Israeli startup SimilarWeb has made a name for itself with an AI-based platform that lets sites and apps track and understand traffic not just on their own sites, but those of its competitors. Now, it’s taking the next step in its growth. The startup has raised $120 million, funding it will use to continue expanding its platform both through acquisitions and investing in its own R&D, with a focus on providing more analytics services to larger enterprises alongside its current base of individuals and companies of all sizes that do business on the web.

Co-led by ION Crossover Partners and Viola Growth, the round doubles the total amount that the startup has raised to date to $240 million. Or Offer, SimilarWeb’s founder and CEO, said in an interview that it was not disclosing its valuation this time around except to say that his company is now “playing in the big pool.” It counts more than half of the Fortune 100 as customers, with Walmart, P&G, Adidas and Google, among them.

For some context, it hit an $800 million valuation in its last equity round, in 2017.

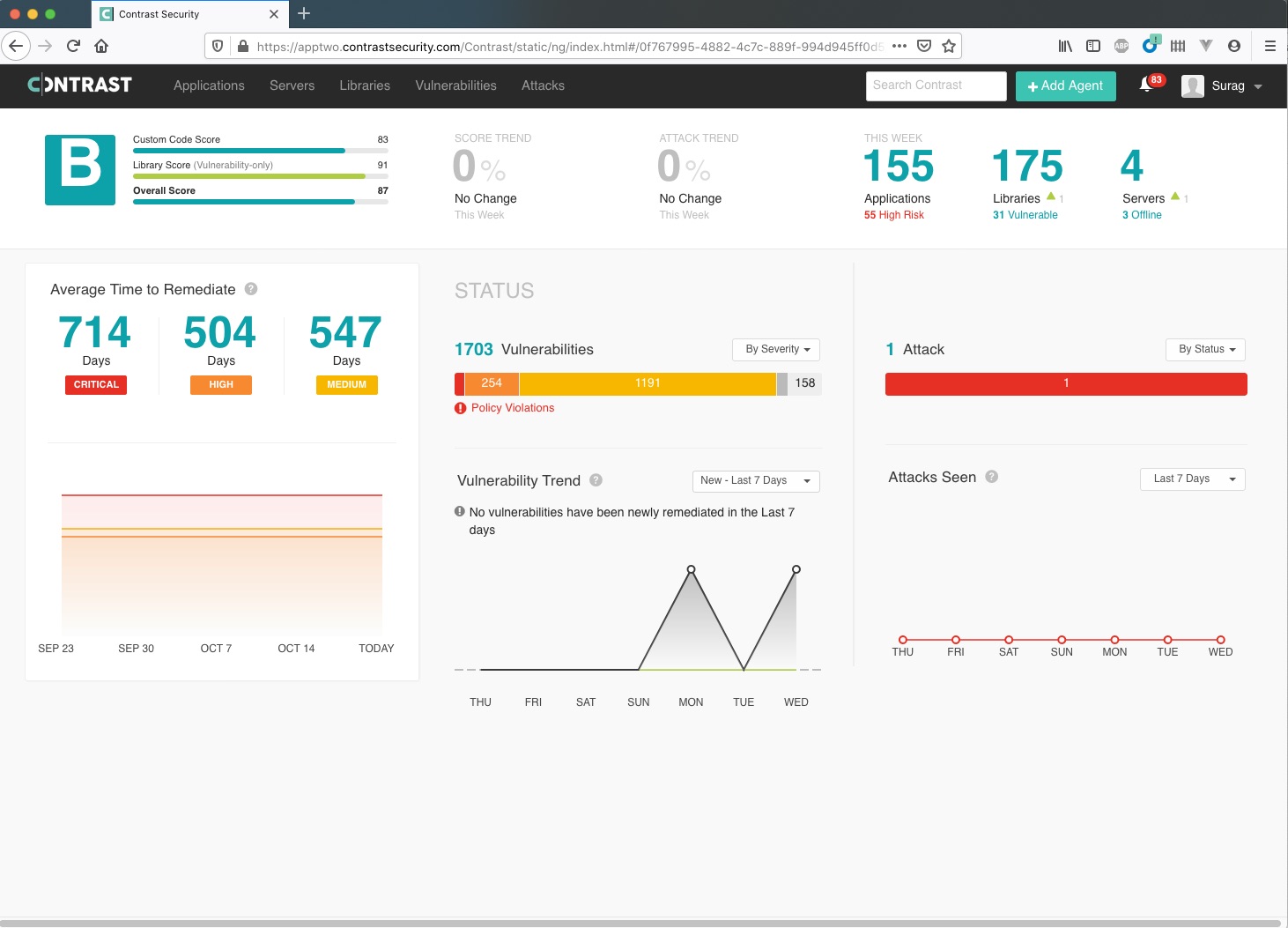

SimilarWeb’s technology competes with other analytics and market intelligence providers ranging from the likes of Nielsen and ComScore through to the Apptopias of the world in that, at its most basic level, it provides a dashboard to users that provides insights into where people are going on desktop and mobile. Where it differs, Offer said, is in how it gets to its information, and what else it’s doing in the process.

For starters, it focuses not just how many people are visiting, but also a look into what is triggering the activity — the “why”, as it were — behind the activity. Using a host of AI tech such as machine learning algorithms and deep learning — like a lot of tech out of Israel, it’s being built by people with deep expertise in this area — Offer says that SimilarWeb is crunching data from a number of different sources to extrapolate its insights.

He declined to give much detail on those sources but told me that he cheered the arrival of privacy gates and cookie lists for helping ferret out, expose and sometimes eradicate some of the more nefarious “analytics” services out there, and said that SimilarWeb has not been affected at all by that swing to more data protection, since it’s not an analytics service, strictly speaking, and doesn’t sniff data on sights in the same way. It’s also exploring widening its data pool, he added:

“We are always thinking about what new signals we could use,” he said. “Maybe they will include CDNs. But it’s like Google with its rankings in search. It’s a never ending story to try to get the highest accuracy in the world.”

The global health pandemic has driven a huge amount of activity on the web this year, with people turning to sites and apps not just for leisure — something to do while staying indoors, to offset all the usual activities that have been cancelled — but for business, whether it be consumers using e-commerce services for shopping, or workers taking everything online and to the cloud to continue operating.

That has also seen a boost of business for all the various companies that help the wheels turn on that machine, SimilarWeb included.

“Consumer behavior is changing dramatically, and all companies need better visibility,” said Offer. “It started with toilet paper and hand sanitizer, then moved to desks and office chairs, but now it’s not just e-commerce but everything. Think about big banks, whose business was 70% offline and is now 70-80% online. Companies are building and undergoing a digital transformation.”

That in turn is driving more people to understand how well their web presence is working, he said, with the basic big question being: “What is my marketshare, and how does that compare to my competition? Everything is about digital visibility, especially in times of change.”

Like many other companies, SimilarWeb did see an initial dip in business, Offer said, and to that end the company has taken on some debt as part of Israel’s Paycheck Protection Program, to help safeguard some jobs that needed to be furloughed. But he added that most of its customers prior to the pandemic kicking off are now back, along with customers from new categories that hadn’t been active much before, like automotive portals.

That change in customer composition is also opening some doors of opportunity for the company. Offer noted that in recent months, a lot of large enterprises — which might have previously used SimilarWeb’s technology indirectly, via a consultancy, for example — have been coming to the company direct.

“We’ve started a new advisory service [where] our own expert works with a big customer that might have more deep and complex questions about the behaviour we are observing. They are questions all big businesses have right now.” The service sounds like a partly-educational effort, teaching companies that are not necessarily digital-first be more proactive, and partly consulting.

New customer segments, and new priorities in the world of business, are two of the things that drove this round, say investors.

“SimilarWeb was always an incredible tool for any digital professional,” said Gili Iohan of ION Crossover Partners, in a statement. “But over the last few months it has become apparent that traffic intelligence — the unparalleled data and digital insight that SimilarWeb offers — is an absolute essential for any company that wants to win in the digital world.”

As for acquisitions, SimilarWeb has historically made these to accelerate its technical march. For example, in 2015 it acquired Quettra to move deeper into mobile analytics and it acquired Swayy to move into content discovery insights (key for e-commerce intelligence). Offer would not go into too much detail about what it has identified as a further target but given that there are quite a lot of companies building tech in this area currently, that there might be a case for some consolidation around bigger platforms to combine some of the features and functionality. Offer said that it was looking at “companies with great data and digital intelligence, with a good product. There are a lot of opportunities right now on the table.”

The company will also be doing some hiring, with the plan to be to add 200 more people globally by January (it has around 600 employees today).

“Since we joined the company three years ago, SimilarWeb has executed a strategic transformation from a general-purpose measurement platform to vertical-based solutions, which has significantly expanded its market opportunity and generated immense customer value,” said Harel Beit-On, Founder and General Partner at Viola Growth, in a statement. “With a stellar management team of accomplished executives, we believe this round positions the company to own the digital intelligence category, and capitalize on the acceleration of the digital era.”