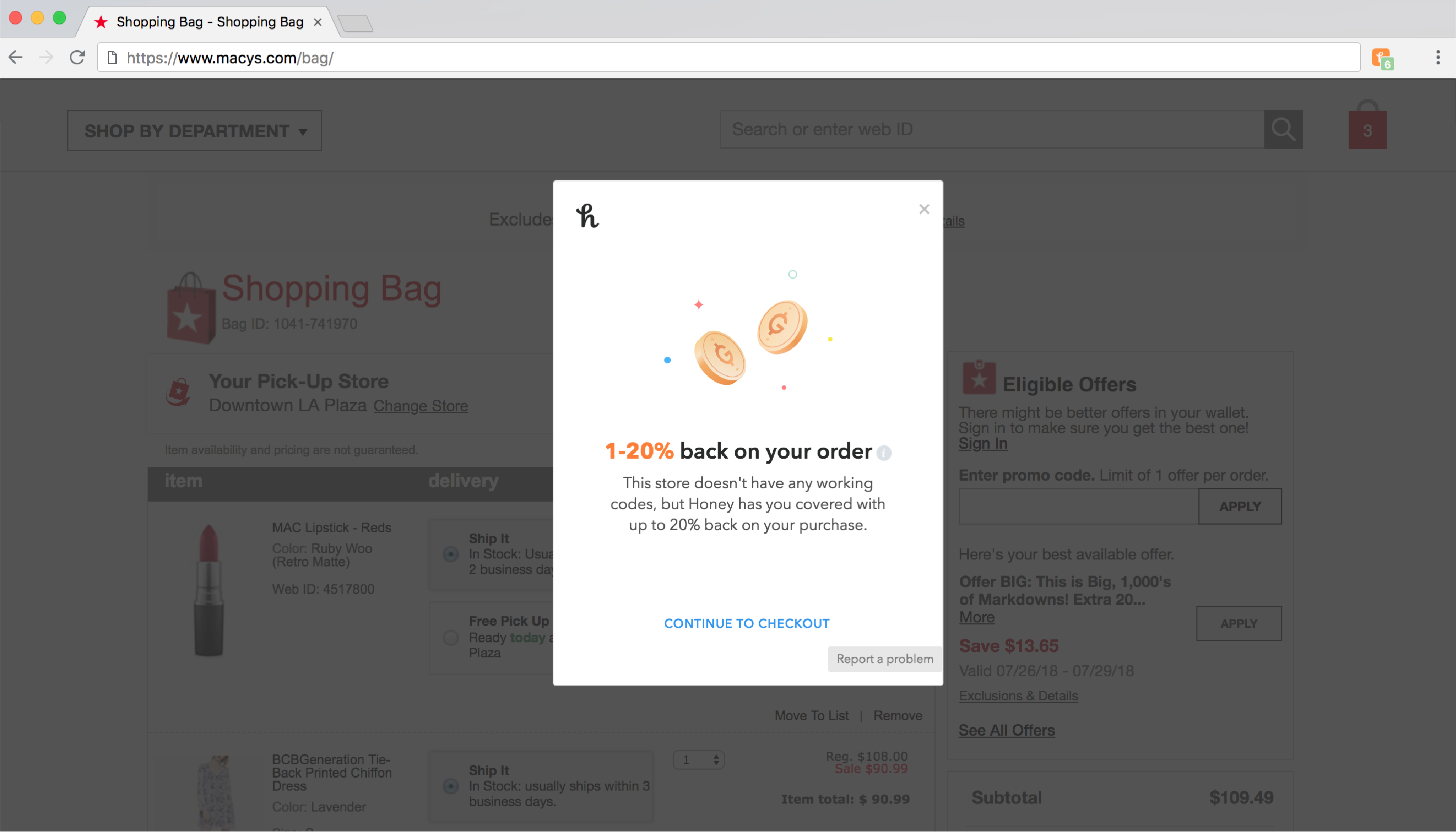

SS: There’s a massive opportunity. For consumers, when they shop online today, they have so many friction points. One of them might be the ability to get free credit without all the fees and things that people associate with credit cards. But there’s also other things like, where’s my package? When will it arrive? How do I do returns? Where are the best offers? Where are the best discounts? There’s a lot of things that people still struggle with. And so what we’re trying to do is create that super-smooth shopping experience, and the more problems we solve for these customers, the better, and the happier they are, and the more they’re going to use it.

TC: Do you have any other financial products, like [longer-term] loans?

SS: We do direct type of payments like that. And then, in some countries here in Europe, we’ve already launched a plastic card, as well. So you can use this like that. And then we also do this kind of Mint.com-like financial dashboard that shows you your spending habits, and all that kind of stuff.

TC: You’re adding this hub in Berlin, but you’re already in Germany–

SS: Yes, Germany is actually our largest market. In Germany, we have about 30 million users, which, you know, takes us about 10 million ahead of that American wallet thing [PayPal], which is quite cool. So Germany is a super important for us, but right now what’s exciting is the U.S., so right now we’re adding customers at a pace that will be about six million customers on an annual basis right now. So the U.S. is really taking off.

TC: This instant credit product is still the biggest producer of revenue?

SS: Yes. If you look at those two things going on here, first is that millennials, in the U.S. and U.K., they don’t have credit cards they have debit cards — 70% of millennials in the U.S. only have debit cards. But they’re still looking sometimes to get a cash flow ease. What’s good about our services is doesn’t cost a consumer anything, so it’s not like the old credit cards which were really expensive for users.

It’s merchant-funded, so that allows the consumers to then sometimes be able to either ease their cash flow by paying in four installments, or try before they buy [meaning they can defer the payment for some period] and stuff like. People forget that people who have debit cards have much harder issues shopping online than people with credit cards, and that’s a big piece of what we’re solving for.

TC: Do you always break the payments into four installments? Do you customize these plans?

SS: Breaking [into] four [payments] is great and that’s one option. What we’ve seen is that consumers have different needs, so some people really like our try-before-you-buy product [where] you pay nothing at the time but then [pay] everything 30 days later when you receive the products. Sometimes, if it’s a bigger purchase, like you’re buying a sofa or something, you split it over 24 months of financing or something like that, which is kind of different. And sometimes people just want to pay for everything instantly. So we just want to make sure that people have all the options that they want.

TC: How much can users spend? What’s the upper boundary?

SS: I’m sure there is one but it’s really hard to answer because it’s very individual, on an individual basis.

TC: And to be clear, you’re buying these from merchants at a discount? Is that how it works?

SS: Basically, the merchant sets up with us, they pay us a merchant fee just like they do with PayPal or somebody else. Then we process the payments for them, and we take the full risk, and all the customer care and everything related to the transaction.

TC: I’m assuming you’re not using your [venture funding] to do this. You have a bank charter in Sweden . . .

SS: Yes, we’re a fully licensed bank and we have deposits to fund the balance sheet. So people in Germany can actually save with Klarna and get 1%, which doesn’t sound a lot, but it’s massively more than they get with any of the traditional banks in Germany.

TC: What about interest fees and late fees? How do those work?

SS: Basically, we keep them extremely low. There are sometimes if you’re late, there might be a late fee but but the whole purpose here is that it’s merchant-funded. So merchants pay for this, and the consumers get a much better product than the traditional credit card or other options.

TC: What’s the default rate?

SS: Super low. If look at overall Klarna, for all markets, it’s is less than 1%.

TC: There is a competitor of yours, AfterPay, that was criticized last year because something like a quarter of its revenue was coming from late payments. What [is your revenue coming from]?

SS: Most of it is coming from merchant fees, and late fees in general are never bigger than the losses that you’re making. But I think it’s definitely an important topic, where all the companies in this industry need to be very careful about how you set up your products.

I think Klarna — maybe because we’ve been around longer than the competitor you’re referring to and because we’re five times their size in totality — maybe we have just come a little bit further in how we think about consumer value and making sure that fees are right and so forth. So those are important topics to keep an eye on. But I also think that what’s even more important is that you have this credit card industry, which in general has charged massive interest rates, a lot of late fees, and been not a very transparent and great industry. And I think, actually, the big opportunity is for people like us, and the one you refer to and others, to disrupt that industry. It’s the credit card industry that we’re going after.

TC: Sure, and I’m not going to defend the credit card industry, but did you say what your interest fees are?

SS: It depends on an individual basis, but it’s definitely lower than the average credit card fee.

TC: Meanwhile, you’re charging merchants more than credit card companies, which you can do because you’re basically increasing their customers’ purchasing power.

SS: Yes. If you look to some markets like Brazil and Turkey that’s kind of how the whole world work. So in a way, that’s kind of the direction we’re heading in, because as a merchant, you’ll have more buying power than as a single individual consumer, so you’ll be able to negotiate better rates, and be able to offer these products at a better rate than this as a single individual [receives].

TC: Obviously you’ve heard concerns that, especially as we’re maybe heading into a recession, easy credit may be dangerous for consumers. Your technology can assess whether or not someone is a good credit risk and whether or not an attempted transaction is fraudulent, but you’re not really getting a picture of a customer’s other financial obligations or burdens.

SS: We do thorough credit checks. It depends because it’s hard to answer these questions when you’re active in 17 markets, because they’re all different. But it’s a definite obvious for us that we need to be able to assess people’s ability to pay, as well as their intent to pay . . . We’ve been doing this for 15 years, so we really learned how to identify that and do it in a, in a thoughtful and in a good way for the consumer.

TC: A lot of competitors have sprung up in recent years. Why hasn’t there been more consolidation in the space? Is it too soon?

SS: I think it might come eventually, but I do think again that there’s a lot of focus on these companies right now . . . and the point is that like, what we’re trying to do all of us, all these companies together, is really going after the trillion-dollar credit card industry that hasn’t served customers well, that hasn’t, you know, and has been all about hiding fees and hasn’t been transparent and whose products and services are fairly poor quality.

There’s a big opportunity to change how this whole [industry works] and that’s true for us and to some degree also true for [mobile-only banks] N26 and Monzo and all the banking disruptors. We’re all going after these big banks that haven’t really served their customers well.

TC: It’s interesting that a lot of them are taking stakes in companies like yours. Visa made a strategic investment in Klarna in 2017. Why aren’t they pulling the trigger on more acquisitions? Is it a matter of them not knowing how to integrate these new technologies into their legacy systems but wanting at the same time to keep tabs on things?

SS: I genuinely think — I’ve been doing this now for 15 years, which is kind of crazy; I was 23 when we started — that the bank disruption is actually happening now and I’m one of the people who would never say that. I’m always like, ‘Oh, [something] is just a trend, it’s hype, it’s going to pass, it’s going to take longer than people expect.’ But I see it happening. Consumers are switching en masse to these new services.

So what the legacy incumbents can do is [choose] from three options: transform themselves, which demands a very courageous CEO to really change a business like that; secondly, M&A; and third, go away and die as a company. So I do think that’s what you’re going to see in the market. In general, if you look at the whole industry, you’re going to see a lot of investments in M&A activity going on, because that’s just how you defend yourself as as an incumbent versus disruption.

TC: Have you been approached?

SS: We get approached all the time, yeah.

TC: I thought it was interesting that you announced in October that AWS is now your preferred cloud provider. I imagine that Amazon is an important partner for you.

SS: Yes.

TC: I’m wondering especially about Amazon given that Amazon and Google are now embedding payment systems into their platforms. How do and your rivals [compete against them]?

SS: I’m [someone who] believes that sticking to core is so important and so, like, what’s happening is we’ve seen a lot of like the big tech giants trying to kind of do more and more and more and more things. And I just think that’s very hard to do over time.

The other thing we do at Klarna is try to consistently stay ahead. When we started 15 years ago, payments online was all about safety; that was the only thing people [cared about] because they felt unsafe shopping online. I think 2010 to 2020 has been about simplicity — one click. one click. one click, because Amazon really taught us that one click was important and everyone wants to do one click. The question is, what happens from 2020 to 2030? That’s what we’ve been thinking about. How do we stay ahead of the game? How do we innovate? How do we keep creating new services and improvements to consumers so that they feel that this is better than what’s out there right now.

In my opinion, that really demands you to be passionate and in love with your business. And I think it’s hard for tech giants to be that at that scale. It’s easy to recognize what’s going on right now; it’s much harder [for them] to guess what’s going to happen five years from now. That’s really demand that passion and closeness to what you’re doing.

TC: Talking about the future, I saw that you talk to the Financial Times this summer, and when they asked you about going public after all these years, you said that, “In many ways we have most of the things in place that we need. It’s more question of timing and focus.” So how is 2020 looking in terms of timing?

SS: Yeah, I don’t know, maybe it could happen. It was kind of funny, because I was reading an interview with Michael Moritz, who’s on our board, and he was saying that we were going to stay private forever. So, I don’t know, it’s hard for me to know that what’s true anymore. People are reporting different things about Klarna.

TC: You never do know what Michael Moritz is going to say. But if you were to go public, I assume it would be a U.S. listing.

SS: I would assume so, too.

TC: What do you make of this whole direct listing concept that your neighbor [in Stockholm, Spotify, pioneered]?

SS: I think it’s wise. I mean Michael [Moritz] is a big proponent of it. I think it makes sense. I read all the arguments, and it looks interesting.

TC: But you’re not raising money with direct listings — your existing shareholders are instead selling their shares on the open market — which sort of begs the question: will you be raising [another private round] of funding again? You raised a big round in summer.

SS: We are in a very exciting phase right now, where the U.S. and U.K. is growing so fast for us. . . And we want to continue investing. We think the potential market in in the US is just massive . . .So we’ll we’ll see what happens, but I wouldn’t rule it out, that one thing that could happen is raise even more money to be investing even more in growth and product delivery, and new products and services, as well as sales and marketing in the US,

TC: Of course, every time you raise money it impacts whether or not you’re profitable. Are you profitable now? Have you been?

SS: Klarna has been profitable every year up until this year.

TC: That giant fundraise [in summer] kind of threw you off.

SS: Yeah, exactly.

Ready first joined PayPal in 2013 when it

Ready first joined PayPal in 2013 when it