Take a look at most subscription-based SaaS pricing strategies and they will often have a free version for a certain number of seats, a pro version for a larger set of seats and an enterprise version for large companies.

But what about everything in between — the company that is just above the 10-seat threshold for the free version, but won’t be growing fast enough to make the pro version worthwhile?

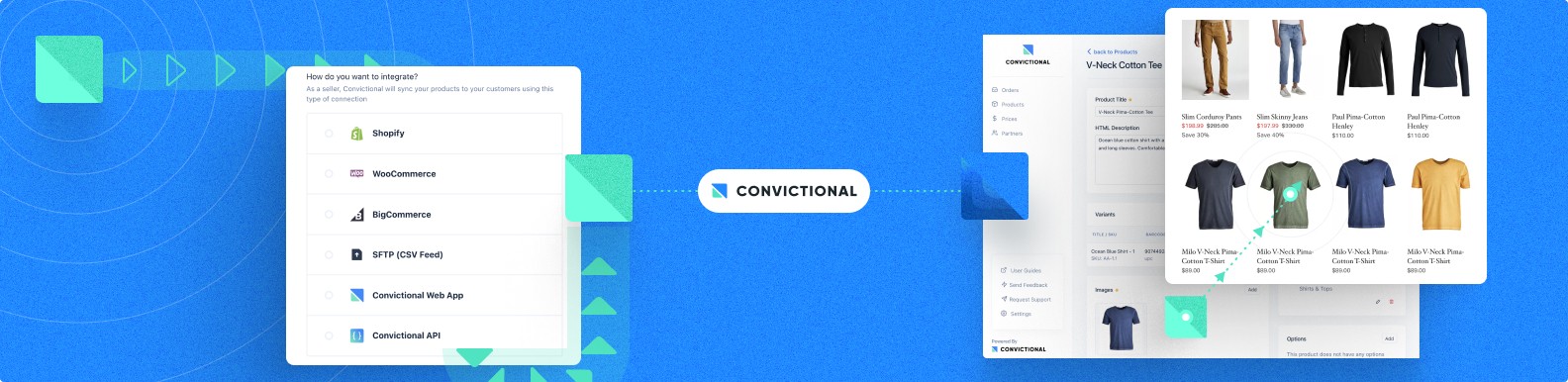

Enter Subskribe, a startup that is bringing flexibility to the world of quote-to-revenue, where it was often difficult for salespeople to set up a software quote when information is found in different places, reconcile it and then bill subscriptions and one-off services.

The company was started in 2020 by Durga Pandey, who previously worked at Google, started the company with former Zuora engineering director Yibin Guo and former Okta senior director of business technology Prakash Raina.

“Everyone likes a recurring model, but the customer doesn’t want to pay for a $5,000 license if they can pay $10 per month,” CEO Pandey told TechCrunch. “In the last 10 years, the SaaS model has changed a lot and is similar to what a Netflix subscription would be, but is still sold like a cell phone plan that offers $40 per month for 400 minutes.”

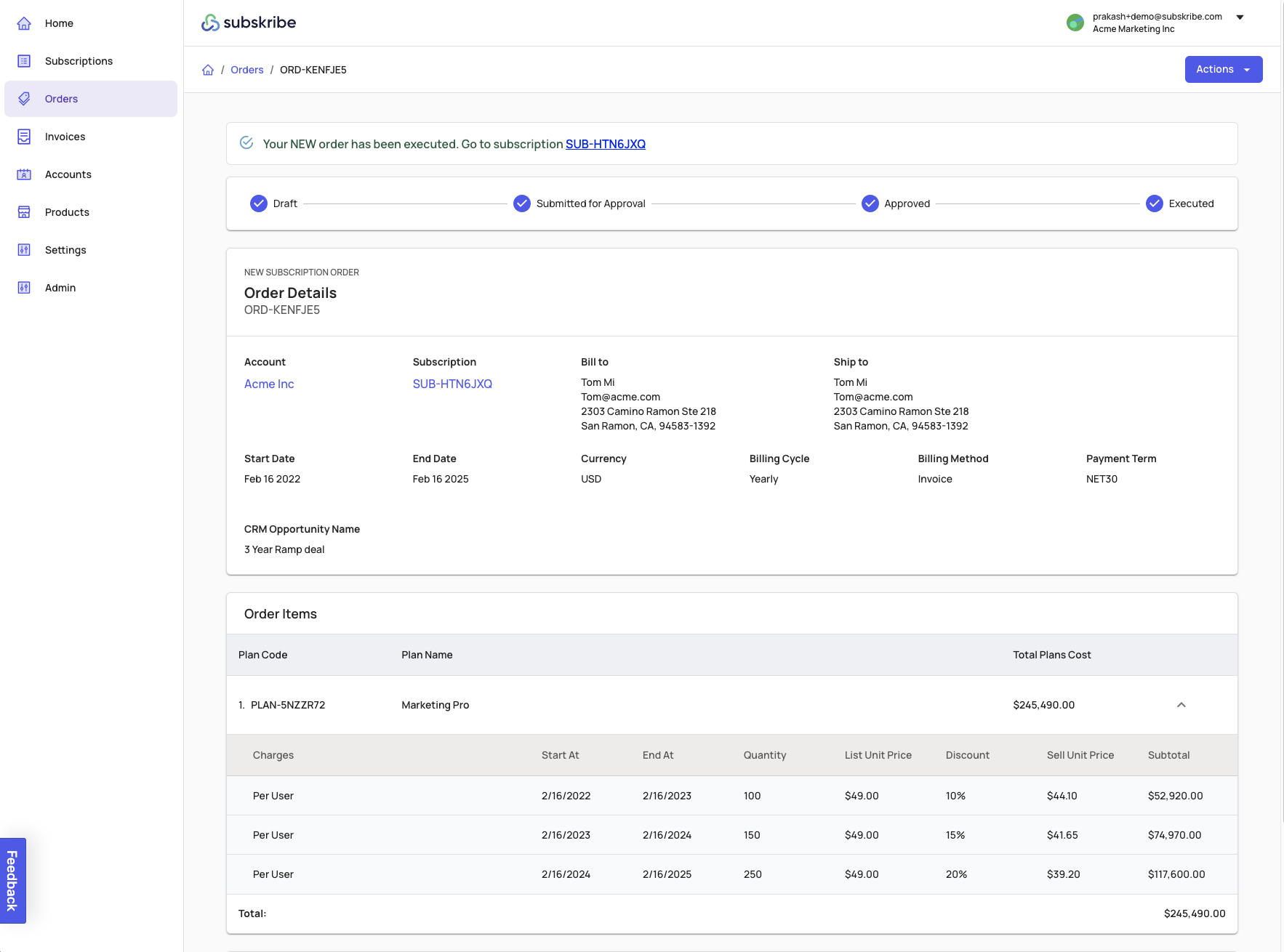

Instead, Subskribe’s technology is designed to be an adaptive quote-to-revenue system built so that salespeople can structure more usage-based contracts, often called ramp deals, that offer increasing discounts as usage grows, and add creative upsells and cross-sells.

Image Credits: Subskribe

Each part of the process, from quoting to billing, refers to the same repository of dynamic orders so that it is a unified experience from end to end. As a result, companies get a deal that’s optimized for their growth and also end up spending less money, Pandey added.

The company officially launched Thursday with a handful of customers and $18.4 million in seed and Series A funding from 8VC, which led the A round, and Slow Ventures, which led the seed round. Joining the round were a group of senior finance and operations executives at companies, including Amplitude, Asana, Coupa, Dialpad, Okta, Plaid and UiPath.

Pandey plans on using the new funding to expand the engineering team and will also focus on expanding its customer base and product development.

Subskribe has only been selling for four months, so there is not much in the way of growth metrics that he could talk about, but he did say there were some big names in its customer pipeline that are close to signing.

“Our goal is to establish ourselves as the de facto player in this space and provide a product that allows these customers to not worry so much about the process of making money,” Pandey added.