Comcast NBCUniversal believes its can access startup innovation while supporting future Olympic gold-medalists.

The American mass media company launched its new SportsTech accelerator today, based in part, on that impetus.

TechCrunch attended a briefing with Comcast execs at 30 Rock NYC to learn more about the initiative.

The SportsTech accelerator is a partnership across Comcast NBCUniversal’s sports media brands: NBC Sports, Sky Sports and the Golf Channel.

The program brings in industry partners NASCAR, U.S. Ski & Snowboard and USA Swimming — all of whose sports broadcast on Comcast NBC channels.

Starting today, pre-Series A sports technology startups can apply to become part of a 10-company cohort.

Accepted ventures will gain $50,000 in equity-based funding and enter SportsTech’s three-month accelerator boot camp — with sports industry support and mentorship — to kick off at Comcast’s Atlanta offices August 2020.

Boomtown Accelerators will join Comcast in managing the SportsTech program, with both sharing a minimum of 6% equity in selected startups.

Industry partners, such as NASCAR and U.S. Ski & Snowboard, will play an advisory role in startup selection, but won’t add capital.

An overarching objective for SportsTech emerged during conversations with execs and Jenna Kurath, Comcast’s VP for Startup Partner Development, who will run the new accelerator.

Comcast and partners aim to access innovation that could advance the business and competitive aspects of each organization.

From McDonald’s McD Tech Labs to Mastercard’s Start Path, corporate incubators and accelerators have become common in large cap America, where companies look to tap startup ingenuity and deal-flow to adapt and hedge disruption.

Toward its own goals, SportsTech has designated several preferred startup categories. They include Business of Sports, Team and Coach Success and Athlete and Player Performance.

SportsTech partners, such as NASCAR, hope to access innovation to drive greater audience engagement. The motorsport series (and its advertising-base) has become more device-distributed, and NASCAR streams more race-day data live, from the pits to the driver’s seat.

“The focus has grown into what are we going to do to introduce more technology in the competition side of the sport…the fan experience side and how we operate as a business,” said NASCAR Chief Innovation Officer Craig Neeb.

“We’re confident we’re going to get access to some incredibly strong and innovative companies,” he said of NASCAR’s SportsTech participation.

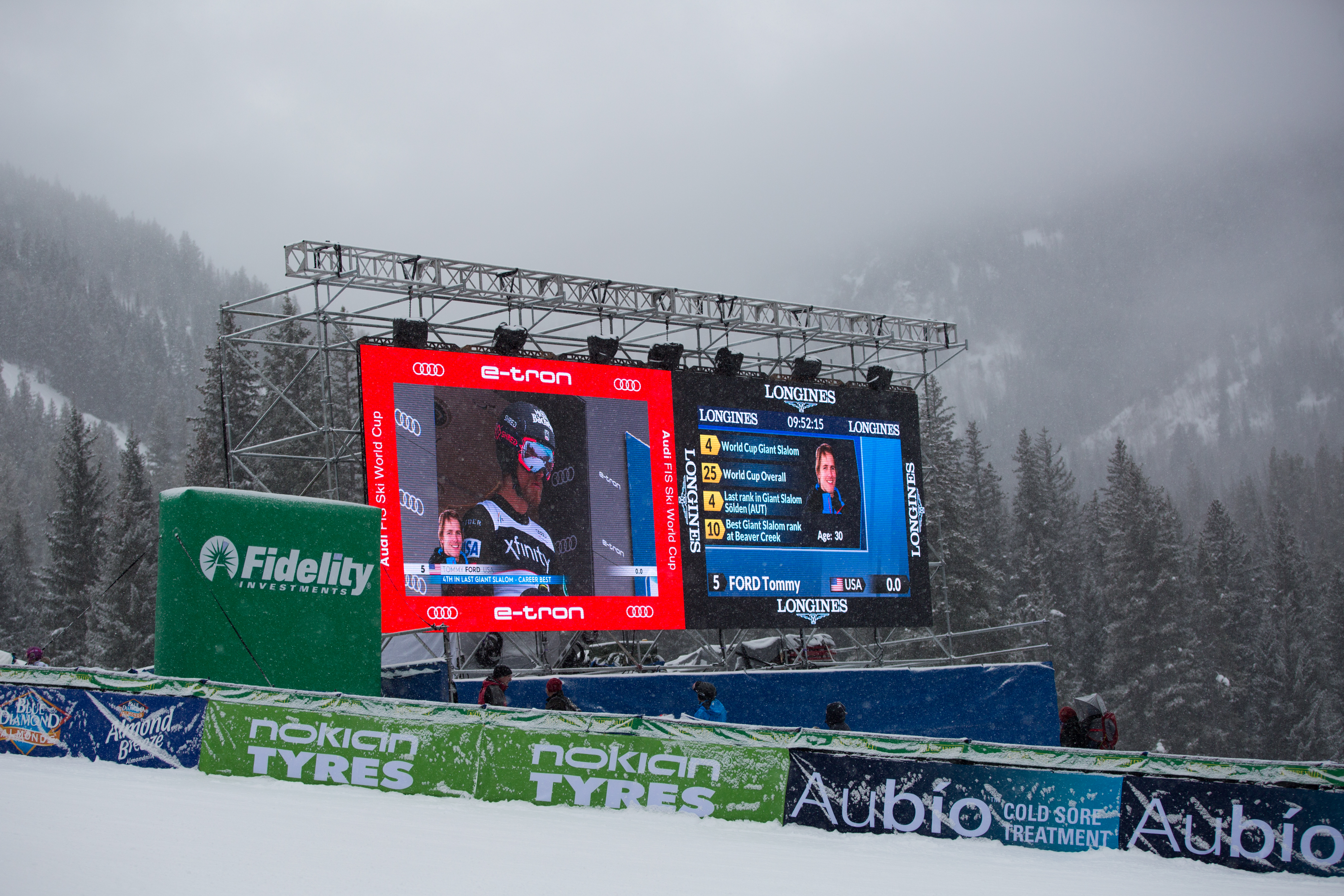

U.S. Ski & Snowboard — the nonprofit that manages America’s snowsport competition teams — has an eye on performance and medical tech for its athletes.

“Wearable technology [to measure performance]…is an area of interest…and things like computer vision and artificial intelligence for us to better understand technical elements, are quite interesting,” said Troy Taylor, U.S. Ski & Snowboard’s Director of High Performance.

Credit: U.S. Ski & Snowboard

Some of that technology could boost prospects of U.S. athletes, such as alpine skiers Tommy Ford and Mikaela Shiffrin, at the 2022 Beijing Winter Olympics.

In a $7.75 billion deal inked in 2014, Comcast NBCUniversal purchased the U.S. broadcast rights for Olympic competition — summer and winter — through 2032.

“We asked ourselves, ‘could we do more?’ The notion of an innovation engine that runs before, during and after the Olympics. Could that give our Team USA a competitive edge in their pursuit for gold?,” said Jenna Kurath.

The answer came up in the affirmative and led to the formation of Comcast’s SportsTech accelerator.

Beyond supporting Olympic achievement, there is a strategic business motivation for Comcast and its new organization.

“The early insights we gain from these companies could lead to other commercial relationships, whether that’s licensing or even acquisition,” Will McIntosh, EVP for NBC Sports Digital and Consumer Business, told TechCrunch.

SportsTech is Comcast’s third accelerator, and the organization has a VC fund, San Francisco-based Comcast Ventures — which has invested in the likes of Lyft, Vimeo and Slack and racked up 67 exits, per Crunchbase data.

After completing the SportsTech accelerator, cohort startups could receive series-level investment or purchase offers from Comcast, its venture arm or industry partners, such as NASCAR.

“Our natural discipline right now is…to have early deliverables. But overtime, with our existing partners, we’ll have conversations about who else could be a logical value-add to bring into this ecosystem,” said Bill Connors, Comcast Central Division President.