Access to global supply chains can be difficult for small businesses in Latin America, but companies like Meru, which raised funding in March to source and import goods between Mexico and China, and now more recently Pandas, are tapping into overseas relationships and technology to make this easier.

In Pandas’ case, the company is doing something similar to Meru, but starting in Colombia, connecting small businesses directly with Asian manufacturers, so that they can reduce the high fees often imposed by half a dozen importers and intermediaries as well as logistical problems that all businesses are facing right now where inventory is now taking many more months to arrive than during pre-pandemic times.

Co-founders Rio Xin and Marcos Esterli started Pandas just three months ago to provide Asian-origin inventory to micro-businesses in Latin America. Their collective background includes careers at McKinsey and Treinta for Esterli, and McKinsey, with more than seven years spent in China, for Xin, where he told TechCrunch he developed a strong network in the region.

“The main issue that we’ve seen is people who don’t understand the Chinese language or how Chinese manufacturers work and then you add in the logistical problems,” Xin added. “We are able to bridge the breach, while at the same time having our team in China to overcome all these logistics problems.”

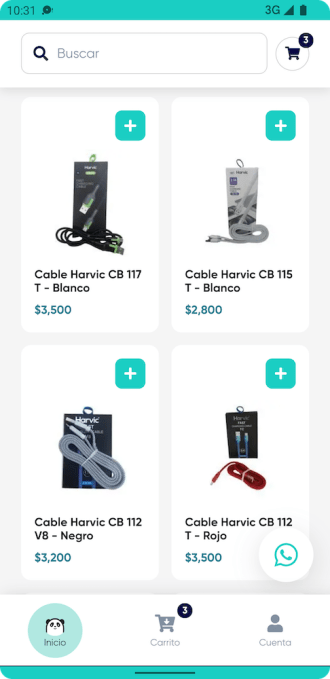

Pandas B2B marketplace. Image Credits: Pandas

Here’s how it works: Businesses order products via the Pandas marketplace, touting lower pricing, in which the business can make purchases in a few clicks. Pandas takes it from there, offering one-day-delivery and customer support.

Esterli explained that people in Latin America have been using smartphones for their personal finances and other tasks, but that has not translated as quickly to the business side.

“A lot of customers told us Alibaba was something they wanted to use, but that it was very complicated to figure out,” he added. “We wanted to build an easy solution that was super intuitive because business owners don’t have that time to spend.”

Initially providing basic electronics products — think headphones, accessories and cables — and with a new round of funding, $5.8 million pre-seed, Pandas will move into categories like textiles and home accessories. The company touts the pre-seed investment as “the largest pre-seed financial in Spanish-speaking LatAm to date.”

Third Kind Venture Capital led the round and was joined by Acequia Capital, Picus Capital, Tekton Ventures, Partech, Liquid2 Ventures, Clocktower Technology Ventures, Gaingels and a host of individual investors, including Tul’s Juan Carlos Narvaez, Jose Jair Bonilla from Chiper, Treinta’s Man Hei and Lluís Cañadell, Pablo Viguera from Belvo, Nowports’ Alfonso de los Rios, Sujay Tyle from Merama and Ironhack’s Gonzalo Manrique.

So far in its young journey, the company is growing 100% month over month and has amassed a supplier network of about 300 out of 5,000 in China, Xin said.

In addition to moving into those new inventory categories, the new capital will enable Pandas to scale its operations, technology and product development and make new hires.

Xin expects to be in most of the main markets across Latin America in the next three years. In the meantime, new features coming down the pipeline in the next 12 months include a suite of fintech and analytics tools like financing.