The competition in the spend management space continues to intensify.

Brex and Rho today each announced AI-powered/enabled accounts payables offerings.

Their announcements coincidentally came out the same day competitor Ramp announced it had expanded into procurement — further evidence that the companies in the space are clamoring to not only meet customer demand but presumably attempt to outdo each other in terms of what they can offer their customers to help control spend.

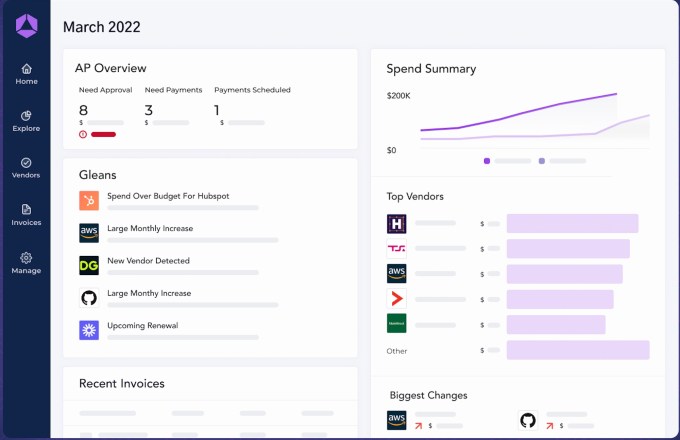

Specifically, Brex today revealed Payables, its AI-enabled Accounts Payable (AP) offering, while Rho announced new AI-powered Accounts Payable automation capabilities. Brex’s offering is live today while Rho said its new capabilities will be live later this month.

Via email, Brex co-CEO and co-founder Henrique Dubugras told TechCrunch that launching the new product had been “in the works” since the startup started building Empower, its spend management platform, over a year ago.

He noted that while Brex has used artificial intelligence for years in various capacities such as customer support and underwriting, what is new now is that it partnered with “multiple” machine learning companies such as Scale AI and Photon “to drive the highest accuracy of information extracted from invoices.”

Prior to this launch, Dubugras said that Brex offered a lighter version of bill pay that gave customers the ability to send scheduled and recurring payments. Now, he said they will “have even more advanced spend controls with multi-level approvals.”

For its part, Rho said it is offering AI-powered invoice and bill processing to its clients. Specifically, invoices sent to a designated AP inbox will “undergo automatic digitization” powered by generative AI technology.

In a statement, the company said the process “transforms the invoice into a bill and creates a corresponding liability in the client’s integrated ERP system. Clients can then authorize bill payments through Rho one by one or in bulk, with liabilities automatically marked as paid in the ERP.”

Rho CEO Everett Cook told TechCrunch via email that the new capabilities had been in the works for nearly a year, building on the company’s initial accounts payable release in 2021. Rho has partnered with OpenAI — a portfolio company of Rho investor DFJ Growth.

With the new product, he claims, customers will be able to “configure one-click workflows that help finance teams process thousands of payables in seconds.”

“Our position on generative AI is that it is only useful if it is grounded in tangible business value,” said Rishav Chopra, SVP of product & design at Rho.

Large opportunity

Besides wanting to better compete, both Brex and Rho expect their new offerings to increase revenue for their respective companies.

Dubugras said the new payables product should increase the percentage of customers’ spend processed via Brex.

“As a result, some of that spend will be on their Brex card, one way in which Brex earns revenue,” he told TechCrunch. “Plus, using a Brex business account for bill pay, another way in which Brex earns revenue, allows customers to send payments faster, eliminating ACH delays while also earning passive yield.”

Brex claims that it is unique relative to other companies in the market in that it is “the only player” with its own business account that can earn revenue in this way, allowing the company to offer payables for free. (TechCrunch has not independently verified this claim.)

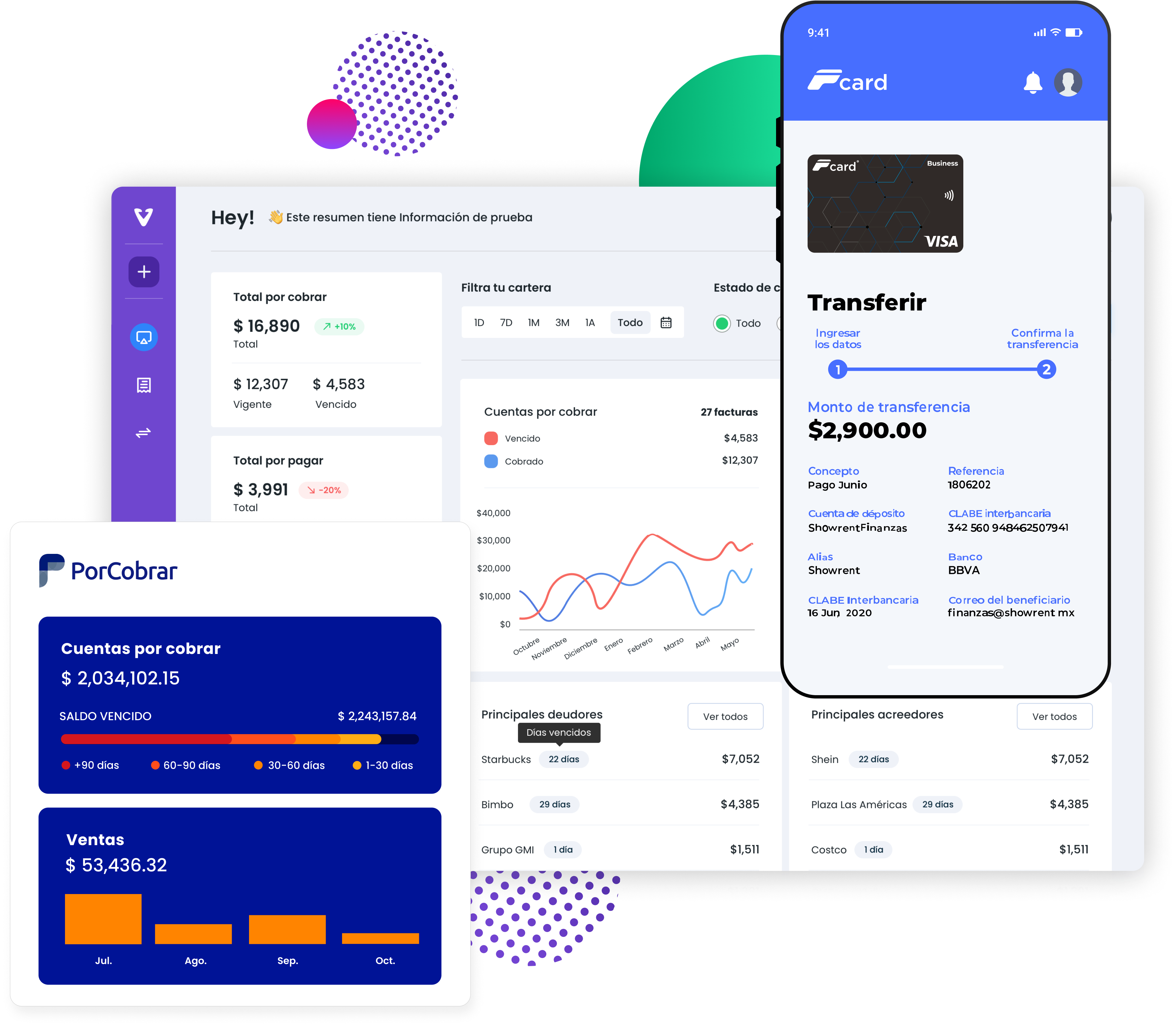

Meanwhile, Rho’s Cook believes that while the “timing is pretty coincidental” with Brex’s announcement, he supposes each of their customers were telling them “the same things” — that “they’re fed up with their legacy AP providers and want a modern solution that’s directly integrated with the rest of their finance stack.”

Legacy providers include the likes of Bill.com and Concur.

Dubugras believes there is a lot of competition in the space for a very good reason, telling TechCrunch: “The spend management space is very dynamic and that is because the opportunity is so large across SaaS and payments. Beyond the noise there is still a lot of differentiation between the players.”

Rho’s Chopra also believes that the current macro environment has led to increased pressures on the part of CFOs and finance teams “to move faster than ever and operate leaner.” This in turn has — for obvious reasons — created more demand for spend management products.

Want more fintech news in your inbox? Sign up for The Interchange here.