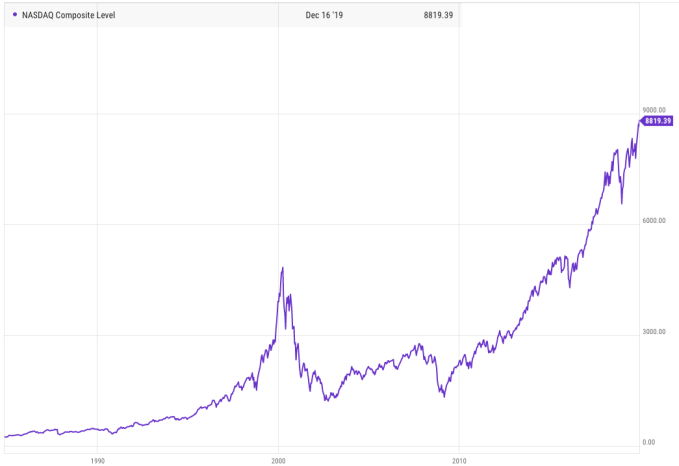

Look, this is the last post I’m writing in 2019 and I’m tired. But I can’t let the year close without taking stock of how well tech stocks did this year. It was bonkers.

So let’s mark the year’s conclusion with some notes for our future selves. Yes, we know that the Nasdaq has been setting new records and SaaS had a good year. But we need to dig in and get the numbers out so that we can look back and remember.

Let’s cap off this year the way it deserves to be remembered, as a kick-ass trip ’round the sun for your local, public technology company.

Keeping score

We’ll start with the indices that we care about:

- The tech-heavy Nasdaq Composite rose 35% in 2019

- The SaaS-heavy Bessemer Cloud Index rose 41% this year

Next, the highest-value U.S.-based technology companies:

- Microsoft was up around 55% in 2019

- Apple managed an 86% gain in the year

- Not be left out, Facebook rose 57%

- Amazon posted its own gain of 23% in 2019

- Alphabet managed to grow by 29%, as well

Now let’s turn to some companies that we care about, even if they are smaller than the Big Five:

- Salesforce? Up 19% this year

- Adobe was up 46% in 2019, which was astounding

- Intel picked up 28% in the year, making it no slouch

- Even Oracle managed to gain 17% in 2019

And so on.

The technology industry’s epic run has been so strong that The Wall Street Journal noted this morning that, powered by tech companies, U.S. stocks “are poised for their best annual performance in six years.” The Journal highlighted the performance of Apple and Microsoft in particular for helping drive the boom. I wonder why.

How long will we live in the neighborhood of Nasdaq 9,000? How long can two tech companies be worth more than $1 trillion at the same time? How long can the biggest tech companies be worth a combined $4.93 trillion (I remember when $3 trillion for the Big Five was news, and I recall when the group reach a collective value of $4 trillion).1

But the worst trade in recent years has been the pessimists’ gambit. No matter what, stocks have kept going up, short-term hiccoughs and other missteps aside.

For nearly everyone, that is. While tech stocks in general did very well, some names that we all know did not. Let’s close on those reminders that a rising tide lifts only most boats.

2019 naughty list

Several of the most lackluster public tech companies were 2019 technology IPOs, interestingly enough. Who didn’t do well? Uber earns a spot on the naughty list for not only being underwater from its IPO price, but also from its final private valuations. And as you guessed, Lyft is down from its IPO price as well, which is not good.

Some 2019 IPOs did well in the middle of the year, but fell a little flat as the year came to a close. Pinterest, Beyond Meat and Zoom meet that criteria, for example. And some SaaS companies struggled, even if we think they will reach $1 billion in revenue in time.

But it was mostly a party. The public markets were good, and tech stocks were great. This helped create another 100+ unicorns in the year.

Such was 2019. On to 2020!

- In time, those numbers will look small. But sitting here on December 31, 2019, they appear huge and towering and, it must be said, somewhat perilously stacked.