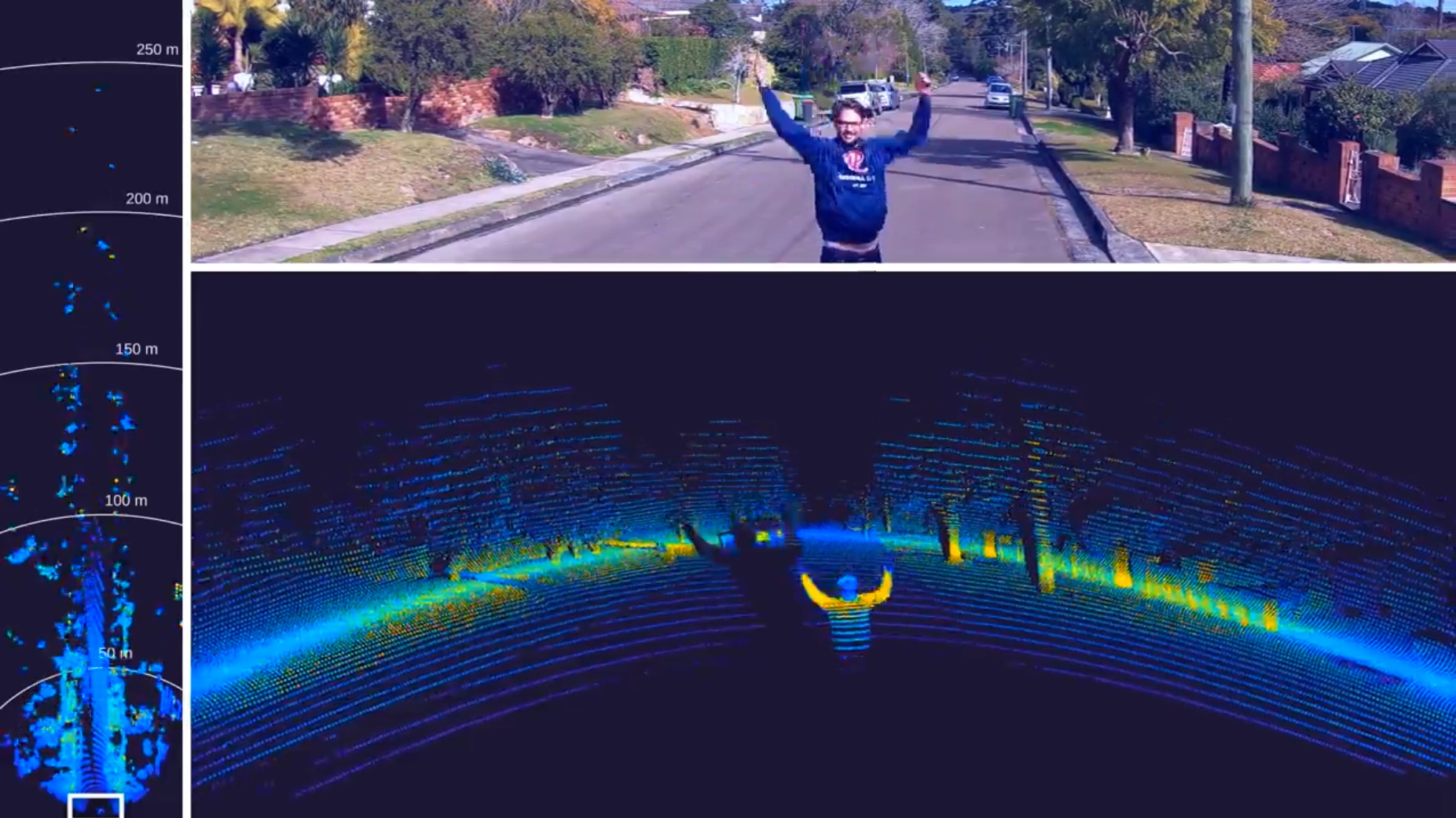

It seems like every company making lidar has a new and clever approach, but Baraja takes the cake. Its method is not only elegant and powerful, but fundamentally avoids many issues that nag other lidar technologies. But it’ll need more than smart tech to make headway in this complex and evolving industry.

To understand how lidar works in general, consult my handy introduction to the topic. Essentially a laser emitted by a device skims across or otherwise very quickly illuminates the scene, and the time it takes for that laser’s photons to return allows it to quite precisely determine the distance of every spot it points at.

But to picture how Baraja’s lidar works, you need to picture the cover of Pink Floyd’s “Dark Side of the Moon.”

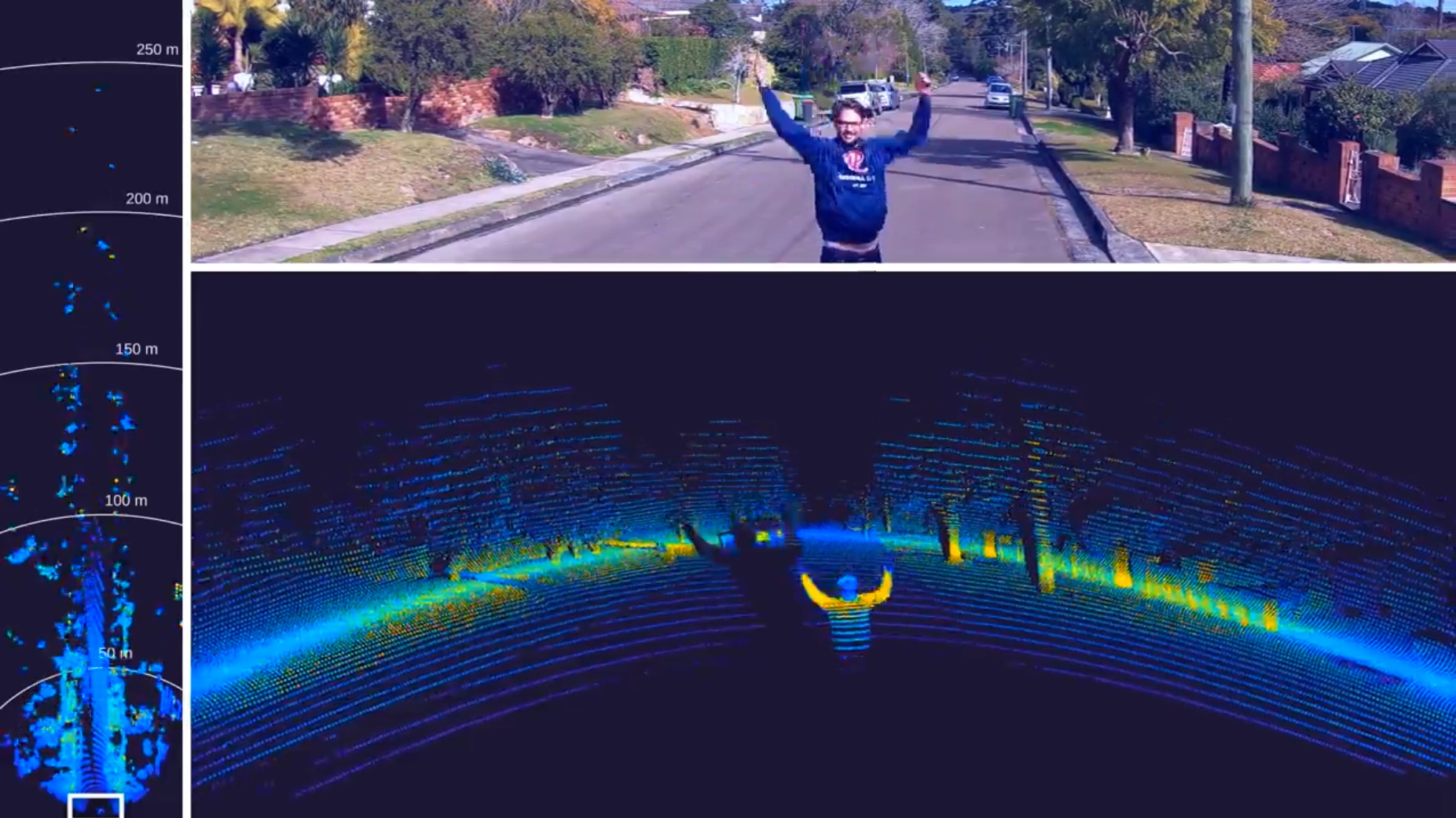

GIFs kind of choke on rainbows, but you get the idea.

Imagine a flashlight shooting through a prism like that, illuminating the scene in front of it — now imagine you could focus that flashlight by selecting which color came out of the prism, sending more light to the top part of the scene (red and orange) or middle (yellow and green). That’s what Baraja’s lidar does, except naturally it’s a bit more complicated than that.

The company has been developing its tech for years with the backing of Sequoia and Australian VC outfit Blackbird, which led a $32 million round late in 2018 — Baraja only revealed its tech the next year and was exhibiting it at CES, where I met with co-founder and CEO Federico Collarte.

“We’ve stayed in stealth for a long, long time,” he told me. “The people who needed to know already knew about us.”

The idea for the tech came out of the telecommunications industry, where Collarte and co-founder Cibby Pulikkaseril thought of a novel use for a fiber optic laser that could reconfigure itself extremely quickly.

“We thought if we could set the light free, send it through prism-like optics, then we could steer a laser beam without moving parts. The idea seemed too simple — we thought, ‘if it worked, then everybody would be doing it this way,’ ” he told me, but they quit their jobs and worked on it for a few months with a friends and family round anyway. “It turns out it does work, and the invention is very novel and hence we’ve been successful in patenting it.”

Rather than send a coherent laser at a single wavelength (1550 nanometers, well into the infrared, is the lidar standard), Baraja uses a set of fixed lenses to refract that beam into a spectrum spread vertically over its field of view. Yet it isn’t one single beam being split but a series of coded pulses, each at a slightly different wavelength that travels ever so slightly differently through the lenses. It returns the same way, the lenses bending it the opposite direction to return to its origin for detection.

It’s a bit difficult to grasp this concept, but once one does it’s hard to see it as anything but astonishingly clever. Not just because of the fascinating optics (which I’m partial to, if it isn’t obvious) but because it obviates a number of serious problems other lidars are facing or about to face.

First, there are next to no moving parts whatsoever in the entire Baraja system. Spinning lidars like the popular early devices from Velodyne are being replaced at large by ones using metamaterials, MEMS, and other methods that don’t have bearings or hinges that can wear out.

Baraja’s “head” unit, connected by fiber optic to the brain.

In Baraja’s system, there are two units, a “dumb” head and an “engine.” The head has no moving parts and no electronics; It’s all glass, just a set of lenses. The engine, which can be located nearby or a foot or two away, produces the laser and sends it to the head via a fiber-optic cable (and some kind of proprietary mechanism that rotates slowly enough that it could theoretically work for years continuously). This means it’s not only very robust physically, but its volume can be spread out wherever is convenient in the car’s body. The head itself can also be resized more or less arbitrarily without significantly altering the optical design, Collarte said.

Second, the method of diffracting the beam gives the system considerable leeway in how it covers the scene. Different wavelengths are sent out at different vertical angles; A shorter wavelength goes out towards the top of the scene and slightly longer one goes a little lower. But the band of 1550 +/- 20 nanometers allows for millions of fractional wavelengths that the system can choose between, giving it the ability to set its own vertical resolution.

It could for instance (these numbers are imaginary) send out a beam every quarter of a nanometer in wavelength, corresponding to a beam going out every quarter of a degree vertically, and by going from the bottom to the top of its frequency range cover the top to the bottom of the scene with equally spaced beams at reasonable intervals.

But why waste a bunch of beams on the sky, say, when you know most of the action is taking place in the middle part of the scene, where the street and roads are? In that case you can send out a few high frequency beams to check up there, then skip down to the middle frequencies, where you can then send out beams with intervals of a thousandth of a nanometer, emerging correspondingly close together to create a denser picture of that central region.

If this is making your brain hurt a little, don’t worry. Just think of Dark Side of the Moon and imagine if you could skip red, orange, and purple, and send out more beams in green and blue — and since you’re only using those colors, you can send out more shades of green-blue and deep blue than before.

Third, the method of creating the spectrum beam provides against interference from other lidar systems. It is an emerging concern that lidar systems of a type could inadvertently send or reflect beams into one another, producing noise and hindering normal operation. Most companies are attempting to mitigate this by some means or another, but Baraja’s method avoids the possibility altogether.

“The interference problem — they’re living with it. We solved it,” said Collarte.

The spectrum system means that for a beam to interfere with the sensor it would have to be both a perfect frequency match and come in at the precise angle at which that frequency emerges from and returns to the lens. That’s already vanishingly unlikely, but to make it astronomically so, each beam from the Baraja device is not a single pulse but a coded set of pulses that can be individually identified. The company’s core technology and secret sauce is the ability to modulate and pulse the laser millions of times per second, and it puts this to good use here.

Collarte acknowledged that competition is fierce in the lidar space, but not necessarily competition for customers. “They have not solved the autonomy problem,” he points out, “so the volumes are too small. Many are running out of money. So if you don’t differentiate, you die.” And some have.

Instead companies are competing for partners and investors, and must show that their solution is not merely a good idea technically, but that it is a sound investment and reasonable to deploy at volume. Collarte praised his investors, Sequoia and Blackbird, but also said that the company will be announcing significant partnerships soon, both in automotive and beyond.