As Harley Davidson rounds year one on its electric debut, we’re still riding in the fog on how to evaluate the company’s EV pivot.

The American symbol of gas, chrome, and steel released its first production electric motorcycle, the LiveWire last fall. The $29,799 machine is the first in a future line-up of EVs planned by Harley-Davidson — spanning motorcycles, bicycles and scooters.

The LiveWire started shipping to dealers September 27. It’s meant to complement, not replace, Harley-Davidson’s premium internal-combustion cruiser motorcycles.

The LiveWire has received mostly positive reviews from motorcycle stalwarts on design, features and performance. Two things are missing, however, to offer an initial grade on Harley Davidson’s first production e-moto and overall commitment to electric.

The company needs to release EV specific sales data and tell us what’s next in its voltage powered lineup.

Stats

Seven months out from the LiveWire debut, there’s been plenty of speculation on how the motorcycle’s fared in the marketplace, particularly with pricing just short of Tesla Model 3.

As a publicly traded company, I was hoping Harley would offer EV data in its end of year and first quarter 2020 financials.

Harley Davidson’s Softail Slim, Image Credits: Harley Davidson

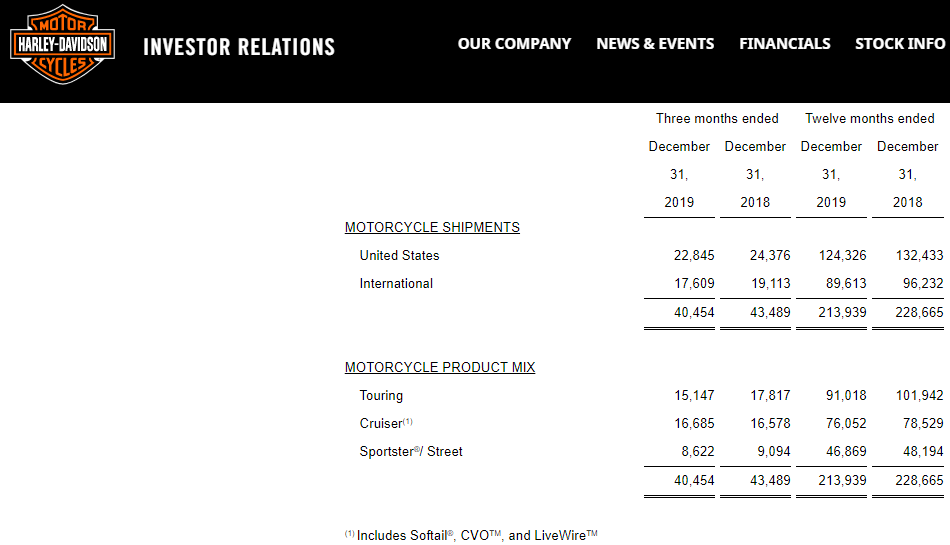

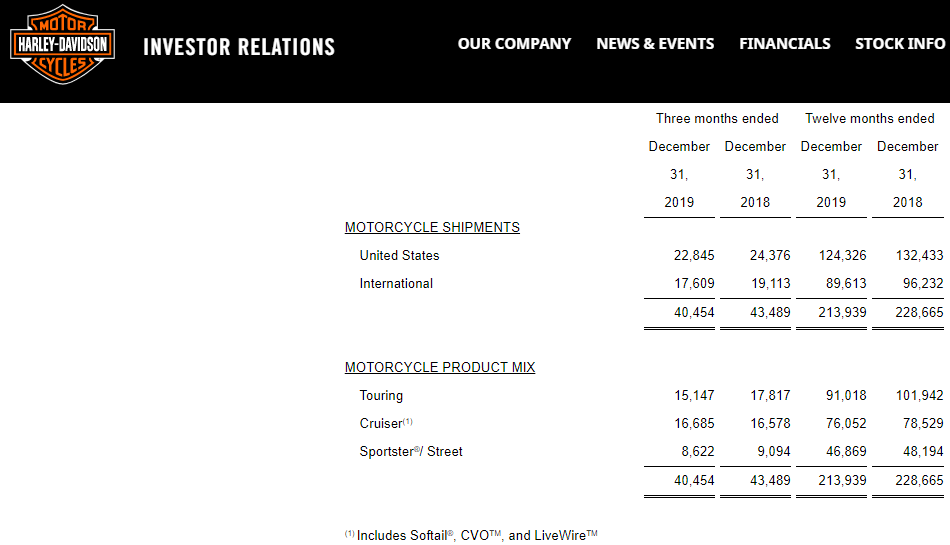

We didn’t see that. HD’s reporting on motorcycle sales doesn’t include a separate line for electric. Instead, LiveWire units sold are folded into Harley’s “Cruiser” stats that include some 16 different motorcycle models across HD’s Softtail and CVO lines. From the numbers, it’s evident sales in that category fell for Harley Davidson over 2019, but it’s not possible to know how Harley’s EV debut performed on sales floors.

I checked with a Harley Davidson spokesperson, who confirmed the company hasn’t released any LiveWire specific sales data in any form.

Source: Harley Davidson’s fourth quarter and full year 2019 financial results

Without this info, we’re left to speculate from incomplete dealer feedback that’s made its way to press, including an October Reuters piece pinning LiveWire as a “flop” with buyers. To be fair, its difficult to find reliable e-motorcycle sales statistics anywhere, as the main source of data in the U.S. — the Motorcycle Industry Council — doesn’t compile or release them.

But Harley Davidson could and should give the public a better benchmark on the progress of its electric products by releasing EV specific sales numbers.

The market

The move to create an electric mobility line has been a bold one for the Milwaukee based company —which is steeped in tradition of creating distinctly loud, powerful, internal combustion two-wheelers since 1903.

With the LiveWire debut, Harley Davidson became the first of the big gas manufacturers to offer a street-legal e-motorcycle for sale in the U.S.

The move is something of a necessity for the company, which like most of the motorcycle industry in the U.S., has been bleeding revenue and younger buyers for years.

The U.S. motorcycle market has been in pretty bad shape since the last recession. New sales dropped by roughly 50% since 2008 — with sharp declines in ownership by everyone under 40 — and have never recovered.

Harley Davidson electric concept display in 2019, Image Credits: Jake Bright/TechCrunch

Execs at Harley Davidson have spoken about the LiveWire, and the company’s planned EV product line, as something to reboot HD with a younger generation in the on-demand mobility age.

While Harley got the jump on traditional motorcycle manufacturers, such as Honda and Kawasaki, it’s definitely not alone in the two wheeled electric space.

HD entered the EV arena with competition from several e-moto startups that are attempting to convert gas riders to electric and attract a younger generation to motorcycling.

One of the leaders is California startup Zero Motorcycles, with 200 dealers worldwide. Zero introduced a LiveWire competitor last year, the $19K SR/F, with a 161-mile city range, one-hour charge capability and a top speed of 124 mph. Italy’s Energica is expanding distribution of its high-performance e-motos in the U.S.

And Canadian startup, Damon Motors, debuted its 200 mph, $24K Hypersport this year, which offers proprietary safety and ergonomics tech for adjustable riding positions and blind-spot detection.

Harley Davidson, e-moto startups, and all the big manufacturers now face growing uncertainty on the buying appetite for motorcycles that could persist into 2020 — and beyond — given the economic environment created by the COVID-19 pandemic.

This month Harley Davidson appointed a new CEO, Jochen Zeitz, to lead the company into the future. On last month’s first quarter earnings call, Zeitz didn’t offer much insight on HD’s EV sales or future, except to say, “We also remain committed to…advancing our efforts in electric.”

Scorecard so far

Without knowing how the LiveWire did in the ultimate product test — getting folks to give up money and buy one — there is some scorecard feedback to register on Harley’s electric debut.

To start with the negative, the company really missed the mark on the $29K price. The messaging on the price and product placement has shifted a bit since I first started talking to HD on LiveWire. In July 2019, Harley execs gave the “premium product” jingle on how the $30K price was justifiable over comparable e-moto offerings, such as Zero’s SR/F, priced $10,000 less.

More recently a Harley Davidson spokesperson commenting on background, described the LiveWire as a halo product — more of an attention getting model, and not priced for mass-market. Whatever actually went into the EV’s pricing, the consensus of just about everyone I’ve spoken to on the LiveWire is that it was priced too damn high.

On the thumbs up side, Harley Davidson did nail a lot of important factors on its electric debut. The company had a difficult task of creating something that bridged two worlds, at least in attributes and public response. The bike had to check out in features and performance as a legitimate e-motorcycle entrant. The LiveWire also had to pass the sniff test with Harley’s existing clientele, who are loyal to chrome and steel cruisers and aren’t exactly Tesla, EV types.

Image Credits: TechCrunch

Price and unknown sales numbers aside, I’d say Harley Davidson achieved both. I spent a day testing the 105 horsepower LiveWire on a track and pestering HD’s engineers on all the bike’s features, including its range and charge time. Overall, I found it to be a solid package across performance, design and key specs. Most of the motorcycle press has agreed.

HD also succeeded in engineering an e-motorcycle in a Harley Davidson way, including styling and creating a distinct, yet subtle, sound for its EV. I showed some LiveWire photos it to my grandpa — a loyal loud-pipes Harley rider since the 50s — and he responded favorably, saying he’d love to try one out. So HD’s electric debut did arouse the right kind of response and enthusiasm with the right crowds. That’s something to build on.

What’s next?

What HD has to do now with its electric program is show us what’s next. And whatever the company releases, it must appeal to and sell to a wider audience, including millennials.

I could envision the company’s next EV product release including a scooter offering — registering Harley in the urban mobility space — and an affordable e-motorcycle with wider market appeal.

Harley Davidson EV concepts, Image Credits: Harley Davidson

And what could Harley’s next e-motorcycle be? I see it as something priced around $10K, lighter and more accessible to beginner riders than the 549 pound LiveWire, cloud and app connected with at least 100 miles of range and a charge time of 30 to 40 minutes. A tracker styled EV channeling Harley’s flat track racers — with some off-road capability — could also help HD hit the mark. Harley released a mockup to this effect, in its EV concepts last year.

Of course, getting it all right on specs, style, and price point will be even more critical for Harley Davidson in COVID-19 economic environment, where spending appetites for things like motorcycles will be more conservative for the foreseeable future.

Harley-Davidson’s LiveWire gave the company’s commitment to electric credibility, Harley’s next round of two-wheeled EVs — and the market response — will tell us more about HD’s relevance in the 21st century mobility world.

One can power Zero’s sporty e-moto from a household outlet or use fast-charging networks — like

One can power Zero’s sporty e-moto from a household outlet or use fast-charging networks — like  Paschel is undaunted by Harley’s EV debut or the other big gas motorcycle manufacturers entering the E-market.

Paschel is undaunted by Harley’s EV debut or the other big gas motorcycle manufacturers entering the E-market. Zero’s SR/F could be the sweet spot of tech, price, range, and performance it has been striving toward to finally go mass market and compete with those brands.

Zero’s SR/F could be the sweet spot of tech, price, range, and performance it has been striving toward to finally go mass market and compete with those brands.