Metropolis, a startup building payment infrastructure for parking facilities, today announced that it raised $167 million in a Series B round co-led by 3L Capital and Assembly Ventures with participation from Dragoneer, Eldridge Industries, Silver Lake Waterman, UP Partners, and former deputy mayor of New York Dan Doctoroff. CEO Alex Israel told TechCrunch via email that the proceeds will be put toward product development, expanding the company’s team, and expanding into “new mobility adjacent verticals.”

Israel contends that parking payment infrastructure is outdated on the whole. Parking garages are stuck in the pre-internet age, he asserts — disconnected from the digital payments ecosystem (e.g., schemes like Apple Pay and Google Pay). Certainly, there’s on-demand systems like SpotHero. Meanwhile, FlashParking, Passport, AirGarage, and REEF Technology (formerly ParkJockey) have raised hundreds of millions from SoftBank and others for tech-forward parking management. But these don’t create the same experiences Metropolis can, Israel claims.

“Metropolis is a mobility commerce company, building infrastructure that allows us to transact in the physical world with the seamlessness and ease we experience online,” Israel told TechCrunch via email. “Our platform powers more than 600 parking facilities, we have more than 1.8 million users, and we connect both to thousands of surrounding restaurants, coffee shops, and retail stores in more than sixty cities.”

Israel, a serial entrepreneur, sold his last company, ParkMe, to Inrix back in 2015. He said that the experience drove him back to the drawing board to develop a new kind of parking payment and management service.

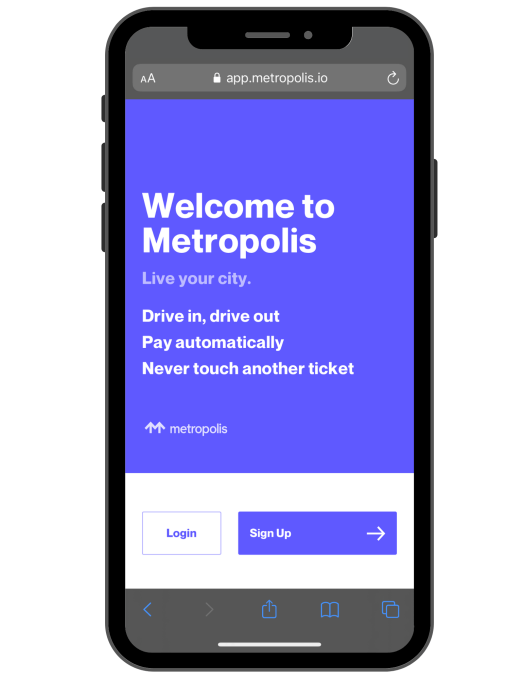

Image Credits: Metropolis

“Metropolis was founded in 2017 with the vision of creating the foundation for future modes of transportation which would allow for seamless transactions and movement,” Israel said. “In order to realize a future with cars that are electric or autonomous, you have to build the infrastructure for them to operate within, and that starts by bringing brick and mortar locations online. Parking and movement within urban environments have not changed in the past 70 years and we set out to change that.”

To this end, Metropolis — which equips existing parking structures with its systems — enables customers to “drive in and drive out” without having to swipe a credit card or pay with cash. Using computer vision systems trained on an in-house data set, the platform can recognize cars via cameras equipped with Metropolis’ software, automatically charging the corresponding customers’ online account. (To use a Metropolis parking facility, customers have to provide their name, license plate, phone number, and payment method.)

From an app, customers can review their visit and know the price in real time. Metropolis emails the receipt after they drive out.

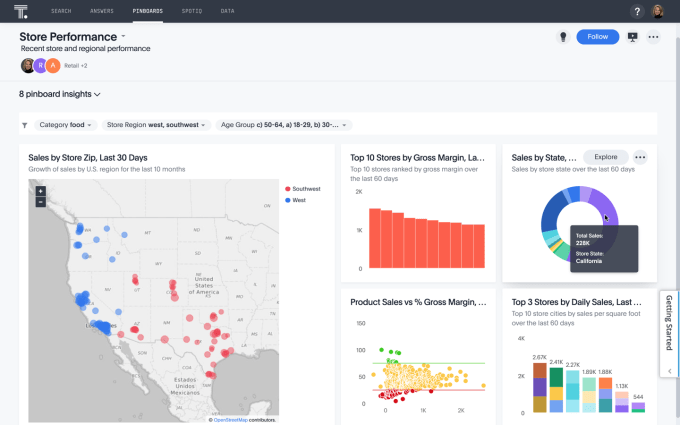

That’s a convenience, to be sure. But Metropolis is investing heavily on the analytics, sales, and marketing side of the business, where it sees a larger addressable market. According to Israel, the high-rise and parking structure owners and municipalities that Metropolis does business with can better inform pricing, staffing, and maintenance with the insights from the platform. And local businesses can gain visibility — promotions and discounts from grocery stores, coffee shops, and other local merchants that choose to partner with Metropolis appear in the aforementioned app.

“Our data means real-time, accurate, and reliable visibility into usage of, and revenue derived from, built environment assets. For commercial real estate businesses, it’s vital to have visibility into both individual property performance, but also portfolio-wide trends,” Israel said. “We have only scratched the surface of the economic opportunity within our cities. For businesses, Metropolis is able to connect them with new customers and revenue opportunities. For people moving around our cities, Metropolis delivers a checkout-free, just-drive-out experience, facilitating a remarkable journey, while connecting them to the local business around them.”

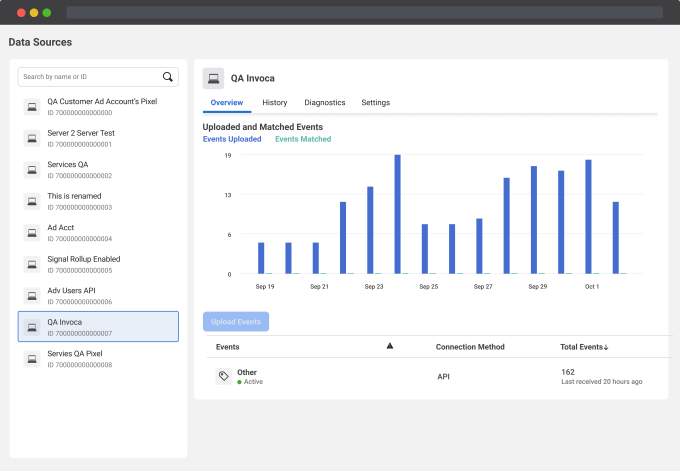

Image Credits: Metropolis

Gearing up for expansion, Metropolis recently acquired Premier Parking, a Nashville-based company that operated hundreds of parking garages and spaces around the U.S. And last November, Metropolis announced a partnership with Uber, Uber Park, which allows Uber riders to use the Uber app to access locations within the Metropolis network.

Israel says that Metropolis plans to expand its workforce of 2,000 employees to 2,500 by the end of the year to support the expansion. It would appear to have the capital to do so; to date, Metropolis has raised $226 million in total.

“Parking, while historically recession resistant, was not COVID-resistant. So commercial real estate owners and operators turned to Metropolis during the pandemic to find efficiencies and opportunities; as people return to work and travel, we are on a major upswing,” Israel said. “Metropolis built its core business in the middle of a global financial crisis, so while others are hitting the brakes to cut burn, our business is built on solid fundamentals, which is why we attracted so much interest from such a range of investors.”