DHL has expanded its DHL Africa eShop business to 13 additional markets, upping the presence of the global shipping company’s e-commerce platform to 34 African countries.

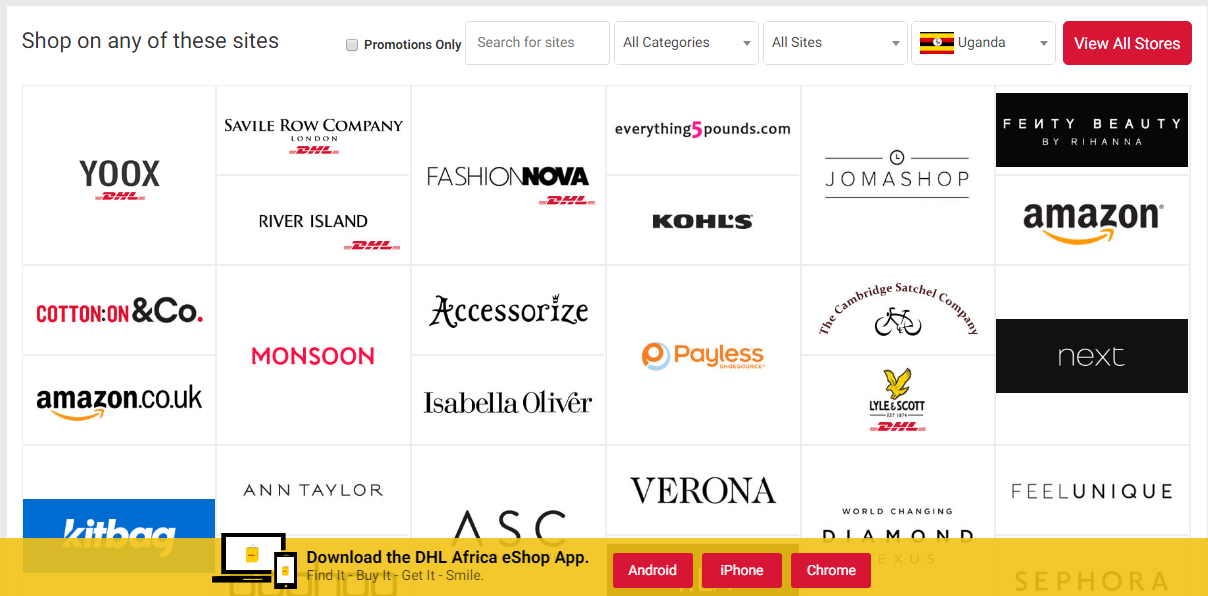

DHL href="https://techcrunch.com/2019/04/11/dhl-launches-africa-eshop-app-for-global-retailers-to-sell-into-africa/">went live with the digital retail app in April, bringing more than 200 U.S. and U.K. sellers — from Neiman Marcus to Carters — online to African consumers.

Africa eShop operates using startup MallforAfrica.com’s white label fulfillment service, Link Commerce. Similar to MallforAfrica’s model, the arrangement allows Africa eShop users to purchase goods directly from the websites of any of the app’s global partners.

This week’s expansion is the second for DHL’s Africa eShop, after adding 9 markets in May.

DHL’s moves run parallel to significant developments this year in the Africa’s online retail scene—namely Jumia’s big capital raise through its IPO.

Here are Africa eShop’s latest additions: Angola, Benin, Burkina Faso, Burundi, Chad, Ethiopia, Guinea, Lesotho, Namibia, Niger, Sudan, Togo, and Zimbabwe.

MallforAfrica CEO Chris Folayan points to the novelty of online sales in many of Africa eShop’s new markets.

“For some of these countries no one has really tapped into e-commerce the way we’re tapping into it, with an ability to buy online and also buy online directly from places like Macy’s or Amazon,” he told TechCrunch on a call.

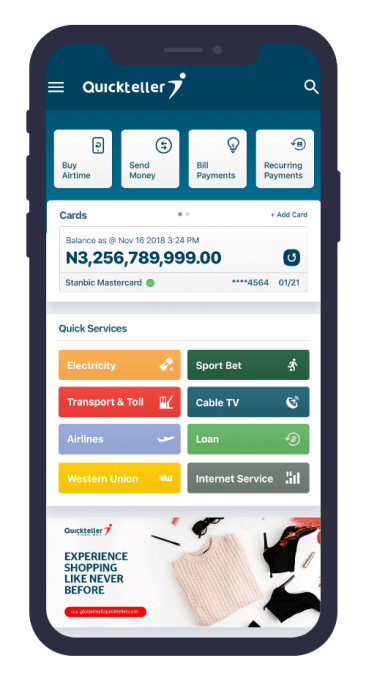

Payment methods include local fintech options, such as Nigeria’s Paga and Kenya’s M-Pesa. DHL Africa eShop leverages the shipping giant’s existing delivery structure on the continent, through its DHL Express courier service.

To add some context, someone with a mobile phone and bank account in, say, Niger can now use DHL’s app to shop at Macys.com and have anything from designer sneakers to kitchenware shipped to their doorstep in Central-Africa.

DHL Africa eShop is also offering incentives to entice first-time digital consumers.

“We will be launching with a promo, buy any 5 items from over 100 retail partners and get a $20 flat shipping fee. This is DHL’s way of showing they are dominant in shipping and eCommerce in Africa.”

As TechCrunch highlighted this spring, the launch and expansion of DHL’s MallforAfrica supported platform is creating a competitive scenario with e-commerce unicorn Jumia.

Jumia is Africa’s most visible e-tailer and operates consumer retail and online service verticals in 14 African countries. Headquartered in Lagos, the company raised more than $200 million in an NYSE IPO this April.

DHL launched the Africa eShop product the day before Jumia went public and made its first country expansion only weeks after.

There’s a brewing business debate on which platform is best positioned to capture a larger share of a projected $2.1 trillion in consumer spending (10% online) expected in Africa by 2025.

Then there’s the question of who’s largest. DHL Africa eShop touts itself as “Africa’s Largest Online Shopping Platform.” Jumia said, “We believe that our platform is the largest e-commerce marketplace in Africa,” in its SEC F-1 filing.

On the prospect of going head to head with Africa’s best funded e-commerce company, Chris Folayan is somewhat circumspect.

“We’re note focused on competing with Jumia, but in a way it’s starting to happen as a result of our expansion and growth,” he said.

Two main spectators in a MallforAfrica, Jumia match up could be the big global e-commerce names.

Alibaba has talked about Africa expansion, but for the moment has not entered in full.

Amazon offers limited e-commerce sales on the continent, but more notably, has started with AWS services in Africa.

DHL and partner MallforAfrica plan to bring Africa eShop to all 54 African countries in coming years.

Another facet to a possible Interswitch IPO is its potential to spark more corporate venture arm and acquisition activity in African fintech, which as a sector receives the bulk of the continent’s startup capital. Interswitch launched a venture arm in 2015

Another facet to a possible Interswitch IPO is its potential to spark more corporate venture arm and acquisition activity in African fintech, which as a sector receives the bulk of the continent’s startup capital. Interswitch launched a venture arm in 2015