Emerge Tools raises $1.7M to help make apps smaller

Apps tend to get bigger over time. Adding new features means adding more code, more third-party frameworks, and more assets like images or videos. Resources like fonts or support documents get duplicated, and things slip through the build process without the best optimization or compression.

Keeping apps small has upsides for the users and the developers, but it’s not necessarily top-of-mind all of the time. It’s the kind of thing that, depending on the size of a dev team and its priorities, can get forgotten until someone complains.

Emerge, a company out of YC’s W21 class, is building tools that help to keep apps small — monitoring changes from build to build, and recommending actions that can trim the required storage space.

Why keep apps small? There’s a bunch of reasons, as Emerge co-founder Joshua Cohenzadeh points out. Make your iOS app too big, for example, and the App Store will suggest to your users that they wait until they’re on WiFi — an opportunity for them to lose interest all together (in a recent blog post, Uber said that App Store size limitations cost them up to 10% of installs.) If you’re hoping to build a userbase worldwide, meanwhile, you’ve got to consider that many potential users might be on slower networks or paying by the megabyte — so every byte counts. Plus, who hasn’t been trying to free up some space on their phone and thought “Wait, why the hell is [app x] taking up 400 mb?”

Emerge co-founders Josh Cohenzadeh and Noah Martin have been building things together since they were, quite literally, kids. In highschool they built QuickRes, a menu bar tool for quickly changing the screen resolution on a mac; over the years, they’d build a popular screenshot manager for the Mac, a menu bar widget for controlling a Tesla, and a now-retired tool for A/B testing your Tinder photos that Cohenzadeh says got them on the wrong side of a cease and desist.

After college and stints at big companies, the two decided to stop making what were arguably side projects (or, as Josh lovingly referred to them, “dinky little apps”) and go full time into building a startup. They set out to apply to Y Combinator, and, while brainstorming ideas, came across research on the great lengths users were going to to transfer data in countries with limited mobile networks. This got them looking into where apps were wasting data… and the deeper they dug, the more they realized that app size was something that many teams — even within many big companies — weren’t consistently focusing on.

“If you’re a small company, you don’t have the resources to have your own performance team. You don’t have the resources to do all these crazy optimizations and things like that.” says Josh. “So the foundation of Emerge was just… let’s standardize this.”

Emerge provides its insights in a few different ways. It can hook into your team’s GitHub to flag app size changes as comments in each pull request; Emerge’s dashboard, meanwhile, gives you multiple different views into what’s taking up space in your app and suggests ways to slim it down.

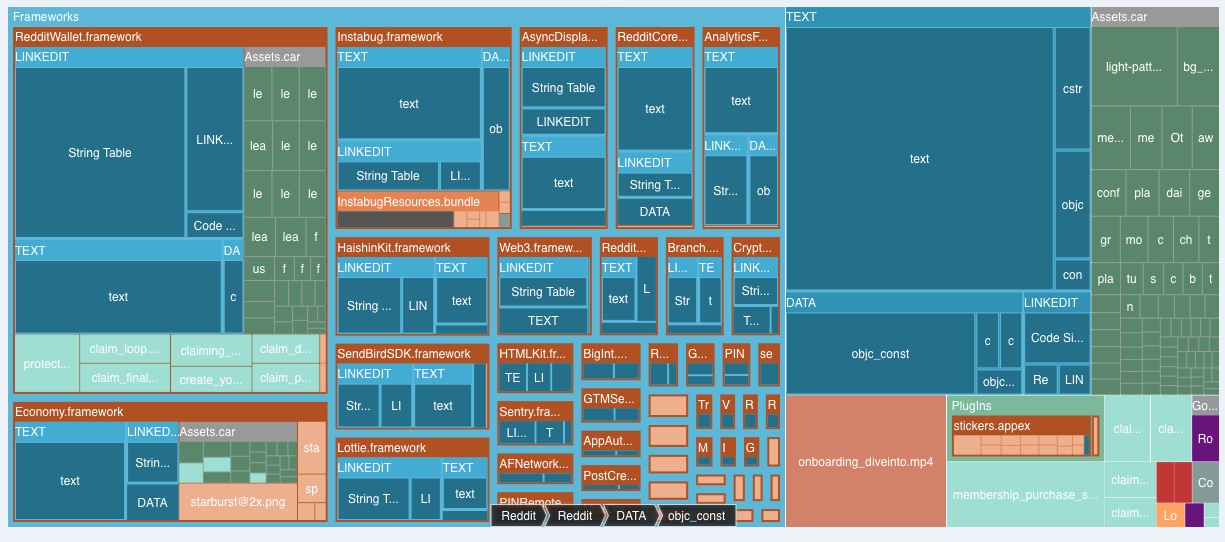

Emerge’s X-Ray view

The “X-ray” view gives an at-a-glance overview of how much space is taken up by each framework or asset. If you’re only using a certain framework for one or two rarely used features but it accounts for 1/5th of your app’s size, is it worth it? It’ll also highlight files that managed to sneak into your build multiple times. “It’s shocking how many companies have duplicate files,” says Josh.

The “Breakdown” view splits it up by category — how much of your app is the binary itself, how much of it is assets like images or video, etc.

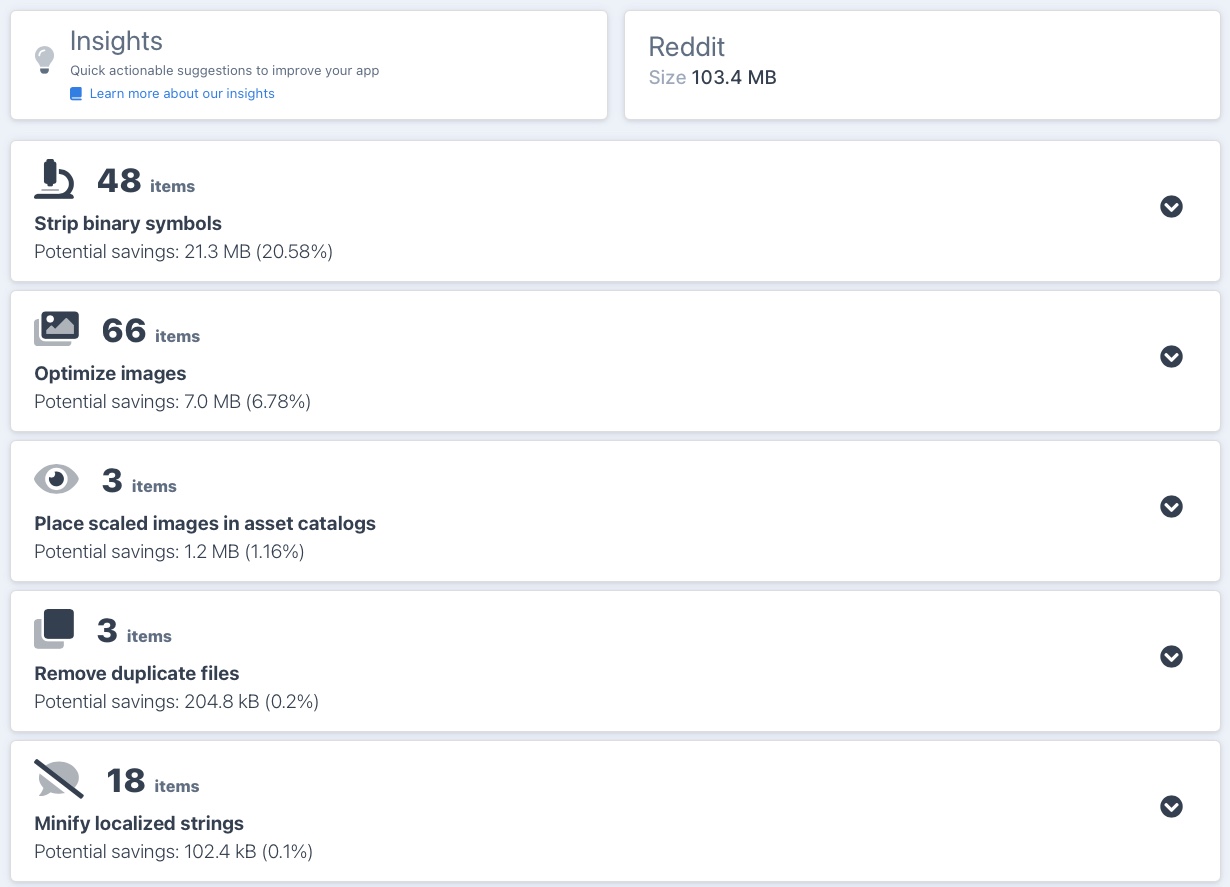

Emerge’s Insights view

An “insights” tab, meanwhile, offers up the actions that could have the biggest impact on app size — like stripping binary symbols in a Swift binary, using a different image type for a given platform (like HEIC instead of PNG on iOS), or figuring out how to ditch those aforementioned duplicate files.

Curious as to what Emerge might find in your app? There’s one catch: their tools aren’t open to everyone, just yet. They’re currently working with each new company individually — because, as Josh tells me, most of the companies they’re working with require strict security reviews and legal agreements before granting tools like this any sort of access. Emerge plans to launch a “full self-service model” for smaller teams soon, he notes. Pricing varies company by company, based on criteria like number of apps, number of builds, team size, and which platforms they’re building for. When it launched earlier this year, Emerge focused solely on iOS apps; last month the team added support for Android apps.

Emerge recently closed a $1.7M round — its first so far. Cohenzadeh tells me the round was backed by Haystack, Matrix Partners, Y Combinator, Liquid2 Ventures, and a handful of angel investors.

Emerge raises $20M to take its digital freight marketplace for truckers up a gear

Trucking is currently the most popular mode of transporting freight in the US, accounting for around $12.5 billion of the $17 billion freight market, according to the Bureau of Transportation Statistics. But with thousands of small and single-vehicle operators and legacy (often paper-based) systems underpinning communications, it’s also one of the most inefficient.

Now, there are signs that this is changing. A startup out of Phoenix, Arizona called Emerge, which has built a platform to for shippers and brokers to find and allocate truck freight more effectively across the long tail of available truck-based carriers (a little like a Flexport but for trucks), is announcing a round of $20 million, funding it will use to continue building out its technology, as well as to keep expanding business.

The funding — led by NewRoad Capital Partners, with previous investors Greycroft and 9Yards Capital also participating — comes on the heels of some already-strong traction for Emerge. Since being founded in 2018 by brothers Andrew and Michael Leto, the company has processed more than $1 billion in freight with 1,500% year-over-year growth between 2018 and 2019. We understand that the company’s valuation is currently at over $100 million.

Some of its traction so far is down to the founders. Both are vets of the trucking industry whose previous company, a multimodal shipment visibility/supply chain solutions platform called 10-4, sold to Trimble in a $400 million deal. And some of that is down to the gap in the market that Emerge is filling.

“Gap” is actually the operative word here. How shipments are booked on trucks today is quite inefficient, with orders often leaving empty spaces on truck beds that could be filled with goods going in the same direction; and in about 20% of all journeys carrying no load at all.

Part of the reason for this is the antiquated way that shippers book space on trucks, and part of the reason is because there is just simply too much fragmentation in the system, with 80% of all shipments today contract-based and the remaining 20% operating as a “spot market” and booked on the fly, and neither of them particularly efficient when it comes to truck occupancy. (Most of the latter spot market is booked through spreadsheets and email, Michael Leto, the CEO, said in an interview.)

Emerge’s solution is something of a stick-and-carrot approach that reminds me a little also of how advertising exchanges work.

A shipper that wants to use the Emerge platform essentially activates/lists its entire inventory of truck providers on the platform to get started. That list and inventory, in turn, become part of a bigger database of other providers: and again, this is a long-tail approach, with typically the trucking companies on the platform having no more than 200 trucks (and often less) in their fleets.

Then, when a shipper goes to Emerge to book a shipment, options are provided that might include previous truckers, but might also include others. The idea is that this provides a more efficient picture, and that in turn gets passed on as cost savings to the customers, who can typically reduce shipping costs by as much as 20% using the platform.

If the cost savings and expanded choice are the carrots, the stick comes in the form of the requirement to upload truck data and share it with other shippers: you can’t use the system without doing it.

“But it’s a network effect,” Leto explained when I asked if there was ever resistance to the model. “We allow these companies to share capacity to drive efficiencies, and to drive and lower costs with less deadhead miles. There are a lot of benefits to capacity sharing.” It doesn’t seem to have deterred too many. There are currently some 30,000 carrier profiles the platform, and 12,000 transportation entities — including carriers, brokers, or other shippers — transacted in Q4 alone, speaking to activity on the platform being strong.

Emerge is not the only company that has identified the opportunity in providing a better and more updated platform to communicate and book space in the fragmented truck market. Sennder out of Berlin — which last year raised a sizeable round of funding — has also built a platform to centralise communications around booking shipments. It, however, seems to have less of an emphasis on encouraging shippers to take the lead in expanding that network effect that Leto describes.

Others that are tackling the wider shipping and logistics market and trying to improve how it runs include Sendy out of Kenya, which recently also announced a $20 million raise; Flexport, which now has a $3.2 billion valuation; Zencargo, which has also raised $20 million; and FreightHub ($30 million); Bringg ($25 million) and NEXT ($97 million).

But within that, Emerge’s performance so far, coupled with the Leto brothers’ history as founders, are giving the startup some extra mileage as we enter the next phase of what trucking might hold, which could include a critical mass of autonomous and electric vehicles on pre-defined routes.

“Uniquely, Emerge combines an exciting new technology designed to serve existing, unmet market need with experienced industry operators and entrepreneurs,” said Tracy Black of NewRoad in a statement. “Andrew and Michael are building the most innovative marketplace we’ve seen in the freight and digital marketplace industry — bringing contracts and carriers together to create new capacity. We are excited to be leading their Series A and I am thrilled to join the board to support their growth,”.