Pitch Deck Teardown: Lupiya’s $8.3M Series A deck

FedNow’s legal terms contain a game changer for digital wallets and payment apps

8 Latin American VCs share why they’re brimming with optimism about the region’s startups

Rainbow or storm?

FedNow will expose fintech’s gaps: Compliance-by-design can help banks avoid risk

All that fintech investment had a real impact on banking penetration in Latin America

6 fintech investors sound off on AI, down rounds and what’s ahead

At the height of the funding boom in 2021, no single sector enjoyed as much VC money as fintech startups did. But in 2023, it appears that fintech companies have to work harder to get funding.

Global funding in the space hit a six-year low in the second quarter, according to CB Insights. Specifically, following a spike in funding in the first quarter driven by Stripe’s outlier $6.5 billion round, global fintech funding declined 48% to $7.8 billion in Q2 2023.

Valuations have also taken a hit. With only a few exceptions, once-valuable fintech firms have seen their valuations drop significantly, based on secondary share activity as analyzed by Notice.co, which offers a pricing tool for the private markets.

We’re widening our lens, looking for more investors to participate in TechCrunch+ surveys, where we poll top professionals about challenges in their industry.

If you’re an investor and would like to participate in future surveys, fill out this form.

As such, it’s no surprise that artificial intelligence (AI) is a hot topic of conversation in the space, as companies work to incorporate it into their offerings — some more meaningfully than others — in an attempt to stand out.

“We’ve seen many of our portfolio companies adopt AI to increase efficiency, improve automation, and enable faster communication with their customers,” said Lizzie Guynn, a partner at TTV Capital.

But Hans Tung, a managing partner at GGV, warned that just because AI is the hot sector of the moment, investors should not invest in it blindly. “AI is . . . overhyped. AI is central to the core business in some companies, and in others it is simply a supporting character,” he said. “We value domain knowledge and information on how to best apply technical solutions to solve customer pain points, be it consumers or enterprises.”

Overall, navigating the venture landscape as a fintech startup in today’s market requires resilience, perseverance and a more responsible frame of thinking around growth. It’s clear that investors are taking more time to evaluate deals than they were during the funding boom.

Aditi Maliwal, a partner at Upfront Ventures, explained how investors in the space are thinking: “We’re able to take a little bit more time to get to an investment decision, as processes aren’t happening in 24 hours like they did at some point in 2020!”

To help TechCrunch+ readers understand what fintech investors are thinking these days, as well as what you should know before approaching them, we interviewed six active investors over the last couple of weeks. Plus, they were gracious enough to share some of the advice they’re giving to their portfolio companies.

We spoke with:

- Mark Goldberg, partner, Index Ventures

- Aditi Maliwal, partner, Upfront Ventures

- Hans Tung, managing partner, GGV Capital

- Lizzie Guynn, partner, TTV Capital

- Ed Yip, partner, Norwest Venture Partners

- Lauren Kolodny, co-founder and partner, Acrew Capital

Mark Goldberg, partner, Index Ventures

Everyone is talking about artificial intelligence. If a company isn’t already using it, they’re looking for ways to incorporate it into their operations. What is getting the thumbs-up and what’s not in the theme of the moment?

What’s been surprising to me about AI in fintech is how much of it seems to be under the hood (automating rote internal tasks) rather than facing externally (flashy new features). This means that many of the most AI-forward companies may not be the most obvious ones.

Over the years, we have seen many startups, especially neobanks, focusing on very niche segments of the population. What are your thoughts on such specific offerings? Is it a good strategy to be so specific and what do you need to do to be successful if so?

The biggest evolution in consumer finance in the last decade has been for people to see their banks as extensions of their own personal brand, like their clothes, car or music. So, it’s a great strategy and we’ll be surprised by the depth and loyalty of these “niche” communities.

Do you expect to see more down rounds in 2023? Are you seeing more companies raising extensions or down rounds compared to 2021 and 2022?

More down rounds are coming. Supply and demand are still out of equilibrium, and I expect that will change as company balance sheets dwindle.

What are you most excited about in the fintech space? What do you feel might be overhyped? Is anything hyped at this point in the cycle?!

I think the fintech tourists are gone, and it takes real conviction in this market to build and invest. Banking today is harder than it should be, especially for the tens of millions of people who don’t have access to traditional financial services.

How do you prefer to receive pitches? What’s the most important thing a founder should know before they get on a call with you?

There’s often one chart or slide that defines a pitch. Cut the noise (and the 30-slide deck) and focus on the one thing that matters most to your story.

Aditi Maliwal, partner, Upfront Ventures

Everyone is talking about artificial intelligence. If a company isn’t already using it, they’re looking for ways to incorporate it into their operations. What are your thoughts on this? What is getting the thumbs-up and what’s not in the theme of the moment?

Every company will adopt AI as another technology that enhances their existing offering. I don’t think of investing in AI companies as any different from people saying in the mid-2000s that they were investing in the internet or investing in mobile. AI is now a new paradigm that everyone is going to adopt. We know that most companies have already been using data to make decisions, so now they are going to be using open source models to help make faster and more efficient decisions.

That said, a couple of categories are getting a lot of attention in and around the fintech ecosystem:

- Copilot solutions for everyone in financial services: While I’m not sure a lot of them are getting funded, I still think the biggest companies will come after this category and provide solutions.

- Creating synthetic users for fraud detection: This is a really big use case that can provide a lot of value. We basically have generative fraud at this point, so you need the right type of generative software to combat the constantly changing fraudulent activities/players.

Over the years, we have seen many startups, especially neobanks, focusing on very niche segments of the population. What are your thoughts on such specific offerings? Is it a good strategy to be so specific and what do you need to do to be successful if so?

Fintech is a mess. Is BaaS the outlier?

It’s been a rollercoaster ride for the banking-as-a-service sector over the last year, with a host of mergers and acquisitions and layoffs. On the other hand, large companies are eagerly adopting the concept for competitive advantages and to drive value for customers.

BaaS can be refer to three different parts of the industry: one is the classic one of offering bank-like services to other players in the industry, a second is providing the charter and bank services, however not doing the underwriting, and a third is banking components, which is more of a fintech, that isn’t a bank, providing bank-like services without a charter.

“I believe [banking-as-a-service] is a potentially phenomenal growth space for banks to go after,” Accenture’s global banking lead, Michael Abbott, told TechCrunch+. “There’s already tried-and-true models out there, like private label and co-branding. You’re providing that banking capability, consumer lending and credit card portfolios to consumers, small businesses and increasingly at the corporate level.”

And it is a big market. Banking-as-a-service is expected to grow 15% each year to be valued at nearly $66 billion by 2030. Companies continue to attract venture capital, too. This year, Treasury Prime secured $40 million in Series C funding and Synctera raised $15 million to launch embedded products in Canada. Meanwhile, Omnio raised $9.8 million and UK-based bank Griffin raised $13.5 million in June.

But it hasn’t all been rosy. Synapse and Figure Technologies were among the first to hold layoffs; Synapse laid off 18% of its employees in June, and Figure Technologies, which includes Figure Pay, laid off 90 people — or about 20% of its workforce — in July.

Banking-as-a-service involves a lot of facets and can be quite confusing, so to make sense of what’s going on, we sat down with people representing BaaS companies, fintech experts and investors to chat about the sector and where it goes from here.

The struggles

While BaaS companies were the recipient of aggressive venture capital infusions in 2020 and 2021, in the last six to 12 months, there was “a recognition or a rationalization of those investments,” Synctera CEO Peter Hazlehurst told TechCrunch+.

Around two dozen companies in this sector were funded during those two years, and perhaps a half dozen are still operating today. So how did that happen? According to Hazlehurst, the answer is pretty simple. “They used venture dollars to make irresistible deals to customers to get usage,” he said. “Twelve months ago, we were losing deals because we wouldn’t sign someone up for free. The challenge was the actual market price of that transaction was underwater.”

Unveiling the winning formula: How B2C fintechs conquer customer acquisition

In the fast-paced world of B2C (business-to-consumer) startups, mastering marketing spend is the key to achieving sustainable growth and securing a leading position in the market. While there’s often a formula to follow, it’s not uncommon to see CEOs and startup founders grappling with these crucial decisions for the first time.

To shed light on this critical matter, we surveyed select portfolio companies to understand their current marketing expenditure patterns. Additionally, we meticulously analyzed the journey of our longest-standing companies, observing their growth from the initial seed stage to IPO readiness.

In this article, I’ll dive deep into the best practices and successful strategies that have proven to elevate B2C fintech companies to the forefront of their game. Expect evidence-based recommendations that will pave the way for your company’s success in the highly competitive business-to-consumer landscape.

#1: Prioritize focus on one to two dominant channels

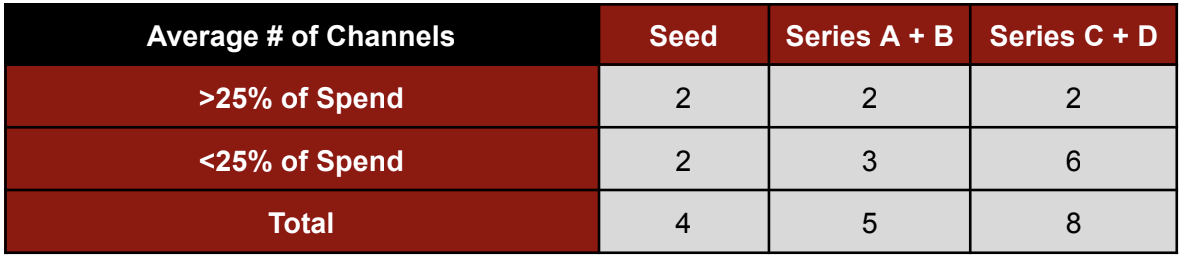

Image Credits: Ian Sherman

Amid the barrage of marketing channels available, the mantra for B2C fintechs is “less is more,” and our evidence-based research supports this approach. Our in-depth analysis of companies from seed to Series D stages revealed that allocating marketing spend to just one to two dominant channels can be a game-changer.

Amid the barrage of marketing channels available, the mantra for B2C fintechs is ‘less is more,’ and our evidence-based research supports this approach.

This was agnostic of company size as well. While our later-stage portfolio companies tended to diversify their marketing efforts and invested in a larger number of channels as opposed to their earlier stage counterparts, our companies consistently maintained a strategic focus on just two core marketing channels that made up greater than 25% of their annual spend.

Our findings clearly demonstrate that despite expanding their marketing channels as they grow, successful B2C fintechs consistently prioritize their investments in the most impactful and effective channels.

This approach allows them to build upon their proven strategies while exploring new avenues for growth. By honing in on these core channels, B2C fintechs can ensure they’re acquiring customers efficiently and with purpose.

#2 While there’s no right way to grow, consider Google Search, Partnerships and Meta as core channels

Image Credits: Ian Sherman

While there’s no one-size-fits-all approach to growth, our research has uncovered key insights that strongly suggest considering Google Search, Partnerships, and Meta platforms as core channels in your marketing strategy: