Brett Calhoun

Contributor

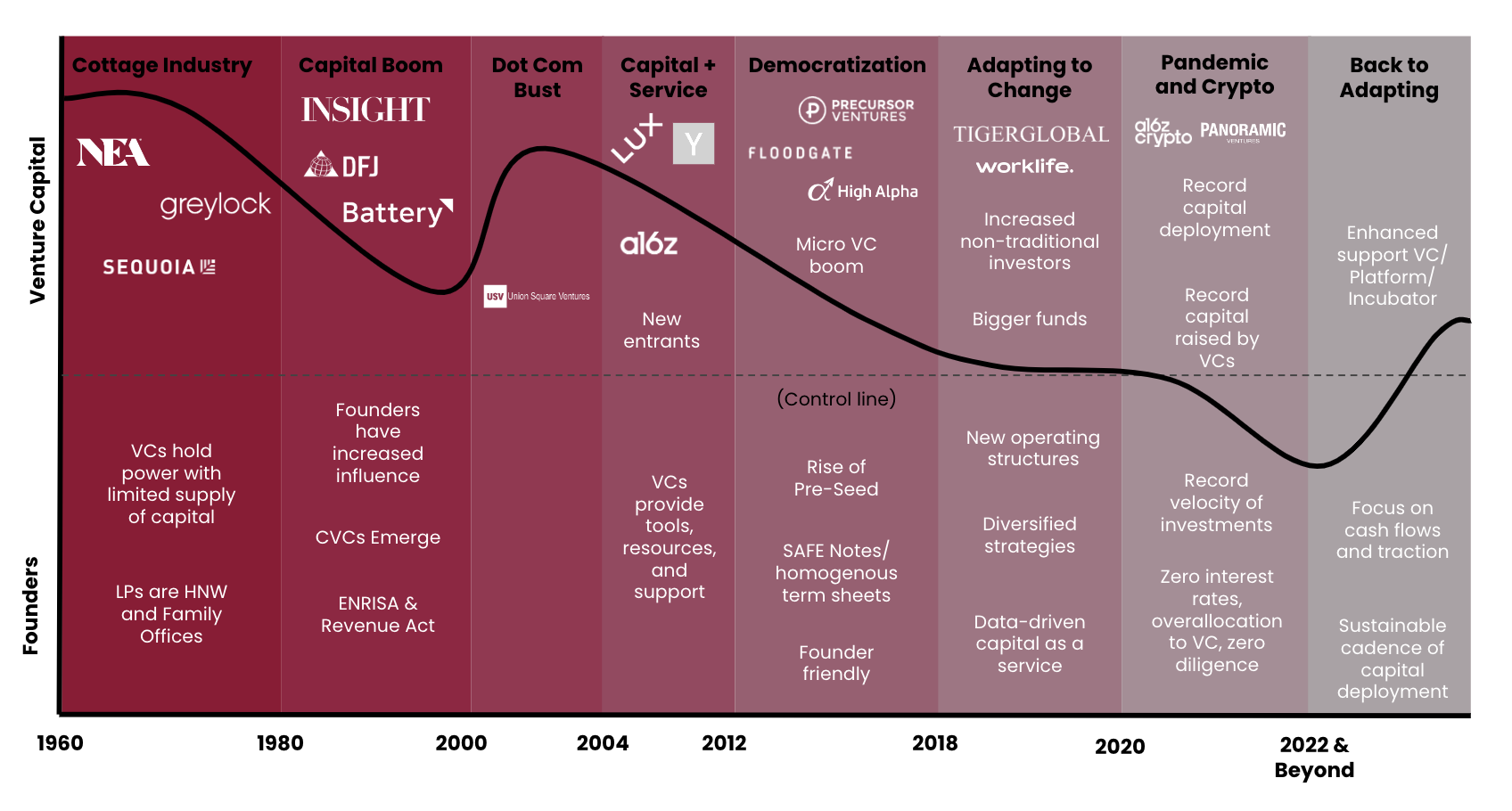

Unparalleled contrasts have marked the last decade and a half — from the devastating plunge of a major housing crash to the soaring heights of the longest bull market and the unforeseen havoc of a global pandemic. Amid these turbulent times, the VC accelerator industry has emerged as a stalwart player.

Fueled by a zero-interest landscape in 2020, it has surged, giving rise to an ever-growing array of funds. That said, a paradigm shift of the broader venture landscape could be on the horizon.

Starting a tech company today costs 99% less than it did 18 years ago when Y Combinator was started (today and 2005), largely due to the emergence of cloud technologies, no-code tools, and artificial intelligence. There is an unprecedented amount of information or knowledge that is now freely available to guide founders (e.g., the free YC Startup School courses).

Network effects have evolved, moving away from the traditional physical spaces to digital ones. Digital communities and social platforms such as Twitter, Signal NFX, YC’s co-founder matching, and Slack communities (e.g., Flyover Tech) have played a significant role in this shift.

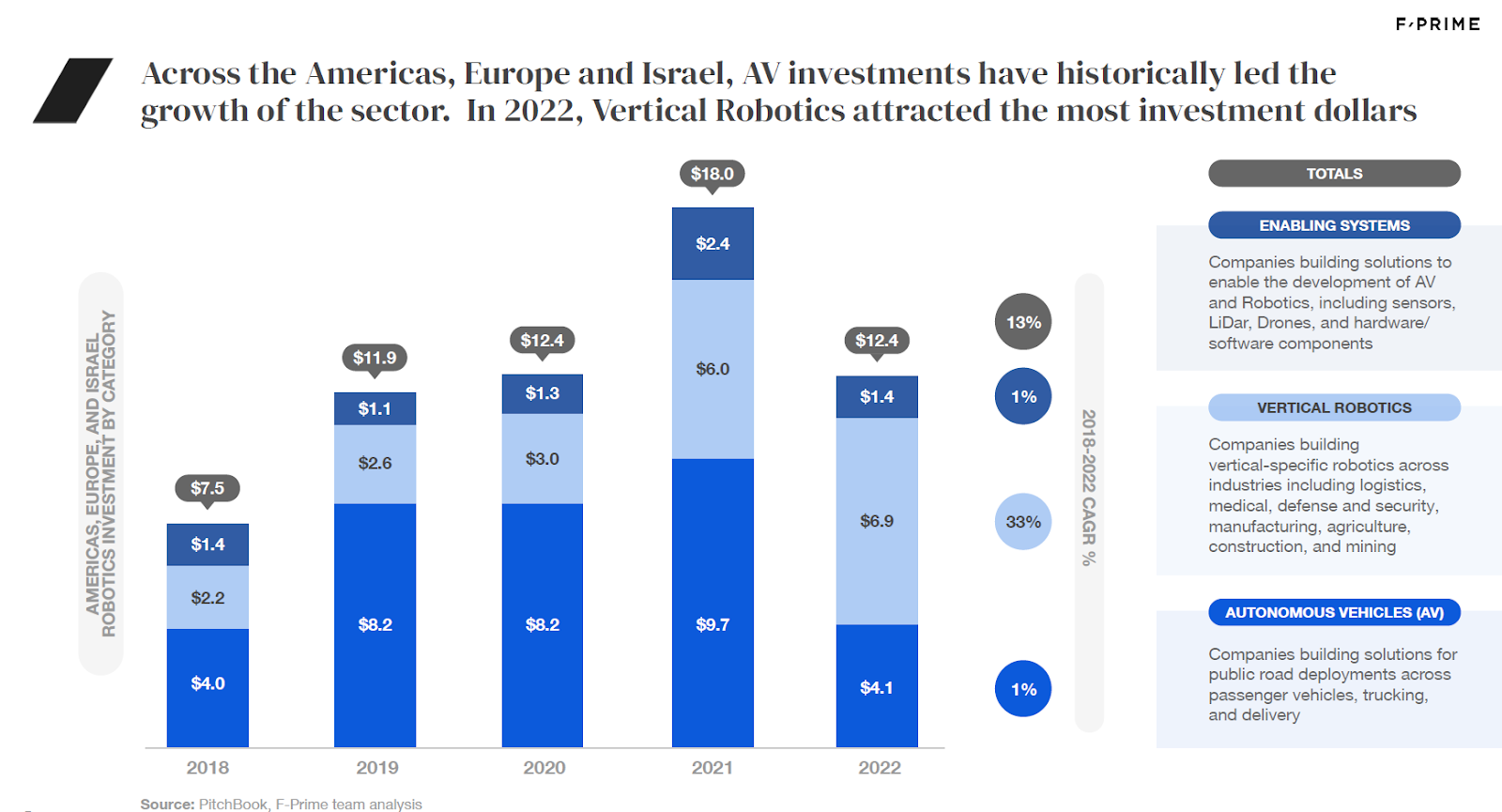

At the start of 2022, there were $1 trillion in assets under management (AUM) and $230 billion in VC dry powder, figures that dwarf the prefinancial crisis AUM by a factor of five. Concurrently, the number of funds raised in the eight-year period up to 2022 was 2,700, up from 883 in 2010. Crowdfunding witnessed a 2.4x growth from 2020 to 2021.

Angel investments in 2022 equaled those from 2006 to 2011 combined. Family office investments increased by 5x, and corporate venture investments rose 6x, thus opening new capital avenues for founders who found it difficult to raise capital.

The competitive landscape also underwent significant changes. At the dawn of 2022, there were 2,900 active VC firms, marking a 225% increase since 2008. This influx of funds has propelled platform VCs to step up their game, nurturing their portfolios and winning deals more aggressively.

Finally, the talent pool for tech startups has broadened immensely. Factors such as remote work, offshore development, and the steadily growing labor pool of software engineers have enabled startups to hire additional engineering talent, adding yet another catalyst to this vibrant ecosystem.

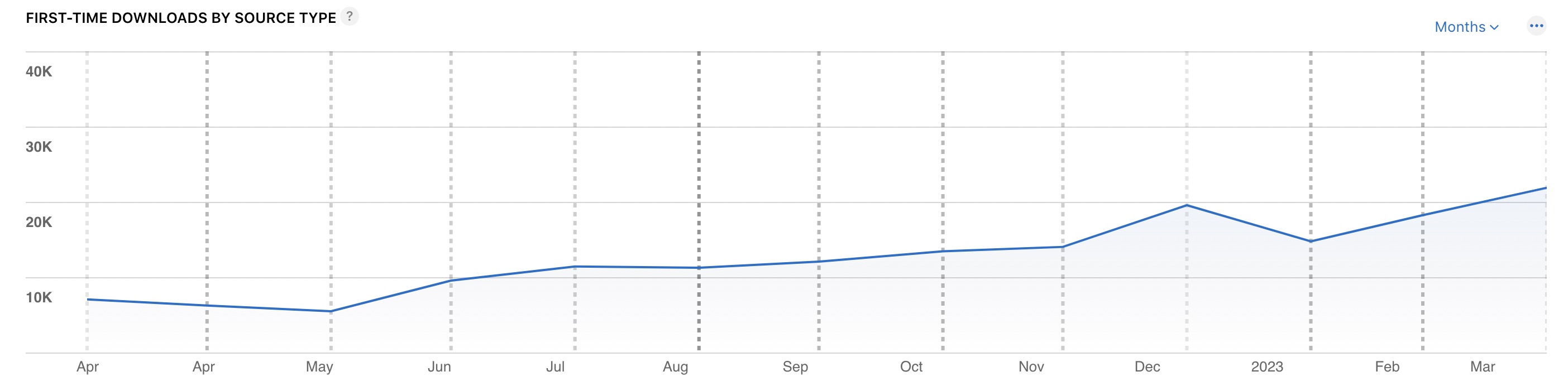

Importantly, the traditional accelerator model has enjoyed the fruits of these potential paradigm shifts. The number of accelerators has more than doubled since 2014, while the number of accelerator-backed startups in the U.S. has nearly quadrupled in the same time period (investments from 2005 to 2015 and total investments through 2021). However, as we look into the future, founders must confront a key question: Are there too many accelerators now, and is joining an accelerator even needed anymore?

Accelerators are facing competition on all sides

The idea that accelerator funds have little value grew in popularity during the pandemic, as capital was so abundant that first-time founders began bypassing accelerators altogether. Moreover, rumors of deeply unethical behavior at accelerators are starting to surface frequently. The most notable example was allegations of fraud at Newchip, a popular virtual startup accelerator.

The liquidation of Newchip sent ripples through the startup ecosystem as perceptions of grifting at accelerators gained momentum online. Another instance of negative press involved the On Deck accelerator, which laid off 25% of its staff in 2022. The layoff came from a deal that went sour with Tiger Global, forcing On Deck to use its Series B funds to keep the lights on in the accelerator.

Founders must confront a key question: Are there too many accelerators now, and is joining an accelerator even needed anymore?

The fall of players like Newchip and On Deck are not isolated incidents. They testify to the growing realization that accelerators increasingly compete for capital and opportunity with other established, institutional VC firms. For example, when YC was founded in 2005, a “pre-seed” round did not exist, and it cost $500,000 to start a tech company. Now pre-seed rounds have surged in popularity to being the most popular round for getting your business from MVP to $1 million+ ARR. In 2022, there was 10x the amount of capital in the market than a decade ago, with hundreds of pre-seed VC funds in existence with hyper-targeted theses (e.g., psychedelics or construction).

The influx of pre-seed venture dollars in circulation has increased competition with accelerators and influenced more funds to pursue a “platform VC” model, with some even having a venture studio (e.g., building companies in-house) or incubator (e.g., long-term support at the earliest stages). In some cases, funds themselves launch “accelerators,” which in most cases are the platform support and capital extended to earlier startups, so the VC invests earlier.

Importantly, a VC firm pursuing pre-seed funding escapes the traditional stigmatized accelerator branding due to more favorable terms. Furthermore, many VCs have also built communities around their accelerator model in ways traditional accelerators fail to. Thematic platform VCs have world-class advisors for specific sectors and create cross-pollination within their portfolios. Some pre-seed VCs are focused on backing community-driven startups that have access to communities, hacking distribution and discovery.

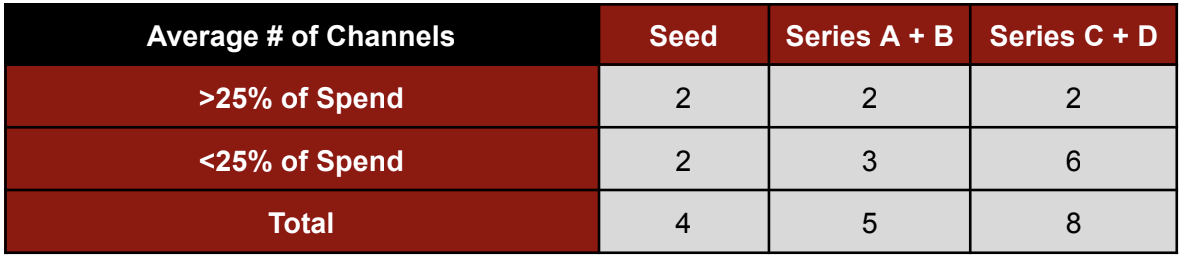

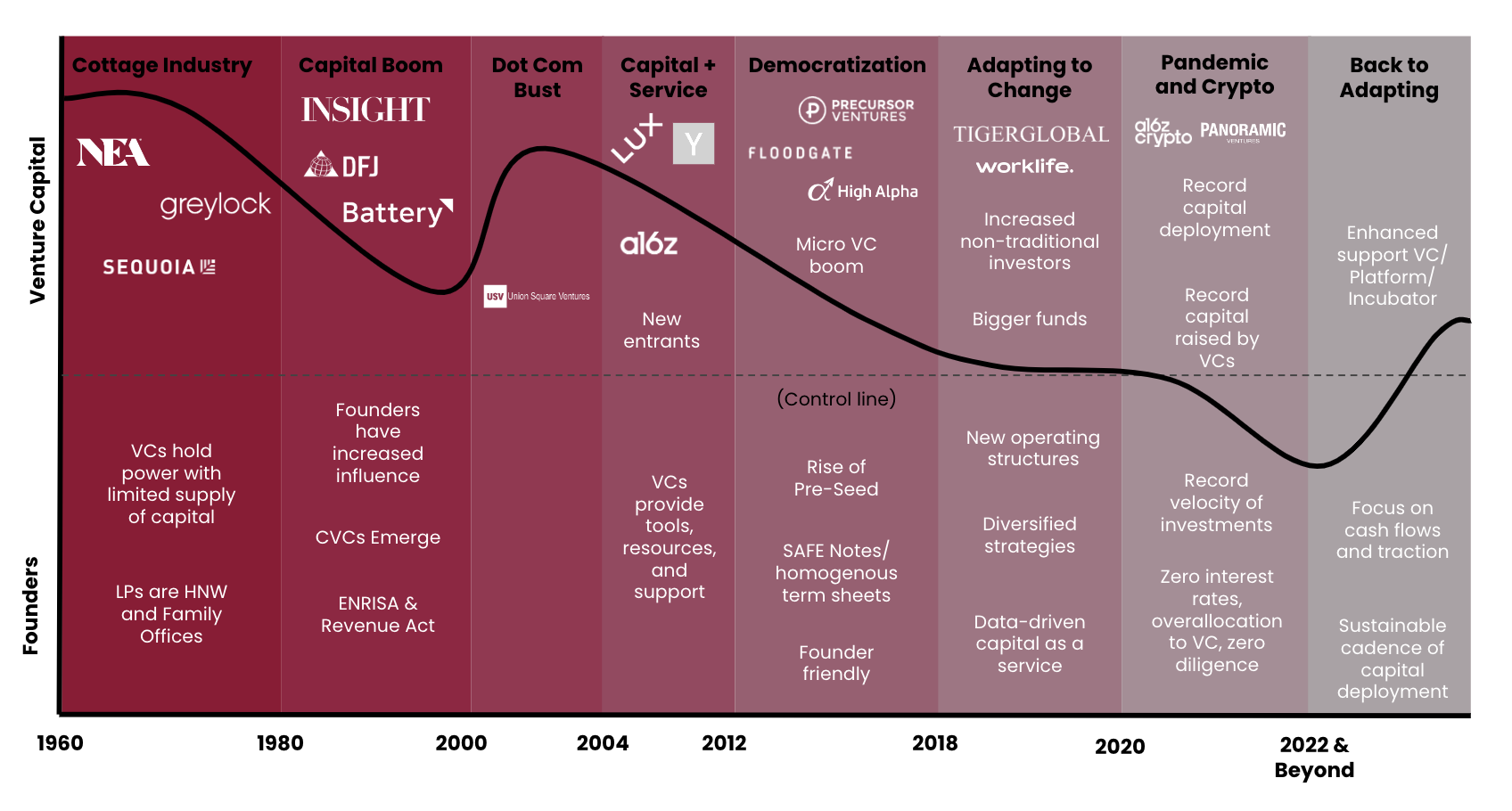

That said, it’s not just micro VCs or emerging managers who are launching platforms; brand names are, too. For example, Sequoia Capital’s Arc or a16z’s Crypto Startup School attracts quality with favorable terms, capital, and a strong brand. The chart below shows how VCs have adapted through market cycles:

Image Credits: Brett Calhoun

Platform VCs vary in both definition and focus depending on the logistics of the firm. For example, at Redbud VC, our team manages a VC fund plus some aspects of a studio, including support from world-class operators who have founded billion-dollar companies. In general, VCs have continued to invest earlier, with many now backing idea-stage or pre-product founders. Some firms like K9 Ventures won’t even back founders who have taken prior institutional capital. Due to the increased competition from the platform role and the hunt for untapped early-stage founders, every VC will soon have a platform or studio component.

Are accelerators giving founders what they need and want?

All this said, what is different about an accelerator versus a platform VC, strategic angel, or an early-stage VC in general? If we drill into what an accelerator does for founders, generally speaking, it can be bucketed into:

- Knowledge sharing.

- Networks.

- Resources.

- Peer groups.

- Capital.

- Events.

The value of the above is directly correlated to the level of entrepreneurial experience the founder possesses. That said, the value accelerators provide comes at a cost: time and equity. The large equity stakes and extensive work can be a repellant to quality founders. If the value is delivered, the equity can be argued, but the time cannot. Some accelerators are adding 20+ hours of programming per week and networking events that may be lackluster.

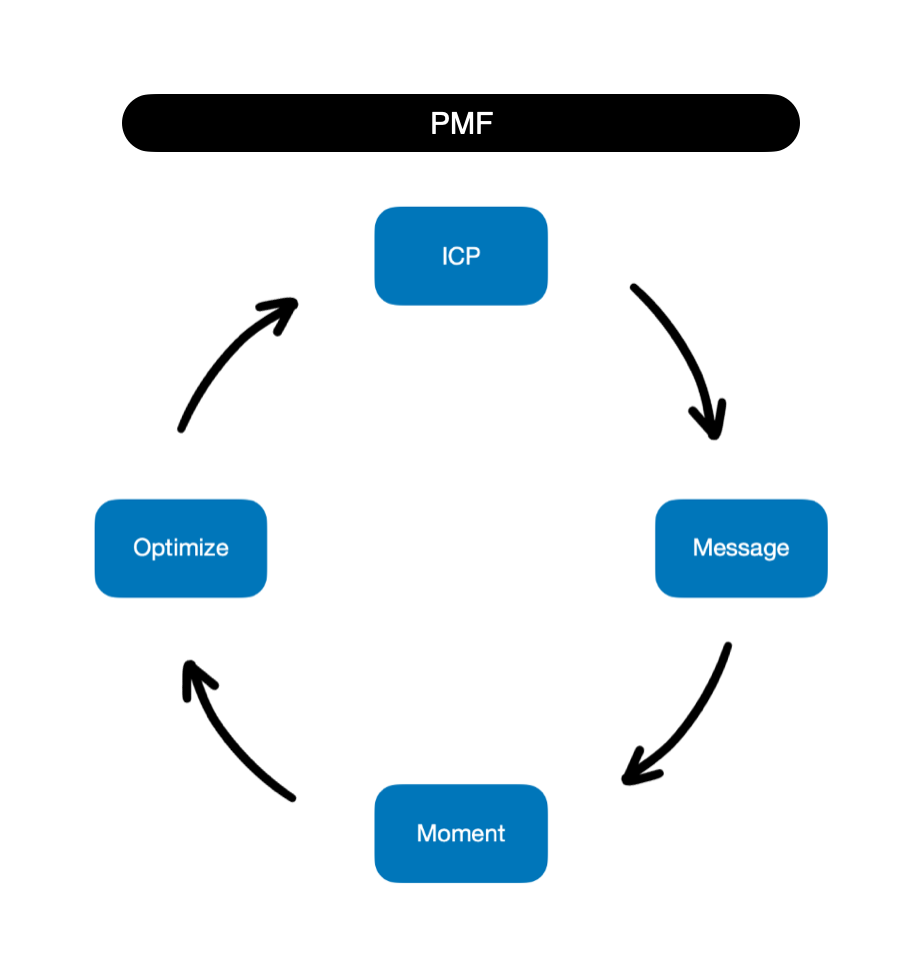

In Redbud VC’s conversations with 2,000+ founders, our team found that what is truly relevant to founders is network effects and knowledge sharing. Founders are time-strapped, so filtered feedback from successful founders can expedite years of learning, and warm intros can save months.