Russ Heddleston

Contributor

Russ is the cofounder and CEO of

DocSend. He was previously a product manager at Facebook, where he arrived via the acquisition of his startup Pursuit.com, and has held roles at Dropbox, Greystripe, and Trulia. Follow him here:

@rheddleston and

@docsend

More posts by this contributor

One of the top things that keeps a startup CEO up at night is the worry of running out of money. As a second-time founder and CEO of DocSend, I consider raising money and keeping my startup sufficiently funded a primary responsibility.

If “don’t run out of money” is a universally accepted warning, then the next question becomes when should you raise your next round of funding? There’s a lot to consider in coming up with an answer. If you start too soon before you have some wins to share, you might fail. If you wait too long you might put yourself in a bad negotiating position or worse, run out of money altogether!

DocSend has been used by over 20,000 founders and VCs for fundraising, and over the years we have published data-backed findings about pitch deck sharing and viewing. Recently, I contributed an article about the seasonality in fundraising and when VCs actually look at the decks.

The data included in this research came from companies that explicitly opted in to participate by responding to an automated email sent to them. We are incredibly appreciative to these founders for making this research possible. You can read more about our startup opt-in process and other aspects of our methodology here.

In this article, I’ll talk about how to apply some of the key takeaways from this research to inform your fundraising efforts.

There are really only two main fundraising seasons

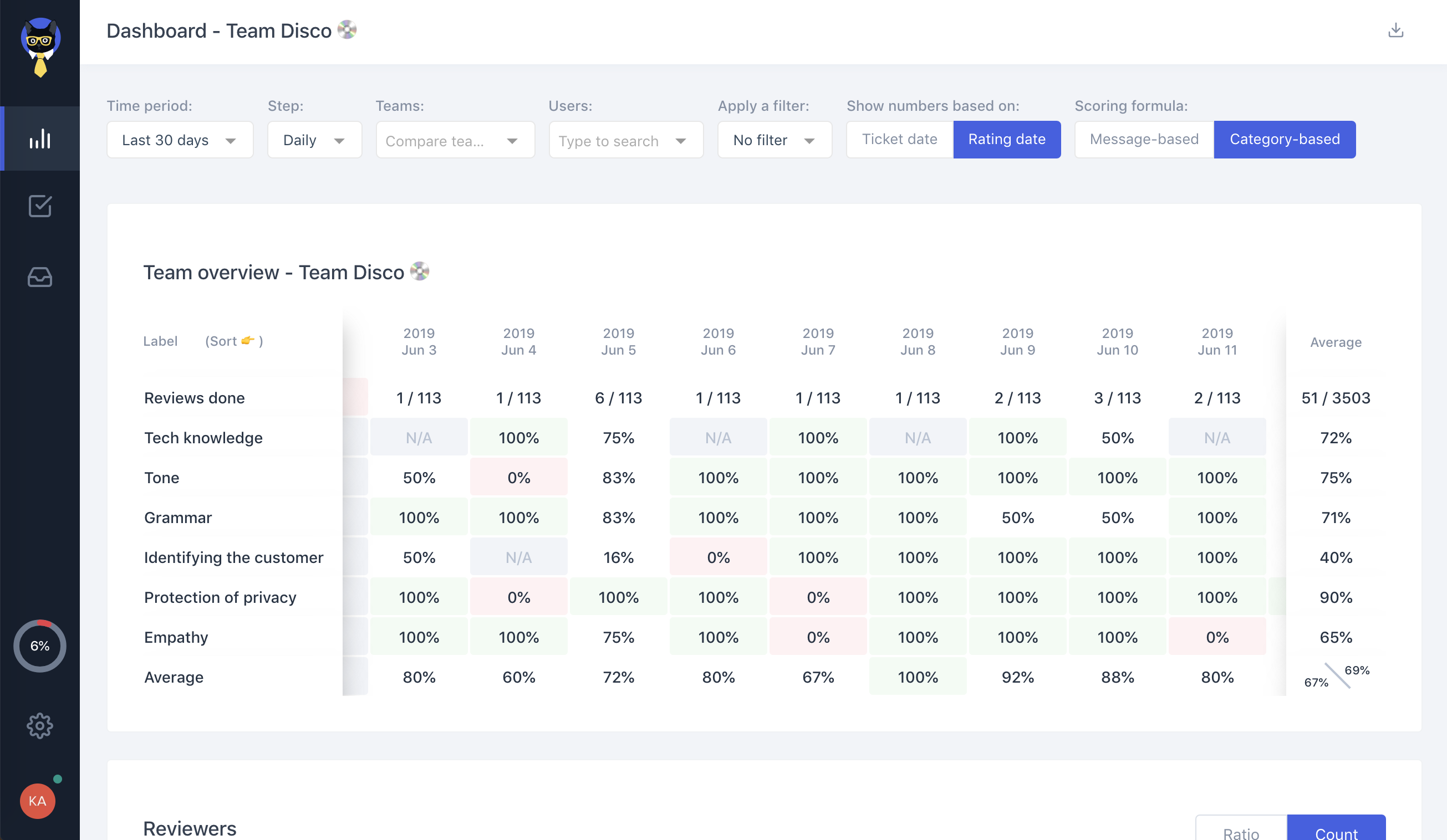

I’ve often heard these anecdotes: “Don’t raise in August because VCs are on vacation,” and “VCs come back in January looking to do a deal.” But this is the first time there’s ever been data to support or disprove these statements. (See the analysis here).

My first big takeaway is that there are two big spikes during the year when VCs review a ton of pitch decks: October and November, then March. The summer definitely flattens out a bit, but August is not as bad as people think and December is actually way worse than most anticipate.

Sure, you might be the exception to this data and you might have pulled off a fundraise over the summer or in December. But if you have control over your timing, why take that risk?

How to think about runway and when to raise

Image via Getty Images / runeer

A startup’s “runway” is how much time they have until they run out of money. The assumption here is that a startup isn’t profitable yet, and is using VC investment to grow their business more quickly at the expense of short-term profitability.

Often a founder will raise a Series Seed and plan to “burn through” all that money in 18 months either investing in product or growing the team. To raise a round successfully at a good valuation you need to be growing at a crazy high rate (which is what you’re burning money on).

YC says you should be growing 7% a week, although that applies to very early stage pre-funding. Once you’ve gotten a bit of traction, the conventional wisdom is that you need to be on the “triple triple double double” path (see the detailed overview here).

So if you raise a Series Seed or A at $2m in ARR, you need to get to $6m in ARR in twelve months (that’s a 9.6% compounding monthly growth rate). If you’re only on track to double in a year, you are likely not VC-fundable and need to go the bridge round route and steer the business towards profitability.

In other research from DocSend we’ve found that the median time spent to fundraise is about three months. If as a CEO you can’t raise capital at the right price, the responsible thing to do is to leave a bit of buffer so you can either reduce your burn rate to extend your runway or find a buyer for your business. Again, the CEO’s main goal is to not run out of money.

This means that ideally you begin to fundraise no less than six months before you anticipate running out of cash. So if you raise capital for 18 months of runway, you need to be back out in the market a short 12 months after popping the champagne to celebrate your last round.

The Q4 fundraising trap you need to avoid

The fundraising data at the end of each year tells a fascinating tale of hope and then a rising fervor of activity before falling off a cliff in December. The lesson in this is that if you can’t get your round closed by the end of November, you run the risk of losing momentum during the holidays and having to reset your process or deal with worse terms by having fewer potential investors at the table. As a VC, you also run the risk of missing out on a hot deal if you can’t get it closed before the holiday.

The story the data shows is that VC visits start low in August at the end of the summer low season and steadily build to their annual peak in November before falling off sharply in December. Entrepreneurs sending decks starts low and steadily builds to a peak in October, which makes sense because you need to send your decks in advance of VCs being able to view them.

So if you are scrambling to get your deck out to VCs in October, realize that you are behind the ball and are at risk of missing the window which means you might be better off waiting until the new year (if you have that luxury).

The secret window

Another surprising discovery in the data was when pitch decks get the most attention. It’s a time of year when relatively few pitch decks are sent, but the viewing of those pitch decks by VCs is incredibly high. This means if you do go out to fundraise in this window, you’ll get significantly more attention than you would at other times of the year. To see the data deep dive on this as well as the overall monthly sending and viewing stats, check out the deep dive in Extra Crunch.

Smart windows to raise capital

This research highlights the need for CEOs to pay closer attention to timing their fundraising activities. Let’s say you raise your Series Seed round in March. You might assume that you should go out to the market again in 12 months.

However, knowing what we do, it could be more advantageous to start raising money a couple months earlier, in January. You’ll get a whole lot more attention and will beat the entrepreneur rush in March. Plus, you don’t want to be caught fundraising in summer.

If there are four things you should take away from this research, they are:

- Peak fundraising times are in October/November and in March.

- Don’t spend too much time celebrating after raising; you’ll like need to go out for your next round in just 12 months.

- Budget a minimum of 6 months to go out and fundraise and try to time to your advantage.

- If you’re raising at the end of the year, you should get started in September at the latest unless you think you’re in a very strong position to raise your round quickly.

Good luck and happy fundraising!

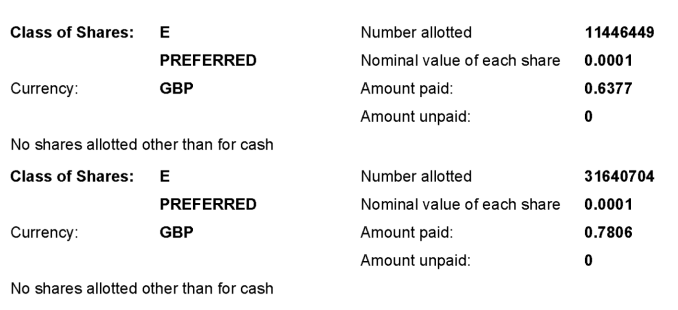

With regards to who is backing Currencycloud’s Series E, one source tells me Goldman Sachs is in the running and is possibly leading the round.

With regards to who is backing Currencycloud’s Series E, one source tells me Goldman Sachs is in the running and is possibly leading the round.