Australian clean-tech Endua fixes renewable energy’s intermittency problem

One of Endua’s hydrogen power banks

One major problem with renewable energy sources like wind, solar and hydro is intermittency. This means they cannot be relied on constantly since, for example, the sun might stop shining or it might be a still, windless day. To fill gaps, users often rely on diesel generators or batteries. But diesel generators produce emissions and batteries only last for a short time. Clean-tech startup Endua says it has found the solution with its modular hydrogen generation and storage technology.

The Australian startup announced today it has raised $11.8 million AUD (about $7.8 million USD). Participants in the round inclued new investors, Queensland Investment Corporation (QIC), Melt Ventures and 77 Partners, which together put in $7.5 million AUD. The rest of the funding came from returning strategic investors Main Sequence (the deep-tech fund founded by government science agency CSIRO), and Ampol, Australia’s largest transport energy provider.

Launched in 2021 by CEO and founder Paul Sernia, Endua uses standalone, modular hydrogen power banks that it says can drive power loads of up to 100kW per module. This is enough to power water pumps, farm sheds or standalone telecom infrastructure. The amount of electricity used is scalable because excess renewable energy is stored as hydrogen and converted into electricity by fuel cells as needed.

Sernia told TechCrunch that storing excess renewable energy as hydrogen overcomes intermittency challenges, since users can draw on their stored energy whenever needed, or when renewable energy generation is insufficient. Endua serves a wide range of customers, including regional communities, farming and agriculture, telecom infrastructure, energy distributors and remote infrastructure.

Endua designed and built electrolysers that split water molecules into hydrogen and oxygen through electrolysis by using renewable energy sources like solar or wind power. Then that generated hydrogen is stored in its modular banks, which are high-pressure storage tanks that can preserve the integrity of hydrogen for months. Once Endua’s customers are ready to convert their stored hydrogen into electricity, the power banks use electrochemical technologies, mostly through hydrogen fuel cells, which creates no carbon emissions.

Endua founder and CEO Paul Sernia

Sernia said Endua’s power banks are designed to integrate with existing energy systems, including renewable energy sources like solar panels and wind turbines, to capture excess energy. This helps ensure customers have a continuous power supply.

Endua will use its new capital to scale its pilot systems and on hiring over the next 18 months. In addition to its funding, Endua has also received a total of $4.3 million in grands, including the Entrepreneurs’ Programme Accelerating Commercialisation Grant, the Cooperative Research Centres Project and the Advanced Manufacturing Growth Centre Grant. All of its products are manufacturered in Australia and it is currently establishing manufacturing facilities in Queensland.

In a statement about the funding, Ampol managing director Matthew Hallliday said, “Endua’s technology lays the foundation for off-grid and diesel energy users to meet decarbonisation commitments and become self-sustaining. We look forward to working with customers as the technology is scaled to further explore applications across our economy.”

Australian clean-tech Endua fixes renewable energy’s intermittency problem by Catherine Shu originally published on TechCrunch

To fix the climate, these 10 investors are betting the house on the ocean

Climate change is a problem important and pressing enough that investors have begun to grasp the opportunities that arise when trying to solve it. Now, they’ve started to cast their nets wider for other, adjacent opportunities.

Tech that serves to conserve the oceans while using it to replace older, more harmful means of generating energy and food seems to be one such opportunity. In fact, when we asked 10 investors in the sector to share their thoughts on the space, we quickly learned that ocean conservation tech startups are seeing more and more interest from generalist investors now that climate change is hot and people are seeking more ways to mitigate its effects.

“Climate change used to be more focused on terrestrial operations. It is now ‘warming’ up to ocean conservation,” Daniela Fernandez, managing partner of Seabird Ventures, told TechCrunch.

The world’s oceans and its climate have always been tightly coupled. Winds generate ocean currents, which in turn influence weather patterns both over the open water and deep into the continents.

“Our planet is 70% ocean, so the urgency of facing and solving climate change can only be properly addressed if we include the ocean in the equation,” said Rita Sousa, partner at Faber Ventures.

The open ocean also contains tremendous amounts of energy. Previously, accessing it meant drilling into the ocean floor to tap hard-to-reach deposits of oil and gas. But today, it increasingly means tapping the enormous energy represented by the ocean’s winds and waves. Just offshore wind alone has the potential to meet global electricity demand by 2040, according to the IEA, which is well in excess of all offshore oil and gas production today.

Stephan Feilhauer, managing director of clean energy at S2G Ventures stressed the viability of technologies like offshore wind as commercial alternatives to fossil fuels: “Offshore wind has established supply chains across the globe. It is possible today to manufacture, install and operate gigawatts of offshore wind energy using technology and equipment that is well-established and has years of operational data to help us understand its performance. Offshore wind is the only ocean-based renewable technology that meets these criteria today.”

The oceans are constantly exchanging gases with the atmosphere, too, most importantly withdrawing and storing about 30% of all carbon dioxide pollution. The ocean’s capacity as a carbon sink has created problems for myriad marine life, which have depended on historically stable acidity levels that are now creeping higher. However, this very capacity also creates opportunities to put key nutrient cycles to work and capture humanity’s excess emissions.

“A healthy ocean will continue to provide crucial opportunities for carbon sequestration,” said Peter Bryant, program director (oceans) at Builders Initiative. “There are a number of opportunities for increasing the ocean’s ability to store carbon. We have biological approaches that include ecosystem restoration, seaweed cultivation and iron fertilization; chemical solutions where you use minerals to lock dissolved carbon dioxide into bicarbonates; and electromagnetic approaches that store carbon by running electric currents through seawater.”

Founders and investors have a growing appreciation for the ocean’s potential as a resource for renewable energy and its capacity to buffer and even solve some of the climate problem. “We’re confident in the ocean’s resilience here. It’s simply one of the best resources we have in the fight against climate, and that means opportunity,” said Reece Pacheco, partner at Propeller. “We won’t achieve our climate goals without the ocean. Full stop.”

Christian Lim, managing director at SWEN Capital Partners, agreed: “It took too much time, but finally the ocean is being recognized as a critical piece of our fight against climate change.”

We spoke with:

- Daniela V. Fernandez, founder and CEO of Sustainable Ocean Alliance, and managing partner at Seabird Ventures

- Tim Agnew, general partner, Bold Ocean Ventures

- Peter Bryant, program director (oceans), Builders Initiative

- Kate Danaher, managing director (oceans and seafood), S2G Ventures

- Francis O’Sullivan, managing director (oceans and seafood), S2G Ventures

- Stephan Feilhauer, managing director (clean energy), S2G Ventures

- Sanjeev Krishnan, senior managing director and chief investment officer, S2G Ventures

- Rita Sousa, partner, Faber Ventures

- Christian Lim, managing director, SWEN Blue Ocean Partners

- Reece Pacheco, partner, Propeller

Daniela V. Fernandez, founder and CEO, Sustainable Ocean Alliance (Seabird Ventures)

Climate change is the elephant in the room. Has the issue’s rising profile sucked the air out of the room or is it bringing attention to ocean conservation that otherwise wouldn’t be there? How have things changed in the past five years?

Climate change has been a topic for decades. It used to be a “nice to have” about a decade ago: “If you have the extra funds to perform climate risk assessment, then we will dedicate it to climate change.”

Now, it’s more of a “must have.” If we don’t address climate change, we’ll see more extreme weather events. Over the past five years, we’ve seen more focus on ocean conservation, but there is still a $149 billion annual ocean funding gap. Climate change used to be more focused on terrestrial operations. It is now “warming” up to ocean conservation.

We are just now beginning to see a distinct shift in tone. The thinking used to be that “the ocean is a victim of climate change,” but now the thought is more “the ocean can become a climate hero” and play a huge role in reducing our carbon footprint. Yet, this shift is still very much in its infancy. In particular, the philanthropic community is just starting to recognize that there is an urgent need to support efforts to develop ocean-based climate solutions.

Until now, most climate funders focused on terrestrial or atmospheric issues, and ocean funders focused on important, but only tangentially climate-related ocean issues such as ending unsustainable fishing practices and establishing marine protected areas. The ocean is already the biggest carbon sink on the planet, and we need to better understand both what absorption of all that carbon is doing to ocean ecosystems, and how much more it can potentially contribute without disrupting its other critical ecosystem functions.

It’s also been encouraging to see governments taking action to truly prioritize and create financial incentives for investing in climate/ocean innovations, such as the bipartisan Infrastructure Law passed in the U.S. in 2022. There is also an upswell of talent realizing that working a “typical” job is no longer an option if we won’t have a liveable planet in the next seven years. We are seeing society reset its priorities and climate is one of the highest ones at the moment.

Climate change has been called “recession-proof” because governments and investors have come to recognize the scope, scale and urgency of the issue. Do you think that’s true of ocean conservation tech as well?

Yes. Climate change and ocean restoration are inherently linked. The ocean is humanity’s biggest protection against climate change, as it produces more than half the air we breathe and absorbs 93% of excess heat from global warming.

Ocean tech and climate change companies and investors all have the same goal. The urgency of the climate crisis has kept passionate funders and entrepreneurs engaged in the development of solutions regardless of the state of the economy.

Climate change has affected the oceans greatly, causing everything from rising water temperatures to more acidification. How are you approaching the question of climate change in your investments?

Seabird Ventures is internally tracking impact and reporting on social and/or environmental factors in our investments. We have externally reported on the following key ocean impact areas:

- Blue carbon & CO2e removal or avoidance: Initiatives in this category are incredibly important for capturing and avoiding harmful GHG emissions, which contribute to climate change and ocean acidification. The impact of these companies is measured by the weight of CO2e emissions reduced or sequestered as a result of the solution.

- Waste reduction and circular use: We focus on companies that reduce the amount of solid waste and plastic polluting our ocean. Two approaches commonly used are preventing plastics from leaking into waterways, and plastic cleanup solutions. Plastic pollutants are responsible for choking marine life and destroying both marine and coastal ecosystems. Tracking impact in this category is done by measuring the mass of plastic reduced, avoided or recycled. Companies offering fully biodegradable plastic alternatives are also considered in this area for their ability to displace the use of traditional plastics.

To fix the climate, these 10 investors are betting the house on the ocean by Tim De Chant originally published on TechCrunch

Orbital Sidekick raises $10M to bring hyperspectral imaging to oil and gas pipeline monitoring

Historically, oil and gas companies have monitored pipeline leaks using inefficient, expensive methods: workers equipped with handheld optical gas imaging cameras, for example. Or, as Orbital Sidekick CEO Dan Katz put it in a recent interview with TechCrunch, “a young pilot sticking their head out the window of a crop-duster.”

“There’s really no persistent, objective, high-accuracy monitoring service that’s available to operators today,” he said. So he and Orbital Sidekick co-founder Tushar Prabhakar set out to create one. Their startup’s solution is a data analytics product that generates intelligence using a constellation of satellites equipped with hyperspectral sensors — and it’s caught the energy industry’s attention.

Today, Orbital Sidekick announced the close of a $10 million investment led by Energy Innovation Capital, with additional participation from major North American energy companies Williams and ONEOK. The University of Minnesota’s Endowment and existing investors 11.2 Capital, Syndicate 708 and the CIA’s strategic investment arm In-Q-Tel also participated.

The new capital is a major boon as the startup seeks to launch its first space-based commercial analytics product and as it gears up to launch its first two commercial satellites in April, aboard SpaceX’s Transporter-7 rideshare mission. Orbital Sidekick is also planning to launch two satellites, which it calls Global Hyperspectral Observation Satellite (GHOSt), each aboard Transporter-8 and Transporter-9. That means if all goes to plan, the company will have a six-satellite GHOSt constellation in orbit before winter this year.

Orbital Sidekick was founded by Katz and Prabhakar in 2016. Keeping true to the mythos of Silicon Valley, the two founded the company in Katz’s garage in San Francisco. The pair had met while working for Space Systems/Loral, a legacy space company that was acquired by Maxar in 2012. Katz has an academic background in physics and astrophysics, while Prabhakar has experience working for some energy tech companies; combined, the two realized there could be real demand for hyperspectral imagery in energy and other sectors.

The company sent its first tech demo to space in 2018 — a breadbox-sized hyperspectral camera that spent a year-and-half bolted outside the International Space Station. That was followed by a 30-kilogram tech demo satellite called Aurora, which launched in June 2021. (The GHOSt satellites are 100 kilograms each.) Alongside this, the company has been generating revenue through aerial programs, which use the hyperspectral system on an aircraft that flies at an altitude of about 1,000 feet. But the company quickly realized that aerial was not a scalable solution.

“There are millions of miles of pipeline across the world,” Katz said. “To try to do that with aircraft is just not feasible, or scalable, from a margin standpoint.”

Hyperspectral lets companies “see” the chemical fingerprint of different substances, like gas, by collecting and measuring hundreds of wavelength bands. For pipelines in particular, hyperspectral information can help identify leaks even if the pipeline is buried underground, as is the case with the vast majority.

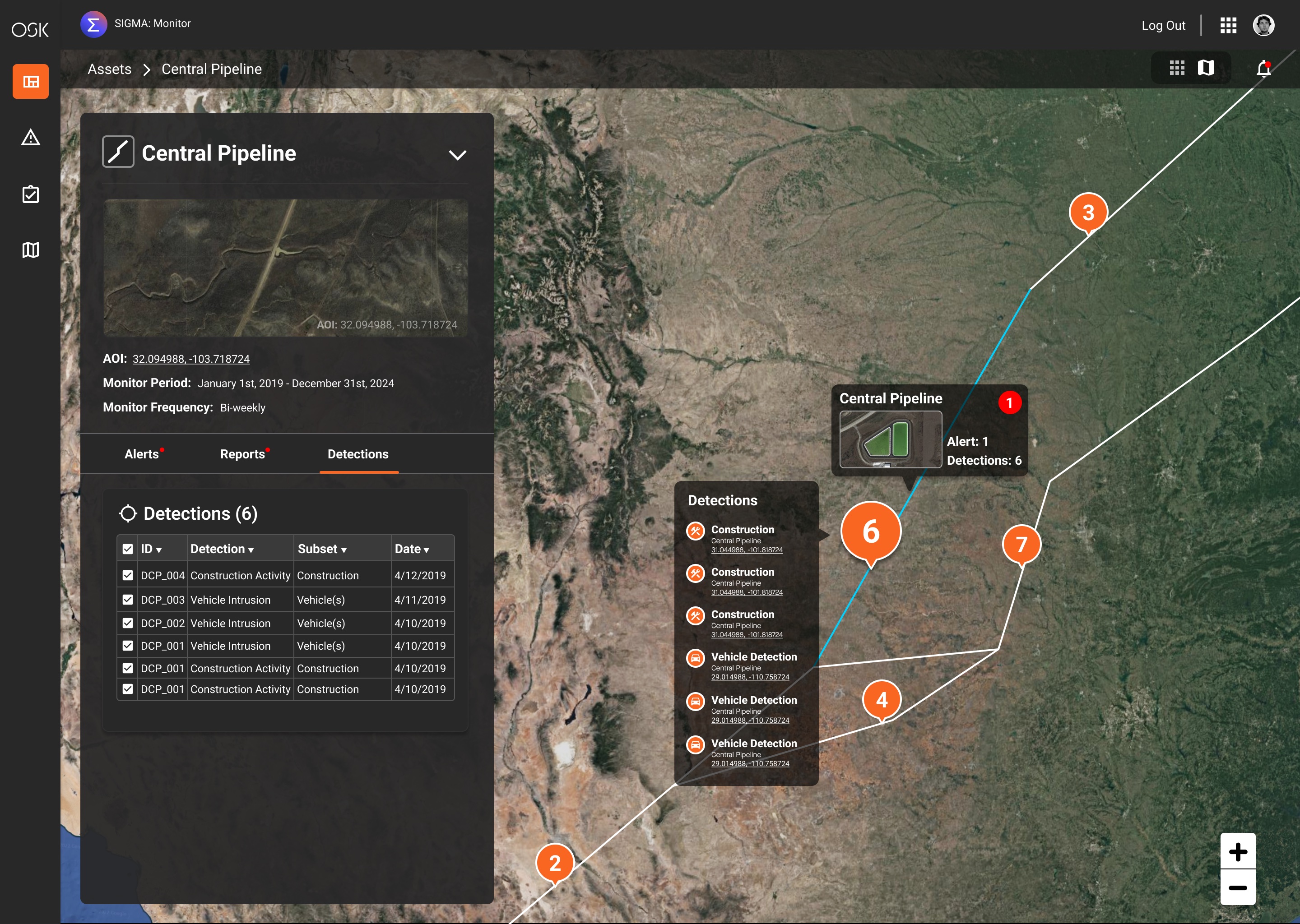

Compared to competitors, Katz said Orbital Sidekick provides higher resolution, at eight meters per pixel, by collecting more than 500 spectral channels. But the “big differentiator,” he said, is the company’s in-house analytics and intelligence platform. That product is called SIGMA, or Spectral Intelligence Global Monitoring Application.

Image Credits: Orbital Sidekick (opens in a new window)

Orbital Sidekick is also developing solutions for defense customers. Notably, the company won a $16 million STRATFI, or Strategic Funding Increase, contract from the U.S. Air Force that matched dollar-for-dollar its $16 million Series A. For defense customers, hyperspectral imagery could be used to detect chemical weapons, or used with other imaging sensors to provide warfighters with a more complete picture of a battlefield.

“Sixteen million dollars in non-diluted capital really just helped accelerate our constellation plans,” Katz said.

Looking ahead, Orbital Sidekick is planning to expand within the energy sector, monitoring not just oil and gas pipelines but oil wells or off-shore oil facilities. Katz said the company is interested in exploring how customers can use Orbital Sidekick’s data and tech to verify carbon credits under a carbon credit marketplace. The startup also has plans in place to expand the GHOSt constellation to at least 14 satellites, to provide, Katz said, a hyperspectral “atlas of the world.”

Orbital Sidekick raises $10M to bring hyperspectral imaging to oil and gas pipeline monitoring by Aria Alamalhodaei originally published on TechCrunch

Noon Energy brings Mars tech down to Earth with carbon-oxygen battery system

The starry-eyed founder story usually goes something like this: Start an earthbound company, make lots of money, launch a rocket company to go to Mars.

If that’s the stereotypical narrative, then Chris Graves has it all backward.

Graves started with the Red Planet, helping to develop a key instrument for NASA’s Perseverance rover that’s currently roaming the Jezero crater. That instrument inspired him to invent a novel battery technology that today forms the foundation of his startup, Noon Energy.

On Mars, the MOXIE instrument is intended to test the viability of making rocket-ready oxygen on Mars to enable return trips to Earth, saving mass on the outbound leg of the trip. The device sucks in carbon dioxide and strips off an oxygen atom, which it stores on board. The remaining carbon monoxide is exhausted into the thin Martian atmosphere.

Here on Earth, Noon’s carbon-oxygen battery is targeted at larger-scale applications to help bridge intermittencies that naturally occur with wind and solar. It runs a modified version of the same chemical reaction as MOXIE, though the goal is to store electricity rather than produce oxygen.

Noon Energy brings Mars tech down to Earth with carbon-oxygen battery system by Tim De Chant originally published on TechCrunch

US offshore oil and gas rigs at ‘significant’ risk of cyberattacks, warns government watchdog

U.S. offshore oil and gas infrastructure faces “significant and increasing” cybersecurity risks that require “urgent” attention, a U.S. government’s watchdog has warned.

The Government Accountability Office said in a new report that the network of over 1,600 offshore facilities that produces a significant portion of U.S. domestic oil and gas are at a growing risk of cyberattacks. The warning comes more than a year after ransomware actors targeted Colonial Pipeline, bringing the U.S. oil pipeline system relied on by millions of Americans to a standstill.

The watchdog warned that not only has the government identified the offshore oil and gas sector as a target of malicious state actors, particularly those backed by China, Iran, North Korea, and Russia, but said operational technology (OT) — often used by these facilities to monitor and control physical equipment — contains multiple security flaws that could allow attackers to remotely take control of various functions, including as those critical to safety.

U.S. cybersecurity agency CISA has released several advisories about OT vulnerabilities this year alone, detailing issues like weak encryption and insecure firmware updates, and urged impacted users to identify baseline mitigations for reducing potential risks.

The GAO noted in its new report that legacy OT infrastructure still in use at many facilities is also vulnerable due to a lack of both built-in cybersecurity measures and software security patches. The report notes that older devices “do not have the capability to log commands sent to the devices, making it more difficult to detect malicious activity.”

The U.S. watchdog is calling on the Department of the Interior’s Bureau of Safety and Environmental Enforcement (BSEE), which oversees offshore oil and gas operations, to address these growing security risks. It says that the agency had initiated efforts to address these cybersecurity risks as far back as 2015, but has yet to take any “substantial” action almost a decade later.

The GAO notes that the BSEE started another such initiative earlier this year and hired a cybersecurity specialist to lead it, but the agency later said the effort was put on hold until the specialist is “adequately versed in the relevant issues.”

“Absent the immediate development and implementation of an appropriate strategy, offshore oil and gas infrastructure will continue to remain at significant risk,” the GAO said, noting that a successful cyberattack on offshore oil and gas infrastructure could have catastrophic consequences, including “deaths and injuries, damaged or destroyed equipment, and pollution to the marine environment.”

The U.S. watchdog is urging the BSEE to urgently develop and implement a cybersecurity strategy that includes risk assessments, objectives, activities, and performance measures; roles, responsibilities, and coordination; and the identification of required resources and investments.

BSEE “generally concurred” with the report and its recommendations. TechCrunch contacted BSEE for comment but did not hear back.

US offshore oil and gas rigs at ‘significant’ risk of cyberattacks, warns government watchdog by Carly Page originally published on TechCrunch

Rising energy costs are making the cloud more expensive

Since winter, around the start of the war in Ukraine, energy costs have risen drastically — particularly in parts of Europe historically dependent on Russian fuel. That’s impacted data centers, which aren’t directly reliant on resources like natural gas but which often draw on power grids and backup generators that generate a portion of their electricity using fossil fuels.

According to a July report from power generation supplier Aggreko, data center operators in the U.K. and Ireland have seen their energy bills increase by as much as 50% over the last three years, with the steepest climbs occurring within the last year. Fifty-eight percent of those in the U.K. said that energy bills have had a “significant impact” on their company’s margins.

It seems inevitable that the energy premium data center operators are being forced to pay will be passed along to customers. Indeed, it’s already happening.

Way back in November 2021, Manchester-based cloud services provider M247 hiked prices a whopping 161%, blaming “unprecedented times in the European energy markets.” Cloud providers OVHcloud, based in France, and Hetzner, based in Germany, both recently announced that they would raise prices by 10% in the coming months to combat soaring energy costs and inflation. In an earnings report, OVHcloud told investors that it expects “electricity costs in 2023 will account for around a mid-to-high-single digit percentage of its revenue, up from mid-single digit in 2022,” Reuters reported.

In a conversation with TechCrunch, Gartner senior director analyst René Buest noted that the era of constantly falling cloud prices has been over for some time. (Google Cloud, for instance, increased the prices of its core services in March independent of rising energy costs.) But she agreed that rising costs — and the associated inflation — have accelerated the upward cloud pricing trend.

Rising energy costs are making the cloud more expensive by Kyle Wiggers originally published on TechCrunch

Ideon Technologies digs up $16M Series A to use particle physics to find critical minerals

Car companies and battery manufacturers have scrambled over the last few years to secure critical minerals supplies, a race that’s only gotten more intense as consumers snap up every EV that comes off the production line.

Demand is so high that the International Energy Agency believes the critical minerals market will grow sevenfold by the end of the decade. Mining companies have been moving as quickly as possible to validate new reserves and bring them online, but prospecting is a laborious and time-consuming task.

There’s an easier way, though. Startup Ideon Technologies, fresh off a $16 million Series A round led by Playground Global that closed last week, has a pretty far-out way to simplify the search for critical minerals. You could say it’s way out there. Like outer space out there.

Ideon Technologies digs up $16M Series A to use particle physics to find critical minerals by Tim De Chant originally published on TechCrunch

OurCrowd announces its new $200M Global Health Equity Fund

OurCrowd, the global crowdfunding venture firm, today announced its newest fund. As the organization announced at today’s Clinton Global Initiative event in New York, it is partnering with the WHO Foundation to launch its Global Health Equity Fund (GHEF), a $200 million fund that will focus on healthcare solutions that can have a global impact.

Even before the pandemic, OurCrowd had long invested in medical startups, but that only accelerated during the pandemic, and best I can tell, it has also become somewhat of a personal mission for the firm’s founder and CEO, Jon Medved. ”COVID-19 was a wake-up call for me as an investor,” said Medved. “The pandemic opened my eyes to health inequity around the world and reinforced the potential of innovative technology to save lives […] This new fund builds on that success with the explicit orientation of having impact. The collaboration with the WHO Foundation will allow us to identify even more exciting investments and facilitate the commitment of investors and entrepreneurs to equitable access to the technologies we support.”

While the fund’s focus is on healthcare, the management team is taking a wider view here that goes beyond startups in the medical field, including other areas that can also have a more indirect impact on health, such as energy and agriculture, for example.

OurCrowd is aligning its fund with the WHO Foundation’s Access Pledge. The idea here is to ensure that portfolio companies will make their solutions accessible to populations experiencing inequity. Specifically, this means any GHEF portfolio company will develop an Access Plan for their solutions and the WHO Foundation and OurCrowd will launch an advisory board to provide them with the assistance needed to do so. That’s not, after all, something that most startups are used to doing — and not necessarily something that most investment funds would want their companies to focus on. But especially in the healthcare space, this seems like the right thing to do.

“Despite clear models for successfully balancing economic return with equitable access, such as the provision of medicines for HIV and AIDS, the world failed to deliver solutions for COVID-19 to everyone, everywhere,” said WHO Foundation CEO Anil Soni. “It is imperative that we deploy solutions in response to that failure, including directing investment to innovation and aligning both to equity as a goal from the start.”

OurCrowd CEO Medved will lead the fund’s team together with OurCrowd Managing Partner Morris Laster and the firm’s team of clinical experts, with WHO Foundation’s Impact Investment Officer Geetha Tharmaratnam also providing support.

At this point, OurCrowd has invested in about 350 companies across its 39 funds for its more than 215,000 members, making it one of Israel’s most active investors. Some if its other healthcare-centric investments include Alpha Tau Medical, which focuses on treating solid malignant tumors, and BrainQ, a non-invasive technology to treat stroke and other neurological pathologies.

OurCrowd announces its new $200M Global Health Equity Fund by Frederic Lardinois originally published on TechCrunch

Now that the Ethereum Merge is behind us, what’s next?

Ethereum has successfully completed its highly anticipated shift from proof-of-work (PoW) into proof-of-stake (PoS) in a process known as the Merge.

The plan was years in the making and has undergone a seemingly endless series of tests and tinkering. It finally happened after being one of the most anticipated and talked-about events in the crypto world this year. But now the event has passed, with Ethereum appearing to clear the technical hurdles presented by the transition.

“Ethereum has a chance now to be a productive, aligned, forward-looking technology compared to one that was rooted in high energy consumption and below par from a transaction or cost perspective,” Sean Ford, interim CEO of blockchain Algorand (which is also PoS), said to TechCrunch. “I’m optimistic about the industry’s chances.”

Although the Merge was a huge feat, there are plenty more upgrades planned for the Ethereum blockchain down the road. In July, Vitalik Buterin, co-founder of Ethereum, said the network will undergo further updates that rhyme with the Merge — Surge, Verge, Purge and Splurge.

“One of the beauties of the Merge that we see is Ethereum has a long technical road map, but it’ll never be complete,” Steven Goldfeder, co-founder and CEO of Offchain Labs (the developer of layer-2 rollup Arbitrum), said to TechCrunch. “There’s never a point where we’re done. The technology will only get better over time. We will continue to innovate and do better things.”

But what does this all really mean for the next era of the Ethereum network?

Now that the Ethereum Merge is behind us, what’s next? by Jacquelyn Melinek originally published on TechCrunch