Eric Tan is Senior Vice President of IT and Business Services

Coupa, a leader in business spend management and a former Battery portfolio company.

Scott Goering

Contributor

Ever since the pandemic hit the U.S. in full force last March, the B2B tech community keeps asking the same questions: Are businesses spending more on technology? What’s the money getting spent on? Is the sales cycle faster? What trends will likely carry into 2021?

Recently we decided to join forces to answer these questions. We analyzed data from the just-released Q4 2020 Outlook of the Coupa Business Spend Index (BSI), a leading indicator of economic growth, in light of hundreds of conversations we have had with business-tech buyers this year.

A former Battery Ventures portfolio company, Coupa* is a business spend-management company that has cumulatively processed more than $2 trillion in business spending. This perspective gives Coupa unique, real-time insights into tech spending trends across multiple industries.

Tech spending is continuing despite the economic recession — which helps explain why many startups are raising large rounds and even tapping public markets for capital.

Broadly speaking, tech spending is continuing despite the economic recession — which helps explain why many tech startups are raising large financing rounds and even tapping the public markets for capital. Here are our three specific takeaways on current tech spending:

Spending is shifting away from remote collaboration to SaaS and cloud computing

Tech spending ranks among the hottest boardroom topics today. Decisions that used to be confined to the CIO’s organization are now operationally and strategically critical to the CEO. Multiple reasons drive this shift, but the pandemic has forced businesses to operate and engage with customers differently, almost overnight. Boards recognize that companies must change their business models and operations if they don’t want to become obsolete. The question on everyone’s mind is no longer “what are our technology investments?” but rather, “how fast can they happen?”

Spending on WFH/remote collaboration tools has largely run its course in the first wave of adaptation forced by the pandemic. Now we’re seeing a second wave of tech spending, in which enterprises adopt technology to make operations easier and simply keep their doors open.

SaaS solutions are replacing unsustainable manual processes. Consider Rhode Island’s decision to shift from in-person citizen surveying to using SurveyMonkey. Many companies are shifting their vendor payments to digital payments, ditching paper checks entirely. Utility provider PG&E is accelerating its digital transformation roadmap from five years to two years.

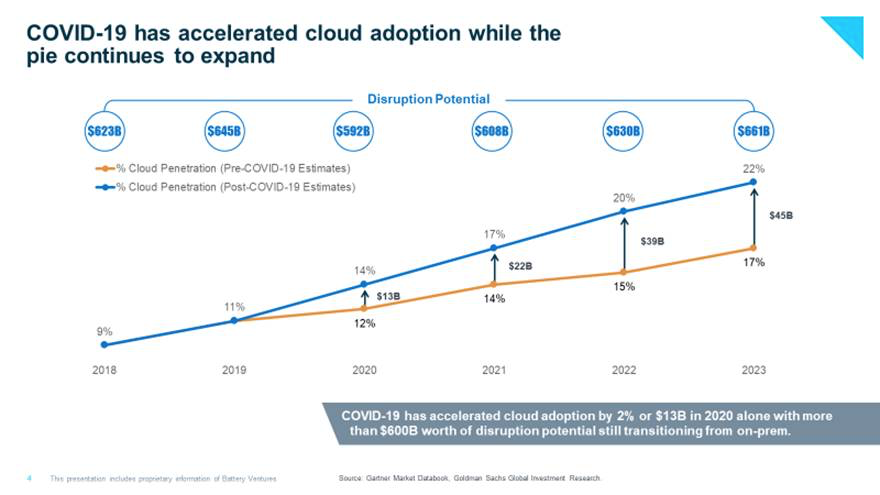

The second wave of adaptation has also pushed many companies to embrace the cloud, as this chart makes clear:

Similarly, the difficulty of maintaining a traditional data center during a pandemic has pushed many companies to finally shift to cloud infrastructure under COVID. As they migrate that workload to the cloud, the pie is still expanding. Goldman Sachs and Battery Ventures data suggest $600 billion worth of disruption potential will bleed into 2021 and beyond.

In addition to SaaS and cloud adoption, companies across sectors are spending on technologies to reduce their reliance on humans. For instance, Tyson Foods is investing in and accelerating the adoption of automated technology to process poultry, pork and beef.

All companies are digital product companies now

Mention “digital product company” in the past, and we’d all think of Netflix. But now every company has to reimagine itself as offering digital products in a meaningful way.