20PRODUCT includes a group of eight people who come from companies like Shopify, Nubank, Spotify, Snap, LinkedIn, Ramp, Match and Xiaomi.

© 2024 TechCrunch. All rights reserved. For personal use only.

Product Management Confabulation

What Product Managers are talking about.

20PRODUCT includes a group of eight people who come from companies like Shopify, Nubank, Spotify, Snap, LinkedIn, Ramp, Match and Xiaomi.

© 2024 TechCrunch. All rights reserved. For personal use only.

Just in time for tax season in the United States, Australian startup CryptoTaxCalculator (CTC) announced it has raised seed capital to expand its automated crypto tax reporting tool further into the U.S. market. Sydney-based CTC is one of many platforms that have gained popularity this year for helping crypto traders navigate the complexities of filing their taxes, though it differs from most of its counterparts in that it is mainly focused on solving problems faced by users of decentralized exchanges.

If you’re paying taxes on crypto you bought or sold through a centralized crypto exchange like Coinbase, Binance, or Gemini, understanding what you owe might be simple, since you can download a form from many of these exchanges detailing your trades, gains, and losses. But for those transacting on decentralized exchanges such as Uniswap or Curve, the process can be far more onerous — and that’s where CTC is most helpful, co-founder and CEO Shane Brunette told TechCrunch in an interview.

CTC has grown from 3 full-time employees last fall to nearly 30 today. Its platform serves over 80,000 users today, up 1,700% in the past year, according to the company. Brunette attributes this growth, in part, to the surging popularity of decentralized finance (DeFi), which CTC is built to support because of its expertise in decentralized transactions.

Unlike with transactions conducted on a centralized exchange, decentralized, on-chain transactions are not recorded by a trusted third-party middleman who can provide a user with their transaction history for tax filing purposes, Brunette said.

Brunette, an avid crypto trader himself, saw these challenges firsthand when he had to file taxes on his trades. He co-founded CTC along with his brother, and they decided to launch the product on Reddit in 2018, he said. CTC was initially focused on integrating with decentralized apps built on Ethereum Virtual Machine (EVM), according to Brunette, but it has since grown to integrate with more than 400+ exchanges, its website shows.

The company supports users in 21 different tax jurisdictions, and roughly 40% of those users are in the U.S. while another 40% are in Australia, Brunette said. He noted that a large portion of CTC’s U.S.-based users has joined the platform more recently, particularly since mid-2020’s “DeFi summer.“

“You can actually think of something like the Ethereum network as being one giant accounting ledger, which has all transactions since the beginning of time, of all parties and what they’ve been doing on that particular chain. The thing is that it’s been written in a way that’s quite convoluted when it comes to an accounting perspective,” Brunette said.

CTC integrates directly with the blockchains underpinning decentralized exchanges. Users only need to provide their public wallet address to CTC, and the platform aggregates all transactions and smart contracts linked to that wallet, essentially reverse-engineering the wallet’s transaction history, according to Brunette.

While centralized exchanges have become more consolidated as crypto matures as an industry, decentralized finance is exploding, and consolidation in that space cannot occur in the same way, Brunette said.

“The problem that tax authorities are facing, for example, is, how do you go about making sure people are tax compliant when there’s nobody there to go and subpoena, or to give you a transaction history of that individual? How do you keep track of this? And so I think the U.S. government’s take right now is really to try to create legislation that encourages a financial middleman, who can provide that transaction history, but that really clashes with the crypto ethos,” Brunette said.

Brunette has built CTC with an awareness of the skepticism many crypto users have towards centralization and middlemen.

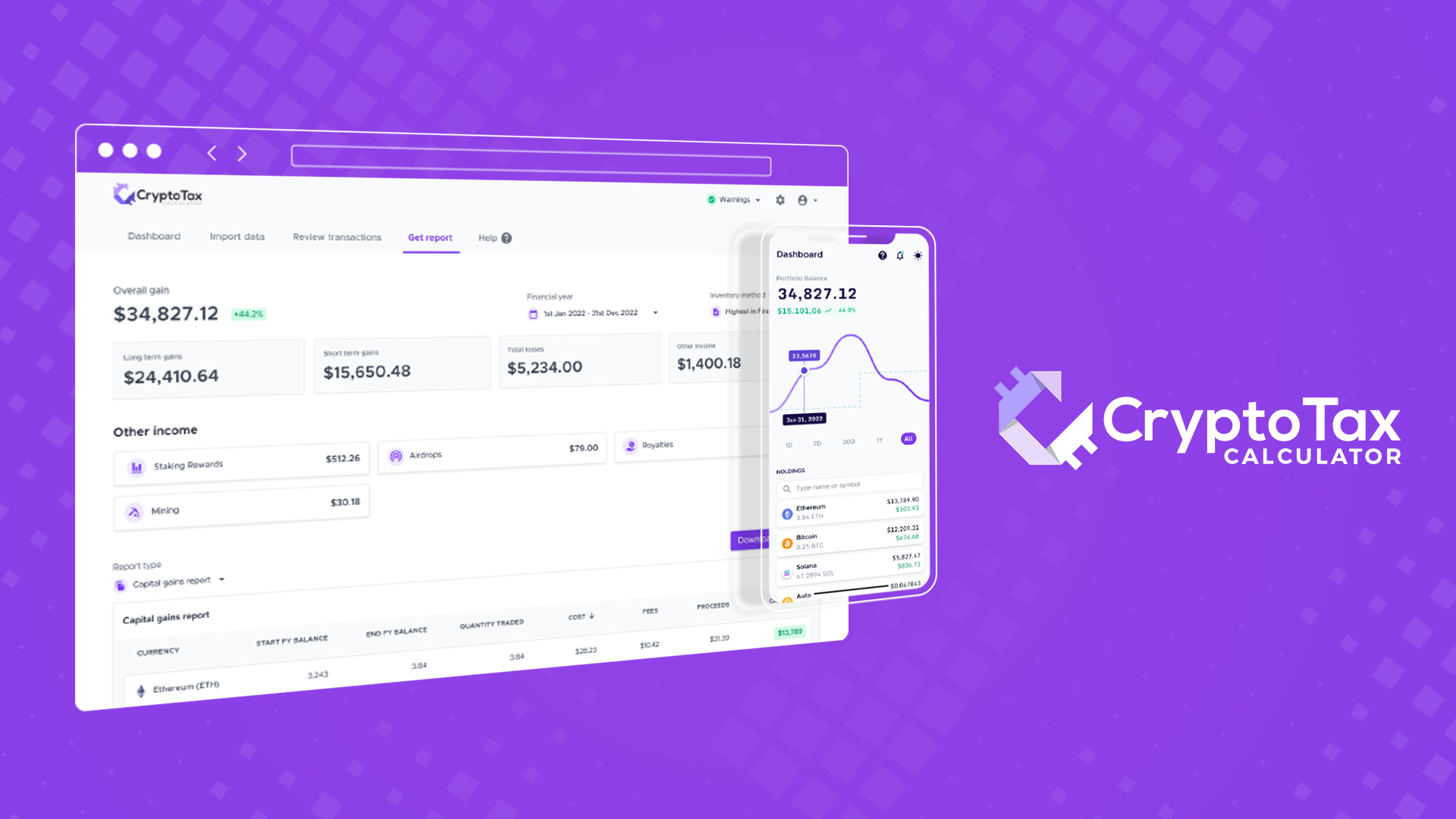

A photo of the CryptoTaxCalculator platform Image Credits: CryptoTaxCalculator

The blockchain itself “is perfect,” according to Brunette. Anyone can theoretically come and inspect the transaction data stored on a blockchain, but having the right tools to parse through it is necessary, he added.

“That’s what we’re really focused on — building some tools that really facilitate an overview across all the different blockchains as well as being able to pull in a centralized exchange data, so you can get a clear path of an individual’s transaction history, and you can reconsolidate to get to a tax outcome,” Brunette said.

While CTC pulls in all the data needed to build a transaction history and performs tax calculations for its users, Brunette still advises advanced crypto users to consult a tax professional to help them interpret regulatory grey areas to determine what they actually need to pay, and what rules apply to their activity.

CTC doesn’t provide any “final” tax data, but it instead provides aggregate information on what income is taxable, Brunette said.

“We give you the lump sums, so you can work out what your tax rate is, et cetera, so it’s kind of really categorizing it. So it’s like, you’ve earned this much from staking rewards — now, what do you want to do with it? It’s worth talking to a tax professional and seeking advice,” he said.

The seed round netted the previously-bootstrapped company a total of A$4 million (around $2.9 million in U.S. dollars). Australian venture firm AirTree led the financing alongside U.S.-based Coinbase Ventures and United Kingdom-based 20VC, a fund run by podcaster Harry Stebbings.

Casual mobile games have reached a fever pitch of interest with consumers, and so too with investors, who are rushing to back the biggest and most promising startups building these quick hits of engagement and diversion. In the latest development, a startup out of London called Tripledot — the company behind a popular Solitaire app, another game called Woodoku (‘wood blocks meet sudoku’), and more — is today announcing that it has raised $116 million. The funding puts the London-based startup’s valuation at $1.4 billion.

The round is being led by 20VC, the firm started by Harry Stebbings, who came into the world of investing initially via his popular 20 minute VC podcast, first teaming up to start VC Stride and eventually starting a fund named after his show (and raising some serious money to run it). Others in the round include Access Industries, Lightspeed Venture Partners and Eldridge, and the round follows a $78 million Series A in April 2021.

As with that Series A, this is a substantial raise for a Series B round, and Lior Shiff — the CEO who co-founded the company with Akin Babayigit (COO) and Eyal Chameides (CPO) — noted that it’s not to run the core business. Tripledot has been profitable since the end of its first year of operation (it was founded in 2017), now has close to 30 million monthly active users across its titles, and last year tripled revenues (without disclosing the actual figure).

“This fundraising is for M&A,” he told TechCrunch in an interview. Specifically, the plan is to acquire interesting startups working on creative ideas, to complement what Babayigit describes as a particularly strong set of skills that Tripledot has gained in developing engaging monetization mechanics and scaling games.

“We’ve gotten to the point of having a lot of technology and expertise that we can now leverage, so we want to buy studios, and use our platform to take those great games to reach a much larger audience,” Shiff added. “We are very good operators.” That’s not to say that Tripledot doesn’t have its own strong in-house game makers, he added, “but many of our peers excel in making great games but not how to reach large audiences, or to scale them into sustainable businesses. Now this capital gives us firepower.”

Dream Games, a big name among casual gaming startups at the moment (and as it happens one of Babayigit’s angel investments) likes to say that its ambition is to become the next Pixar. “Well, we’d like to be the next Activision Blizzard,” Shiff said.

Casual games and their ascendancy as a popular medium (and their success as startups) isn’t new news: Peak Games sold to Zynga for $1.8 billion in 2020, which you could say was one of high watermark events to put the business opportunity, and specific technical execution needed, for casual games on the map. Following that, Turkey’s Dream Games (founded by Peak alums) has been growing quickly and earlier this year raised $255 million to continue its run. Homa Games — which makes a platform for third parties to develop publish casual games (thus somewhat of a competitor to Tripledot) — raised $50 million this past October. And Spyke, another one from the Turkey Peak stable, raised big money in January based on the pedigree and track record of their founders, before even launching a single title.

All the same, the subject of just how popular a casual game can become, how they can loop in in audiences that you don’t traditionally think of a gaming demographics, and how sometimes creating something that is the exact opposite of a calculated business decision and finding massive success from that all came into sharp focus, and gave some pause for thought, earlier this year with the emergence of Wordle, a very simple word puzzle that went stratospherically viral in January.

Started as a puzzle written for his partner by developer Josh Wardle, Wordle only ever existed on Wardle’s website (no app), and never paid for or made any kind of marketing effort, and yet in its simplicity, scarcity (only one puzzle every 24 hours) and just the right amount of challenge/reward mechanics, it took off and found fans among grannies, school kids and everyone in between. (My friend’s elderly mother plays it on a computer and shares her results only through very blurry photos she takes of her monitor since she doesn’t use a smartphone.)

As Wardle told us in an interview in January, he had some inbound calls from investors, but really was more surprised than prepared to think of what to do next (save for making sure the game could manage the sudden onslaught of traffic it was sending to servers) since he didn’t want to turn it into a “business.”

In the end, he sold Wordle to the New York Times, which is now hosting it and will fold it into its own quiet word-puzzle-based casual gaming empire (which is fitting, as it served as some of the inspiration for building Wordle in the first place).

Shiff said Tripledot didn’t consider buying Wordle but its founders respected what it highlighted about the use cases and possibilities of casual games.

“It’s my mom, my aunt, who are playing these,” he said. “They would never say they’re gamers but will spend an hour on these. Maybe for a mental break, or while waiting for the dentist, historically they might have used puzzle books but now play on their phones.”

Babayigit noted that Tripledot doesn’t have any plans to develop web-only games, or to put out titles simply for building audience without specific business purpose — all potential “lessons” one might take from the likes of Wordle: which at the end of the day was perhaps partly attractive for being a kind of unicorn — not the $1 billion startup kind, but the kind that exist in a bubble free of the trappings of reality where games need to make money to continue to be viable. One lesson it did take is that there seem to be many more avenues left for development and variation in the longer run.

“I think casual games are still underserved,” said Babayigit. “The recent launches of Dream, Wordle and others have unleashed 2 billion gamers into the world, and we think that people are now looking for other types of experiences and games. Wordle actually proves that. So many more games can be built for those audiences, it’s still pretty crazy.”

And this is what the investors see, too.

“Tripledot’s growth rate and efficacy in building successful and highly retentive games is unmatched,” said Stebbings. “The leadership of Tripledot is singular; they have built an operation that has been scaling up rapidly while keeping its commitment to quality and a great company culture that knows how to attract and retain the best talents in gaming. We are looking forward to being part of the Tripledot journey.”

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week, Natasha and Danny, otherwise known as your two new favorite Book influencers (inside joke, you’ll get if you listen to the show), hopped on the mics to take everyone threw the news, with Grace and Chris in the background.

Here’s what we got into:

Well, as you can tell, it’s been a busy writing and speaking week for your humble hosts. We’re grateful for the opportunity, and will be back in your ears on Monday.

Equity drops every Monday at 7:00 a.m. PST and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

P.S. We can’t wait to see you all at our live show next week. If you haven’t grabbed free tickets, GET THEM!

Harry Stebbings, the well-known podcaster behind ‘20 minute VC’, announced today that he raised a duo of funds for 20VC, the venture capital fund he launched off of his show’s success. The pair of funds – one for early-stage and one for growth stage – total to $140 million in assets under management, plucked from LPs including MIT, Spotify’s founder Daniel Ek and RIT Capital partners.

The total is a 15X increase from Stebbings’ inaugural $8.3 million fund, launched less than a year ago.

Stebbings said that his early-stage fund, 20VC Early, will invest checks between $250,000 to $750,000, while his growth-stage fund, 20VC Explorer, will invest in Series B onwards, with checks between $1 million to $5 million.

The 20VC portfolio already includes a few reported unicorns, including audio app Clubhouse and virtual event organizer Hopin. But, maybe more notable, is what his assumed success – as a 24 year-old who has won a spot in competitive deals and raised a massive venture capital fund – means for the way that tech is evolving.

First, media experience, and the ability to spout useful content in a noisy world, is being increasingly valued as an asset in the modernizing world of VC. This week, Andreessen Horowitz launched Future, a full-fledged media operation that will cover trends in startups and tech.Stebbings’ podcast, which has over 200,000 subscribers and 80 million downloads to date, has cultivated an audience by interviewing tech’s elite, from Twitter co-founder Biz Stone to Slack founder Stewart Butterfield and to A16z’s Angela Strange. Those connections getting leveraged into dollars is a proof point of this growing idea, and sometimes meme, that Twitter followers can help anyone start a rolling fund.

Which brings me to my second point, which is that Stebbings raising such a massive tranche of capital could quiet some of the worry around emerging fund managers being unable to, well, 15X their initial micro-funds. In other words: you might be able to get a few of your buddies to venture to throw some checks in, but how do you get a full endowment to sign on board? Based on recent conversations I’ve had with emerging fund managers, it’s hard to get institutions, the ones with real check-writing power, on board for new funds because they only have so much capital allocated toward venture. It’s even harder for diverse, underrepresented founders. Whether or not Stebbings is a one-off is unclear, but we do at least know that venture backers are viewing his rolodex as a key competitive advantage, and asset in the wild world of investing.

At the end of the day, media is venture and venture is media. Stebbings sits at the intersection of that trend, and with $140 million more, it will be interesting to see what he does next, and if returns come for the ride.