Atlas is developing a work benefits tool for global companies to manage their contractor benefits from one place.

© 2024 TechCrunch. All rights reserved. For personal use only.

Product Management Confabulation

What Product Managers are talking about.

Atlas is developing a work benefits tool for global companies to manage their contractor benefits from one place.

© 2024 TechCrunch. All rights reserved. For personal use only.

French startup Swile shared some revenue metrics just a year after merging with Bimpli, the employee benefits division of BPCE. Swile’s main product is a payment card for employee benefits, such as meal vouchers.

In 2022, Swile generated €138 million in revenue ($153 million at today’s exchange rate) — that includes Bimpli’s revenue. And yet, the company’s losses widened to €72 million ($80 million). In other words, 2022 has been a mixed bag.

But the company says that this was a transitioning phase as Swile expects to turn a profit on an EBITDA basis starting next quarter. It doesn’t mean that Swile will be profitable for the entire year, but the company is at an inflection point.

The reason why Swile has been losing so much money is that it raised $200 million in a Series D funding round led by SoftBank Group International back in 2021.

“We raised €200 million after all. And we didn’t do it so that we could go out and drink mojitos. It was about continuing to gain market share. And it worked, as we continued to win market share in 2022,” Swile founder and CEO Loïc Soubeyrand told me.

So what’s Swile’s market share then? In France, companies have to contribute to lunch when it’s in the middle of a work day. Some companies offer a cafeteria with cheap meals, others hand out meal vouchers that you can spend in restaurants and bakeries.

According to the CNTR, meal voucher companies handled a transaction volume of €8.5 billion in France in 2022 alone. Swile says that it handles €3 billion in transaction volume per year. Other big players in the space include Edenred, Up Coop and Sodexo.

“We have 5 million users in France and 500,000 in Brazil. So that’s 5.5 million in total, of which more than two-thirds use meal vouchers as we also handle gift vouchers,” Soubeyrand said.

There’s still some room for growth in Swile’s home market as 40% of employees who receive meal vouchers are still using paper vouchers. At some point, Swile and other meal voucher providers expect that these companies will switch to payment cards.

“On top of that, what’s really interesting to note is that this is a market that has been growing natively and organically for the past three years, at double-digit rates. We’ve had over 10% growth for the past three years,” Soubeyrand said.

Due to the COVID-19 pandemic and many companies allowing remote work, some employees who used to go to the cafeteria now prefer to receive meal vouchers. Similarly, due to inflation, many companies allocate more money to meal vouchers.

While Swile still expects to generate the majority of its revenue from meal vouchers, the company has been testing a corporate travel booking platform. Last year, Swile acquired Okarito and rebranded it to Swile Travel. It is currently available in beta.

“It’s going to become Swile Travel and we’ve just integrated it into our super app, because the aim is to use a single app to unify this experience,” Soubeyrand said.

There are 85,000 companies that are already using Swile, and the company plans to tap this user base to launch this new product. It will compete with American Express and Egencia as well as newer entrants like Navan (formerly known as Trip Actions) and TravelPerk. Up next, Swile will add expense management to its suite of products as well.

“This industry is called travel & expenses. For now, we officially have the travel platform. And of course, once you travel, you need to make a few small expenses. And you already have the Swile card in your pocket,” Soubeyrand said.

Swile already says that it isn’t going to be profitable in 2023. The company will become profitable next quarter and will hopefully remain profitable every quarter after that.

In 2024, Swile expects to report €30 million in EBITDA for the French market. In 2025, that number should rise to €50 million to €70 million.

“We’re giving ourselves five years to diversify our revenue lines beyond employee benefits,” Soubeyrand said. “And we really want all travel & expense revenue — and perhaps other future revenue lines — to account for at least 25% of our revenue within five years.”

Employee benefits startup Swile expects to become profitable next quarter by Romain Dillet originally published on TechCrunch

In the current environment, Start-ups are having to do a couple of seemingly contradictory things at the same time. Firstly, they have to keep employees (the ones they want to keep, at least) happy. The other is attract new employees in a market where there remains fierce competition for talent. In their armoury to address this, they have ‘employee benefits’, whether it be mental health sessions or restaurant vouchers. However, many of these schemes leave something to be desired.

The “employee benefits & well-being” market is said to be worth €200 billion, and Europe makes up more than 40% of that market.

However, employee benefits engagement hovers around 20%, meaning companies waste a lot of money on unused packages.

Coverflex, a startup out of Portugal, thinks it has at least part of the answers.

Its solution claims to allow a company to design more bespoke employee compensation such as health insurance, meal allowance, fringe benefits and discounts by aggregating multiple providers. It says its platform then allows companies to reduce costs costs with tax-efficient benefits while giving employees more value and improving their financial literacy on compensation and benefits.

It’s now pulled in a €15 million Series A led by Paris-based CVC SCOR Ventures. Breega (pre-seed lead investor) re-invested as did MS&AD, Armilar, Stableton, BiG Start Ventures and Shilling. Angels participating include Firmin Zocchetto (CEO at PayFit), Job van der Voort (CEO at Remote), Humberto Ayres Pereira (CEO at Rows), Alessandro Petazzi (Co-founder of Musement), and Davide Dattoli (Founder of Talent Garden), among others.

In a statement, Miguel Amaro, Coverflex CEO said: “In the current macro environment, this Series A round validates our ambitious vision, product-market fit in Portugal, and a market opportunity in Europe, especially in Italy.” The company plans to target that country aggressively in the future.

Will Thorne, Head of SCOR Ventures who joins the company’s board, also commented: “Employers have an opportunity to reshape employee benefits management and improve employee satisfaction while closing the care and protection gap using a new generation of tools and services. Coverflex empowers companies and staff to deliver this ambition.”

Coverflex claims to have 3,600 clients, including Santander, Natixis, OysterHR, Bolt, Emma, Revolut and Smartex, with 70,000 active users, who, it says, use Coverflex more than 8 times on average per month.

Portugal’s Coverflex raises a €15M Series A to make employee benefits more flexible and engaging by Mike Butcher originally published on TechCrunch

It always feels good to get paid, so it’s no surprise that a payroll model like earned wage access (EWA), which lets employees withdraw their accrued wages at any time, has exploded in popularity.

The pandemic certainly played a big role in helping people understand the benefits of being able to treat their accrued salaries like a small bank account. While wage advances and payday loans have been around for much longer, they serve a very different purpose. With EWA, since you’re only accessing money you’ve already earned, there’s no risk of accumulating debt, and workers can better manage their finances.

The potential for this model is huge, but the industry is still very much in its early stages. Several countries don’t yet have an EWA provider, and in most others, providers are still taking their first steps.

Jennifer Ho, partner at Integra Partners, is confident that the EWA industry is going to keep growing after positive early interest. “In 2021, over $1.13 billion was raised by startups offering EWA products. Due to changing lifestyles, rising costs of living and the residual impact of COVID-19, many small and medium-sized enterprises have grown dependent on EWA,” she said.

That’s not to say there aren’t some issues. Most EWA providers are still experimenting to find out what works, and the business models vary widely, which is a symptom of an industry trying to find its footing. Two of the more prominent models involve either charging the employer a flat fee or charging employees per transaction.

Aris Xenofontos, partner at Seaya, believes an employer-paid model is the way to go for two reasons: social impact and long-term viability. “From a social impact perspective, would you want the party that needs the money the most, the employee, to pay for the services? And from a long-term viability perspective, offering the service for free to employees helps drive better adoption — often 2x-3x the adoption you get when employees pay per transaction,” he said.

“EWA companies are typically B2B2C businesses and face the same challenges that many B2B2C businesses face: The decision-maker and the consumer have different incentives and priorities.” Jennifer Ho, partner, Integra Partners

“Taking into account that the purely EWA business model is not among the strongest in the fintech world, choosing the model that helps drive better adoption leads to more cross-selling opportunities, and eventually, better economics.”

To get a more in-depth look at the state of the EWA industry, how it should be classified and where the money is going, we spoke to a few active investors in the space:

EWA is already prevalent in the U.S. in industries such as retail and fast food, so how difficult will it be for startups to bring the technology to new sectors? Which sectors are the most ripe, and which ones offer the most resistance?

Jennifer: EWA works in any sector where wages are not paid instantly, and it works best when they can serve large pools of financially underserved employees. The less savings people have to finance their day-to-day ahead of wage disbursement, the more valuable EWA becomes.

In developed markets, this typically means sectors that have a large blue-collar workforce. However, in emerging markets like Southeast Asia, where financial literacy remains relatively low, and large segments of the middle class remain financially underserved, EWA can have a far broader impact.

Aris: We have been observing recently a penetration of EWA in two dimensions: vertically and horizontally.

From a vertical perspective, retail and fast food are indeed some of the first ones to come to mind, but other sectors are seeing growing penetration as well. Especially those where the headcount is blue collar dominated, such as manufacturing and transport.

From a horizontal perspective, we see EWA penetrating nearly every sector at the lower compensation/entry-level employees point. This is for sectors where the proportion of permanent full-time employees is high.

We believe the cost of living crisis that started in 2022 and will presumably last for some time is likely to promote this horizontal penetration.

Aditi: The best way to roll out EWA to new sectors is by distributing through payroll providers. One sector where EWA is viewed favorably is the nursing/medical industry.

Earned wage access is still a fairly new service, and we see multiple models, with some charging employers and others charging employees. Which earned wage access model is the strongest? Why?

Jennifer: From a financial inclusion perspective, models where the employer — rather than the employee — bears the cost have the stronger social impact case. What we’ve found is that EWA startups typically service a mix of customers across both models, where the employer pays in some cases and the employee pays in others.

3 investors explain why earned wage access startups are set to cash more checks by Karan Bhasin originally published on TechCrunch

How will employee benefits startups fare when their corporate customers start slashing costs as the market goes downhill? We’re going to find out if current trends continue.

There was a spike in the number of startups offering employee benefits services through a B2B2C model last year, as nearly every company focused on employee benefits amid the Great Resignation in an effort to retain and attract talent. These startups sell everything from paid care leave coordination and fertility services to discounted gym memberships to consumers through their employers.

But the freewheeling spending of 2021 is now over, and some of these startups could find their offered services on the chopping block if market conditions continue to worsen.

If there is indeed a recession on the horizon, many of these startups would be right to fear for their future growth, but Brian Kropp, chief of HR research at Gartner, doesn’t think this downturn will mirror the last. Kropp told TechCrunch that even if the market enters a recession, it won’t be similar to what we saw in 2008 because of the ongoing labor shortage.

Last month, U.S. Treasury Secretary Janet Yellen said the economy is “in a period of transition,” on the grounds that “we have a very strong labor market. When you are creating almost 400,000 jobs a month, that is not a recession.”

Today, we learned that the U.S. added 528,000 new jobs last month and the unemployment rate has fallen to 3.5%, but for many people in tech, this is a distinction without a difference: according to layoffs.fyi, 467 startups have let go of 64,518 employees so far in 2022.

Marketing can’t cure everything that ails a company, but it is the easiest channel to make iterative changes that produce immediate results.

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription</p

In his latest TechCrunch+ column, Jonathan Martinez says it’s time to “re-forecast, re-prioritize and refine” strategies to move key growth metrics like ARPU and LTV.

Using multiple examples, he shares a few ways companies can project revenue using shorter time intervals, along with exercises to help fine-tune their marketing stack.

“If new channels and major experiments were in the picture, it’s probably best to shelve those for when the markets recover,” he advises.

Thanks very much for reading,

Walter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

Image Credits: Anna Minkina (opens in a new window) / Getty Images

On Tuesday, VP and managing director of Dell Technologies Capital, Yair Snir, shared an article explaining why founders should plan to get acquired, particularly since their odds of going public are so long.

In a follow-up, he takes readers inside the post-acquisition integration period/process:

“While IPOs may get more headlines, a well-timed, well-planned acquisition can mean even larger opportunities for you, your team and the technologies you’ve built,” says Snir.

Image Credits: We Are (opens in a new window) / Getty Images

When I worked at a startup located near a wall-climbing gym, a manager proudly announced that they’d negotiated a discount for our entire staff as a company perk.

But once it was explained that this benefit was only valuable to the employees who were already gym members, it seemed somewhat exclusionary. To restore parity, employees who declined a gym membership were offered ride-hailing credits.

“Founders need to ask themselves what really matters to their business, and which benefits best align with their cultural values,” says Anitra St. Hilaire, vice president of People at ThreeFlow.

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

I’m a software engineer currently on an H-1B. My employer sponsored me for an EB-2 green card, and my application has been approved, but I’m still waiting for a decision on my application to register for permanent residence.

I want to leave my employer and do something completely different. Can I transfer my green card to another employer in a different field and position, or should I stick it out in my current position until I receive my green card?

If I should stick it out, how long should I stay with my current employer after I receive my green card?

— Craving Change

Image Credits: Nigel Sussman (opens in a new window)

Russia’s invasion of Ukraine, pandemic supply chain issues, and the looming recession are dragging down the euro’s value, but there could be a silver lining for European startups.

Besides helping them make more money from selling to the U.S., a stronger dollar could encourage U.S. investors on the fence to invest across the pond, suggest Alex Wilhelm and Anna Heim in The Exchange.

“U.S. dealmakers on the fence may find a stronger dollar to be a nudge toward conviction, if not enough to truly change behavior.”

Image Credits: Stephen Swintek (opens in a new window) / Getty Images

According to PitchBook, 270 new venture funds raised a total of $16.8 billion in 2021. Twelve months later, the managers of those funds are trying to make sense of a changed landscape where the old rules no longer apply.

To learn more about how their strategies and tactics have evolved, Rebecca Szkutak interviewed these first-time fund managers:

Image Credits: Glambook (opens in a new window)

This summer, Glambook, a booking platform that aims to become the “Uber for the beauty industry” raised $2.5 million at a $12 million valuation.

To help TechCrunch+ readers understand why Glambook’s pitch helped seal the deal, Haje Jan Kamps tears down their 19-slide deck, depicting a company that’s rapidly gaining traction in a “market that is bigger than you think.”

I’ve been the first human resources leader at two successful startups. In both instances, I’ve built the human resources function and people teams from the ground up.

Doing this from scratch means you have to consider everything, from compliance to compensation. Often, processes and procedures just fell into place before I joined, so it was my job to evaluate whether they made sense.

One of the most complex and interesting topics I tackle is employee benefits packages. It’s a subject that comes up often at startups that want to ensure they have a competitive edge when it comes to hiring and retaining talent.

However, it’s also been known to get out of hand, and with startups tightening their budgets, I believe we’ll start to see benefits changing drastically in the coming months.

Founders need to ask themselves what really matters to their business, and which benefits best align with their cultural values.

Virtually every company will have its own take on what should be offered to employees, so founders inevitably struggle with what makes the cut (and what doesn’t). There’s no “one size fits all” benefits package, and nor should there be, as each company has its own objectives and goals.

Here are four aspects for founders should consider when building benefits packages:

It’s imperative that startups should not try to match what other technology companies are offering. It’ll be impossible to offer every flashy new perk that you come across, or provide extravagant packages like Google or Facebook.

For example, Netflix offers unlimited parental leave, which is incredible, but for an early startup, offering this would be daunting and difficult.

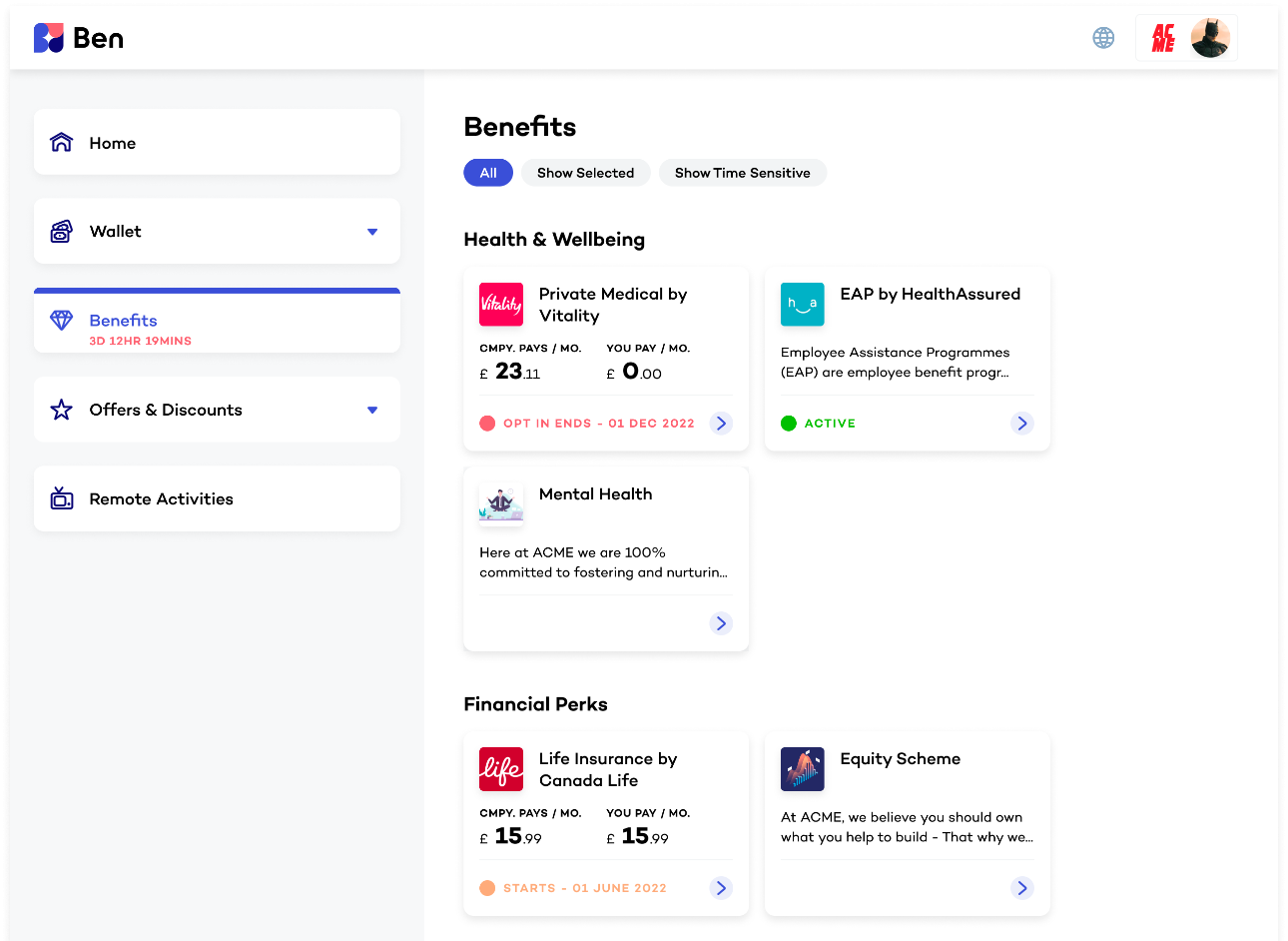

Employee benefits platform Ben today announced it has raised $16 million in a series A round of funding led by European VC giant Atomico.

While salary is undoubtedly the main draw in a company’s compensation offer, additional “perks” can help sweeten the deal for current or would-be employees — this could be anything from gym subsidies or an ebike subscription, to meal allowances and mental wellbeing support. But curating and bundling all these various benefits is a massively resource-intensive endeavor, something that Ben is setting out to solve.

Founded out of London in 2019, Ben is a SaaS platform that offers core employment benefits such as life insurance, health, and pension, as well as more lifestyle-based nice-to-haves such as gym memberships and work-from-home allowances.

While Ben is aimed at the human resources (HR) realm, it essentially straddles both the HR and fintech divide, integrating with systems spanning accounting, HR, and payroll to automate many of the onboarding and enrolment processes. Through the platform, employers can set budgets and spend controls for each worker’s perks, as well as facilitate the entire payments process to the service provider. On top of that, Ben can also issue Mastercards that each employee can use on whatever perks they want within the limits stipulated by the company.

“What was once a huge burden for HR teams to compile and manage is now collated and presented through the Ben platform,” Ben cofounder and CEO Sebastian Fallert explained to TechCrunch. “This both expands choice greatly while also minimizing time-consuming admin.”

Ben’s benefits

A quick peek across the employee benefits’ landscape reveals a number of similar companies, including Forma which recently announced a $40 million series B round of funding back in March, while London-based Juno secured a $4 million round.

Ben, for its part, is pitching its “end-to-end flexibility” and comprehensiveness of its benefits as one of its core differentiators, spanning regulated “core” (e.g. life insurance and pensions) products and lifestyle (e.g. gyms) perks.

“On the ‘core’ front, we’re able to provide country-specific coverage through our global broker network and enrolment technology,” Ben cofounder and COO David Duckworth said. “This is important, so companies always get the best combination of coverage and price. On the lifestyle front, we have relationships with benefits suppliers and can enable spend controls on the Ben Mastercard to turn any merchant into a benefit, including spending Lifestyle budgets on core products.”

On top of that, Duckworth also pointed to the fact that Ben is an “open” platform that isn’t locked into a set range of benefits.

“Companies are not limited to specific providers and can bring their own providers and broker relationships, while Ben takes over the ongoing administration,” he said.

It’s also worth noting that a key premise behind the “extensiveness” and flexibility of the benefits on offer is that different people have different needs, depending on a multitude of factors — including their age.

“This is the first time in history that four generations coexist in the workforce at the same time,” Fallert added. “Baby Boomers, Generation X, Millennials, and Generation Z participate in a complex global economy, and their benefit requirements vary and fluctuate. Companies, many of whom are spending around 33% of payroll on benefits, are reassessing their traditional benefits packages to fit more culturally and ethnically diverse teams distributed around the world.”

In an environment that includes an ongoing talent shortage and the so-called great resignation, it’s clear that there is perhaps a growing demand for technologies that help to attract and retain workers. And, in fact, lead investor Atomico has a decent track record in backing companies aligned with the space, including Peakon which exited to Workday in a $700 million deal last year; JobandTalent, which attained a $2.35 valuation last December; and Gympass, which most recently hit a $2.2 billion valuation.

Ben had previously raised a $2.5 million seed round of funding, and with another $16 million in the bank the company is now well-financed to solve the benefits complexity problem for SMEs and enterprise clients alike. And in the three years since its foundation, Ben has already secured a number of sizeable customers, including Zalando, Deliveroo, Funding Circle, and BitPanda.

“Employees are looking for more choice in what benefits they would like and it’s in the interest of employers to be flexible, but until now it’s been complex and costly,” Fallert said.

Aside from lead backer Atomico, Ben’s series A round also included investments from Cherry Ventures, DN Capital, Seedcamp, and founders and executives from notable fintech / HR companies including Peakon, Remote, and Personio.

Pazcare, a Bangalore-based employee benefits and insurtech platform, announced today it has raised $8.2 million led by Jafco Asia, bringing its valuation to $48 million. The funding also included participation from returning investors 3One4 Capital and BEENEXT.

Pazcare currently offers health, term, accident insurance and outpatient health benefits. It monetizes from service providers through commissions.

The startup says it currently serves more than 130,000 members from over 500 companies on its platform and has seen quarter-on-quarter growth of 100%. Its enterprise clients include Mindtickle, Mamaearth, Levi’s, Cash Karo and Open Financial.

Pazcare’s last round of funding was a $3.5 million seed round raised in October 2021. It has now raised a total of about $12 million since its founding in 2021 by Sanchit Malik and Manish Mishra. It aims to bring 2,000 more companies onto its platform over the next few quarters.

Malik told TechCrunch that the new funding will be used to expand Pazcare’s offerings and double its team size. He and Mishra wanted to create Pazcare because “health and life insurance penetration in India has been very low,” Malik told TechCrunch. “In India, we are on our own, either we buy insurance by ourselves or we are dependent on our employers to provide these benefits. We believe that insurance penetration will be primarily employer-driven and this became a big trigger for us to get into it.”

In a statement, Jafco Asia head of South Asia investments Supriya Singh said, “B2B insurance is a large white space in Asia. Pazcare is well equipped to disrupt this space and the company’s numbers speak for itself.”