With JioFinance, the Indian tycoon Mukesh Ambani is making his boldest consumer-facing move yet into financial services.

© 2024 TechCrunch. All rights reserved. For personal use only.

Product Management Confabulation

What Product Managers are talking about.

With JioFinance, the Indian tycoon Mukesh Ambani is making his boldest consumer-facing move yet into financial services.

© 2024 TechCrunch. All rights reserved. For personal use only.

India’s Adani Group is plotting a move into e-commerce and digital payments, according to a Financial Times report, as the conglomerate seeks to diversify its portfolio and compete with Mukesh Ambani’s Reliance, Amazon, and Walmart’s Flipkart and PhonePe. The energy-to-infrastructure giant Adani Group is considering applying for a license to operate on India’s Unified Payments […]

© 2024 TechCrunch. All rights reserved. For personal use only.

JioCinema introduced a new monthly subscription plan on Thursday, with the lowest tier costing just 35 cents. The revamp in the pricing strategy comes as the market-leading service seeks to exert greater pressure on rivals including Netflix and Prime Video. The service — backed by Asia’s richest man, Mukesh Ambani — introduced two monthly tiers: […]

© 2024 TechCrunch. All rights reserved. For personal use only.

Reliance, its portfolio Viacom18 and Disney are merging their media businesses in India, creating the largest media entity in the world’s most populous nation. Reliance, which will control the joint venture, directly owns 16.34% of the merged entity, which it has valued at $8.5 billion. Disney will own a 36.84% stake in the merged entity, […]

© 2024 TechCrunch. All rights reserved. For personal use only.

Reliance, its portfolio Viacom18 and Disney are merging their media businesses in India, creating the largest media entity in the South Asian market. Reliance will control and own 16.34% of the joint venture, which it has valued at $8.5 billion. Disney will own a 36.84% stake in the merged entity whereas Reliance-backed Viacom18, which also […]

© 2024 TechCrunch. All rights reserved. For personal use only.

Jio Financial Services, the financial services unit of Mukesh Ambani-run Indian conglomerate Reliance Industries, plans to expand to merchant lending and insurance, Ambani said at Reliance’s annual general meeting in a speech that is likely to have a repercussions for countless startups.

“JFS will massively increase financial services penetration by transforming and modernising them with a digital-first approach that simplifies financial products, reduces cost of service, and expands reach to every citizen through easily accessible digital channels,” he said.

“For tens of thousands of SMEs, merchants, and self-employed entrepreneurs, ease of doing business must mean ease in borrowing, investments, and payment solutions. JFS plans to democratise financial services for 1.42 billion Indians, giving them access to simple, affordable, innovative, and intuitive products and services.”

TechCrunch reported last week that Reliance was testing a sound box payment system at its campus. Analysts believe that the real allure of the sound box extends beyond its auditory alerts — it provides invaluable insights into merchant behaviors, facilitating the offering of loans based on this data.

The company will also enter the insurance segment, offering “simple, yet smart life, general and health insurance products through a seamless digital interface.” Jio Financial Services will explore partnerships with global players, he said.

“It will use predictive data analytics to co-create contextual products with partners and cater to customer requirements in a truly unique way,” he said.

Ambani’s comments offer peek into the strategic trajectory of Jio Financial Services, mere days subsequent to the lackluster inauguration of the financial entity onto the public market. Reliance’s discussion about the future plans of Jio Financial Services has been somewhat limited so far, except for its earlier announcement of a joint venture with BlackRock.

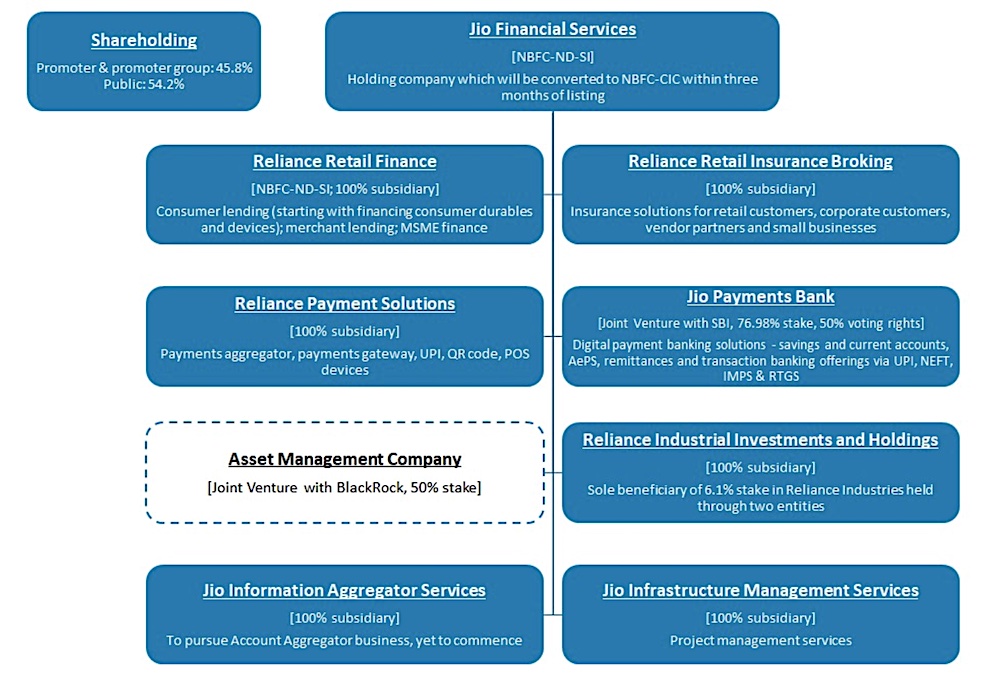

Jio Financial Services company structure (Image: Morgan Stanley)

Jio Financial Services owns 6.1% in Reliance. Ambani said JFS operates in a sector that is very capital intensive, and Reliance has made it one of the “world’s highest capitalised financial service platforms at inception.”

“There is unprecedented opportunity to transform the asset management industry by introducing a full-service tech-enabled asset manager with affordable and transparent investment products to meet the needs of every segment of society,” said Larry Fink, Chairman and chief executive of BlackRock, at Reliance’s event on Monday.

Jio Financial Services will also explore blockchain-based platforms and participation in central bank digital currency, he said.

Ambani added:

I have three reasons to be absolutely confident about JFS achieving tremendous success over the next few years.

1. The digital-first architecture of JFS will give it an unmatched head start to reach millions of Indians.

2. This is a highly capital-intensive business. Your Company has provided JFS with a strong capital foundation to build a best-in-class, trusted financial services enterprise and achieve rapid growth. Reliance has capitalised JFS with a net worth of Rs 1,20,000 crore to create one of the world’s highest capitalised financial service platforms at inception.

3. JFS is blessed with a very strong board, led by Shri K.V. Kamath, a veteran and most respected banker. A highly motivated leadership team is being built with a combination of financial industry experts and young leaders who are eager to take on big challenges.

Reliance Industries said Monday it has appointed the three children of billionaire Mukesh Ambani — Isha Ambani, Akash Ambani and Anant Ambani — to its board, the latest in the succession plan at the country’s largest company, which operates the nation’s largest telecom operator and retail chain.

Nita, Ambani’s wife, has resigned from the board, said the $202 billion oil-to-retail giant in a statement, published on the local stock exchange.

The early signs of the succession planning has been apparent in recent years with 66-year-old Ambani promoting his children to lead many of the empire’s businesses. Akash leads the digital business, Jio Platforms, whereas his twin sister Isha helms Reliance Retail. Anant leads the new energy business.

“Isha Ambani, Akash Ambani and Anant Ambani have been closely involved with and are leading and managing key businesses of RIL over the last few years including retail, digital services and energy and materials businesses,” the company said in a statement.

“They also serve on the boards of the key subsidiaries of RIL. Their appointment to the Board of RIL will enable RIL to gain from their insights and infuse new ideas, the Board opined.”

The world’s largest asset manager is re-entering India — and it’s doing so in a partnership with India’s richest man. Jio Financial Services and BlackRock said Wednesday they have agreed to form a joint venture, called Jio BlackRock, as the Indian conglomerate Reliance’s finance unit begins the lucrative asset management play in the South Asian market.

The firms are targeting an initial investment of $150 million each into the new 50:50 venture, which will seek to offer tech-enabled access to “affordable, innovative” investment solutions for millions of investors in India, they said.

The joint venture gives a peek into the financial services ambitions of billionaire Mukesh Ambani. In a surprising move last year, Ambani announced the demerger of Reliance Strategic Investments and Holdings and its listing as Jio Financial. Jio Financial Services was demerged last week and attained a valuation of about $20 billion in a special session conducted by Indian exchanges.

“This is an exciting partnership between JFS and BlackRock, one of the largest and most respected asset management companies globally,” said Hitesh Sethia, President and CEO of Jio Financial Services, in a statement.

“The partnership will leverage BlackRock’s deep expertise in investment and risk management along with the technology capability and deep market expertise of JFS to drive digital delivery of products. Jio BlackRock will be a truly transformational, customer centric and digital-first enterprise with the vision to democratise access to financial investment solutions and deliver financial well-being to the doorstep of every Indian.”

More to follow.