Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

Global app spending reached $65 billion in the first half of 2022, up only slightly from the $64.4 billion during the same period in 2021, as hypergrowth fueled by the pandemic has decreased. But overall, the app economy is continuing to grow, having produced a record number of downloads and consumer spending across both the iOS and Google Play stores combined in 2021, according to the latest year-end reports. Global spending across iOS and Google Play last year was $133 billion, and consumers downloaded 143.6 billion apps.

This Week in Apps offers a way to keep up with this fast-moving industry in one place with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and much more.

Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters

Top Stories

Twitter gets editable… do we still care?

After years of user demand for an edit button, Twitter’s news this week that such a feature was now entering testing felt a little anticlimactic.

Twitter broke its own embargo over the impending launch. There weren’t any interviews. Instead, Twitter just casually noted the edit feature was being tested internally, it said in a tweet published ahead of its blog post announcement. Here’s a feature you wanted. I guess we’ll ship it.

And though the feature will roll out to users later this month, it won’t be broadly available. Instead, users can pay for a Twitter Blue subscription to access the edit feature, Twitter said. But only “some” Twitter Blue subscribers will even see the option, as it will still be in a test mode at first. Then there’s the fact that Twitter Blue subscribers have already been somewhat placated by the “Undo Tweet” feature — an option that lets you quickly unsend a tweet when you spot a typo. (It’s actually a delay to post, which makes the “unsending” possible.) This reduces the need for an edit button in many cases, as it turns out.

A true edit feature, meanwhile, introduces a layer of complexity on top of the increasingly cluttered social app. Although Twitter says the feature will have an edit log to minimize abuse, there’s concern that people will re-write tweets knowing that many won’t ever look at the past versions.

If anything, the demand for an edit button had become more a meme than a true user request. It was just sort of unfathomable to some Twitter users that a basic feature like this was not being built. But over the years, people have learned to work around the lack of editing. We’d delete and retweet things. We’d reply with a correction, cursing the lack of an edit button as we did. And then we moved on. Now Twitter wants everyone to pay for this long-requested functionality? Ouch.

Here come the BeReal clones

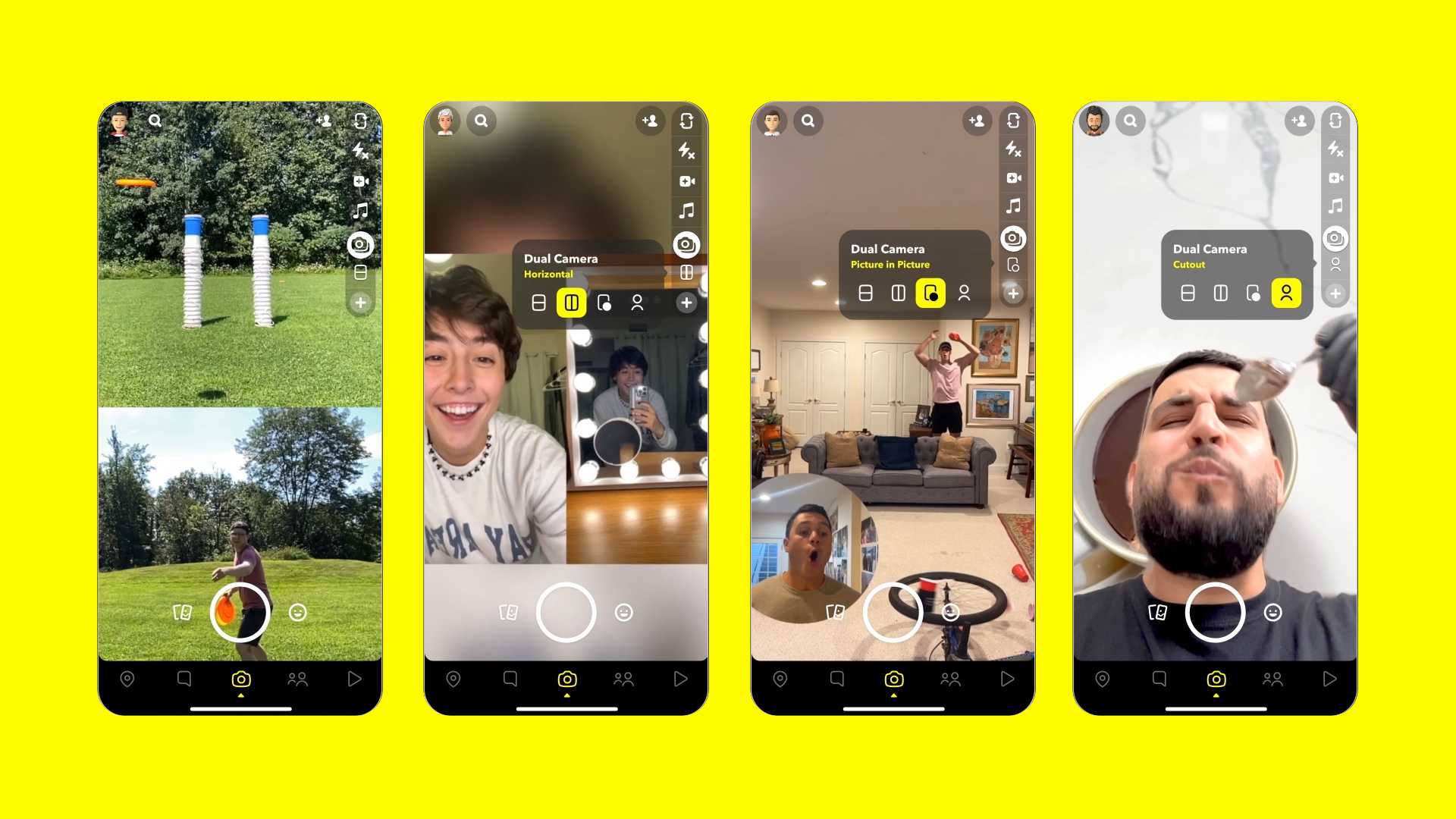

Image Credits: Snapchat

Remember when every social app was copying Snapchat’s Stories — Instagram successfully so? More recently, that sort of copy-and-paste development cycle has been focused on shoehorning a TikTok-like vertical video feed into every other social app, including Instagram and Facebook (Reels), YouTube (Shorts), Snapchat (Spotlight) and others — even Twitter gave it a shot for a time.

But now, the top social apps have set their sights on BeReal, the scrappy social app for unfiltered sharing that’s been sitting just a bit too long at the top of the App Store to keep calling it a “trend.” That has the major social platforms worried about the impact the newcomer is having on their respective user bases. In particular, BeReal seems to be succeeding in appealing to a younger, Gen Z audience in search of a more authentic social networking experience. It allows them to connect with their friends without all the embellishments that, for years, have been the hallmarks of social apps — filters, AR and advanced editing tools resulting in a curated, idealized feed. Instead, BeReal users are in search of imperfection — yet another nail in the coffin for the old “Instagram aesthetic” that’s since been replaced by intentionally poorly shot photos and lo-fi selfies.

Last week, we saw Instagram building out a new feature that’s clearly designed to be a BeReal clone, as it would send Instagram users a notification after which they’d have two minutes to capture and share an “IG Candid” photo to their Story. This is essentially the same mechanic BeReal uses today. Before that, it built a Dual camera feature that lets users shoot from both cameras at once. But that one missed the key component to BeReal’s draw: connecting with friends.

Now Snapchat is jumping on the BeReal bandwagon, with the launch of its own Dual Camera feature. Similar to BeReal, the new mode also lets users capture photos and videos from both their front and back cameras at the same time. But in its case, the app allows users to customize where and how their selfie photo appears — either picture-in-picture, in a horizontal or vertical side-by-side layout or in a unique “image cutout” mode. This latter option cuts out your selfie from the background, then overlays it on top of the footage from the back camera. This differentiates Snap’s feature from BeReal as it could inspire a different type of image-sharing experience to emerge.

It’s also the latest example of how advances in machine learning technologies have been allowing technology companies to do more with users’ photos. Apple, for instance, is introducing an image cutout feature in iOS 16 that lets you cut and paste the subject of a photo into other apps — like texting a picture of your dog’s image cutout in iMessage. This technology is also powering other areas involving photos across iOS — like the “copy subject” feature in mobile Safari or “remove background” in Files, for example.

Elsewhere, Pinterest’s buzzy new app Shuffles is also using image cutouts to allow users to grab images from their Pins for use in collages.

But whether or not an image cutout feature will prove a draw for Snapchat users is still unknown. After all, the dual camera photo-taking tech itself is not driving demand for BeReal — it’s the social connections it enables.

California advances an age-appropriate design code bill for apps

Lawmakers in California have passed a bill, the California Age-Appropriate Design Code Act, that would require apps and websites to increase protections for children, in the absence of any sort of federal standards. The legislation supports the implementation of a range of design changes and features across sites and apps. For instance, companies would have to turn on the highest privacy settings for minors by default — something apps like Instagram have begun doing for minor users (at least new ones), in anticipation of such legislation.

It would also restrict companies from collecting users’ precise locations — a privacy protection that, coincidentally, just went viral on TikTok, as users warned each other how to disable precise location for Instagram’s app in their phone’s Settings. This prompted Instagram head Adam Mosseri to refute the claims users were making, noting that the app was not actually tracking users or sharing their location with others.

Additionally, the bill calls for protections around data collection, prohibiting companies from collecting any data beyond what’s absolutely necessary or using the data collection in a way that would negatively impact the physical or mental health of minors. Apps and sites would also have to have the strongest privacy protections in place, disabling features that personalize the experience based on prior behavior or browsing history, which could affect numerous apps using recommendation algorithms, like TikTok. And it could restrict apps in other ways, like limiting messaging with strangers, and disallowing techniques designed to addict kids into spending hours with the service, among other things.

While such guidelines sound good on paper, the broad and vague language used in the bill could create complications in implementing some of the changes, critics have argued. In addition, privacy advocates pointed out that this could increase the use of age-verification tech, which often requires users to submit personal data in order to use a service.

If signed into law by Governor Gavin Newsom, the bill could become law by 2024.

Weekly News

Platforms: Apple

- Ahead of next week’s event, Apple released iOS 16, beta 8 to developers with additional bug fixes and performance improvements.

- It also rolled out Xcode Cloud subscriptions to developers using Xcode 13.4.1 or later and are members of the Apple Developer Program. The subscription offers 25 compute hours per month for free (until the end of 2023 when it will become $15/mo). Pricing kicks in starting at $49.99/mo for 100 hours and goes up to 1,000 compute hours at $400/mo. Account holders can start, upgrade or downgrade a subscription at any time, Apple says.

- An app developer’s lawsuit over App Store rejections, scams and fraud has ended in a settlement agreement after court filings show a request to dismiss the suit earlier this summer. The plaintiff, app developer and former Pinterest engineer Kosta Eleftheriou, made a name for himself in recent months calling out some of the worst App Store scams. This later culminated in a lawsuit of his own against Apple, filed in California’s Superior Court in Santa Clara County in March 2021, where he alleged his own app had been unfairly rejected from the App Store and then later targeted by scammers, leading to lost revenues. Terms of the settlement were not disclosed.

Platforms: Google

- Google blocked Trump’s social media app, Truth Social, from launching on the Play Store over its content moderation issues. Specifically, Google found the app contained physical threats and incitements to violence, which are banned by its policy. But the app remains live on iOS despite hosting some of the same dangerous content in violation of Apple’s rules. Meanwhile, Google has now reinstated the Parler app to the Play Store after initially removing it over similar content moderation issues following the January 6 Capitol attack.

- Google rolled out third-party in-app billing in the Play Store to additional markets, including India, Australia, Indonesia, Japan and the European Economic Area, making the option available to end users. Interested non-gaming developers can apply for the program and, if they qualify, will be able to use third-party payment systems in their apps. The company announced the program earlier this year. It notes that “reasonable service fees” will still apply to those who make the switch, but didn’t disclose the percentages involved.

E-commerce

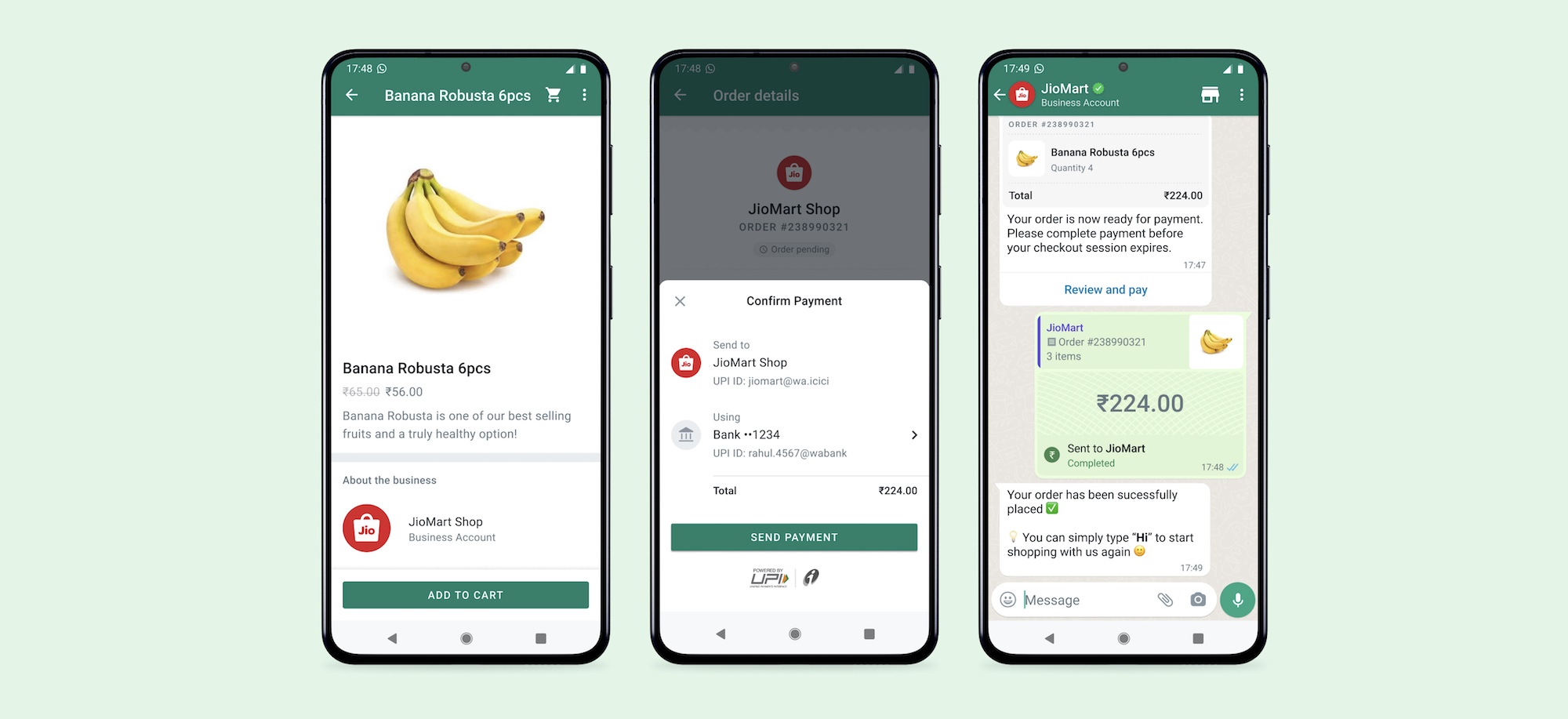

Image Credits: WhatsApp

- Meta partnered with India’s Reliance Retail and Jio Platforms to bring grocery shopping to WhatsApp. The launch will allow customers in India to browse JioMart’s grocery catalog on WhatsApp, then add items to a cart and make the payments via local payments rail UPI without leaving the messaging app.

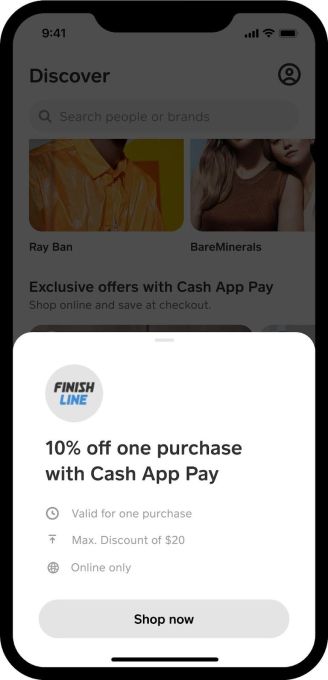

- Block’s Cash App will now allow users to make payments on e-commerce sites outside the Square network, including with new partners American Eagle, Aerie, Tommy Hilfiger, Finish Line and JD Sports. Other merchants will join in the following months, like Romwe, Savage x Fenty, SHEIN, thredUP and Wish.

Social

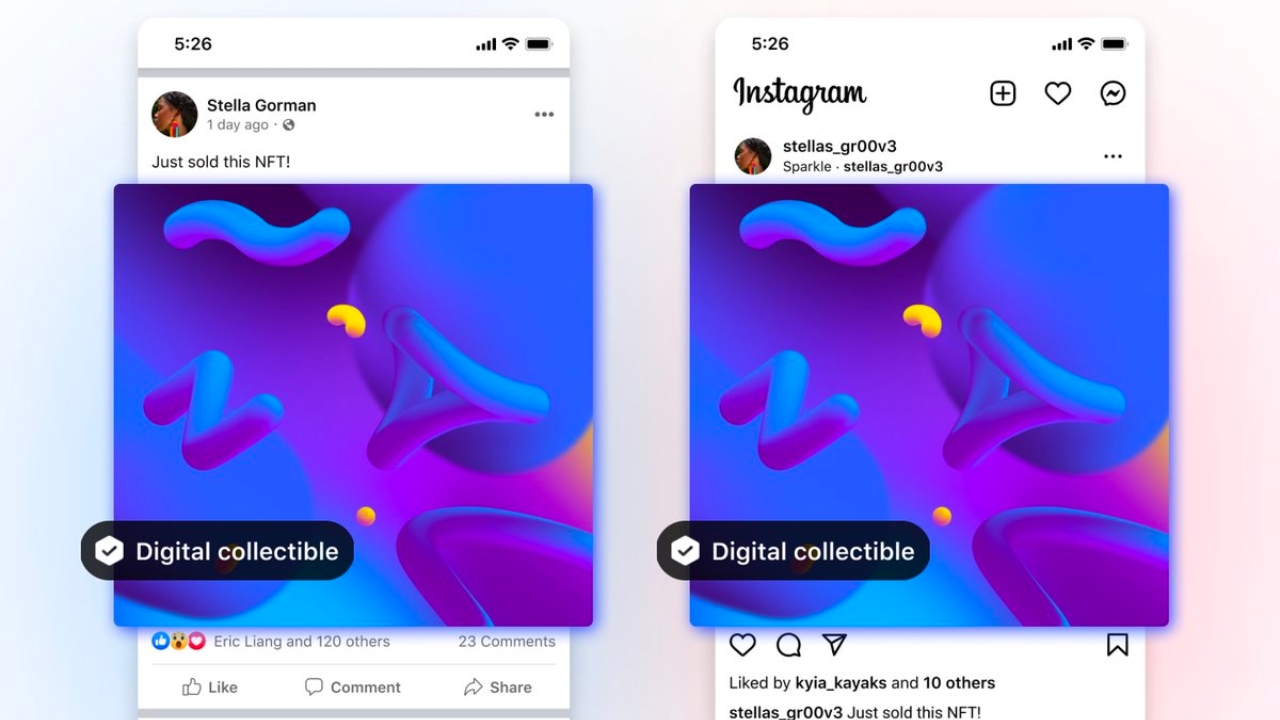

Image Credits: Meta

- Facebook and Instagram now let users post NFTs to their profiles by connecting their wallets, like Rainbow, MetaMask, Trust Wallet, Coinbase Wallet and Dapper Wallet. NFTs minted on the Ethereum, Polygon and Flow blockchains are supported.

- Facebook said it’s shutting down its Nextdoor clone called Neighborhoods next month after realizing that Facebook Groups was actually just fine for this purpose. It also recently shut down live shopping and its standalone gaming app.

- Instagram began testing new features that will help users better control what they see on the app. This includes the option to mark multiple posts on the Explore page as “Not Interested,” and another option that will let you tell Instagram you want to stop seeing posts with content you’re no longer interested in.

- Twitter launched its “close friends” feature, Twitter Circle, to global users. The feature allows users to add up to 150 people to their Twitter Circle in order to make some tweets available only to those they know and trust instead of to the wider public.

Image Credits: Twitter

- Twitter was reportedly working on an OnlyFans competitor, The Verge reported, but ended those efforts due to issues with CSAM on the platform.

- TikTok laid off employees from its U.S. ad department, amid a restructuring, The Information reported. The head of the ad sales team, former Meta executive Blake Chandlee, had forewarned about layoffs earlier this month.

- Snap also confirmed it would lay off around 20% of its 6,400-plus staff, after The Verge reported on its plans. The company also said it would cancel its original shows and in-app games, and would shut down its Zenly and Voisey apps. The Zenly shutdown is most surprising, given the app is still fairly popular with 35 million MAUs.

- Last summer’s hit social app Poparazzi’s parent company, TTYL, is prepping a new social app that adds the ability for users to post not only photos but also videos, and answers to questions and prompts to their friends’ profiles. The app, called Made With Friends, is due out in October.

Image Credits: Made With Friends

Messaging

- Google brought back the Duo icon with an update to its Google Meet Android app after recently consolidating the Meet and Duo apps, making “Meet” the surviving brand. The company said this would help people who were searching for “Duo” to find and launch the newly merged application.

- An Indian court ordered Telegram to disclose details of channels violating copyright in a lawsuit filed by a teacher. The teacher shared a list of channels circulating her lectures and books on competitive exams, which were being sold on these channels at discounted prices, she said.

- Researchers at the University of Washington made an underwater communication app, AquaApp, that uses sonic signals to pass messages. The system uses the phone’s speaker to create high-frequency audio signals to communicate.

Streaming & Entertainment

- Alongside its announcement of NBC’s Dateline as its latest podcast subscription, Apple shared that the number of Apple Podcast subscribers had grown by 300%+ since June 2021 and 25%+ of the top 100 shows in its Top Shows chart now offer a subscription.

- Sony Music sued Triller over copyright infringement after missing payments, its lawsuit alleges.

- Netflix snatched up two Snap executives to lead its new ad-supported business: Chief Business Officer Jeremi Gorman and VP of Sales for the Americas Peter Naylor, according to The Verge.

Dating

- Video dating app Filter Off described to TechCrunch how it used GPT-3 to create a number of chatbots combined with a script to create human-like faces to trick scammers into interacting with fake dating app profiles. These profiles weren’t seen by normal app users, only by those the algorithm identified as scammers. This ended up with scammers trying to scam each other or scam other bots. Read the full story here.

Gaming

- Facebook is shutting down its standalone Facebook Gaming app on iOS and Android on October 28, 2022 and will transfer games, content and groups over to the main Facebook app. The move comes as the company prioritizes its investments around discovery and recommendations in the main Facebook feed, leading to other closures like live shopping and its specialized neighborhood groups product.

- Epic Games defeated another copyright infringement lawsuit over its Fortnite dances. This one had claimed Fortnite ripped off a choreographer’s routine for the “It’s Complicated” emote in the game. A judge ruled the two dances didn’t share enough creative elements for the emote to be considered infringement.

- Meta renamed its Oculus Mobile app to “Meta Quest” as its continues it transition away from the Oculus branding to take on the Meta name.

Health & Fitness

- Streaming music service Deezer entered the wellness market with the launch of an app called Zen featuring guided yoga, meditation and other inspiration that can be recommended based on mood or goals. The app will roll out more broadly in 2023, offering the company the opportunity to cross-sell content, it said.

Utilities

- Keyboard tech licensing startup Fleksy expanded its SDK to indie devs and app makers who want to add more text input features — like text input autocorrection, prediction and swipe — to their apps.

- Truecaller released an update to its iOS app featuring better spam detection, faster performance, quick onboarding and a smaller app size. The new app also addresses user concerns over call detection and spam identification that had previously worked better on Android.

Travel & Transportation

- Uber updated its app with new safety features, including a new way to text 911 and others in partnership with ADT. Now, tapping the shield-shaped icon will bring up four options: contact 911, contact an ADT safety agent, share trip status or report a safety issue to the company.

Government & Policy

- The U.S. Department of Justice is in the early stages of drafting an antitrust lawsuit against Apple, according to sources cited by Politico. While the report suggested a potential suit could arrive by the end of the year, it also stressed that a final decision about if or when to sue Apple had not yet been made.

- The U.S. Federal Trade Commission (FTC) filed a lawsuit against data broker Kochava Inc. for selling geolocation data from “hundreds of millions of mobile devices,” it says, which could be used to trace the movements of individuals, including those to and from sensitive locations.

Security & Privacy

- Microsoft revealed how a high-severity vulnerability impacted TikTok users on Android. Though now patched, the vulnerability could have allowed attackers to take over user accounts that clicked on a malicious link.

Funding and M&A

Sony acquired mobile game developer Savage Game Studios for an undisclosed sum. The company will join Sony’s newly created and independently operating PlayStation Studios Mobile Division, which will focus on creating games based on new and existing PlayStation IP.

Sony acquired mobile game developer Savage Game Studios for an undisclosed sum. The company will join Sony’s newly created and independently operating PlayStation Studios Mobile Division, which will focus on creating games based on new and existing PlayStation IP.

OneSignal, a startup that helps businesses automate SMS, email and in-app campaigns, raised $50 million in Series C funding, led by BAM Elevate. The company has raised $80 million to date and counts around 6,000 paying customers.

OneSignal, a startup that helps businesses automate SMS, email and in-app campaigns, raised $50 million in Series C funding, led by BAM Elevate. The company has raised $80 million to date and counts around 6,000 paying customers.

Investing app Landa, which lets users make fractional investments in rental properties, emerged from stealth with an $8 million seed and $25 million Series A, co-led by NFX, 83North and Viola. To date, users have invested in around 400 properties in the app across NYC and Atlanta. It’s soon launching in Charlotte, Birmingham, Tampa, Orlando and Jacksonville, Florida.

Investing app Landa, which lets users make fractional investments in rental properties, emerged from stealth with an $8 million seed and $25 million Series A, co-led by NFX, 83North and Viola. To date, users have invested in around 400 properties in the app across NYC and Atlanta. It’s soon launching in Charlotte, Birmingham, Tampa, Orlando and Jacksonville, Florida.

PsycApps, a gamified mental health app for teens and adults, raised $1.7 in seed funding from U.S.-based Morningside Ventures. The startup has been through clinical trials, allowing it to secure contracts with schools in the U.K., including Regional College and Paragon Skills.

PsycApps, a gamified mental health app for teens and adults, raised $1.7 in seed funding from U.S.-based Morningside Ventures. The startup has been through clinical trials, allowing it to secure contracts with schools in the U.K., including Regional College and Paragon Skills.

Reddit acquired audience contextualization company Spiketrap to boost its ads business for an undisclosed sum. Reddit says Spiketrap’s AI-powered contextual analysis and tools will help Reddit to improve in areas like ad quality scoring and will boost prediction models for powering auto-bidding.

Reddit acquired audience contextualization company Spiketrap to boost its ads business for an undisclosed sum. Reddit says Spiketrap’s AI-powered contextual analysis and tools will help Reddit to improve in areas like ad quality scoring and will boost prediction models for powering auto-bidding.

Grocery delivery app Instacart is acquiring Eversight, an AI-powered pricing and promotions platform for Consumer Packaged Goods (CPG) brands and retailers, for an undisclosed sum.

Grocery delivery app Instacart is acquiring Eversight, an AI-powered pricing and promotions platform for Consumer Packaged Goods (CPG) brands and retailers, for an undisclosed sum.

Triller reportedly raised $200 million in debt and equity per a report by The Wrap, and is targeting a $3 billion valuation in its expected IPO this year.

Triller reportedly raised $200 million in debt and equity per a report by The Wrap, and is targeting a $3 billion valuation in its expected IPO this year.

Downloads

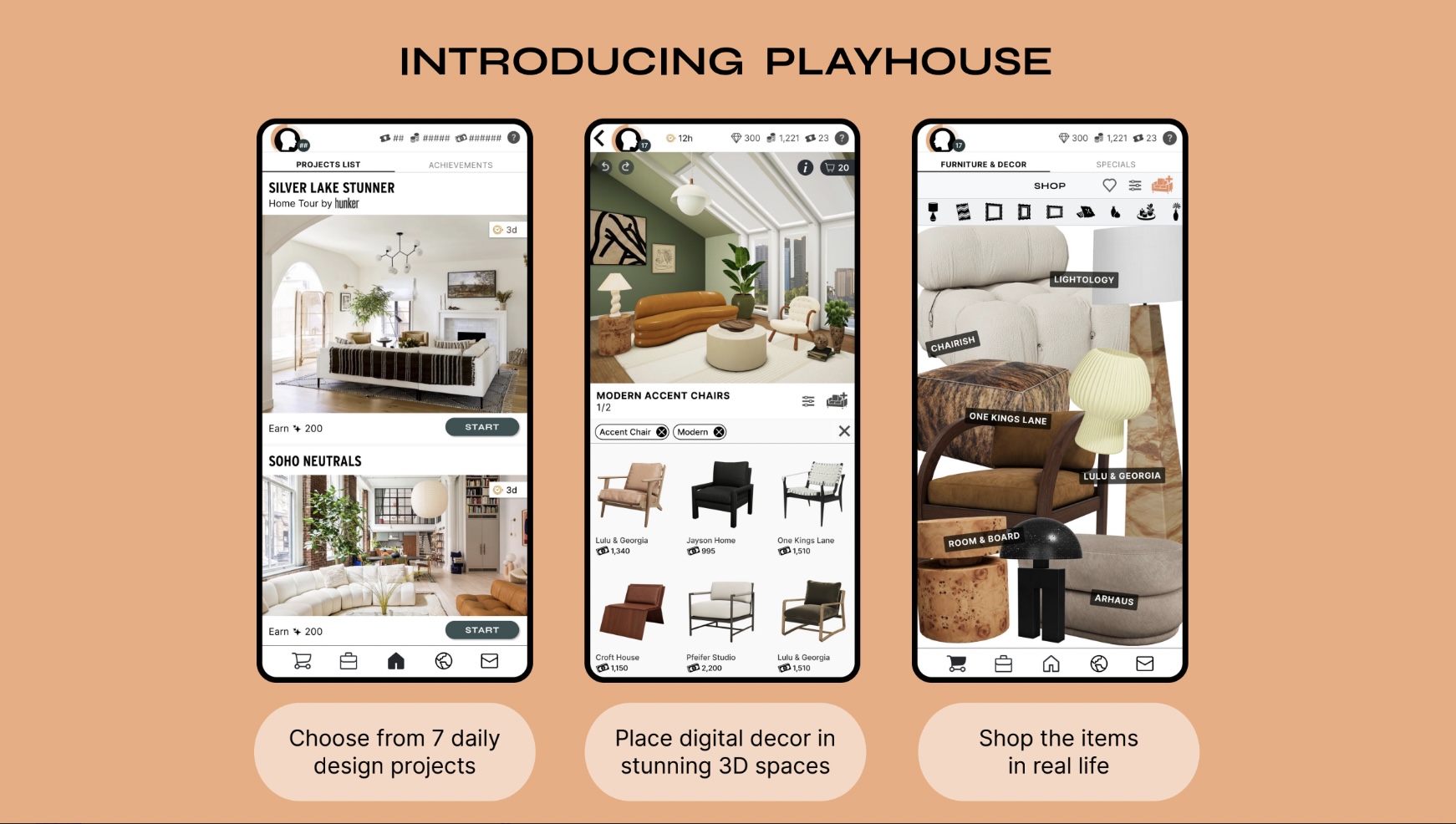

Robin Games’ PLAYHOUSE

Image Credits: Robin Games

Women-led mobile gaming startup Robin Games raised funding around the idea of carving out a new niche in the market of “lifestyle gaming” by creating a fantasy gaming experience that’s more sophisticated and stylish — something more in line with the sort of content you’d typically find in a lifestyle magazine or Instagram influencer’s profile. This week, the startup released its first title to tackle this concept with the launch of a mobile game, PLAYHOUSE, which combines both gameplay and shopping in one experience.

Available on iOS and Android, PLAYHOUSE is a DIY design game that allows players to drag-and-drop furniture and décor into spaces to create original looks for rooms using elements like wall art, sofas, chairs, tables, plants and more. Unlike some competing design games, the pieces can be moved, rotated, resized or layered to create a unique look. But what makes this experience even more interesting is that users can shop the items in the game by clicking through to the retailer’s website. At launch, it’s partnering with over 100 brands like Arhaus, Article, 1stDibs, Chairish, One Kings Lane, ABC Carpet & Home, Jenni Kayne, Society6, Bloomscape, Room & Board and Lulu & Georgia, and others.

The app monetizes as a free-to-play title with in-app purchases, however, not affiliate commissions. (Read the full review on TechCrunch.)

Duolingo’s new Math app (waitlist)

Language learning app maker Duolingo has launched its latest creation, Duolingo Math, announced during its Duocon conference — after first being teased at the event the year prior. Similar to how Duolingo turns language learning into mini-games, the new app will teach third-grade math to users in a snack-sized experience aimed at making learning fun and accessible. The company says the new app will initially be available to iPhone and iPad users who sign up for the waitlist.

Add other's IG Candid to your story tray. And everyday at a different time, get a notification to capture and share a Photo in 2 Minutes.

Add other's IG Candid to your story tray. And everyday at a different time, get a notification to capture and share a Photo in 2 Minutes.  for clarity. Location Services is a device setting on your phone, not a new feature from Instagram, and it powers things like location tags. We don’t share your location with other people.

for clarity. Location Services is a device setting on your phone, not a new feature from Instagram, and it powers things like location tags. We don’t share your location with other people.