Getting paid for providing content online isn’t simple, and as the ad-based economy continues to collapse pretty much everyone is looking for alternatives. One problem: While the web is great at moving images and audio and files around, it has a real problem with money. Coil, Mozilla, and Creative Commons hope to change that with a native web payments standard and $100M to get it off the ground.

“Web monetization” is the name of the game here, not just generally but also the specific new web protocol being proposed. It’s meant to be an open, interoperable standard that will let anyone send money to anyone else on the web.

That doesn’t mean it sprang fully formed out of nowhere, though. It’s based on a protocol called Interledger pursued by former Ripple CTO Stefan Thomas in his new company Coil.

“We were basically applying the concept of internet protocol to payments — routing little packets of money,” Thomas told TechCrunch, though he was quick to add that it’s not blockchain-powered. Those systems, he said, are useful in their place, but end up bogged down in upkeep and administration. And services like Flattr are great, he said, but limited by the fact that they’re essentially run by a single company.

Interledger, he explained, is a protocol for securely and universally connecting existing payment systems in a totally agnostic way. “It supports any underlying payment structure, bitcoin or a bank ledger or whatever, and any connection you use, satellite or wi-fi, it doesn’t care. We were working on on it for a long time, since like 2015, and last year were like, well, how do we get this out into the real world?”

The answer was a new company, for one thing, but also partnering with open web advocates at Mozilla and Creative Commons on Grant for the Web, a $100M fund to disburse with their input. Both have a seat at the table in selecting grant recipients, and the latter is a recipient itself.

“This is an opportunity for CC to experiment with optional micropayments in CC Search,” said Creative Commons interim CEO Cable Green. “If users want to provide micropayments to authors of openly licensed images, to show gratitude, we’re interested in exploring these options with our global community.”

“An open source micropayment protocol and ecosystem could be good for creators and users,” he continued. “Building a web that doesn’t rely on data acquisition and advertising is a good thing.”

The $100M fund is all Coil money, which makes sense as Coil was founded to promote and develop the Interledger and Web Monetization protocols. Huge funding pushes don’t seem like the ordinary way to establish new web standards, but Thomas explained that payments are a unique case.

“The underlying business model for the web is kind of broken,” he said. And that’s partly by design: Enormous companies with vested interests in existing payment and monetization structures are always working to maintain the status quo or shift it in a favorable direction — companies like Google that rely on advertising, or Visa and others that power traditional payment methods.

“From our perspective, what the standard is ultimately competing with is proprietary platforms with billions in funding,” Thomas said.

The $100M fund will be spread out over five years or so, and will be awarded both to companies and people that use or plan to use the Web Monetization standard in an interesting way, and to content creators who are poorly served by existing monetization methods.

Long tail content that’s nevertheless important, like investigative journalism or documentaries from and by marginalized communities, is one of the targets for the fund. Grants could come in the form of direct funding, or matching subscribers’ contributions. There’s no quid pro quo, Thomas said, except for a hard minimum of half the content being released under an open license like Creative Commons — which that organization is likely excited about.

Right now a subscription-based browser extension that allows easy payments to sites that have implemented the standard is the only way to get in the door. Admittedly that’s not a very sexy onboarding experience. But part of the fund is intended to juice the development and adoption of the standard much more widely.

It’s a way — though an expensive one, sure — to show that an alternative model exists to the traditional ad-based or subscription-based methods of supporting content.

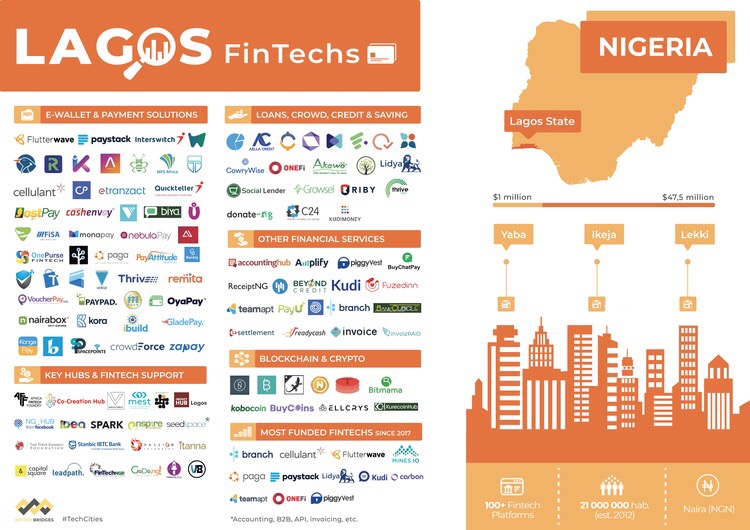

In both raw and per capita numbers, Nigeria has been slower to convert to digital payments than leading African countries, such as Kenya, according to joint

In both raw and per capita numbers, Nigeria has been slower to convert to digital payments than leading African countries, such as Kenya, according to joint