Tyto Care, a telehealth company that enables physicians to conduct on-demand remote exams, announced today that it has added $9 million to its Series C, bringing the round’s total to $33.5 million. The new funding comes from strategic investors Sanford Health, Itochu, and Shenzhen Capital Group. First announced last year, the oversubscribed Series C was led by Ping An Global Voyager Fund, run by the Chinese financial conglomerate.

Itochu, Shenzhen Capital Group, and Sanford Health, the largest rural not-for-profit health care system in the United States, will serve as Tyto’s new strategic partners as it expands in Japan, China, and the U.S., its largest market. The New York-based company has now raised $54 million to date.

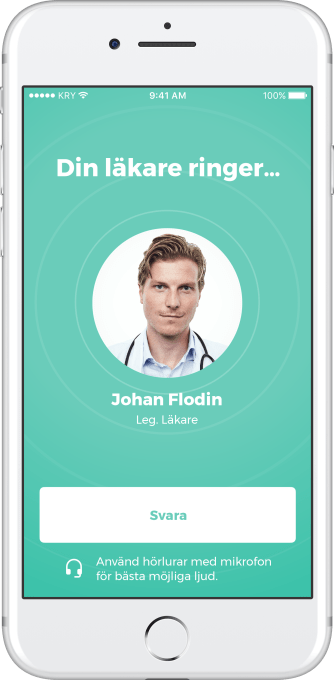

Tyto’s telehealth service combines a set of connected hardware that patients keep at home and video calls with doctors. Called TytoHome, the small handheld tools are used to examine the heart, lungs, throat, ears, skin, abdomen, heart rate, and body temperature of a patient, enabling doctors to assess their condition remotely and decide if they need further medical care. Tyto also integrates with third-party tools for blood pressure, blood oxygen saturation, and weight scales. Patient data can be aggregated into Tyto’s data platform, which the company says will eventually be used to help with diagnosis and health alerts.

Remote health exams are especially helpful for children, elderly people, patients with chronic conditions, and patients recovering from operations who need frequent monitoring. In an email, CEO and co-founder Dedi Gilad told TechCrunch that the company also targets rural areas that have limited access to healthcare facilities or are affected by the global shortage of physicians.

The U.S., Japan and China “are all turning to digital health technology to help solve a myriad of public health issues, including expensive healthcare and aging and dense populations,” Gilad said.

Founded in 2012, the company launched in the U.S. in 2017 after receiving clearance from the Food and Drug Administration, and in 2018 in Canada after it also received regulatory approval there. Because of different healthcare systems and regulations in each of its markets, the company expands in new markets like Japan and China through strategic partnerships with health systems, telehealth companies (including Ping An Good Doctor in China, which has 170 million users), large private practices, and self-insured employers. So far it has struck partnerships with 50 health organizations.

Tyto’s new funding will be used to find new partners in the U.S. and expand into new markets in Europe and Asia. It also plans to add new modular exam tools for home diagnostics and remote monitoring.

In statement, Shenzhen Capital Group chairman Zewang Ni said “Tyto Care’s mission of making high-quality healthcare accessible from the comfort of home is crucial, especially in China. We believe that telehealth will significantly improve the lives of Chinese consumers, whether they are parents with sick children at home, elderly patients facing chronic illnesses, or citizens living in remote areas with less access to medical care.”