Cyberthreats are on the rise everywhere. Companies are facing a barrage of attacks from hackers near and far, and their security operations centers are struggling to keep up. They can no longer rely on manual processes to respond to automated attacks, forcing security chiefs to consider new approaches to automating their defenses.

That’s where JASK comes in. The startup offers an autonomous security operations platform to respond to this new security environment, and it’s a mission that is finding resonance among investors. After raising a $12 million Series A round led by Dell Technologies Capital last year, the company has now received a $25 million Series B from Ted Schlein of Kleiner Perkins, bringing the company’s total funding to $39 million including its seed. Schlein will join the board of directors.

Schlein is a distinguished security investor, having invested in such noted security exits as Mandiant, LifeLock, and CarbonBlack. He was also the first investor in ArcSight, where JASK founders Greg Martin and Damian Miller led the security operations practice. Shlein is also an investor in stealthy security startup Endgame Systems as well as enterprise analytics startup Segment.

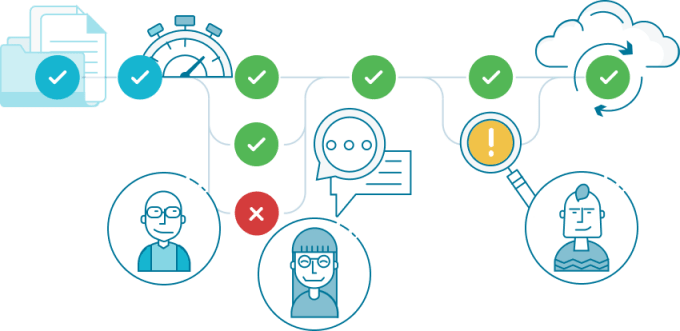

As I wrote in an in-depth profile of JASK earlier this year, the startup is attempting to completely rebuild the modern security operations center from the ground up. Rather than building manual playbooks, it wants to create a hybrid human-artificial intelligence system that can learn and adapt to new threats while offering more engaging feedback to security analysts. The hope is that the platform will massively reduce the burden of security so that human analysts can spend more of their time on challenging cases rather than routine ones.

The challenges in building such an autonomous security operations center (SOC) are multi-fold. Wrangling the data is difficult, since formats can be highly divergent between companies. How companies respond to threats can also be very diverse — some companies may choose to ignore some low-level threats while others have more robust policies, requiring JASK’s platform to adapt to each company in a unique way. Perhaps the toughest challenge is just constantly adapting the system’s machine learning models to counter innovative hackers.

A few weeks ago, the company announced further visualization tools to help security analysts understand their threat environment. Last month, it brought on Greg Fitzgerald as chief marketing officer. Fitzgerald previously served as CMO of security high-flyer Cylance, as well as SVP of marketing at Fortinet and Sourcefire at Cisco. It has also announced a massive expansion of its second headquarters in Austin, where it expects to grow to 100 people this year.

In addition to Kleiner and DTC, other investors included Battery, TenEleven Ventures, and Vertical Venture Partners.

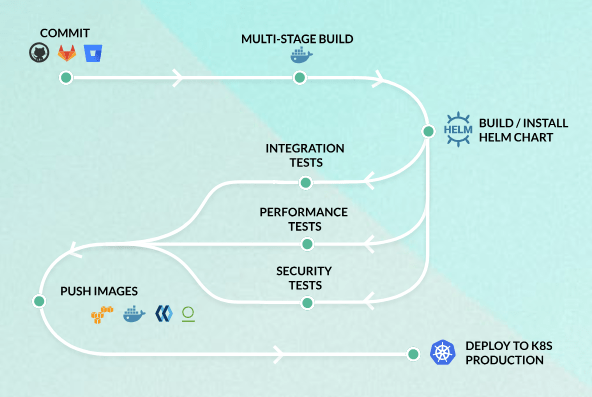

“The meteoric rise of Kubernetes is happening so fast that most toolchains haven’t kept up, and M12 knows it,” said Raziel Tabib, Codefresh co-founder and CEO. “With this latest round of funding we’re going to aggressively accelerate our roadmap and expand our customer base.”

“The meteoric rise of Kubernetes is happening so fast that most toolchains haven’t kept up, and M12 knows it,” said Raziel Tabib, Codefresh co-founder and CEO. “With this latest round of funding we’re going to aggressively accelerate our roadmap and expand our customer base.” “Today, virtually every company is using software to continuously improve its products and business,” said Matt Parson, CloudBees’ chief financial officer. “The DevOps market is exploding as the transformation to a global continuous economy emerges. We have seen significant growth in our business over the last several years, but we now see an even bigger opportunity just in front of us as continuous software delivery becomes a strategic imperative for every business.”

“Today, virtually every company is using software to continuously improve its products and business,” said Matt Parson, CloudBees’ chief financial officer. “The DevOps market is exploding as the transformation to a global continuous economy emerges. We have seen significant growth in our business over the last several years, but we now see an even bigger opportunity just in front of us as continuous software delivery becomes a strategic imperative for every business.”