Three years ago, Mila showed up on Kickstarter with its smart air purifier. The company created an air cleaner with a choice of different filters to suit the use case (and price point) customers were interested in, along with an impressive array of sensors built into the device itself. Today, the San Francisco-based company announced it closed a $10 million Series A to scrub the nasties out of the air for more people.

The company’s seed round was led by no other than Electrolux. Mila claims it was Electrolux’s first startup investment. The appliance giant also participated in the current round. Mila’s $10 million Series A was led by returning partner Cercano Management (the former venture arm of the late Paul Allen’s investment firm) and “an undisclosed global consumer goods brand.” The company says it’ll spend the money to hire, scale operations, expand its product portfolio and work toward its ultimate goal of meeting the global need for better indoor air quality. The company is also planning to launch Mila Halo, a smart humidifier.

The company raised its $10 million round in an all-equity deal at a $52 million post-money valuation, the company tells me. It says the new valuation represents a 3x value increase over its seed round the year prior.

“We’re at the cusp of a great ‘air awakening’ as the quality of the air we breathe becomes more top of mind for families. But the products families typically turn to provide little to no insight on whether or not they’re actually working. With Mila, families can finally monitor and control their indoor air quality effortlessly,” Grant Prigge, CEO and co-founder at Mila said in an interview with TechCrunch. “This investment

will allow us to meet growing demand while continuing to build thoughtful, beautiful experiences that improve the health of our homes.”

The company is operating in a fiercely competitive market — it isn’t like there is a shortage of air purifiers to choose from — but the company’s clever, cute design and the ability to use a number of different filters depending on the need sets it apart from its competitors. The app is also outstanding, reporting particulates (PM1, PM2.5, PM10), humidity, temperature, volatile compounds (TVOC), CO2 and CO. The purifier uses this data to scrub the air more intelligently — running the fans slowly if they’re not really needed, or running at full blast if nasties need to be scrubbed from the air.

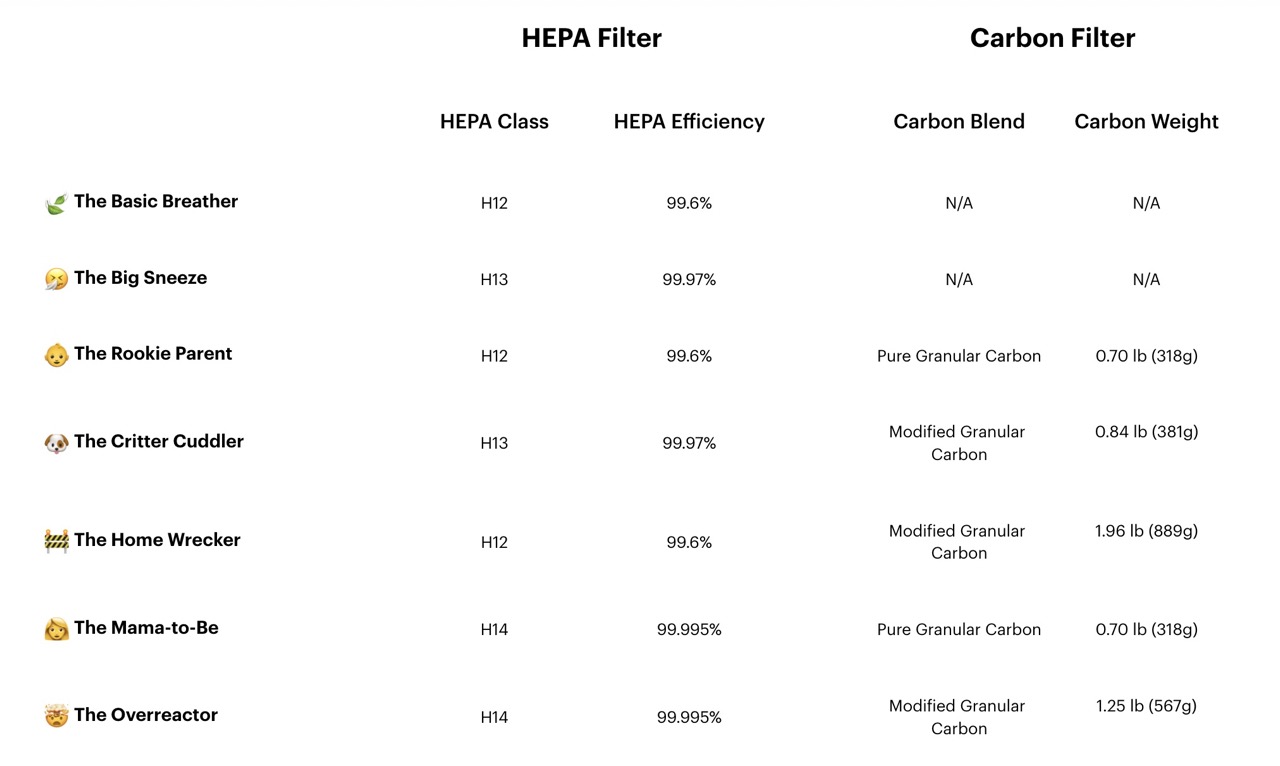

Mila has seven hilariously named filters to choose from, which all have slightly different characteristics, depending on what customers are looking for. Image Credits: Mila

We spoke with Grant Prigge, the company’s CEO and co-founder, to learn a bit more. The interview is edited for clarity and length.

TC: Who are the lead investors, and what has it been like to work with them so far?

Grant Prigge: Mila went from a small passion project with a couple hundred thousand dollars of angel funding from friends, to having Electrolux, one of the largest consumer appliance manufacturers in the world, as its first institutional investor. Mila was Electrolux’s first venture investment in the company’s 100 years of existence.

After launching what became the largest air purifier launch in crowdfunding history, with more than $1.5 million in preorders, Paul Allen’s Vulcan Capital led Mila’s second round. Our Series A was led by Cercano Management, the venture spinoff of Vulcan Capital, and one of the largest consumer goods manufacturers in the world.

Most people cautioned us against working with big corporate investors, but they’ve been some of the best partners we could ask for, providing thoughtful feedback and lending their support along the way. With Electrolux’s support, we’ve been able to punch well above our weight, especially when it comes to navigating the supply chain challenges of the past few years. And with our newest investor, we see the same synergy in marketing and branding as we bring Mila to millions of homes across the globe.

What is the goal with the fundraise? What does the money unlock?

This fundraise enables us to expand our team and meet the growing demand for Mila’s award-winning air purifier. Additionally, it’ll allow us to expand our product portfolio with additions that work to enhance the health of our homes and indoor environments. In the new year, we’re incredibly excited to release Mila Halo, which is the first humidifier of its kind that actually makes it safe to use tap water, thanks to Halo’s proprietary water filtration system. Halo was the recipient of a CES Innovation Award in 2022.

It is the convergence of a growing portfolio of hardware solutions with an air quality control system that is becoming more intelligent by the day. We believe Mila will become the Home Health Operating System of the future.

What’s the long-term vision?

Our mission is to bring every family back from airblivion to shape the healthy home of the future. The quality of the air we breathe is now recognized as the single largest environmental threat to human health. Around the world, dirty air is behind 7 million early deaths annually — more than AIDS, diabetes and traffic accidents combined.

These past two years have only highlighted how little we know about the air we breathe. Consumers are becoming more aware of how critical their home environment is to their health — they just lack the tools to do something about it. In fact, 91% of consumers say they now understand how air quality impacts their health, but 69% say they don’t know what to do about it.

Mila intends to solve that. Indoor air quality (IAQ) is a $16 billion market ripe for disruption. We aim to be the dominant brand, making every home a healthier place to breathe.

What is the Mila Cares program, and why are you giving away purifiers for free?

One of the things that blew us away during our original Kickstarter campaign was the letters we got from our customers about who they were buying their Mila for. Spouses were buying it for their hubby who suffered from allergies, girlfriends were buying it to save the relationship between the cat and boyfriend, dads were buying it for their young kids who suffered from asthma and suffering from an autoimmune issue. These thoughtful notes and stories inspired and humbled us, and clearly showed that people were buying our products for the health of their loved ones, and we vowed to take that responsibility seriously in everything we do. It reinforced that compassion and care should always be a core pillar of our brand (hence, the name “Mila Cares”).

One way we do this is through the Mila Cares Program. Any customer can nominate someone in need of clean air, and any member of the Mila team can give out a Mila Cares Package. The only requirement is that it touched them in some way. Sometimes a laugh, sometimes a cry. The nominee then gets a surprise Mila Cares Package, almost always containing a Mila air purifier, with a personal letter from us.

To date, we’ve given out more than 100 Mila Cares Packages, and it allows us to celebrate deserving air breathers in the communities we’re lucky to be a part of in a meaningful way.

Backed by Electrolux, Mila raises at a $52M valuation to add smarts to fresh air by Haje Jan Kamps originally published on TechCrunch