Demonstrating that there’s a robust market for contract management solutions, LinkSquares, a company developing intelligent software that helps brands maintain and ink new contracts, today announced that it raised $100 million in series C financing led by G Squared. The tranche, which had participation from new investor G2 Venture Partners as well as existing backers, brings the startup’s total funding to $161.4 million at an $800 million valuation.

“With this new investment, we will continue to grow our business with in-house legal teams, continue to grow our presence in international markets, like Canada, the U.K. and Australia, [and build a] multi-product suite that expands beyond contract lifecycle management into other use cases for in-house legal teams,” CEO Vishal Sunak told TechCrunch via email. “[We] think that … there’s an opportunity to build more products that the entire legal team can use in areas like intellectual property management, outside counsel, [and] governance risk compliance.”

Founded in 2015, LinkSquares was inspired by Sunak’s and Chris Combs’ work with contracts and due diligence over the course of a company acquisition. Combs was leading business development at Backupify when it was acquired by data backup company Datto, now owned by Vista Equity Partners, in 2015, while Sunak was serving as Datto’s operations director.

“During that time, it was all hands on deck as [Backupify] lined everything up to support the acquisition,” Sunak explained. “Datto hoped to migrate Backupify’s customer data to their cloud infrastructure. However, one obstacle to this business goal was to understand each individual signed customer contract, and determine if Datto had the right to move the data without permission. The idea to review each contract, read the provision related to data transfer, and store the answer seemed straightforward — at first. In reality, because Backupify had negotiated more than 2,000 contracts, the act of finding all the contracts and looking for the provision language was an impossible undertaking.”

As it turned out, Backupify wasn’t the only company struggling to surface insights from its contractual agreements. According to World Commerce & Contracting, nearly 40% of organizations don’t have a clear idea of who’s responsible for their contracts internally. Unaffiliated, earlier research from the Blickstein Group suggests that most organizations track only basic contract management metrics like volume by customer, partner, program type and geography.

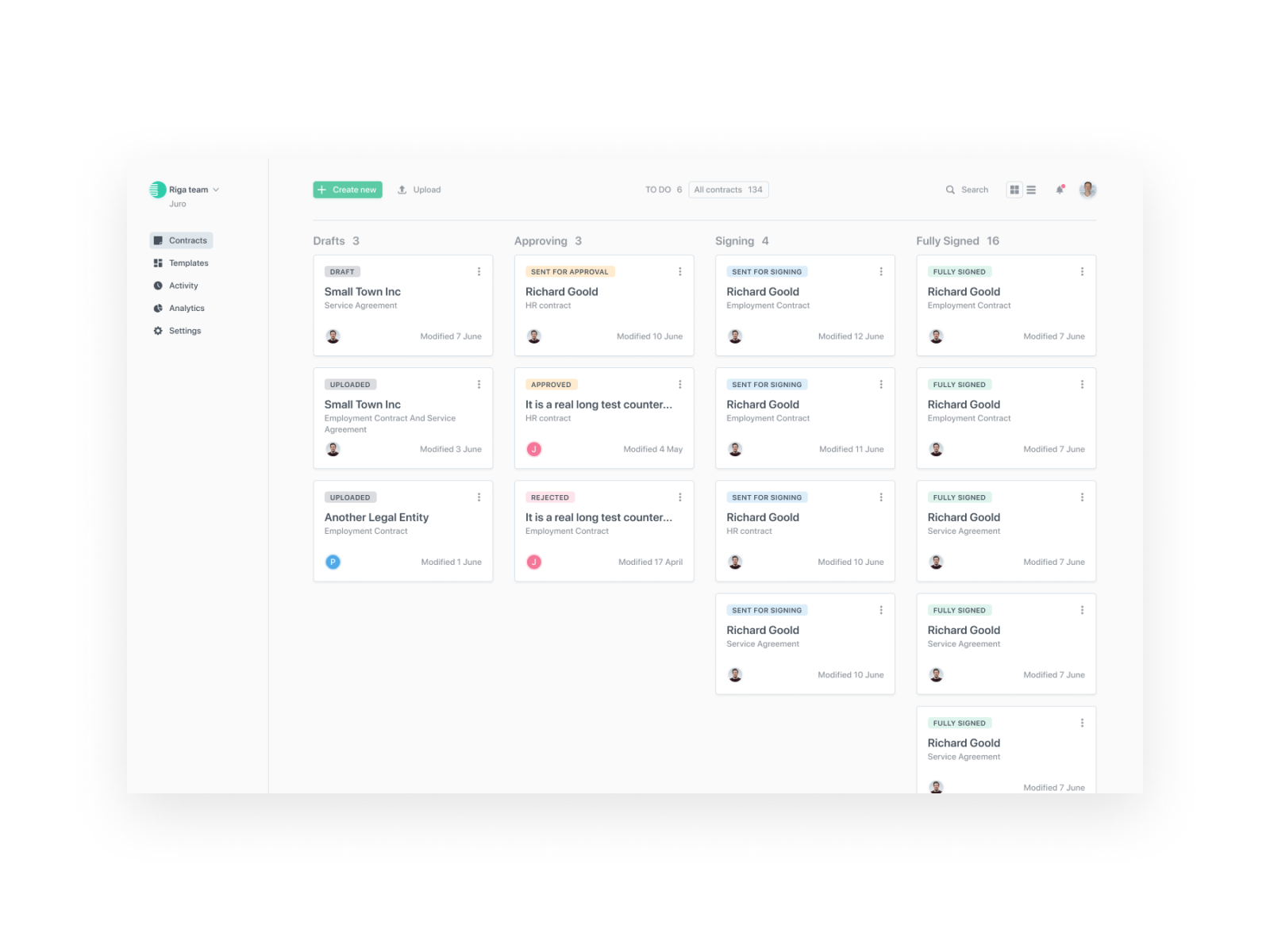

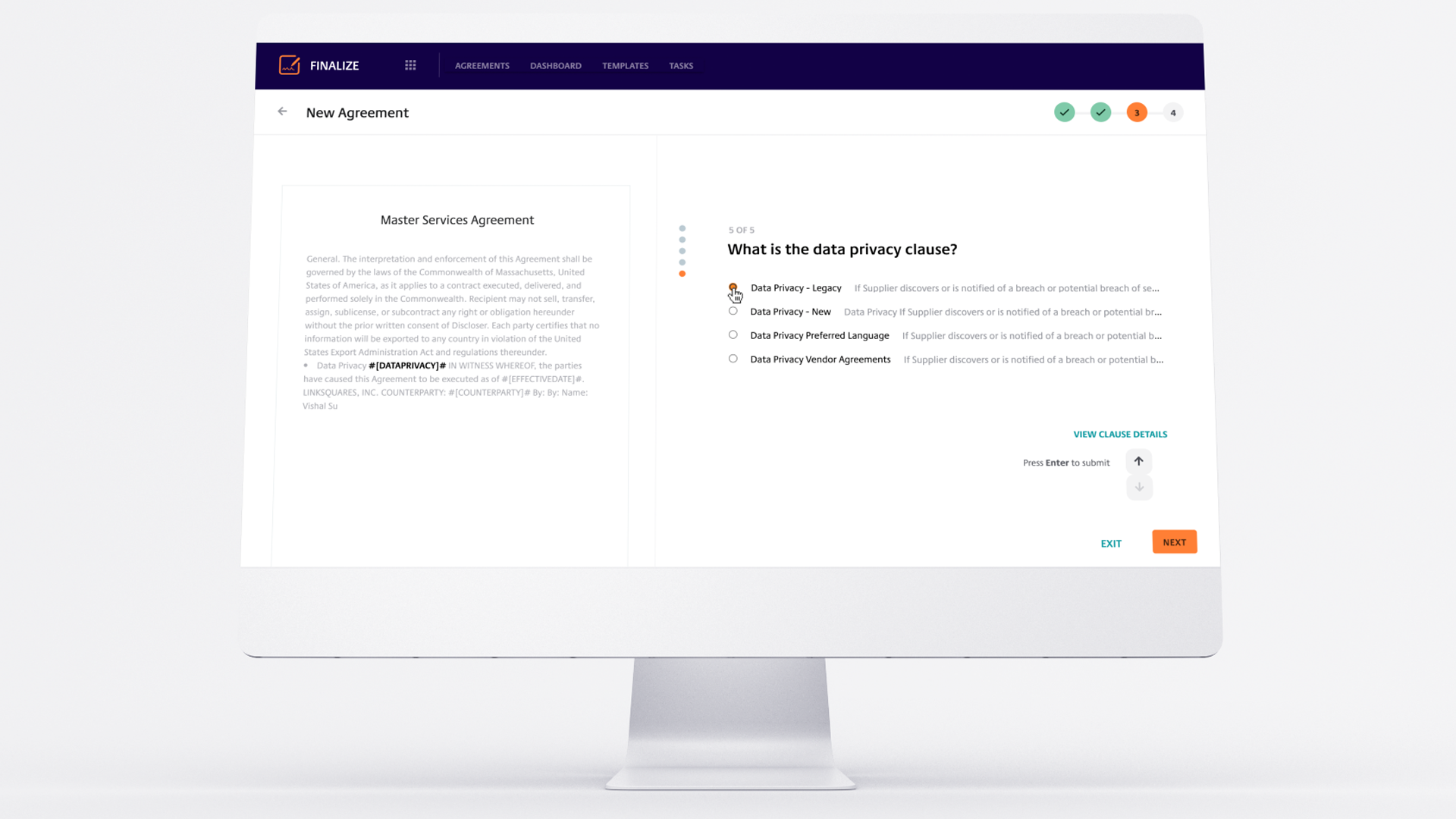

Combs and Sunak sought with LinkSquares to build a platform that combines legal analysis with sophisticated contract lifecycle capabilities. Leveraging AI and “the expertise of top legal customers,” LinkSquares helps companies to write contracts, analyze what’s in existing documents and collaborate with other teams across the organization, Sunak says.

Image Credits: LinkSquares

“In-house legal brings a unique skill set to a company that has real value to stakeholders up and down the corporate ladder, but they are often viewed as the company bottleneck. Modern legal teams need to cement their seat at the executive-level. In order to do this, they need to have consistent and accurate data at their fingertips,” Sunak said. “[L]egal teams have needs outside of contract lifecycle management, too, and are often forced into siloed single-use products that don’t integrate with other company business systems which creates major challenges for adoption, usage and data flow.”

LinkSquares offers post-signature analytics and a searchable repository for contracts, allowing companies to use AI to extract both contract data and metadata. Sunak claims that the platform, which is has processed more than four million documents and over 100 million unique data points to date, can yield roughly 115 answers to contract metadata in 20 seconds.

Beyond this, LinkSquares integrates with services from Salesforce, Adobe, DocuSign and HelloSign and will next week gain an in-house e-signature solution, LinkSquares Sign, to deliver “full end-to-end” contract lifecycle management.

“For our contract lifecycle management product, our pretrained contract metadata extraction technology runs immediately without any training required by the user … We aim to have more than 250 out-of-the-box extraction values by year-end,” Sunak added. “Additionally, we have now … benchmarks on what is being negotiated in real-time by our customers and really interesting trend data about the usage of certain provisions, language and clauses, which we’re excited to be publishing later this year and even putting this into our product as a way for legal teams to better understand their positioning in negotiations.”

Growing market

Gartner projects that legal department budgets allotted to technology will increase threefold by 2025. Already, 2021 was a record year for legal tech, with $1.4 billion invested by venture capital firms in the first half of the year — more than in the entirety of 2020 and well above what was raised in 2018 and 2019, according to Crunchbase data.

LinkSquares — which has 550 customers including DraftKings, Igloo and Wayfair — hit over $20 million in annual recurring revenue (ARR) in 2021, Sunak claims. The plan is to grow ARR 150% by the end of 2022 and double LinkSquares’ workforce to 500 employees.

“We believe LinkSquares is well-positioned to address this critical need with what we view to be market-leading proprietary AI. We see the company’s success to date has stemmed from its best-in-class financial metrics and win rates,” Spencer McLeod, G Squared partner and head of research, told TechCrunch. “The management team has the vision to transform this space and we believe that through continued execution and product innovation, LinkSquares can redefine how modern legal teams operate.”

But legal tech spending and investments don’t necessarily correlate with adoption. For example, according to a 2020 American Bar Association study, only 58% of firms use cloud-based data storage while just 7% use tools employing AI (e.g., ContractPodAI, Cognitiv+ and SirionLabs).

Hurdles to tech deployment in the legal field have historically included time constraints, cost concerns and a lack of commitment to skills training. Firm administrators are inclined to view any non-billable activity, like training, as a waste of time. Sunak himself acknowledges that over the past decade or so, contract lifecycle management vendors have provided a poor purchasing experience.

That’s all to say that software like LinkSquares isn’t a silver bullet. Effective contract management requires improving internal processes and fostering — or bolstering — employees’ relevant skills. Only then can improvements to contract value be realized through cost reduction and revenue enhancements — a message LinkSquares will have to communicate clearly as it looks to retain and grow its customer base.

“[Vendors have sold] feature-bloated products, complex implementations, [and an] overemphasis on pre-signature workflows as the solution for every contract management problem,” Sunak said. “[But we’re] seeing a lot of wind getting into the sails now and in the years to come as forecasted … The [contract lifecycle management space] has a lot of activity, which is very positive. Legal tech and contract management specifically is a hot space and it is great to see contract management and contract lifecycle management being pillared by companies like DocuSign and Icertis.”