Risk defense startup SpecTrust is emerging from stealth today with a $4.3 million seed raise and a public launch.

Cyber Mentor Fund led the round, which also included participation from Rally Ventures, SignalFire, Dreamit Ventures and Legion Capital.

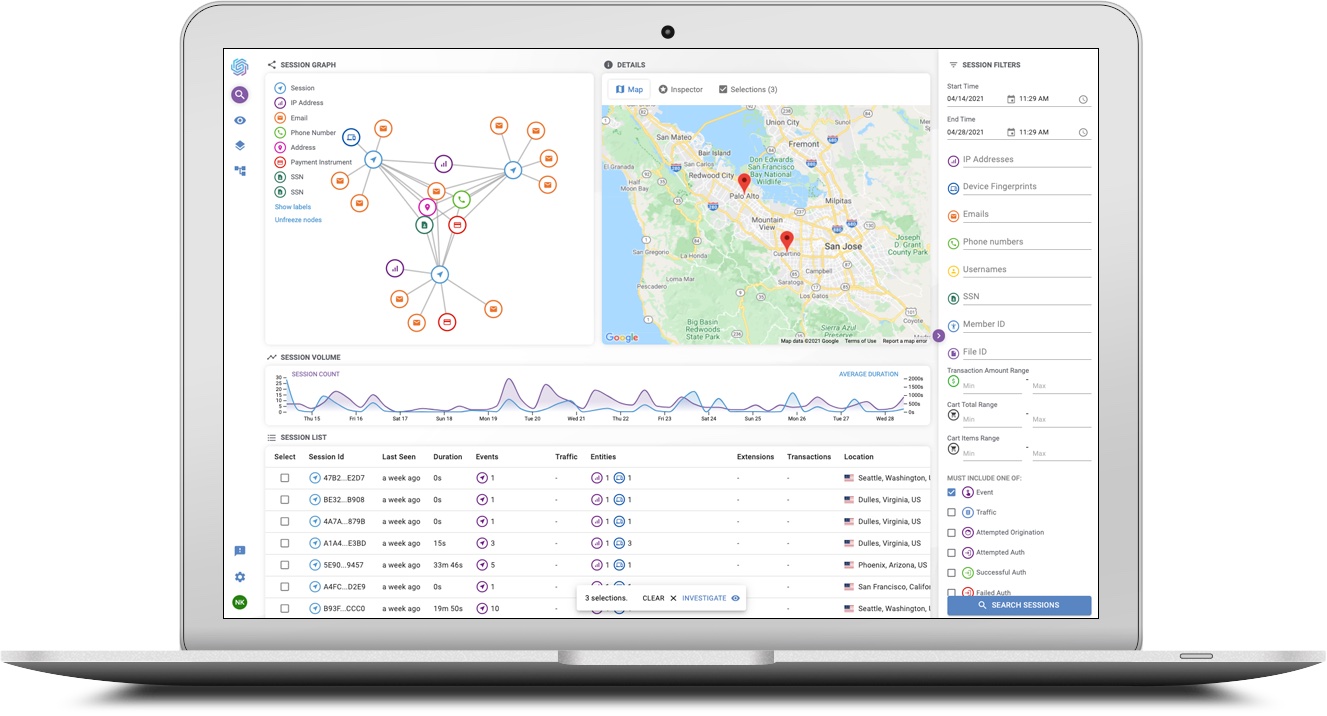

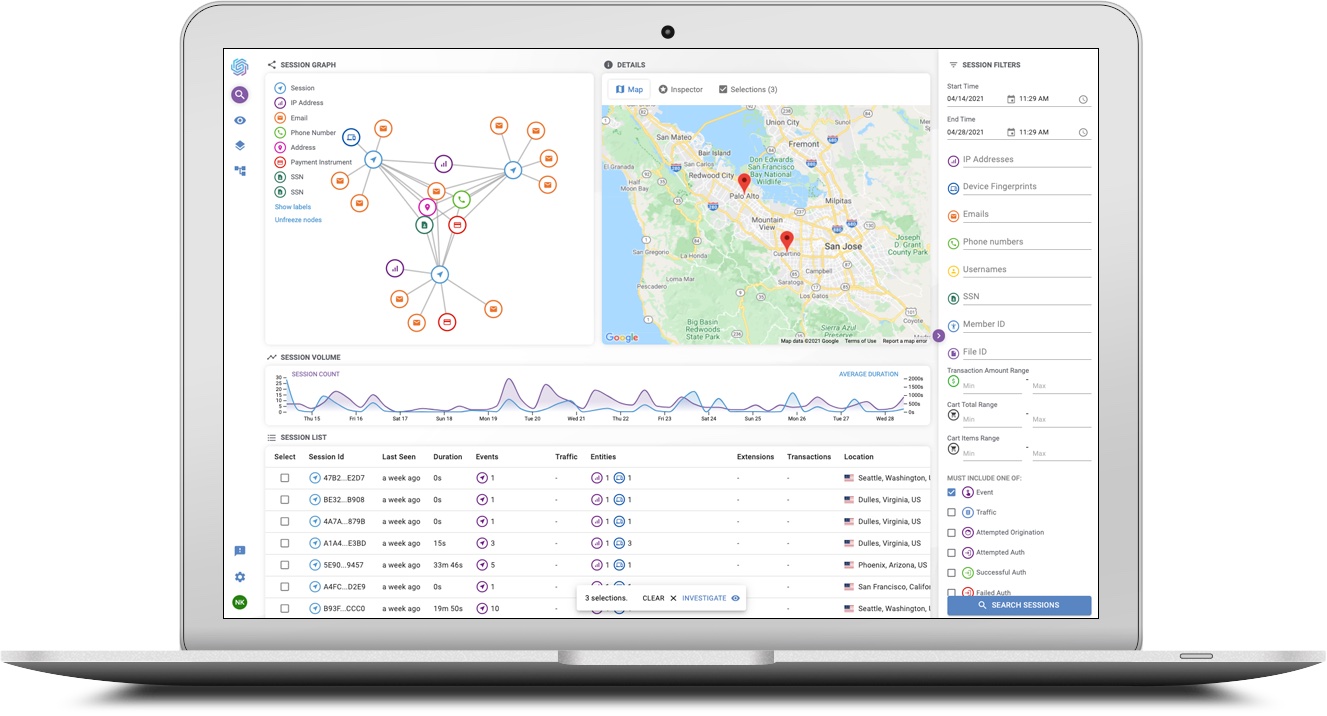

SpecTrust aims to “fix the economics of fighting fraud” with a no-code platform that it says cuts 90% of a business’ risk infrastructure spend that responds to threats in “minutes instead of months.”

“In January of 2020, I got a bug in my ear to, instead of an API, build a cloud-based service that handles all this complex orchestration and unifies all this data,” said CEO Nate Kharrl, who co-founded the company with Bryce Verdier and Patrick Chen. “And, it worked. And it worked fast enough that you can’t even tell it’s there doing its work.”

For example, he says, SpecTrust even in its early days was able to pull identity behavior information in seconds.

“Today, it’s more like five and seven milliseconds,” he said. “And, engineers don’t have to lift anything or adjust data models.”

Since the San Jose, California-based startup’s offering is deployed on the internet, between a website or app and its users, an organization gets fraud protection without draining the resources of its engineers, the company says. Founded by a team that ran risk management divisions at eBay and ThreatMetrix, SpecTrust is banking on the fact that companies — especially financial institutions — will be drawn to the flexibility afforded by a no-code offering.

Much of the industry is split up between compliance and onboarding, authenticating risk and payments, and user trust and safety, Kharrl said.

“We put all the tools together to address all things combined, to make sure the person an institution is talking to is who they say they are, and not acting with malicious intent,” he told TechCrunch. “We sit in between them and their traffic to make sure the risk and fraud teams have what they need to spot bad guys.”

Image Credit: SpecTrust

Online businesses spend billions on risk defense yet still lose a lot of money to fraudsters, scammers and identity thieves, Kharrl said. And, the COVID-19 pandemic led to a global shift in the digital economy as more people came to rely on the internet to meet day-to-day needs.

“With these new trends in commerce and banking came more opportunities for fraudsters, scammers and identity thieves to target people and businesses,” he added. For example, an alarming number of cybercriminals employed no-code attack tools and click-to-deploy infrastructure to launch sophisticated attacks.

Fintech and crypto companies are feeling the biggest impacts, as legacy software designed for big banks, for example, can be slow and expensive, said Kharrl.

“We built SpecTrust to instantly put complete assessment, automation and enforcement capabilities in the hands of teams charged with fighting modern cybercrime threats,” he said.

Using its platform, the company says an organization’s risk team can review and investigate everything a customer does “from its first page view to its last click with unified behavior, identity, history and risk data.”

Even non-technical staffers can do things like identify attack behavior, verify customer identity information, validate payment details and work to mitigate threats before they become losses, according to Kharrl.

Jon Lim of SignalFire says that SpecTrust has built an end-to-end risk protection platform that enables customers of all sizes and risk profiles “to access the latest innovative risk protection solutions, quickly respond to the evolving threat landscape and share the best practices and learnings across the entire customer base.”

And of course, it was drawn to the startup’s no-code platform and ability to provide visibility over every user interaction versus treating each interaction as an independent event.

“This not only delivers stronger protection to customers but also a smoother experience to the end user,” Lim said.

The fraud prevention space is hot these days. Sift, which also aims to predict and prevent fraud, in April raised $50 million in a funding round that valued the company at over $1 billion.