The company's public fund disbursement and e-commerce platform makes accepting school tuition and enabling educational enrichment more accessible.

© 2024 TechCrunch. All rights reserved. For personal use only.

Product Management Confabulation

What Product Managers are talking about.

The company's public fund disbursement and e-commerce platform makes accepting school tuition and enabling educational enrichment more accessible.

© 2024 TechCrunch. All rights reserved. For personal use only.

SoftBank’s retreat from its past investing exuberance continues apace. This morning, Kahoot, the Norwegian startup that provides a popular platform for people to build and use education-focused games, announced that General Atlantic is buying out SoftBank’s entire 15% stake in the company. SoftBank is exiting at a loss. The firm sunk at least $215 million into the company in the last several years. However, 15% of Kahoot’s current market cap (10.415 billion Norwegian Krone) works out to about $152 million (1,562,250,000 NOK).

This looks like an all-secondary round: no new investment coming in alongside the buyout. (We’re confirming this with Kahoot and will update as we learn more.) “Kahoot plans to partner with General Atlantic to accelerate further growth initiatives, drive innovation, and expand its global footprint in homes, schools, and corporations,” the company said in a statement.

Nevertheless, the deal comes as Kahoot, like many other tech companies, continues to feel the pinch of the general downturn in technology stocks and the wider technology market. A year ago, its shares were trading at 70.25 NOK on the Oslo Stock Exchange. They are now worth only 22.77 NOK. And that is with a bump of nearly 27% that Kahoot had this morning on the news of the investment/divestment.

SoftBank, meanwhile, has been in hot water itself, facing up to big losses in its splashy Vision Fund investment vehicles on the back of those wider tech industry doldrums. In August, Vision Fund I reported a loss of over $17 billion for just one quarter (Q1). Vision Fund 2 is reportedly down in value by some 19% on the funds that have been invested so far. Amid layoffs and big executive changes, no surprise, then, that it is now divesting stakes that are underperforming. (It’s still working on a Vision Fund 3 though, so never say die in the world of tech.)

“We are very grateful to SoftBank for their partnership over the past two years. As Kahoot! continues to pursue its mission to improve lifelong learning by building a leading global learning and engagement platform, we are thrilled to add a partner of General Atlantic’s caliber,” Eilert Hanoa, CEO of Kahoot, said in a statement. “The team at GA brings deep experience in scaling global education technology and software businesses and positioning market leaders for long-term success, and we look forward to our next phase of momentum in empowering the learning ecosystem around the world.”

“We believe Kahoot has significant potential for further growth as digital learning solutions continue to be adopted across its work, school, and home markets,” added Chris Caulkin, MD and head of technology for EMEA at General Atlantic. “With its much-loved brand, product-centric approach, and engaged global user base, Kahoot is well positioned to scale, and we look forward to supporting Eilert and the full Kahoot! team in the years to come as they reach and engage ever more users worldwide.” General Atlantic and SoftBank have partnered on many deals in the past, so there was clearly already a relationship between the two and that may have played a factor here as well.

To be fair, since SB Northstar (the SoftBank Group fund making the investment) made its first investment in Kahoot nearly two years ago, in October 2020, Kahoot has grown a lot. It had 1.3 billion users (“participating players”) at that time; now that number is 8 billion.

What started as a “YouTube for education”- style model (big emphasis on user-created content and a way of using what you have made for yourself or your own learning group, but also dipping in and using material made by others) has worked to diversify deeper into enterprise and more. It said today that Kahoot! at Work is used in 97% of Fortune 500 companies for corporate learning and engagement, and that Kahoot! at School is used by approximately 9 million teachers in the classroom. And Kahoot! at Home & Study has over 18 million users as an “at-home gamified learning solution.”

Indeed, the company went large during the Covid-19 pandemic, doubling down on being one of the platforms to help fill the gap of amusement and engagement for students who were no longer in classrooms; and ditto for remote workers as a way of team building and more.

But as with many companies that found business ballooning because of market conditions, now as more people return to the office, students are back in the classroom, and generally budgets are all being reined in in the current economic climate, it will be having an effect on Kahoot as well.

We’ll update this post as we learn more.

General Atlantic buys out SoftBank’s 15% stake in edtech Kahoot, now valued at about $152M vs the $215M SoftBank ponied up 2 years ago by Ingrid Lunden originally published on TechCrunch

Raising venture capital is rarely an easy lift for startups, but 2022 is turning out to be a more challenging year than we’ve seen for some time. As venture capital continues its slowdown after an aggressive 2020 and record-breaking 2021, it’s clear that early-stage founders looking for their first dollars will require a new approach.

What do early-stage founders need to know to capture VC interest, and dollars, in a challenging market? It’s a vital question, and it’s why we’ve invited three investors — who we think know their stuff — to share their insight and advice on the TechCrunch+ stage at TechCrunch Disrupt on October 18-20 in San Francisco.

We’re thrilled that Annie Case, a partner at Kleiner Perkins; Jomayra Herrera, a partner at Reach Capital; and Sheel Mohnot, the co-founder and GP at Better Tomorrow Ventures, will join us for a panel discussion called How to Raise First Dollars in a Difficult Market: The Venture Perspective.

Learn more about these investors, and you’ll understand why they’re eminently qualified to tackle this topic.

Annie Case, a partner at Kleiner Perkins, focuses on investments in consumer, healthcare and marketplaces. Before joining Kleiner Perkins, Case worked at Uber, where she supported the SVP of operations and helped scale the Uber Eats business to international markets.

As a consultant at Bain and Company, Case worked with clients in technology, private equity and education. She graduated from Stanford University with a BS in human biology and an MS in management science and engineering.

Jomayra Herrera is a partner at Reach Capital, a venture fund focused on early-stage education technology and future-of-work companies. She is currently a board director for Workwhile and a board observer for Outschool.

Before joining Reach, Herrera served as a principal at Cowboy Ventures, where she focused on investing in consumer internet and marketplace companies. She helped lead investments in companies like Contra and Landing.

Prior to Cowboy, Herrera was one of the first venture investors at Emerson Collective. She worked across early- to growth-stage teams and championed investments in companies including Career Karma, Guild Education and Handshake.

Sheel Mohnot is a co-founder of Better Tomorrow Ventures, a seed-stage venture capital fund investing in fintech companies around the world. He is also the GP of the 500 Fintech fund.

Mohnot previously served as vice president of business development at Groupon after a startup he founded, FeeFighters, was acquired by the company in 2012. In 2013, Monot co-founded Innovative Auctions, a high-stakes auction company.

TechCrunch Disrupt is back in person on October 18-20 in San Francisco. Early action equals bigger savings. Buy your pass now and save up to $1,300. Student, government and nonprofit passes are available for just $195. Prices increase July 29.

Mark Pavlyukovskyy, Ajay Gupta and Glen Anderson formed New Zealand’s first operator-run fund, NZVC, over the last year and made its first close of $10 million on what Pavlyukovskyy said will end up being around $15 million when all is said and done.

Pavlyukovskyy, who was born in Ukraine and grew up in the United States, came to New Zealand as part of the Edmund Hillary Fellowship visa program just as the country closed the border during the global pandemic.

He had previously exited edtech company Piper and was traveling around to other countries examining their education technology when he learned about New Zealand and the Hillary entrepreneur visa.

“In meeting and talking to founders, I saw interesting talent coming here, but there was no support, and startups were very undercapitalized and had low valuations,” Pavlyukovskyy said. “We started talking about how we could leverage our connections to Silicon Valley to help New Zealand companies scale.”

He says when looking at the New Zealand startup ecosystem, it is similar to Israel and Singapore, and has “fountains of talent.” Despite being isolated geographically, it has a strong connection to the rest of the world. He likened the country’s culture to what you might see in the U.S. and Canada, it has a stable political system and, despite the remote location, has an entrepreneurial spirit.

In addition, he saw a very nascent funding ecosystem that mainly consisted of angel investors and some venture investors, but none of them were operators nor had much experience actually building companies from zero to 1, Pavlyukovskyy added.

“There were no other experienced founders to guide them or give them advice on how to build companies,” he said. “Founders were coming in and messing up the cap table or the board structure. We want to come in early to prevent some of these problems from taking place. From me being a serial entrepreneur, I want to be able to give suggestions and advice, which is the fun part.”

As such, NZVC’s fund is targeting the seed to Series A gap. The firm has deployed $4 million into 25 companies so far. Its limited partners are also operators and are either connected to New Zealand or provide an opportunity to get exposure to companies they may not have otherwise seen.

For example, the investor base includes AngelList founder Naval Ravikant, Foundry Group’s Brad Feld and Ryan McIntyre, Disney COO Tom Staggs and Skype founder Jaan Tallinn.

The firm is focused on B2B SaaS, deep tech, marketplaces and the web3 and cryptocurrency space. Now that the pandemic has proven that today’s entrepreneurs can start companies anywhere and locate their team anywhere, that has enabled founders to hire remote teams and do sales outside of New Zealand, Pavlyukovskyy said.

NZVC has invested in companies like Seachange, which is doing hydrofoiling and electric car ferries, and Pyper Vision, a fog-clearing drone for airports. It is also infused capital into companies in the mental health space, including Chnnl, a platform for healthcare workers to give confidential feedback; Sahha, an AI-based tool to analyze mental health passively without asking you questions; and oVRcome, a VR-based product aimed at curing phobias through exposure therapy.

“The New Zealand government strongly supports and subsidizes university research, and as a result, some companies have done well and have had successes,” Pavlyukovskyy added.

Kleiner Perkins, one of Silicon Valley’s legacy venture capital firms, is kicking off 2022 right by celebrating five decades in business and $1.8 billion in funds raised for two new funds — KP20 and Select2.

KP20 is an $800 million venture fund focused on early-stage investments in enterprise, consumer, hardtech, fintech and healthcare companies, while Select2 is a $1 billion fund — the most the firm has raised at once — that extends its core investment strategy to focus on high inflection investments across those same five areas.

Select2 follows the $750 million Kleiner Perkins Select fund the firm announced last April.

Partner Ilya Fushman told TechCrunch that the firm’s focus is the same today as it was when Kleiner Perkins started in 1972: “Venture is a non-scalable, boutique craft that requires incredibly dedicated practitioners with diverse and complementary backgrounds that span technology, operating and investing.”

With a history of being early investors in technology darlings, like Google, Amazon, Netscape and Genentech, Fushman said the investor team curated over the past four years is taking over the next generation of the firm, while the new funds will be able to back the next generation of iconic companies, he said.

Kleiner Perkins’ investor team. Image Credits: Kleiner Perkins

In addition to the funds, Kleiner Perkins promoted several team members as new partners: Annie Case, a consumer marketplaces and digital health expert, and Josh Coyne, who leads investments in business software.

Case told TechCrunch that within the digital health space, she is seeing more investment going into mental and behavioral health and alternative medicines, while on the consumer side, there is a lot happening in education technology, mainly due to school districts and parents adapting to the experience of teaching during the global pandemic. The firm is also spending more time looking at opportunities in crypto and web3.

As for raising $1.8 billion in one go, Fushman says Kleiner Perkins is adjusting to the current conditions where companies are not only growing bigger and faster, but also growing across sectors, technology and internationally. The scale of opportunity is bigger than ever before, and that is reflected in exit valuations and the number of companies that get started each year.

And having more fund capital at the firm’s disposal enables the company to deploy it into later rounds, or with a bigger check to get in, and still be able to provide a similar venture assistance Kleiner Perkins is known for in the early stage.

“The market overall for venture makes it an exciting time to grow beyond early-stage and provide a full spectrum of capital,” Fushman said. “As we help companies grow, if we see them hitting an inflection or we miss out on the Series A, we can do something from the Select fund.”

ClassDojo’s first eight years as an edtech consumer startup could look like failure: zero revenue; no paid users; and a team that hasn’t aggressively grown in years. But the company, which helps parents and teachers communicate about students, has raised tens of millions in venture capital from elite Silicon Valley investors including Y Combinator, GSV, SignalFire and General Catalyst over its life.

If you ask co-founder Sam Chaudhary to explain how the startup survived so long without bringing in money, he responds simply: “When you have something that you think will be for the long term you can put [in] a lot of energy. So, we always kind of maintained the belief that like bringing people together and helping them be connected, especially last year when they needed to be apart, physically apart, was going to be really important.”

In layman’s terms: ClassDojo has been playing the long-game in edtech since 2011, quietly aggregating free users-turned-fans across the world’s public schools, which are notoriously hard to sell due to tight budgets. Every engineer on the team serves a population that is the size of the city of San Francisco. The company has been intentionally frugal throughout the process. Its core service, which is an interface that allows parents and teachers to communicate updates and stay involved in the classroom, is free for anyone to download.

“Our view from the start was actually that the idea of districts isn’t the customer of education, [that’s] kind of backwards,” he said. “It’s like Airbnb saying we’re going to transform travel by selling to hotels.” The route has helped ClassDojo gain traction with 51 million users across 180 countries.

Two years ago, ClassDojo tested this customer love. It launched its first monetization attempt in 2019: Beyond School, a service that complements in-school learning with at-home tutorials. Within four months of launching the paid service, ClassDojo hit profitability. In 2020, the added dimension of COVID-19 helped ClassDojo triple its revenue and grow to have hundreds of thousands of paying subscribers.

It’s a lesson in how a venture-backed startup can successfully live for years without any plans to monetize, grow a super-fan user base, and eventually turn those users into paying customers if the fit is right.

The acceleration of ClassDojo’s business got noticed by Josh Buckley, the new CEO of Product Hunt and a solo capitalist.

“For years, they’ve quietly been building the most adored brand in the industry; kids, teachers and families they serve love it. Their business model follows that vision; they’re focused on serving the consumers, not the ‘system’” Buckley said.

Buckley led a new $30 million financing round for ClassDojo, he tells TechCrunch. The round also includes Superhuman CEO Rahul Vohra, Coda CEO and former Youtube head of product and engineering Shishir Mehrotra, former product lead of growth for Airbnb Lenny Rachitsky, and others.

The financing comes nearly two years after ClassDojo raised a $35 million Series C round led by GSV. When new capital is less than the preceding round it usually signals a downround, but Chaudhary says that ClassDojo had a “significant markup on valuation” with the extension round. The trend of opportunistic extension rounds has grown for edtech startups recently as the pandemic underscores the need for remote learning innovation.

With new financing and massive scale, ClassDojo is now trying to evolve from a communication app into a platform that can help students get better learning experiences beyond the one they get from schools.

Chaudhary says that they plan to double ClassDojo’s 55-person team, invest in product, and enter new markets.

“For me, I’d always thought ClassDojo could enable a better future, specifically one where kids’ outcomes aren’t entirely determined by what their ZIP code can offer them,” Chaudhary said. “That’s the kind of future we’ve been building toward.” He likened ClassDojo’s goal as similar to Netflix: provide a broad scope of material for a broad scope of people, not just on-demand political dramas.

ClassDojo is already creating content around topics not discussed in school such as how to fail and how to become an empathetic person, as part of its Big Idea series. The Beyond School offering helps students set goals and track activities, as well as find activities such as dinner table discussion starters or bedtime meditations.

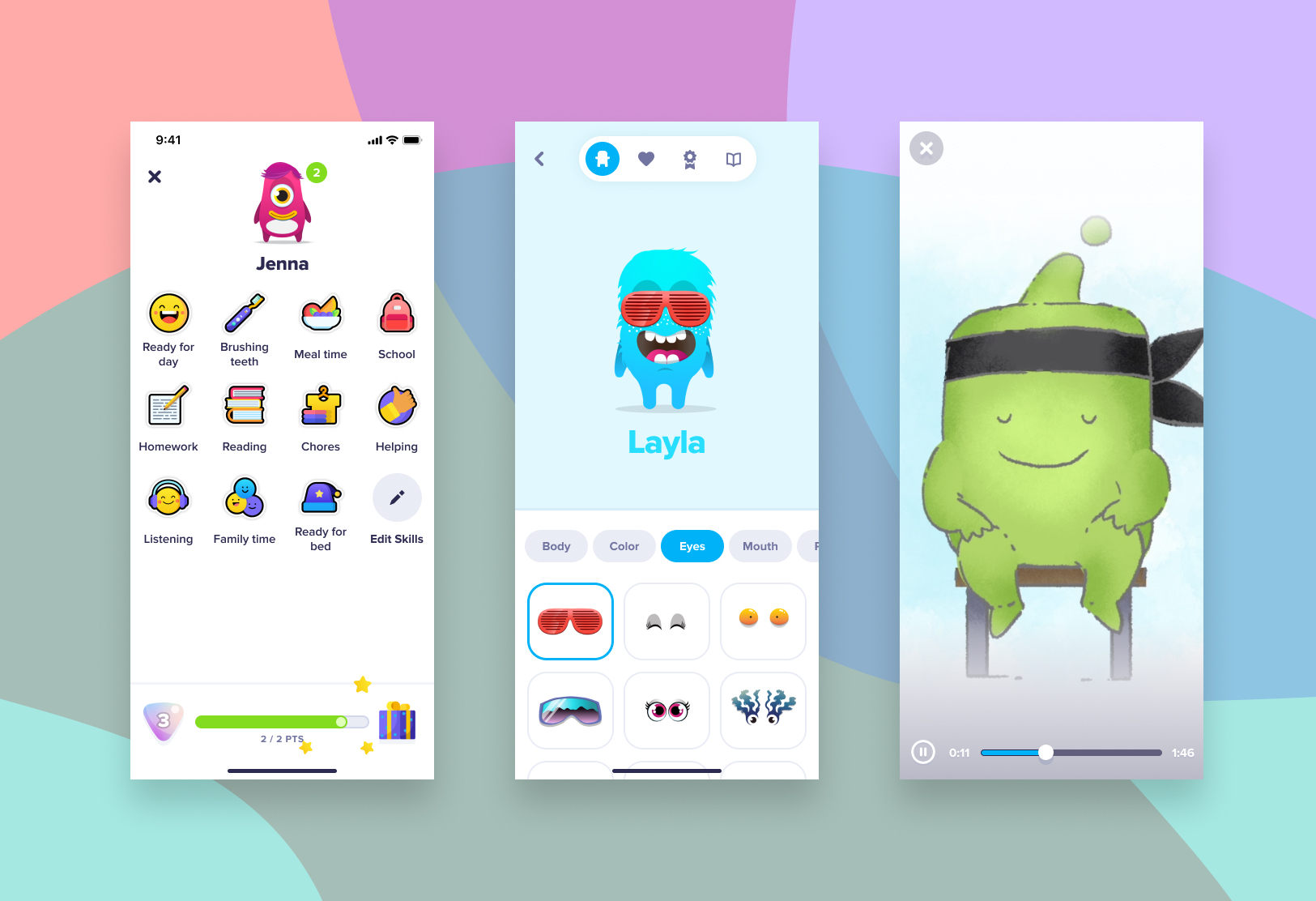

Image Credits: ClassDojo

ClassDojo charges $7.99 a month, or $59.99 annually, for its premium content. The platform is finding small ways to add personalization and spice to its content, such as customized avatars, but further innovation will be key in making its next phase work.

While ClassDojo certainly has a strong user engine to monetize off of, the content game is difficult to win at. Content, to an extent, is commoditized. If you can find a free tutorial on YouTube or Khan Academy, why buy a subscription to an edtech platform that offers the same solution? The commodification of education is good for end-users and is often why startups have a freemium model as a customer acquisition strategy. To convert free users into paying subscribers, edtech startups need to offer differentiated and targeted content.

The United States continues to be a dominant market for ClassDojo, which also has users in the United Kingdom, Ireland, United Arab Emirates and more. While some in edtech express concern that United States consistently lags in consumer spending in education, Chaudhary thinks it’s an unfair assessment.

“To believe that, you have to believe that families don’t care all that much about their kids. And I just don’t think that’s true,” he said. “All the ways that American people express their care for children, there’s such a range, from extracurricular to sports camp to moving to the right zip code.”

And with that mindset, ClassDojo thinks that it can become the brand that families turn to when they think about a child’s education.

“I think there’s just like a missing brand in the world right now,” Chaudhary said. “There’s a blank, a lot of fear, uncertainty, and doubt.”

Ironhack, a company offering programming bootcamps across Europe and North and South America, has raised $20 million in its latest round of funding.

The Miami-based company with locations in Amsterdam, Barcelona, Berlin, Lisbon, Madrid, Mexico City, Miami, Paris and Sao Paulo said it will use the money to build out more virtual offerings to compliment the company’s campuses.

Over the next five years, 13 million jobs will be added to the tech industry in the U.S., according to Ironhack co-founder Ariel Quiñones. That’s in addition to another 20 million jobs that Quiñones expects to come from the growth of the technology sector in the EU.

Ironhack isn’t the only bootcamp to benefit from this growth. Last year, Lambda School raised $74 million for its coding education program.

Ironhack’s raised its latest round from Endeavor Catalyst, a fund that invests in entrepreneurs from emerging and underserved markets; Lumos Capital, which was formed by investors with a long history in education technology; Creas Capital, a Spanish impact investment firm; and Brighteye, a European edtech investor.

Prices for the company’s classes vary by country. In the U.S. an Ironhack bootcamp costs $12,000, while that figure is more like $3,000 for classes in Mexico City.

The company offers classes in subjects ranging from web development to UX/UI design and data analytics to cybersecurity, according to a statement.

“We believe that practical skills training, a supportive global community and career development programs can give everyone, regardless of their education or employment history, the ability to write their stories through technology,” said Ariel Quiñones, co-founder of Ironhack.

Since its launch in 2013, the company has graduated more than 8,000 students, with a job placement rate of 89%, according to data collected as of July 2020. Companies who have employed Ironhack graudates include Capgemini, Siemens, and Santander, the company said.

In the eight years since Aceable’s launch, the company has grown from a driver’s ed test prep service to an online training tool for drivers and real estate agents.

Only four years ago, Aceable was raising $4 million in financing, from investors including Floodgate Capital and Silverton Partners.

Now, with another $50 million in the bank and over $100 million in total capital raised, Aceable is looking to grow the number of certifications it offers — with a special focus on professional development.

The company said that it would look to grow both organically and inorganically (which is an inelegant way of saying that it’s likely to go shopping for potential acquisitions).

Re-skilling and up-skilling are set to become buzzwords again as Americans who were laid off because of the inadequate support small businesses received from Congress in the wake of the COVID-19 outbreak begin looking for new work.

EdTech has seen a huge boost during the pandemic, with millions of Americans turning to online classes to learn new skills or trades or hone existing skillsets.

“Changing or growing your career can create new opportunities to reach your life goals. Our vision is to make it accessible to anyone to gain a skill and a certification capable of setting you on the path of a well-paid career that you love,” said Blake Garrett, Aceable’s founder and chief executive. “We see HGGC as a strategic, long-term financial partner that embraces and accelerates our vision to create unparalleled education experiences that make it accessible for people to change their lives.”

Other startups have also landed tens of millions of dollars to capture this newfound interest in reskilling or upskilling. In June, Degreed raised $32 million for its own spin on the edtech market. But there’s still some question over who benefits from these new platforms.

It’s possible that Aceable could exist along a continuum with some of these other platforms, or serve communities that aren’t addressed by the current options on the market.

As the company notes, one in four working professionals takes license and certification training a year — and these classes are often the gatekeeper to greater financial success.

“We are big believers in Aceable’s mission and their long track record of success in developing mobile-first education technology,” said John Block, Partner at HGGC. “Our investment reinforces our confidence in the team and will allow Aceable to grow to the next level while helping people achieve the life they want through continuing education.”

Aceable now counts more than 2,200 hours of educational content on its platform, which have been used to train 13 million students across 36 states. The company was first spun up from the Capital Factory accelerator program and has raised its cash from investors including Sageview Capital, Silverton Partners, Floodgate Fund, Next Coast Venture Partners, Wildcat VC, Nextgen Partners and now HGGC.

The coronavirus has erased a large chunk of college’s value proposition: the on-campus experience.

Campuses are closed, sports have been paused and, understandably, students don’t want to pay the same tuition for a fraction of the services. As a result, enrollment is down across the country and university business models are under unrelenting pressure.

The entire athletics program at East Carolina University has been furloughed with pay cuts. Ohio Wesleyan University eliminated 18 majors and consolidated a number of programs to save $4 million a year. And Pennsylvania’s Kutztown University lost 1,000 students to online school within weeks of reopening its campus, sacrificing $3.5 million in room and board fees.

And that’s just in the last few weeks.

As universities struggle, edtech is being positioned as a solution for their largest problem: remote teaching. Coursera, a massive open online course (MOOC), created a campus product to help schools quickly offer digital coursework. Podium Education raised millions last month to offer universities for-credit tech programs. Eruditus brought on more than $100 million in the last few months to create programming for elite universities. In some ways, the growth is the story of edtech’s ongoing surge amid the coronavirus pandemic: Remote schooling has forced institutions to piece together third-party solutions to keep operations afloat.

However, while some startups are helping universities offer virtual programming overnight, professors on the ground are warning their institutions to think long-term about what kind of technologies are net positive to adopt.

It’s a stress test that could lead to a reckoning among edtech startups.

As the last eight months have taught us, Zoom-based school is a lackluster alternative to the in-person experience. College campuses, thus, are tasked with finding a more creative way to offer engaging virtual content to students who are stuck in their dorm rooms.

Coursera launched Coursera for Campus to help colleges bring on online courses (credit optional) with built-in exams; more than 3,700 schools across the world are using the software.

“Professors would really want super-high-quality branded content that has assessments built into it if they’re going to deliver that learning for credit,” CEO Jeff Maggioncalda said. “That’s not the kind of learning you can get on YouTube.”

For now, though, Maggioncalda says he doesn’t think the death of a physical college campus experience is the future. He’s betting that the product can help colleges save money on faculty costs and reinvest that same money into the campus.

“There will be schools that will continue to offer residential experience, and I think what they’re gonna find is, if your real value proposition is that residential experience, then lead into that heavily,” he said. “But make sure that you’ve got really good content and credentials that are available so that your students don’t have to sacrifice.”

Georgia Tech professor David Joyner says that MOOCs like Coursera “are good for outreach and access, but are not good for accreditation.” Instead, he thinks edtech needs to be built first and foremost for universities to be most effective.

Podium Education, for example, builds courses in partnership with universities to offer for-credit courses. The newly launched startup raised $12 million in October and works with more than 20 colleges. Eruditus, an edtech startup that raised over $100 million in September, creates courses in collaboration with more than 30 elite universities, including MIT, Harvard, UC Berkeley, IIT and more.

Coursera, Podium and Eruditus are all signaling a future where universities could be getting a plug-and-play model of asynchronously taught curriculum.

Now that COVID-19 has accelerated the adoption of digital education tools, edtech has become one of the hottest areas of investment.

As someone who has been in edtech for nearly 20 years, this sounds like the precise moment to capitalize on all the newfound interest. Which is why what I’m about to say might be surprising: I’m leaving edtech for the world of gaming with my new company, Solitaired.

I first got into edtech in high school, when a friend and I founded EasyBib, a website that helped students cite sources for their papers. At the time, we were just students who felt there had to be a better way than formatting tedious citations for research papers by hand. But as we dove into the business further, we realized there was a lot to like about bibliographies and education technology in general.

For one, the education market is large. There are more than 56 million K-16 students in the U.S., and over 1.3 billion globally. Federal, state and local governments spend an aggregate of 5% of GDP on education, and that doesn’t even include what students and parents spend on content and technology.

Secondly, it’s structured. Students generally all go through the same curriculum together. That means most students have the same problem in the same way; if you solve a problem for one group of users, you’ve probably solved it for most users.

The citation problem was just like that. When we sold our company to Chegg, we were already reaching four out of five students that needed bibliographies, or over 30 million students in the U.S. Edtech companies that help students with math, chemistry, homework help, tutoring and other curricular needs can build massive audiences quickly.

Edtech that’s part of the curriculum also has high engagement. EasyBib users stayed on our site for nearly ten minutes per session, creating one citation after another for their bibliographies. For direct-to-consumer edtech companies that are ad and subscription driven, this behavior creates many monetization opportunities.

While we grew fast, our endemic market opportunity was limited. Why? The strengths of edtech can also be its downsides, especially for a startup. On the user growth front, we focused on school relationships, marketing and SEO. But once we reached four out of every five students in the U.S., there wasn’t much more room to grow.

To increase engagement even further, we tried a number of things: encouraging more citation creation, adding research and note-taking features and building a Chrome extension to be more ever-present in the user’s research journey. Those efforts fell short too. Ultimately, the school calendar dictated how often students needed to use us, and we were constrained by the number of research papers teachers assigned.

These challenges can certainly be overcome. But as a startup, we had to decide if we wanted to pursue adjacencies and expansions ourselves. Ultimately, this realization was one of the reasons we decided to sell our company to Chegg, which had a wider user base and product synergies that we couldn’t achieve on our own. As anyone who follows Chegg might know, they’ve been very successful in accelerating the edtech digital transformation.

When we began thinking about our second business, we had these lessons in the back of our mind. That’s when we discovered gaming.