Slack’s rapid rise and upcoming IPO are clear signs of the ripe opportunity to be had in the field of enterprise messaging. Today, a startup that’s built a messaging product specifically for the financial services vertical is also proving that out. Symphony, which offers secure messaging and other collaboration tools for bankers and those who work with them, is today announcing that it has raised $165 million. With this round, Symphony’s valuation now tops $1.4 billion.

The funding comes from Standard Chartered and MUFG Innovation Partners (a division of Mitsubishi that makes fintech investments), and also included other (unnamed) current and new investors. Symphony has now raised a very hefty $460 million, with previous backers including Google, Lakestar, Natixis, Societe Generale, UBS, Merus Capital and BNP Paribas, along with a consortium of 14 of the world’s largest investment banks and money managers, including Bank of America, BlackRock, Citibank, Deutsche Bank, Goldman Sachs, HSBC, and JP Morgan.

Notably, its financial backers are all strategic investors in the company: they use Symphony both for internal collaboration as well a channel to communicate with outside partners and integrate data from across their networks in a secure and compliant way.

And before you consider Symphony’s expansion into new products and plans for the funding — more on those below — that usage has been on an upward trajectory. With an expanded presence outside of its home market of the US into Europe and Asia, the company now has 425,000 users across some 400 companies using its mobile and desktop apps for messaging, voice and video conversations, and more. As a point of comparison, when the company last raised money, in 2017, it had 200,000 paying customers.

Even given that rapid take up of messaging, and of Symphony in particular, the size of this round came by surprise. In an interview earlier, David Gurlé, Symphony’s founder and CEO, said the original intention was to raise a more modest $50 million – $75 million. It appears that when your primary customers are also investors, things can ramp up quickly.

The funding will be used to continue growing the platform’s functionality, both organically and by way of acquisitions. In terms of the latter, areas where Gurlé believes Symphony would be better off buying rather than building itself include market intelligence and IT integration (indeed, there are a number of players in both areas and so consolidation may well be on the cards).

In terms of breaking new ground on its own, Gurlé said that a lot of it is dictated by Symphony’s customers. “A year ago, customers started approaching us looking for workflow automation tools,” he said, “and that was the beginning of a new chapter for us.”

That came in the form of a new product called Symphony Market Solutions, with many of the companies now adopting its product doing so in the context of “digital transformation” agendas — bringing their IT infrastructure and what it’s there to serve up to speed with modern developments.

For banks and others in the financial services industry, this is a notable development: more than any other vertical, except tech itself of course, financial giants have long been recruiters and builders of their own innovative IT services. That was in part because that is what necessity dictated: with tens of billions of dollars at stake, proprietary trading software built to do something better than your rivals can could give you a distinct advance. And part practicality: it can help you keep a better security and audit trail for what passes through that product.

Fast forward to today, and banks are cutting costs like everyone else, and they are also suffering from the brain drain that has hit many other verticals: big technology companies, and the lure of building a potentially lucrative startup, have become magnets for many of the greatest technical minds.

That has resulted in an interesting emergence of companies that are building products for these companies, knowing specifically what they need, and they’re getting more face time and consideration by buyers than ever before. Symphony is not the only one; BlueVoyant — which also recently raised funding — has also developed a similar proposition specifically in the area of security.

In terms of what else is coming on the horizon and Gurlé noted that the majority of traffic on Symphony today is related to internal communications, with a healthy proportion of that not between humans but humans and chatbots — there are now 1,000 on the platform — that they query to update or gather information.

“Symphony has generated tremendous interest for revolutionising buy-side and sell-side secure messaging and collaboration in global markets, both in content curation and consumption as well as the workflow across the whole deal life-cycle,” said Yann Gerardin, Deputy Chief Operating Officer and Head of Corporate and Institutional Banking at BNP Paribas, in a statement.

On the use of the chatbots, Darren Cohen, global head of Principal Strategic Investments (PSI), Goldman Sachs, noted that it’s a likely sign of how the product and the banking industry will continue to developl “The rapid proliferation of Symphony bots and application integrations across the trade lifecycle and throughout the enterprise gives us a glimpse into the future,” he said in a statement. “Symphony’s secure infrastructure and diverse ecosystem will enable the industry to unlock significant operational efficiency and meaningfully enhance the client experience.”

The other side of the communications are coming from organizations that are using Symphony to communicate with each other and share information across walled gardens.

Alex Manson, Global Head of SC Ventures, Standard Chartered, pointed out in an interview that this is helping Symphony expand its presence in other verticals, for example with the accounting and legal firms that are using the app to communicate with their clients, who are already using Symphony.

Another vertical that’s seeing some early traction with Symphony is government, which has a similarly strong need for security and audit trails. The startup is currently running some trials with government groups but declined to provide details on them.

Interestingly, Symphony is also exploring another kind of walled garden expansion:

Gurlé said that within banks, wholesale and retail sides are looking to work together more closely, and they are using Symphony for that purpose. In one product that Symphony is still developing, it’s looking of ways of incorporating popular consumer messaging applications like WhatsApp and WeChat into its system as well: “This is where a large proportion of the retail side’s users are,” he said. The idea is that these kinds of integrations will help create and track conversations on those consumer platforms more easily, helping with the bank’s wider audit trail.

For its investor-customers, Symphony represents not just a service that can help them get their jobs done more efficiently, but an opportunity for learning at a time when many fintech startups, including challenger banks, are nipping at incumbents’ feet.

“What is the bank of today versus the bank of tomorrow?” Manson said. “Collaboration tools give us the potential to bridge verticals, especially as the lines between them become blurry.”

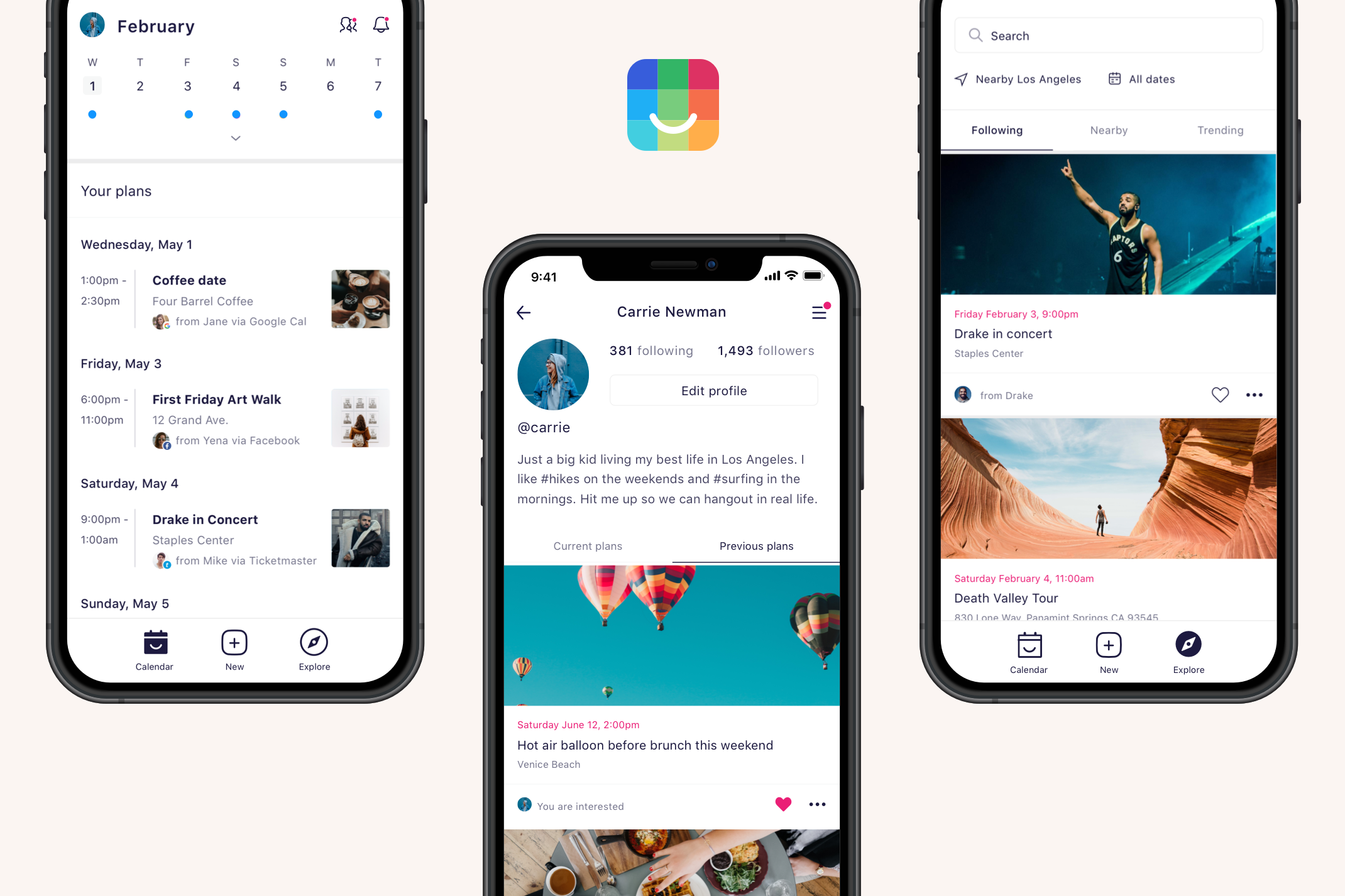

Unfortunately without reams of personal data and leading artificial intelligence that Facebook owns, IRL’s in-house suggestions via the Explore tab can feel pretty haphazard. I saw lots of mediocre happy hours, crafting nights, and community talks that weren’t quite the hip nightlife recommendations I was hoping for, and for now there’s no sorting by category. That’s where Shafi hopes influencers will fill in. And he’s confident that Facebook’s business model discourages it moving deeper into events. “Facebook’s revenue driver is time spent on the app. While meaningful to society, events as a feature is not a primary revenue driver so they don’t get the resources that other features on Facebook get.”

Unfortunately without reams of personal data and leading artificial intelligence that Facebook owns, IRL’s in-house suggestions via the Explore tab can feel pretty haphazard. I saw lots of mediocre happy hours, crafting nights, and community talks that weren’t quite the hip nightlife recommendations I was hoping for, and for now there’s no sorting by category. That’s where Shafi hopes influencers will fill in. And he’s confident that Facebook’s business model discourages it moving deeper into events. “Facebook’s revenue driver is time spent on the app. While meaningful to society, events as a feature is not a primary revenue driver so they don’t get the resources that other features on Facebook get.”