When mHub opened its doors in Chicago seven years ago, the vision was to create a traditional incubator for people making things. It would involve a prototyping lab, offices, shared workspaces, meeting rooms and classrooms. In those seven years, the accelerator says it has supported more than 500 startups, 200 manufacturers, been awarded around 450 patents, and helped to create roughly 4,000 jobs. Now, it is moving into a newly acquired, freshly refurbished space in a Chicago opportunity zone to help it incubate, accelerate and support more startups that can have a positive impact on humanity. TechCrunch spoke to mHub’s CEO and co-founder Haven Allen to find out what’s next for mHub, and what makes Chicago its perfect home.

“It’s been quite a journey over the last six years; we’ve definitely evolved beyond just the incubator,” said Allen. “Today, we have over 250 startups. But we also have manufacturers and groups like Keurig here, inventing the next Keurig machine out of our facilities. It’s both a lot of very early-stage, but some established ones that are looking for that sort of place where they can come test and build on the newest, latest equipment, connect with investors and connect with talent to scale up product sales.”

From mHub’s perspective, it had very much outgrown its current space, and its new center offers the startups and innovators and developers what they need, in the perfect geographical location.

“We wanted to be in an opportunity zone so that we could leverage that designation to attract and bring more venture capital to the table,” said Allen. “We wanted to be in one of the plant manufacturing districts and have access to public transit. And this just hits the Venn diagram perfectly right.”

The new center on Chicago’s Near Westside at 240 N. Ashland has been built-out to provide mHub with the facilities that it needs to support the development it wants to foster.

“We’ll build out more labs around energy technologies and specific testing equipment, electronics equipment and new wet labs, more battery related technologies,” said Allen. “In our current space, we don’t have really private offices beyond some of our industry partners that are embedded here. So we can support some of these growing teams as they need more space as they build their teams and inventory.”

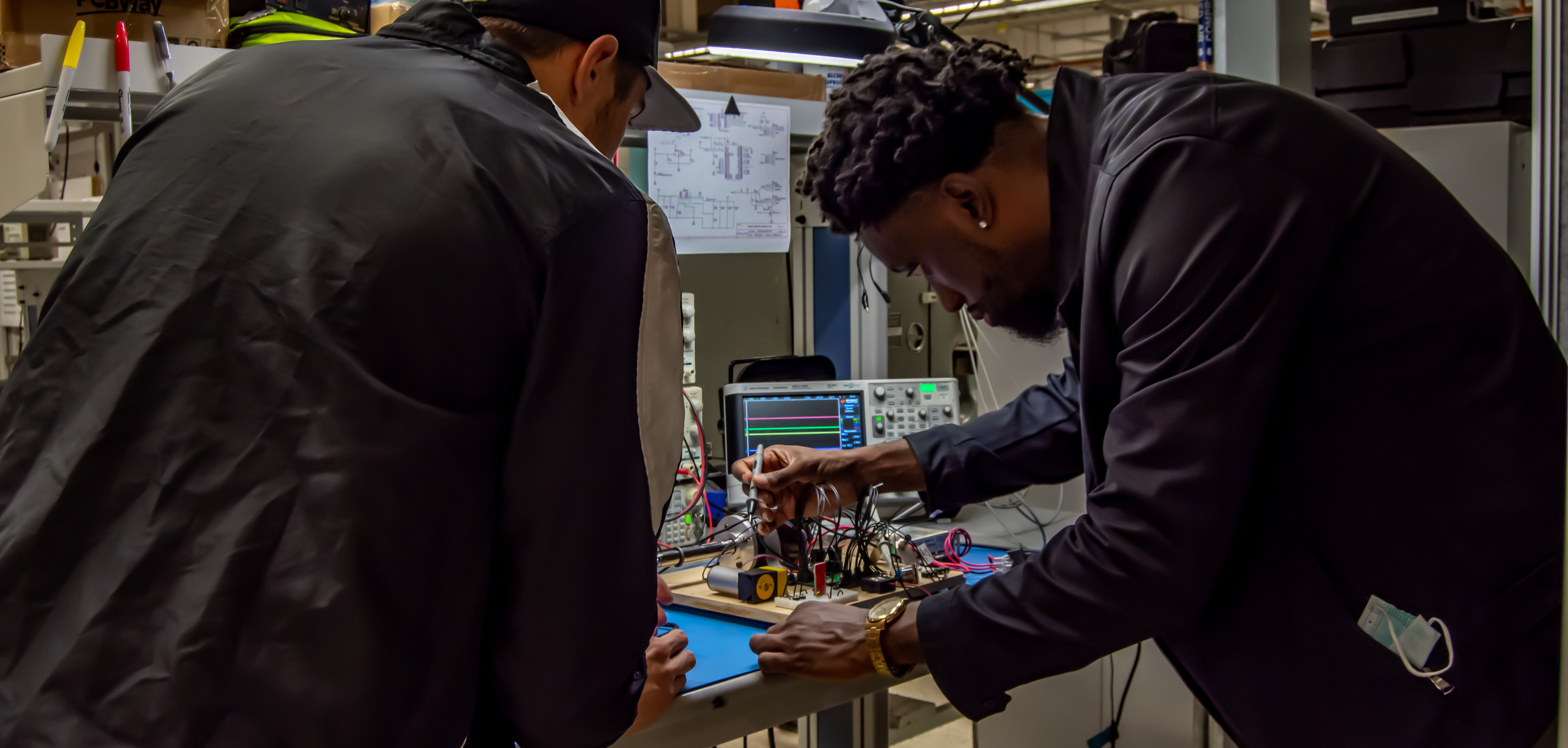

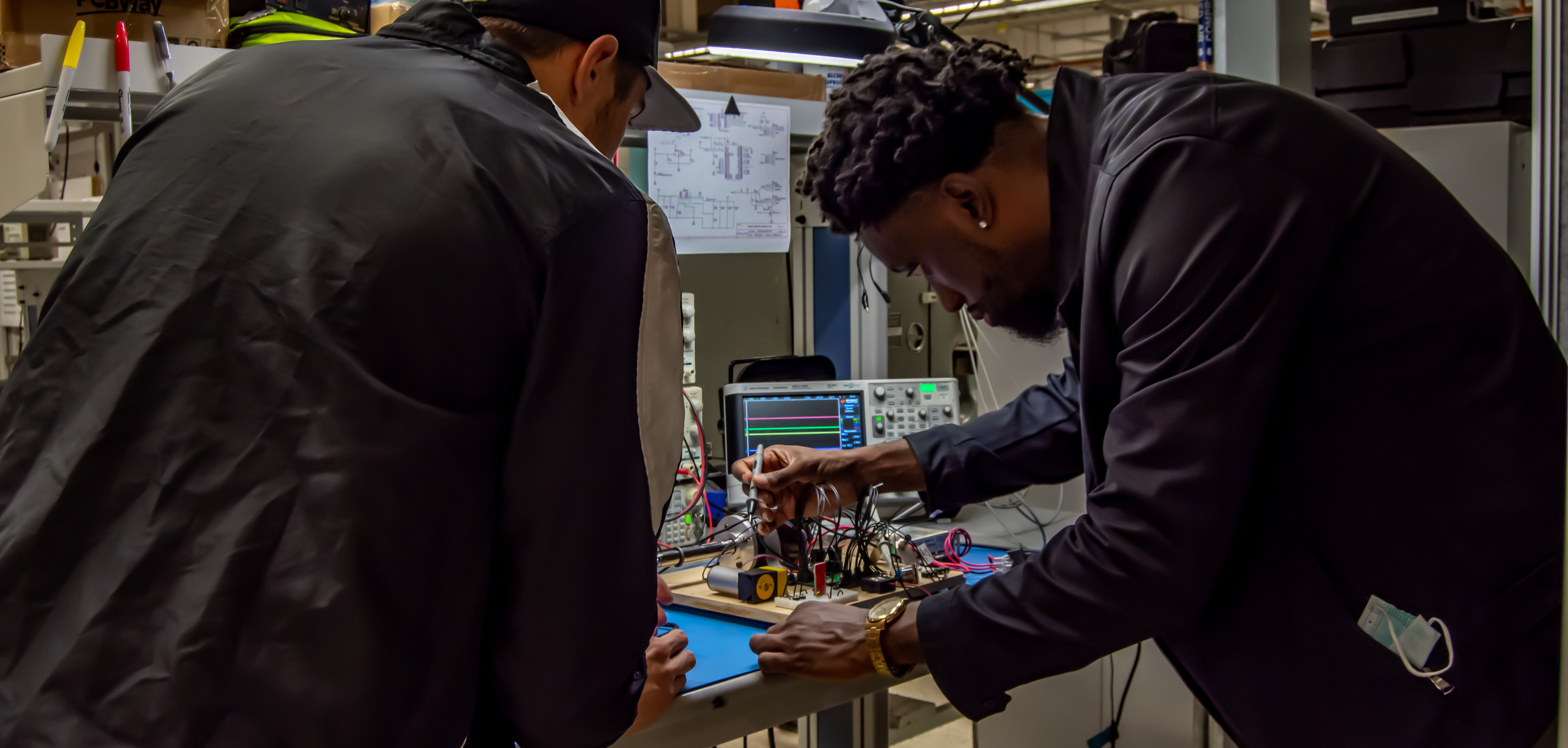

mHub members working in the accelerator’s current electronics lab. Image Credits: mHub

In addition to the physical facilities that mHub provides, it also brings together people to help cultivate innovation and connection.

“We have 600 engineers here, which is an incredibly valuable resource for the startups in the manufacturing community,” said Allen. “So there’s a lot of contracting and collaboration that we facilitate between the startups as well as outsourcing to industry for short-term R&D projects.”

As for Chicago itself, its combination of universities, diversified manufacturing economy, existing supply chain and easy access across the country makes it geographically ideal for an incubator like mHub and the startups it wants to attract.

“We’re looking for products and founders that are trying to create things that we believe can impact humanity,” said Allen. “We really lean in on climate, energy, med devices and sustainable manufacturing, knowing that we obviously have climate issues. And there’s lots of ways that we’re going to solve it. Human behavior doesn’t appear to be the one way, so how can technology actually drive some of the advances we need?”

mHub supports startups both through its incubator and its accelerator program. The incubator program is open to anyone who is there to build a business and mHub feels it can support them. The accelerator selection process is more rigorous. It involves a selection committee of roughly 20 people drawn from investors, industry and people who have led manufacturing science at universities and national labs, and the ability to meet 19 factors. But the crucial criteria are the novelty of their ideas, their understanding of their markets, their teams and their willingness to be coached.

“We bring cohorts together around a theme partner with industry,” said Allen. “We give each of the teams $75,000 cash and $25,000 of engineering credits that they just have to use to advance their product. Then we hyper-resource them for a six-month program, and then keep them having access to the whole labs and resources for two years beyond that.”

mHub is opening its next round for climate- and energy-focused startups on May 8.

mHub opens much bigger facility to kick Chicago startups into high gear by Haje Jan Kamps originally published on TechCrunch