500 Global’s take on the rising competition among startup accelerators

It’s been a little over a year since accelerator 500 Startups rebranded to 500 Global in an attempt to reposition itself as a venture firm. It also launched a $140 million fund to invest in later-stage companies for a total of $2.8 billion in assets under management, according to its website.

The new 500 fund has a strategy similar to Y Combinator’s continuity fund, which exists for growth-stage investments and contrasts with Techstars, which recently closed an $8 million pre-seed fund for startups too early for even its own accelerator.

This repositioning of 500 Global’s brand and priorities sets a fresh, broader tone for its new accelerator participants. This week, over a dozen startups in the firm’s accelerator program presented on a virtually held live demo day, which featured several moonshots, debuting weeks after Y Combinator’s demo day.

The demo day seemed a perfect time to check in with Clayton Bryan, partner and head of 500 Global’s accelerator fund, to hear how the accelerator program has evolved (and if there’s still a point to this demo day madness).

500 Global’s take on the rising competition among startup accelerators by Natasha Mascarenhas originally published on TechCrunch

The biggest moonshots from 500 Global’s latest Demo Day

It’s demo day season. This morning marked the kickoff of VC firm 500 Global’s Fall 2022 Demo Day, which saw over a dozen startups give their best pitches to prospective investors — and customers. Participants ran the gamut from fintech and sustainability to edtech and developer tools, and several stood out from the rest of the pack.

The event comes just weeks after Y Combinator had its bi-annual Demo Day, its first since moving operations back to in-person. 500 Global, formerly branded under 500 Startups, has an accelerator that competes with YC. Both outfits look to back early-stage founders with money and advice in exchange for equity. YC has backed over 3,500 founders, while 500 Global has backed more than 2,800 founders, according to each institution’s websites. Unlike YC, 500 Global has geographic-specific accelerator programs, similar to Techstars, with focus on areas like Aichi, Japan, Cambodia, and Alberta, Canada.

That said, today’s debut from 500 Global is from its first and flagship program, hailing back from 2010 and, fittingly, including companies from all around the globe. All companies go through a four-month program but start at different times, thanks to 500 Global’s somewhat new rolling admissions strategy. Let’s dig into some of the moonshots of the batch and end with some notes from Clayton Bryan, partner and head of 500 Global’s Accelerator Fund.

The moonshots

For example, there’s Taiwan-based Rosetta.ai, an ecommerce startup tapping AI to let customers search for products — particularly apparel and cosmetic — through specific attributes. Rosetta’s AI algorithm “sees” which attributes (e.g., sleeveless, ruffled, microbeads) a shopper might want as they browse an online store and builds a “preference profile” for them, which merchants can use to cross-sell or set up promotions that trigger if it seems likely the shopper will abandon their cart.

Image Credits: Rosetta.ai

It’s early days for Rosetta. But the company, which was founded in 2016, has raised $2.4 million in capital to date and claims to have customers including Shu Uemura, in which L’Oréal owns a majority stake. The trick will be continuing to win customers over rivals like Lily AI, which similarly attempts to match customers with products using attributes and AI models.

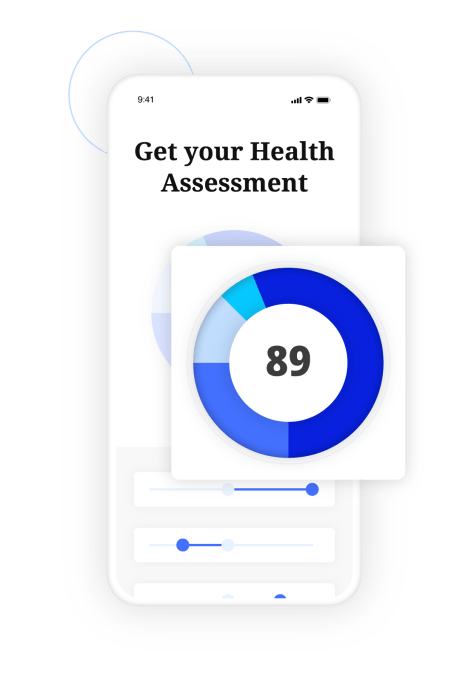

Elsewhere on Demo Day, Lydia.ai walked through its health assessment service for insurance carriers. Designed to do away with lengthy medical exams and forms, Lydia has insurance plan applicants answer a few questions about their health — e.g., whether they have a chronic illness, have recently been hospitalization and so on — via their smartphones. The platform then generates an abstracted health score supposedly devoid of sensitive medical details, which insurers can use for risk management and underwriting.

Image Credits: Lydia.ai

Lydia isn’t the first to attempt this. Health tech startup Fedo also algorithmically generates health scores, quantifying a person’s risk for diseases and their propensity to claim. The opaqueness of Lydia’s approach also raises questions, like whether its algorithms account for demographic differences and historic biases in health care. But if the startup remains true to its mission — insuring the next billion people — it could be one to watch, particularly given the capital (~$13 million) already behind it.

One of the more unique Demo Say startups that presented was BetaStore, a supplier for the “informal” retail outlets common in Africa. Informal retailers are unlicensed and unregistered retailers that don’t report to tax agencies, typically operating out of open markets and shops. BetaStore serves as a goods marketplace for informal retailers, providing access to staples such as dish soap, laundry detergent and all-purpose cleaner at wholesale prices and delivering them to the retailers (within 48 hours).

Image Credits: BetaStore

BetaStore customers can order products via chat, text message or WhatsApp. On the backend, the platform provides sales analytics to manufacturers, which BetaStore notes can be leveraged to make “data-driven” decisions to scale up shipments.

BetaStore appears to be off to a strong start. Founded in 2020, the Nigeria-based startup claims to have distributed over 140,000 goods to retail customers in Nigeria, Ivory Coast and Senegal and fielded over 20,000 orders. Recently, BetaStore began offering financing to retailers and plans to launch a buy now, pay later product in the coming months.

One year after the rebrand

Minutes after Demo Day ended, Bryan spoke to TechCrunch about 500 Global and how it’s growing within an increasingly volatile (and competitive) market.

“It’s been kind of gloomy, but we’ve told our companies time and time again that the silver lining is that 2021 was a phenomenal year for venture funds raising financing,” he said, fitting into the news that U.S. based investors are sitting on $290 billion in dry powder right now. The accelerator’s top advice was to start fundraising earlier, ready the company more before going out to the market, and stay smart on managing expenses. His advice these days is that startups should be preparing for at least 18 months of runway.

It has been almost a year since 500 Global rebranded from 500 startups, a move that Bryan said was meant to reposition the institution as less of an accelerator, and more of a venture firm. Its more than semantics; former batch participants have come back to 500 for follow-on funding, during their Series A but up till their series D.

“Historically, we haven’t had any any optionality, but now we’re going multi-strategy and we’re working on later stage funds,” he said. “We have the demand with our founder community, we have a demand even within our partner community that they want to have access to more de-risked companies.”

He added: “We’re very proud of our accelerator. It is a key vantage…but now it’s helped unlock other opportunities for us as a firm that we’re exploring with a lot of enthusiasm.”

As for if 500 will change its investment cadence, check size or focus – similar to YC as it prepared for a downturn – Bryan said there’s more to come.

“We’re not immune to the the changes that are happening in our ecosystem, we’re aware of what other funds are doing and other programs are doing,” he said. “Our program has been operating strongly for the last 10 plus years. But at the same time, we can’t rest on our laurels, and we’ve got to make sure that we have compelling deal terms.”

The biggest moonshots from 500 Global’s latest Demo Day by Kyle Wiggers originally published on TechCrunch

As Russians head for the exits, Immigram platform launches to scale professional migration

The number of applications for international visas in the UK and elsewhere, in order to leave Russia, has exploded following the latter’s invasion of Ukraine. It’s estimated that since February over 200,000 people have fled the country, with many observers calling it a “brain drain”. And while it’s possible to apply for normal visas abroad, the reality is of a slow and difficult process. At the same time, most countries now have professional visa programs based on talent – but even then, Visa lawyers can be notoriously slow and expensive.

Now a new startup hope to capitalize on this flight from Russia and former CIS states associated with the Putin regime.

London-based Immigram is an immigration platform for tech professionals and entrepreneurs that has now raised $500,000 in a funding round led by Xploration Capital. Also participating was Mikita Mikado, an Belarusian immigrant founder to the US and СEO of PandaDoc, Joint Journey Ventures, and a group of angel investors. Immigram is also backed by Hatchery, a startup incubator run by University College London.

Immigram’s idea is to build a B2B SaaS platform enabling employers to attract and retain international talent by guiding them through the entire relocation journey. This is from applying for a relevant visa to finding an apartment and getting a bank account. The platform claims to combine legal advice with tech-enabled processes to “automate immigration”.

Core to the idea is Immigram’s scoring system which is geared to the UK Global Talent Visa. Since launching earlier this year, Immigram says it has helped 150 clients relocate. This would likely be a lot slower via a traditional lawyer.

Immigram also providing a B2C solution. Unlike traditional law firms that charge by the hour, Immigram says it provides fixed pricing, costs 50% less, and issues refunds in case an application is unsuccessful. So far it says it’s been used by execs from Google, Meta, Twitter, Revolut, Bumble, and Yandex, as well as founders and alumni of Y Combinator, 500 Startups, and Techstars.

Immigram’s founders – Anastasia Mirolyubova and Mikhail Sharonov – who both relocated to the UK from Russia several years ago and came up with the idea which is based on the UK’s increasing focus on the business and technical aspects of applications rather than the legal aspects.

The United States might also soon introduce a similar option. In January 2022, the House Rules Committee introduced a bill that creates a temporary visa for foreign-born entrepreneurs.

“We are building the product around the immigrant, not a particular country. The global talent shortage amounts to 40 million skilled workers right now, and it’s already affecting the immigration laws and is pushing developed countries to establish new talent visa programs. Our goal is to build an end-to-end global mobility platform that will guide people through the entire journey and help them find a community of like-minded people anywhere,” said Anastasia Mirolyubova, CEO and co-founder at Immigram in a statement.

“We are now at a very particular moment in history when countries begin to compete for people. Immigram facilitates that process by helping professionals fully realize their ambition on a global scale,” added Igor Kim, Managing Partner at Xploration Capital.

Immigram will compete with companies like Jobbatical or Localyze, but these do not normally have access to CIS markets and concentrate mainly on EU-based labor.

Immigram is also now offering a special service to talented Ukrainian IT specialists to move to the UK via the Global Talent route.

Stax gets $2.2M for its app that lets Africans make transactions via automated USSD codes

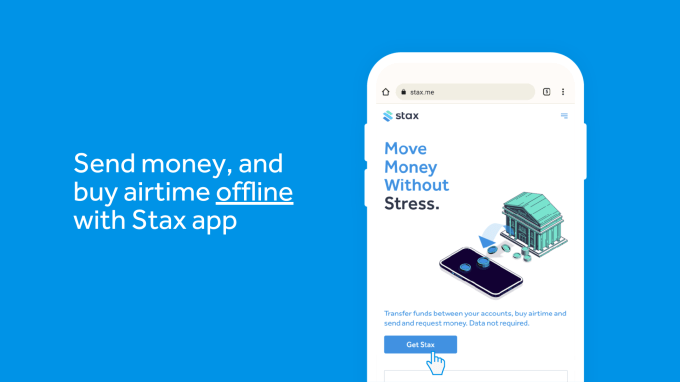

Stax, a startup that allows Africans to buy airtime, send and request money, and transfer funds between accounts via automated USSD codes, has raised a $2.2 million seed extension round.

U.S.-based VC firms World Within Ventures and Noemis Ventures co-led the round with Anthemis Group, Orange DAO, 500 Startups, Garuda Ventures and GAN Ventures participating.

In a market where internet-enabled app-based banking can reach 300 million subscribers on the continent, USSD technology, predominantly offline and used mainly by feature phones, outpaces it with 850 million connections. This technology allows people to send and receive money, pay for bills and buy data offline, and reports say more than 90% of digital transactions in sub-Saharan Africa are performed on its rails.

Telcos and banks dominate this mass market, providing the tech infrastructure that facilitates these code-based transactions. Typically, how it works is users dial a code for a service, say GTBank’s *737#, then follow a prompt asking if they want to send or receive money, pay bills or check their account balance, among other features, and the telco or bank acts upon that request.

But USSD does come with its unique challenges. Take Nigeria, for instance, where the average banked customer has three to five bank accounts and while some people use bank applications or fintech platforms to make online transactions, others rely on USSD codes. For the latter, memorizing one or two codes is one thing; cramming about five is a different ballgame.

Enter Stax. The company, founded by Ben Lyon, Jess Shorland and David Kutalek, fetches all these codes from multiple accounts together into an app users can access offline, letting them perform transactions without dialling any USSD code. The play here for Stax is to improve users’ experiences.

“Stax is all of your bank accounts, mobile wallets, crypto in a single app that works without mobile data. What we’re trying to respond to is tap into this recognition that you have about 300 million smartphone owners across Africa, who have a strong preference to transact via USSD instead of apps because they keep their mobile data turned off,” said CEO Lyon to TechCrunch.

“And so what we’re doing is building for them, because despite having a smartphone, they want to be offline. And that’s really the sweet spot where Stax comes out.”

Stax describes itself as a remote team with employees working from the U.S., the U.K, Nigeria and Kenya. Its platform is active in 10 African markets; however, it fully supports six countries — Kenya, Uganda, Tanzania, Nigeria, Ghana and Ethiopia, where more than 100 banks and mobile money accounts are available for customers to use.

The platform came out of beta last May. It had fewer than 3,000 monthly active users in its first month but has since grown to acquire more than 170,000 customers, of which only 40,000 are active monthly users.

While USSD is hailed for its ease-of-use and offline features, experts have highlighted over the years that improper validation in the technology can lead to attacks from hackers with a propensity to leak sensitive information.

Lyon acknowledges this issue and draws attention to the lack of a unified data regulation, which he feels is somewhat responsible for these issues. “For any company that wants to go pan-African, then it’s going to be intensely difficult to comply with all of those local regulations. And so my view on that is that the only way to win that game is to play a different game,” he said.

When users download Stax, they are only required to allow permissions from the app to send and view messages, access contacts and make and manage phone calls. According to Lyon, these permissions don’t divulge customers’ personal information. Therefore, in the event of a hack, for example, hackers can’t harm users, do anything with the data stolen or move money.

“We’d like to know as little as possible about our users individually; we don’t want to know their personal and identifiable details. So just moving toward saying this is a utility app for your money void of advertisement and cross-selling, we’re never going to sell your data, we’re never going to try and narrow ads to you,” explained the CEO on how Stax combats this situation.

Cross-selling users with data-backed insights would’ve presented Stax with an opportunity to get ad dollars. But having designed its app for a different purpose, the company— which currently makes no revenue— intends to charge commissions from partner brands who provide additional services to its users down the line.

Before Stax, Lyon, head of product Shorland and CTO Kutalek, met in Kenya while running different fintech-related businesses. Mobile money is more used in Kenya than anywhere else globally. So, when it came to starting a new project, they brainstormed around the technology powering it and saw an opportunity to optimize USSD rails for future use cases.

“We recognized that almost all digital financial services in the continent use USSD as their primary channel. So we set out originally with the question of ‘how can we make USSD programmable and how can we open it up so that one could effectively kind of screen scrape USSD services to build new experiences on them?’” said Lyon.

The first iteration of the company was Hover. It was an API platform that allowed developers to build apps on USSD rails. Two years later, after the platform did not make enough revenue from developers, the team chose to go vertical to what it is today, Stax, a universal money app on USSD rails for African users. The parent company remains Hover.

Stax plans to include several features in the course of its journey, including a self custody crypto wallet starting with USDC so users can buy airtime when they dial nonfinancial codes. The seed extension equips Stax to develop these features and expand its services from 10 African countries to 50 when it closes its Series A round.

Lyon said Stax is also eyeing an emerging market play where it will expand beyond Africa into other markets where USSD is prevalent, like South and Southeast Asia. But that will come much later.

DOJ seizes $3.6B in bitcoins after busting entrepreneur couple in Bitfinex laundering scheme

The U.S. Justice Department (DOJ) has seized over 94,000 bitcoins that were allegedly stolen in the 2016 hack of crypto exchange Bitfinex and arrested a married couple suspected to have laundered the money, the department announced today. The couple — Ilya Lichtenstein, 34, and Heather Morgan, 31 — faces charges of conspiring to launder money and to defraud the U.S. government. Facing up to 25 years in prison if convicted, they are set to make their initial appearance in federal court in Manhattan later today.

The asset seizure, worth $3.6 billion at today’s bitcoin prices, is the largest in the Justice Department’s history, officials said. They did not recover the entire sum of funds lost in the 2016 hack, though — the 119,754 bitcoins allegedly stolen in total are now worth $4.5 billion.

While Morgan and Lichtenstein were not formally accused of perpetrating the hack, prosecutors said they discovered the suspects because the bitcoins were sent to a digital wallet Lichtenstein controlled. The couple obtained the coins after a hacker breached Bitfinex’s systems, initiating more than 2,000 illegal transactions, the DOJ said.

Lichtenstein and Morgan are both deeply involved in the tech startup ecosystem, according to their LinkedIn profiles. Lichtenstein, a dual citizen of the U.S. and Russia who goes by the nickname “Dutch,” founded a Y Combinator-backed sales software company called MixRank. Morgan is the founder and CEO of B2B sales startup SalesFolk, where Lichtenstein has served as an advisor since 2014, according to data from Crunchbase and LinkedIn. Lichtenstein also serves as a mentor at venture firm 500 Startups and an advisor to Ethereum wallet provider Endpass, per his profile, while Morgan has written columns for Forbes and Inc.

Over one-third of the stolen bitcoins were transferred out of Lichtenstein’s wallet “via a complicated money laundering process” involving making accounts with fake names and converting the bitcoins to other, more private digital currencies like Monero, a process known as “chain-hopping.” The 94,000 bitcoins that weren’t laundered remained in the wallet that was used to store the proceeds from the hack, which is how agents say they were able to recover them after conducting an extensive online search through court-authorized warrants.

Bitfinex said in a statement today that it would work together with U.S. officials to attempt to return the stolen funds to their rightful owners.

“Today, federal law enforcement demonstrates once again that we can follow money through the blockchain, and that we will not allow cryptocurrency to be a safe haven for money laundering or a zone of lawlessness within our financial system,” assistant attorney general Kenneth A. Polite Jr. of the DOJ’s criminal division said in the agency’s statement.

Lawtrades aims to change how your company utilizes legal resources

Similar to other industries embracing contract work, Lawtrades is giving legal professionals a way to become independent and run their own virtual law practices.

Raad Ahmed and Ashish Walia started the company in 2016 with an initial focus on startups and small businesses, trying to find product-market fit (as one does), but finding that legal usage among companies of that size was often project-based, infrequent and short-term if the company folds.

In 2019, the company pivoted to working with mid-market and enterprise-level companies by selling into legal departments, and that’s when growth took off, Ahmed told TechCrunch.

Today, Lawtrades works with companies, like Doordash, Gusto and Pinterest, to offer them a marketplace of professionals that can be hired remotely and with flexibility. Its technology enables professionals and companies to create profiles and be matched to opportunities, monitor projects and pay through the platform.

“Ultimately, it is a new internet-native work model that we are starting with legal because it is a $100 billion market that has not been disrupted much in the last 100 years,” Ahmed said.

Lawtrades app design. Image Credits: Lawtrades

He and Walia wanted to build a different hiring experience from the likes of LinkedIn, where companies would have to weed through hundreds of applicants to find the qualified few. Professionals are also able to provide a flat pricing structure, unlike law firms which have overhead and other firm costs that are typically factored into billable hours.

Following the doubling of revenue in 2021, it closed on a $6 million Series A round, led by Four Cities Capital, with participation from Draper Associates and 500 Startups. The round also included nearly 100 customers, angel investors and company founders, including Gumroad founder Sahil Lavingia, Teachable’s Ankur Nagpal and GoDaddy CEO Aman Bhutani.

“Due to the world finally embracing remote legal work and more lawyers leaving big law firms to work for themselves, we’re cash flow positive and leveraging revenue-based financing, so we didn’t have to do a big dilutive equity raise,” Ahmed said.

At the end of 2021, Lawtrades had 80 customers on the platform and 150 active engagements. On the talent side, there are over 1,000 profiles, up from 400 made by the end of 2020. Currently, it is running on an invite-only model, and 5% are accepted into the network. The makeup of the network is 60% women and over 35% are minorities.

In December, the company’s revenue run rate was $8 million, up from $3 million at the beginning of 2021, Ahmed added. More than $11 million was earned on the platform to date by the network and over 60,000 hours of work was logged on the platform in 2021, a 200% boost from 2020.

Ahmed plans to use the new funding to rebrand the company, launch an iOS app, expand into other professional categories, like finance and management consulting, and gain an international footprint. He also intends to double Lawtrades’ current headcount from 15 to 30 across product, support and sales.

“The world of work is in a unique position,” he added. “People are working remotely and companies are looking for talent, so it is an all-out talent war with the best people getting the best offers. With our model, the power is in the individual to pick the kind of work they want to do. That’s how we are able to attract amazing talent and then be able to get companies that want to hire them. We are iterating on and pushing the boundaries of the 40-hour work week.”

Startup accelerators’ definition of ‘value add’ is due for a refresh

Even to outsiders, the inner workings of startup accelerators has become familiar: pumped up on camaraderie and energy drinks, scrappy founders do product demos onstage before a room full of buzzy journalists and investors.

Fast-forward two years into a pandemic and, even a stint with the return of hacker homes, much has changed about the way launch pads for startups look, feel and show value today. The earliest investors are rethinking signaling risk, dilution and, most surprisingly, the worth of a traditional demo day.

Pro rata

Let’s start with a juicy topic: pro rata.

Signaling risk happens when a VC chooses to not do pro rata, or follow-on investing, in an existing portfolio company. The idea is that investors who know you best — the ones who bet on you earlier than others — are choosing not to invest in you in your next phase of growth, which must mean that the deal isn’t that great. Negative perception can trickle down to other investors who, despite what their Twitter bios will tell you, are pretty risk-averse folks.

Accelerators have an interesting role to play here. If an accelerator like Y Combinator ever gets to host 1,000 startups per batch, an automatic pro-rata investment in each startup would be both capital-intensive and perhaps unintentionally dilute its own signal. Like clockwork, in 2020, the accelerator changed its policy on automatic pro-rata investments and chose to invest on a case-by-case basis, just like 500 Startups.

“We have significantly exceeded the funds we raised for pro ratas, and the investors who support YC do not have the appetite to fund the pro rata program at the same scale,” the accelerator wrote in a post then. “In addition, processing hundreds of follow-on rounds per year has created significant operational complexities for YC that we did not anticipate.

“Said simply, investing in every round for every YC company requires more capital than we want to raise and manage. We always tell startups to stay small and manage their budgets carefully. In this instance, we failed to follow our own advice.”

SQream acquires no-code data platform Panoply

SQream, a well-funded Israel-based data analytics platform, today announced that it has acquired no-code data platform Panoply in an effort to expand its cloud services.

At the core of SQream’s service is its GPU-centric “data acceleration platform,” which promises to speed up SQL queries and enable users to run their queries on more data. Panoply, on the other hand, offers its users a no-code data integration platform with support for over 300 different sources, which its users can then query in their favorite BI and analytics tools, or analyze using SQL queries in Panoply itself. In addition, Panoply also helps its users automate their data warehouse configurations. As such, it looks like the two platforms are quite complementary, with Panoply providing SQream with the tools and expertise to expand its platform to a wider user base.

“This is a significant step towards implementing SQream’s vision to provide our customers with the fastest data analytics platform in the industry, at any scale of data for multi-size enterprises, and in any environment — cloud, on prem and on the edge,” said SQream co-founder and CEO Ami Gal. “With Panoply’s acquisition, we are combining SQream’s GPU-powered, cutting edge technology with Panoply’s phenomenal ease of use and seamless integration and onboarding. This is a huge milestone on our journey to provide the world with the new category of analytics platform that is ready for tomorrow’s data challenges.”

Panoply raised $24 million in outside capital since its inception in 2015. Investors include the likes of Ibex Investors and C5 Captial, which led the company’s $10 million round in 2020, as well as Blumberg Capital, 500 Startups, FundersGuild and Intel Capital. The two companies did not disclose the price of today’s acquisition.

Panoply will continue to operate as a separate business unit, but as Panoply co-founder and CEO Yaniv Leven notes in today’s announcement, the acquisition means that the 160+ strong team will now have access to additional resources and expertise. SQream says it has “ambition growth plans” for the service in order to meet demand for the platform’s services.

“Since our inception, we’ve taken a different approach to cloud analytics,” Leven. “We’ve made it our mission to transform the focus of cloud architecture from data-centric to information-centric, by focusing on the insights you can gain from your data, rather than just the technical process of moving and storing it. SQream’s focus on driving fast data insights echoes this mission. The synergy between SQream and Panoply holds great promise for data practitioners as it expands Panoply’s reach to a wider audience and provides Panoply’s advantages of automation, no-code and simplicity to larger and larger organizations.”

Kalendar AI wants its sales bots to win your next customers

Kalendar AI, a San Francisco-based startup that’s been building on top of GPT-3‘s language model — developing a SaaS for automating lead generation and sales outreach to make it easier for companies to get initial meetings with prospective customers — has raised $3.2 million in pre-seed funding from 500 Startups; The Lean Startup author, Eric Ries; VC firms Village Global and Metaplanet; and 20+ angel investors (including CEOs of “popular” but undisclosed companies).

“Our AI technology writes personalized invitations to ideal customers with personalized decks — inviting them to take a meeting,” explains founder and CEO Ravi Vadrevu.

The SaaS was launched in February this year, although the startup itself — which is called Kriya Inc — was founded back in 2017 and had been bootstrapping prior to raising this pre-seed.

The idea for the b2b product is to automate the time-consuming and expensive process of sales outreach, including locating and pitching leads, as well as to offer tools to streamline and enhance initial sales meetings.

Kalendar AI claims to have amassed a database of 340M+ “ideal customer profiles” upon which it unleashes its AI sales rep bots to send “personalized” pitches (including “interactive presentations that convert into one-click meetings”) to likely looking customers.

“Our solution brings down the time to initiate a conversation to book an appointment from 7 days to 30 seconds from a sales perspective,” claims Vadrevu, who also argues there are big productivity wins from a marketing perspective vs other channels.

So where is Kalendar AI getting data on all those hundreds of millions of potential customers from?

“We have our own datasets that we built over years from publicly available information,” he tells TechCrunch, specifying that it uses Common Crawl, an open-source repository of the Internet, to collect “publicly available metadata information” and “form an index for searching”.

“We get all the available B2B company domains and the people associated to those domains (this information updates every quarter),” he goes on, adding: “We only engage people on their business email, and don’t store any personal information. We disclaim this in the footer of our every interaction that our technology predicted their business email in real-time using machine learning patterns.”

For “content narratives”, Vadrevu says the AI relies upon “real-time data services” such as the latest company news, company descriptions, current weather/events around a location, industry news, etc.

“We plan to increase such contexts by investing in content R&D,” he further notes.

Asked if it’s using any data scraped from LinkedIn, Vadrevu claims not — arguing: “We don’t need LinkedIn profiles as we process names & predict emails from publicly available domain/company metadata in real-time. LinkedIn is a personal network, and most business interactions usually happen, and more effective on a business email.”

Scraping LinkedIn is “not only unethical but it’s also unnecessary”, he adds when pressed for a confirm that Kalendar AI does not scrape the Microsoft-owned professional social network to enrich its database.

The SaaS is “nearing” its first 100 customers at this stage, per Vadrevu, who says the best markets for the product so far are technology, marketing & advertising, IT & Infrastructure.

“We have customers ranging from a small team of 5 people to public companies like Upwork. However, most of our customers are digital media companies, startups, and new growth entrepreneurs building businesses on top of our platform,” he adds.

“We’ve reached $1M in ARR revenue in the last three months, consistently maintaining a 60% month-over-month growth,” he also tells us, specifying that the new funding will mostly go toward building out the engineering team and improving the product.

“Currently [we’re] focused on forming an engineering growth team responsible for optimizing our algorithms to ensure the engagement is pleasant, effective, and efficient for all of our customers and the recipients.”

Now, it doesn’t require a ghost in the machine to tell you that while AI can be a powerful productivity tool it can also be terribly hit-and-miss.

And even if the claimed “personalization” of sales pitches is spot on target, receiving an automated sales pitching might risk a potential customer feeling, well, roundly unimpressed at the robotic cold call. Or — to put it another way — like they just got spammed. So a pitch-by-robot might be all too easy to ignore.

“It’s a very hard problem and we don’t please everyone yet,” admits Vadrevu. “We have a 2% error rate that sometimes creates unpleasant experiences where we created channels for people to directly give us feedback and let them opt-out of our platform.

“What surprises us by being transparent is that more people are considerate about helping businesses than we thought.”

“If we become successful, the beauty of AI eventually empowers businesses & individuals connecting in many ways beyond sales like how we call connect today,” he adds. “We’re still very early and are grateful for our investors who’re supporting us.”

The startup’s ultimate goal for is the product is to be able to provide a fully end-to-end SaaS for sales outreach and meetings (including videoconferencing and CRM), not just fancy personalized pitches that its AI sales bots fire out at inhuman speeds.

“Our vision is to build an ecosystem around the appointments we set, including video conferencing, CRM, etc., to improve the quality of the meetings,” he says.

“The immediate impact of such technology is on sales (revenue autopilot), which otherwise involves heavy marketing & sales processes to achieve. The adjacent markets for such a technology could also be recruiting, job search, etc., which is not our focus,” Vadrevu also suggests.

The startup’s own sales pitch for its SaaS is that it can radically reduce the time and cost of booking “a high quality meeting that directly impacts revenue“.

But of course the b2b product is certainly not free.

A “basic plan” starts at $2,000/m for 20 “AI authors” (booking an estimated range of 20 meetings per month; since its fee is pay-per-meeting), according to Vadrevu.

While a “Scale plan” starts at $4,000/m for 50 AI authors (booking an estimated range of 40 meetings pm).

Vadrevu argues this pricing puts the product “on the cheaper side” vs other tools companies would be using to try to lock in leads, suggesting b2b companies’ customer acquisition costs for a single meeting range from $150 to $2,000 (i.e. “using Google SEM, digital marketing, sales tools, etc to get the same ROI”).

“We’re making it cheap for our customers by bundling meetings into SaaS,” he further argues. “At scale, we might get into a price per meeting prediction but we saw that SaaS is ideal for our customers.”

On the competitive front, Vadrevu claims Kalendar AI is breaking new ground — and that “no one else is doing what we are doing until now as it’s incredibly hard” — emphasizing that development covers product iterations on content personalization with real-time feedback loops; AI-powered matching that needs to be adequately accurate, safe and not (so) spammy; as well as compliance with variable data regulations — hence why it took the startup three years to push the button on a market launch.

But pressed to name some startup competition, he says that for the personalized outbound messaging component there are AI copywriting tools such as Copy.ai; while for inbound decks he suggests it’s competing with scheduling pages such as Chili Piper, Calendly, and “any other inbound marketing funnel tools”.

Still, Kalendar AI’s wider pitch is that it’s going further by using AI to join up a bunch of manual sales and marketing work.

“Currently for b2b companies, there’s marketing and sales working separately to book appointments. But it takes a lot of manual effort to reach a consistent number of meetings every month on autopilot,” he adds. “Our approach leverages personalized sales outreach, coupled with interactive inbound (decks with one-click meetings; we might patent it) bringing down the cost & time to book a high quality meeting that directly impacts revenue.”