Through telemedicine and direct-to-consumer sales platforms, startups are streamlining the historically arduous process of accessing contraception.

The latest effort to secure a significant financing round is The Pill Club, an online birth control prescription and delivery service. Consumer-focused investor VMG Partners has led its $51 million Series B, with participation from new investors GV and ACME Capital (formerly known as Sherpa Capital), and existing investors Base10 Partners and Shasta Ventures. The Pill Club declined to disclose its valuation.

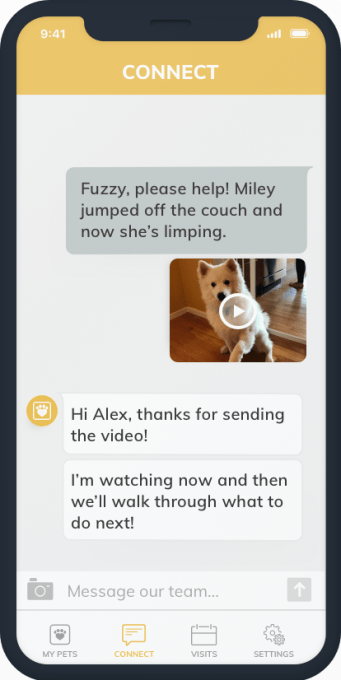

Launched in 2016 in San Carlos, California, The Pill Club couples healthcare services with at-home delivery, reaching customers in all 50 states. With a team of doctors, nurses and patient care coordinators, the startup operates its own pharmacy and is licensed to prescribe medication in 35 states. With the new funding, which brings its total raised to $67 million, founder and chief executive officer Nick Chang said he plans to scale the business 50 percent and expand its prescription service across the entire U.S.

“At the end of the day, our company is about empowering women,” Chang told TechCrunch. “What does that mean? It means empowering our patients to make their own healthcare decisions and making reproductive healthcare more common — something to not be shy about or worried about.”

Chang, who has spent his career in medicine and holds an M.D. from Duke University, previously founded Ganogen. The business, which sought to facilitate patient’s access to organ donors, ultimately shut down but was a catalyst to The Pill Club’s formation, as were experiences from Chang’s youth.

“I [grew] up with an older sister who was on birth control since she was 14 for menstrual regulation,” Chang said. “She really felt embarrassed to pick up the medication and to talk to anyone about it and that was really insightful for me. There are so many hurdles in accessing birth control besides clinics being around.”

Some 67 million women between the ages of 13 to 44 live in the U.S.; 19 million of them live in contraceptive deserts, or areas that lack reasonable access to public clinics. The Pill Club wants to eliminate those deserts, as do other companies in the digital health arena.

Digital health has remained one of the hottest destinations for VC investment. In 2018, investors put about $4.5 billion into U.S. companies in the sector, a 17 percent increase year-over-year, according to PitchBook data. Telemedicine startups garnered a record $1.25 billion in funding in that timeframe thanks to large financings for industry leader Oscar, a health insurance startup that raised $540 million in 2018 alone; as well as an $88 million Series A for newcomer Roman, which offers a cloud pharmacy for erectile dysfunction.

Startups focused on women’s health, meanwhile, have continued to garner more attention from VCs. These companies, including The Pill Club and comepetitor Nurx, have not only benefited from the rapid rise of telehealth, but also from a societal shift sparked in part by President Donald Trump and Republican lawmakers’ attempts to limit women’s access to birth control.

“People want to talk about this,” Chang said. “With so much happening from Hollywood to politics … it’s really got some people to say ‘ok, we really need to talk about what we are prioritizing as a society.'”

In addition to accelerating the expansion of its 260-person team, The Pill Club plans to use the investment to explore launching more services within women’s healthcare and to broaden the educational content it offers its customers.

“This is just the beginning of a much broader and bigger movement,” Chang said.