Goldsky raises $20M to bring real-time, on-chain data to crypto companies

Despite well-known volatility in the crypto market, crypto startups building infrastructure to support the industry’s long-term growth have seemed to fare better than their peers. This is especially true for data, a universally necessary input for web3 companies, with crypto data firms like Messari reportedly fundraising amid a down market.

Goldsky, a data infrastructure company for crypto startups, has raised $20 million in a seed round led by Felicis and Dragonfly Capital. The round brings their total funding to $22 million, which includes capital from angel investors such as Elad Gil, Plaid founders Zach Perret and William Hockey, Zhuoxun Yin of Magic Eden and Uniswap Labs.

The company’s co-founder and CEO Kevin Li said that while Goldsky closed the seed round before this summer’s dropoff in crypto prices, the company’s focus on infrastructure has given it an edge to weather bear market conditions.

Goldsky co-founder and CEO Kevin Li Image Credits: Goldsky

“I think there are a lot of more aspirational tools that are out there, and by all means, we need those tools. That’s how we advance the state of crypto. But as an infrastructure company who is marketing to effectively every other crypto company, what we’re building is extremely obvious and valuable to our customers,” Li told TechCrunch in an interview.

Li met his co-founder while both of them were working in data engineering roles at digital insights company Heap Analytics. Li’s next jobs at Google and Meta eventually led him to 0x Labs, where he helped build a decentralized exchange aggregator called Motion, which he described as “Expedia, but for trading tokens.”

While Li saw what he described as staggering volumes on the platform, he noticed that the main bottleneck for further growth was not actually around the engineering process.

“It was more about, how can we get the data we need to ship those features, because we can make the prettiest [product] in the world, but if it doesn’t actually represent real data, no one’s going to use it,” Li said.

Li began building Goldsky to address the expensive challenge for web3 companies that comes with reading and processing data from deployed smart contracts. By automating the creation of data pipelines, Goldsky enables its customers to spend more time working on building their core products rather than parsing the data feeding into those products, Li explained.

Companies, especially startups, lack the time or expertise to figure out how to parse on-chain data, which is a fairly specialized skill, he added. While there are other startups such as The Graph working to solve similar problems, Li said Goldsky’s differentiation lies, in part, in its focus on providing accurate real-time data to companies.

“If you just look across the rest of the spectrum of other companies in this space, you’ll see that there are quite a few companies that build APIs. There are quite a few companies that allow for people to query SQL databases,” Li said. “I think both those are very valuable, and you need both of those in order to build a successful business, but they’re only a small piece of the greater data challenges that every other company has, and I think particularly real-time data is actually really hard to get right.”

Li noted that Goldsky, founded last October, was one of the earliest companies to invest heavily in real-time data. He shared an example to illustrate why providing real-time data in crypto is so challenging:

“What’s interesting about crypto is that there’s actually a kind of a settling phase. If you’re very close to the head of the chain, it actually takes time for some of those transactions to be confirmed, so your data is not actually truly immutable while transactions are getting confirmed,” Li said.

The company is currently focused on serving crypto-native companies such as DeFi protocols, though Li declined to share numbers on how many customers Goldsky has or its revenue/profitability. He did share examples of some of the company’s current customers, including fellow crypto infrastructure firm Arweave and NFT company POAP.

The team is comprised of 8 people today, all of whom are engineers working remotely (half are located in Canada, according to Li). While Li plans to use the fresh funding to add some new headcount in areas such as product management and design, he said that he wants to keep the team around ~15 total employees for now to ensure Goldsky is hiring the right people.

Sundeep Pechu, a general partner at Felicis, led the venture firm’s investment into Goldsky. Pechu said he sees Goldsky’s biggest competition coming from companies attempting to build their own data infrastructure in-house rather than from other startups in the space.

“When we were doing diligence, we were talking to a bunch of companies, and we were asking them what they were using. Almost everybody was building something internally, so it’s just such a nascent market,” Pechu said.

Goldsky raises $20M to bring real-time, on-chain data to crypto companies by Anita Ramaswamy originally published on TechCrunch

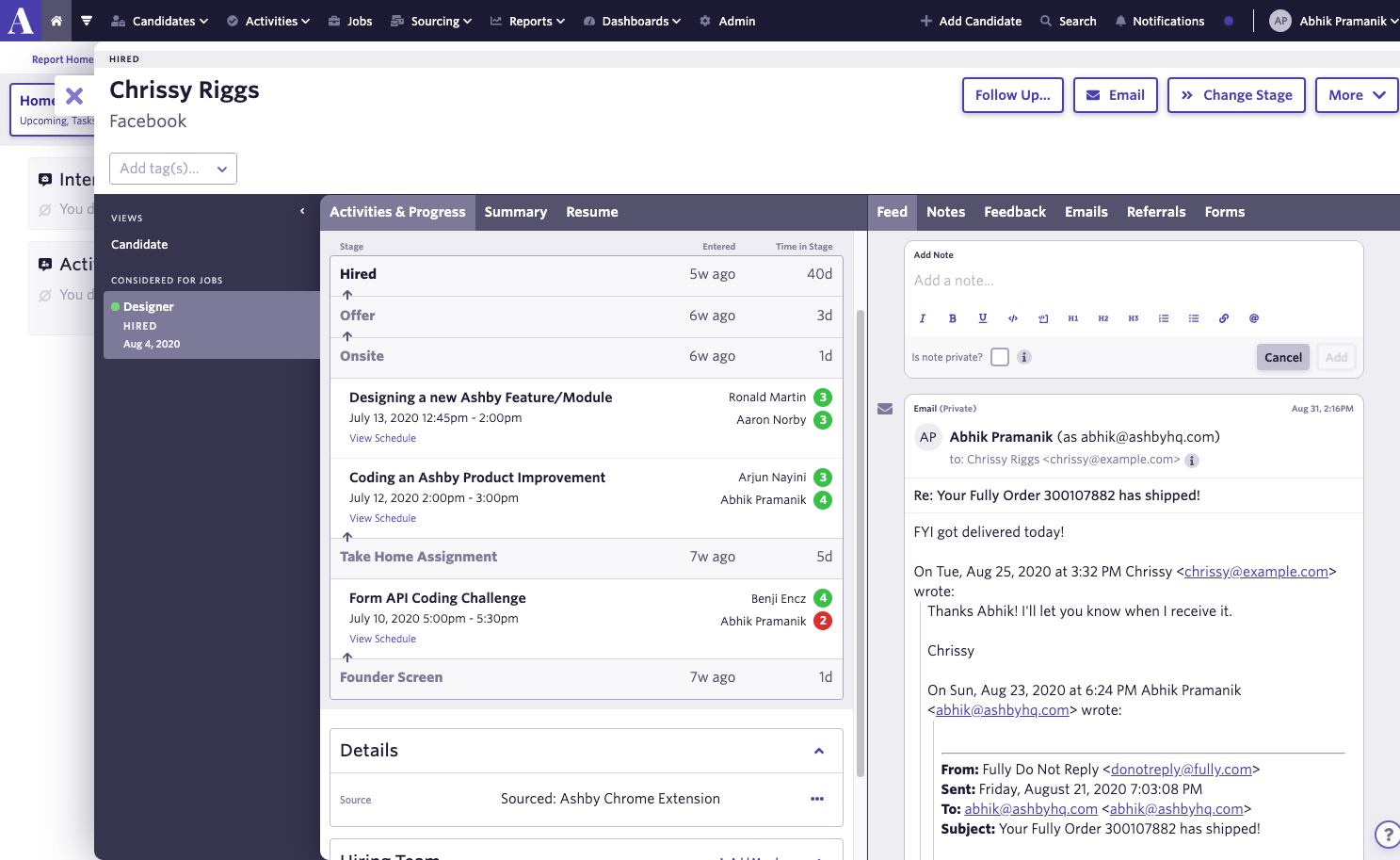

Ashby lands $21.5M to automate key aspects of recruiting

As hiring remains challenging in an economy where jobs are plentiful (depending on the sector), venture capitalists continue to pump money into HR startups focused on assessing and onboarding candidates. According to PitchBook, companies focused on tackling hurdles in payroll and people management and recruitment raised $12 billion last year. For example, Velocity Global, which offers a platform that handles onboarding and payroll, raised $400 million in a single funding round last year, while employee management software vendor Rippling landed $250 million.

In a sign that the enthusiasm isn’t dying down, Ashby, a new recruitment platform launching out of stealth, has raised $21.5 million in equity financing. F-Prime Capital led the Series B with participation from Elad Gil, Lachy Groom, Semper Virens, Base Case Capital and Gaingels, bringing Ashby’s total raised to $34.5 million.

Ashby was founded in 2018 by Benjamin Encz and Abhik Pramanik, who met while working together at PlanGrid, a construction productivity software startup. Prior to PlanGrid, Pramanik was an R&D engineer at Industrial Light & Magic and co-launched Choir, a mobile app designed to provide therapies to those with mental health challenges. Encz was a project lead at German IT service provider Datagroup before building clinical software, workflows and processes for the Mayo Clinic.

At PlanGrid, where Encz was the director of engineering and spent the bulk of his time on recruitment and recruitment-related tasks, Encz says he ran into limitations with existing applicant tracking systems (ATS) — and was inspired to build one from scratch. It isn’t just him. According to one survey, 50% of employers don’t use ATS software, whether because of blockers with implementation or insufficient C-suite buy-in.

“Recruitment teams are being disproportionately impacted by current tech layoffs — this creates the need to run leaner budgets and do more with less headcount,” Encz told TechCrunch in an email interview. “Ashby is consolidating recruitment tools for companies with double-digit employee counts. [The platform’s] automation of tasks like sourcing and scheduling are big advantages for lean recruiting teams.”

Ashby’s job candidate tracking dashboard. Image Credits: Ashby

Encz sees Ashby replacing solutions from vendors like Greenhouse and Lever with algorithms — specifically scheduling and profiling algorithms. He claims that the platform uses AI to automatically find times that work for interviewers and interviewees and infer demographic data like gender and ethnicity, which clients use for aggregate analyses of diversity, equity and inclusion (DEI) hiring metrics.

Encz was quick to assert that the demographic data can only be used in the aggregate and not in a way that impacts individual hiring decisions.

“The average recruiting team of a company with more than 100 employees has three to five tools, which is expensive, compromises data quality and slows down the process,” Encz said. “Existing recruiting data and analytics are limited and unreliable, making it difficult for finance to do … planning. Hiring managers can’t keep track of candidate pipeline or track DEI statistics. Ashby’s platform is particularly strong in data collection, data quality, multi-departmental workflows and reporting — we have templates and custom options.”

The market for recruitment software could reach reach $3.85 billion by 2028. A number of startups are competing for a slice of it, unsurprisingly, like Guide and Fletcher. Elsewhere, recruitment platform Gem gained unicorn status last September.

But Encz says that Ashby already has a number of high-profile customers, including Notion, Opendoor, FullStory and Figma, and a client base exceeding 500 brands. He declined to share revenue metrics while averring that the company is prepared for a potential slowdown, noting that Ashby intends to increase headcount from 55 employees to 75 by the end of the year.

As alluded to earlier, one factor in Ashby’s favor is enduring demand for HR tech broadly speaking. The market has proven remarkably resilient in the face of both pandemic and economic headwinds, as companies invest in digital infrastructure and macroeconomic fears increase the pressure on HR teams — some of which had to contend with layoffs among their ranks — to vet candidates carefully.

“Last year was a huge accelerant — this year less so,” Encz said. “We anticipate a potential slowdown but we are well-capitalized. The Series B was opportunistically based on strong growth and wanting to have a healthy cash reserve. In the next 12 months, will use the new injection of funding to expand Ashby’s offering further beyond what is typically found in ATS, allowing us to be more aggressive on product, design and engineering hiring.”

Ashby lands $21.5M to automate key aspects of recruiting by Kyle Wiggers originally published on TechCrunch

Sprig raises $30M to help companies gauge users’ reactions to products

Sprig, a startup offering tools for user and software product research, today announced that it raised $30 million in a funding round from Andreessen Horowitz, Accel, First Round Capital, Elad Gil and Figma Ventures. It brings the company’s total raised to $90 million, which CEO Ryan Glasgow says is being put toward expanding Sprig’s service line, support sales and marketing efforts, and dedicating resources to integrations and partnerships.

Glasgow founded Sprig in 2019. Prior to starting the company, he was an early team member and product manager at website builder Weebly and search app Vurb. While at Weebly, Sprig says he realized how difficult it was to research across the product development life cycle, especially when timelines are tight and research resources are in high demand.

“While I had access to a variety of tools ranging from product analytics and A/B testing to feature flagging and roadmaps, I lacked a tool that would make it fast and effortless to understand [Weebly’s] customers in real-time,” he told TechCrunch. “I knew there was a better way, and in January 2019, I started Sprig, then called UserLeap.”

To Glasgow’s point, public metrics suggest that user experience research is rarely prioritized. A 2019 survey from UserZoom found that companies struggle to integrate user research into product development and that budgets remain stagnant, even as the majority of CEOs see user and customer experience as a competitive differentiator. According to one report, only 55% of companies currently conduct any user experience testing — despite the fact that every dollar invested in user experience is estimated to net a $100 return, a Forrester Research study found.

Image Credits: Sprig

Sprig provides surveys and templates for research teams conducting user experience studies. But it also goes beyond this, analyzing open-ended question responses in the surveys to summarize the results into themes. Leveraging AI, Sprig recognizes “thematic similarities” between the answers, Glasgow said — even in the absence of overlapping words and phrases.

“Sprig’s surveys are built on an events-based architecture to trigger based on specific actions or inactions (e.g., dropped out of onboarding, didn’t use a specific feature) and user characteristics (e.g,. plan type or geography) after a low or no code one-time integration,” Glasgow explained. “Companies operating at … scale often consider building an in-house survey tool, which requires a dedicated team of engineers to operate and maintain it. With the cost of a fully loaded engineer costing upwards of $200,000 annually, investing in Sprig is a no-brainer.”

Indeed, research is often costly — software-as-a-service companies spend an estimated 23% of their revenue on R&D, for example — and there’s no guarantee it’ll lead to a successful outcome. Forty-two percent of companies in a recent CB Insights poll cited “no market need” as the reason that one of their products failed to gain traction.

Sprig recently launched Concept & Usability Testing, a service that allows companies to test ideas, concepts, designs and prototypes before deploying them into production. Concept & Usability Testing includes browser-based testing that allows participants taking a Sprig survey to review one or multiple concepts, complete recorded tasks and provide feedback, while allowing teams to source new participants from an existing research panel, product or app.

Glasgow sees UserTesting, UserZoom, and Qualtrics as competitors in the fast-growing user experience monitoring market. UserTesting went public last year after raising over $150 million in capital. Qualtrics’ IPO came sooner, in January 2021, and drove the firm’s market cap to $23 billion. Just in June, Maze — a close rival — nabbed $40 million in a Series B round, while UserZoom last April closed a $100 million tranche and acquired experience insights company EnjoyHQ.

The competition taken into account, Glasgow is pleased with Sprig’s performance of late, noting that net recurring revenue grew 300% over the last 12 months. (He demurred when asked about annual recurring revenue.) Sprig counts Dropbox, Loom and Square among its current customers, and the company plans to grow its headcount from 95 today to 125 by the end of the year.

“Sprig did not need the funding, but we were proactively approached by our existing investors at an increase from our previous valuation. It was too good to pass up, so we did a quick inside round that only took a few days,” Glasgow added. “Companies need to have conviction before deploying resources to build new products and be able to evolve the product based on user feedback. Sprig helps scale research programs by quickly uncovering insights freeing up the team to focus on the highest leverage work.”

Startups race to build a crypto-native, consumer-friendly messaging platform for web3

There’s no shortage of headlines about the onset of “crypto winter.” Amid a growing pile of bankruptcies, one of the buzziest startups in the business, the NFT marketplace OpenSea, announced a major layoff just today.

Behind the scenes, however, plenty of founders and VCs are doubling down on the promise of largely decentralized, blockchain-based outfits, and toward that end, one of the “more interesting parts of crypto right now” is at the “intersection of social messaging and web3,” says renowned entrepreneur and investor Elad Gil. In short, he thinks today’s messaging tools don’t cut it, and that there will be new opportunities for crypto-native startups to get it right.

Gil has already made an early bet, leading a $4 million seed round in Lines, a startup whose three co-founders studied philosophy at Harvard and whose CEO, Sahil Handa, boasts that the nascent company will become “web3’s messaging platform,” even while he and his former classmates are still developing its tech.

That it’s still a work in progress is apparently just fine with Lines’s backers, which also include renowned angel investors Naval Ravikant, Balaji Srinivasan, Gokul Rajaram. What they’re backing is a vision. There’s a “rapidly increasing number of people using crypto pseudonyms to purchase digital currency, swap NFTs, vote on proposals, and manage treasuries,” explains Handa. “But whenever someone tries to communicate with another person in this network, there’s no way of knowing whether or not they are talking to the right person.”

Lines meanwhile strives to enable users to send messages from wallet to wallet and to join group chats based on token ownership. Indeed, Handa paints a picture of a communication layer that’s both ambivalent about underlying blockchains and the particular crypto wallet a person is using, and that, as a result, empowers users in a wide variety of ways. They can find the owner of a particular NFT they’d like to buy, for example, or discover like-minded individuals based on the tokens they’ve acquired, or reach out to potential new contributors of a DAO (a kind of “group chat with a bank account,” as DAOs have been called).

Certainly, Gil thinks the timing is right as more people organize and transact as a group online. In earlier days, he notes, “Your bitcoin or crypto asset and mine were identical, so I would have less reason to ping an anonymous user via their wallet. But with DAOs, there is the need to coordinate with various members beyond just using Discord.” In the world of web3, he says, users “want to be able to identify and interact with people for governance, to reward contributions, do airdrops, and so forth.” With NFTs and other collectibles, “I may want to be able to ping you to buy or sell or trade, so there are other incentives for a communication layer to be useful,” he adds.

The question is whether enough people will agree that Lines is offering the exact right solution. As with every messaging app ever, its value will largely be determined by how many people use it. And how many people use it will determine if the startup is able to strike partnerships with platforms like OpenSea that it needs on its side.

In the meantime, Handa and co-founders — who have yet to decide on a business model — will soon be in competition with other messaging apps that are trying to take on Twitter, Telegram, or Discord, where most web3 conversations live today and where, because it’s all but impossible to verify that people are who they say they are, phishing attempts and other scams are rampant.

Gil himself says he’s already aware of “various teams working on identity, social layers, and communication on top of web3.”

Most of these are still flying beneath the radar, but some are beginning to emerge publicly. Last month, for example, a crypto analytics platform called Nansen rolled out a messaging app that it says lets users log in with a crypto wallet and then connect to groups based on their crypto holdings and the NFTs that they verifiably own. Like Lines, the firm describes the app as a “crypto-native communications hub” for web3 communities.

An NFT marketplace, Rarible, separately announced a wallet-based messenger feature last year.

Naturally, Lines argues that it has an advantage over others. Namely, says Handa, while he and his friends are building for web3, they have enough distance from it to build an app that both crypto natives understand but that people newer to web3 can easily grasp and use, too.

“We’re really focused on the client-side use cases, rather than how decentralized the messaging protocol itself is,” says Handa, who is still two credits away from graduating and very much plans to nab his diploma. (“My thesis is about identity and web3 communications, so it’s not really a distraction at this point,” he offers.)

He says he “thinks it helps that we haven’t been in the crypto space for 10 years” and thus “aren’t super ideological about the way we’re building the platform. We’re really just doing it based on what makes sense from a consumer perspective and a community perspective. So many crypto products aren’t thought out from consumer perspective,” he continues, “so we’re trying to find that first use case, make a compelling product, and then eventually, if other platforms want to integrate [with us], they can.”

Other investors in Lines’s seed round include Scalar Capital, Volt Capital, Caffeinated Capital, Consensys Mesh, Hash3, Mischief, and numerous other individuals, including Figma CEO and co-founder Dylan Field, and entrepreneur-investor Scott Belsky. Handa says Lines is using the capital to recruit, and that it’s in the market for three more engineers right now.

Volt Capital debuts second $50M fund backed by many of crypto’s kingmakers

Despite a nightmarish month for cryptocurrencies, venture backers dead-set on the sector are still amassing capital to mint new unicorns in the space.

This morning, a16z announced its latest $4.5 billion mega-fund. Today, the firm’s honchos Marc Andreessen and Chris Dixon are also placing bets in the second fund of Soona Amhaz’s Volt Capital. The new $50 million fund arrives just over a year after Amhaz debuted her $10 million vehicle dedicated to investments in the crypto sector.

Alongside Dixon and Andreessen, other backers of the firm include Elad Gil, Balaji Srinivasan and Albert Wegner.

It’s been a wild bull run for the crypto space, but onlookers increasingly worry that the sector is on the verge of a prolonged downturn.

Amhaz sees plenty of headwinds in the sector including looming regulatory tightening and the potential of a consumer pullback, but says her team’s strengths, which “combine technical expertise, engineering and community building” continue to be great assets to the firm’s field of bets, which includes crypto analytics company Nansen, login platform Magic, and treasury management startup Coinshift.

While plenty of firms that have been historically been skeptical of the crypto space debuted new funds or partners this year, Amhaz says that a downturn will separate the wheat from the chaff in the industry.

“Tourist investors… will get washed out quickly,” Amhaz told TechCrunch in an interview.

Subscribe to TechCrunch’s crypto newsletter “Chain Reaction” for news, funding updates and hot takes on the wild world of web3 — and take a listen to our companion podcast!

Filing: Anduril is raising up to $1.2B, sources say at a $7B pre-money valuation, for its defense tech

Technology built to improve state resilience — be it in the form of cybersecurity, energy independence, national defense or something else entirely — has come into stronger focus in the wake of the war in Ukraine, and the lines it has drawn between countries on the two sides of that conflict. Now, one of the more prominent startups building defense tech in the U.S. has filed paperwork indicating that it is raising a big round of funding that underscores this shift, and the resulting opportunities for companies like it.

Anduril — which brings together AI, robotics, computer vision, cybersecurity and new networking technologies to build both software and hardware-based defense systems, in aid of helping the U.S. and allied countries against the “software-defined conflicts of tomorrow” as it describes them — is raising up to $1.2 billion, according to documents the startup has filed in Delaware. PrimeUnicornIndex, which identified the filing, notes that if all of the authorized shares, at $16.52/share, for the new Series E are issued, it could raise the company’s valuation to as much as $6.65 billion. We understand however from sources that it’s actually $7 billion pre-money.

The Delaware filing does not disclose how much of that amount has been raised, nor who is investing. A spokesperson for Anduril would not comment for this story. But a source told us recently that at least one of the company’s past investors, 8VC, is in this round and said that it would be getting made public in the coming weeks, which implies that it is close to closing. Others that have invested in Anduril previously include Elad Gil (who led Anduril’s last round, a $450 million Series D in June 2021), D1 Capital Partners, Valor Equity Partners, Lux Capital, General Catalyst and Founders Fund.

For some more context on the fundraising, The Information first reported hearing about it about a month ago; at that time it was estimated to be between $500 million and $1 billion at a valuation of about $7 billion. The Delaware filing seems to indicate that the valuation is working out to be higher than originally estimated, and the amount being raised is higher, too.

Anduril’s fundraise is coming amid some notable shifts taking place in the world of venture funding.

On one hand, we and others have been charting the difficulties that startups have faced in raising and closing funding rounds, with the fallout coming from the top down, so to speak.

Publicly-traded tech stocks have seen big drops and sell-offs across the board, which has had a knock-on effect on the IPO market, which in turn has led to jitters among investors (typically also facing pressure from the performance of stocks in the public markets) backing large, late, growth-stage rounds for privately-held “scaleups”, with mid-sized rounds also seeing a chilling effect, and so on, trickling all the way down even to the earliest-stage startups. In all cases, after years of frothy activity, bubbles are bursting and valuations are typically dropping as well.

On the other hand, there are multiple exceptions to that rule, depending on factors like the sector in question, the company and its performance, how much is being raised, and who is doing the investing.

Anduril is ticking a couple of those boxes, starting first with the shift in attention around companies building defense and “resilience” technology, and the wider business opportunity for them.

Although a number VCs have steered away from making military technology investments over the years, there have always been some VCs that have focused specifically in that area, including those like In-Q-Tel, the investing arm of the CIA.

Now, partly spurred by world events; the power and influence of countries perceived to be potential hostile threats; and the role that technology is playing as a weapon and battleground, investors like these are now being joined by a newer wave of backers and buyers.

As one example, after many years of no activity in this space, NATO last autumn announced a new Innovation Fund, initially seeded with $1 billion to invest in defense, security, and deep-tech startups that “may otherwise be unable to develop successfully the innovative solutions most needed to the protection of the [NATO] Alliance.” From what we understand that might also include technology designed to improve resilience in areas like energy generation — something that has been a looming issue, given the embargoes being put on Russia over its invasion of Ukraine, and how that is playing out with its position as a key supplier of oil and gas in Europe.

The funnel of buyers is also growing. Earlier this year, for instance, Germany announced a commitment of €100 billion towards defense spending — again, prompted by Putin’s invasion of Ukraine and the threat Russia now presents — which will also have a strong technology component.

That activity is not limited to Europe. In January, Anduril won a contract valued at nearly $1 billion with the U.S. Department of Defense to provide counter-unmanned systems and systems integration to the DoD’s Special Operations Command, a deal that may have caught the eye of investors, given the timing with this round.

Rali_cap gets backing from global VCs and launches $30M fintech fund for emerging markets

Rali_cap, an early-stage venture capital firm focused on emerging markets fintech, has launched a $30 million fund. Last month, the firm, formerly known as Rally Cap Ventures, reached its first close of $20 million (its initial target) before increasing the fund size, signaling a strong LP appetite.

The two-year-old VC fund invests in B2B and API-first fintechs across Africa, Latin America and South Asia at pre-seed and seed stages. It expects to achieve a second close by the end of June.

Rali_cap was first a collective before a fund, said Hayden Simmons, the general partner that launched the firm in 2020, to TechCrunch in an interview.

As someone hands-on — he boasts a decade of experience working for emerging market fintechs such as Migo, Novi, and Juvo in business development and partnership roles — Simmons said he saw a prospect in aggregating a community of “experts” (primarily operators and angels) to collaborate via Slack on deal sourcing, due diligence and founder support and invest in emerging market fintechs.

“This way, we thought we could outperform traditional venture models in driving value to founders and getting more people involved in the venture capital game,” Simmons told TechCrunch on a call.

Two years on, this collective has nearly 240 individual LPs. They include executives and managers from fintechs such as Wave, Block, MercadoPago, Rappi, Flutterwave, Yoco, Visa, Plaid, Stripe, Coinbase– and e-commerce platforms like Jumia and Shopify. About 40% are based in the U.S., while the rest are spread across Africa, Latin America, and Southeast Asia, markets where they deployed over $6 million last year.

But at some point, most collectives with this strategy or a similar one try to launch and run funds (Future Africa and AngelList are some examples) which is what rali_cap found itself doing soon enough.

“By the end of 2020, we recognized that was too passive of a strategy,” Simmons remarked. “We had this super engaged community of all these fintech angels, but we decided that it made more sense to have our capital, as well to be able to fund the deals that we were also seeing.”

We’ve also seen this play out with angel investors who have become prominent solo venture capitalists like Olumide Soyombo of Voltron Capital— and globally, Elad Gil and Lachy Groom.

Last year, rali_cap raised $2 million, money it has since deployed. And as a fintech-focused firm, it ensured the limited partners for this new $30 million fund came from firms with an affinity toward fintech. They include Breyer Capital, Propel VC, Better Tomorrow Ventures, FT Partners, Bain Capital, Lateral Capital, a few family offices, HNIs, and a multi-billion dollar crossover fund also known for investing in smaller funds.

Rali_cap has backed 12 African startups, 13 Latin American startups, and 7 Asian startups. They range from banking-as-a-service and card issuance players to open finance and SME digitization platforms, including Belvo, Mono, Minka, Stitch, Union54, Pomelo, Simetrik, Brick and Abhi. Meanwhile, some of rali_cap’s LPs have taken part in follow-on early and growth-stage rounds of these startups.

“Our whole thesis is that the unit economics of investing in early stage B2C fintech in these markets don’t make sense yet,” said Simmons on why rali_cap only invests in B2B fintech platforms.

“So it’s still too hard to build B2C products from multiple markets in Africa that target a large enough total addressable market (TAM) due to the fragmented nature of the continent. The focus on APIs enables more efficient expansion within a market because they can grow the TAM, help B2C fintechs underwrite people at the last mile, stitch together multiple markets, and enable cross regional expansion,” he added.

Rali_cap is particular about startups in large markets across these regions– Nigeria, Egypt and South Africa in Africa; Brazil and Mexico in Latin America; and Pakistan and Bangladesh in South Asia. “But we’re always open for exceptions,” said Simmons.

According to partner Kyane Kassiri, rali_cap invests between $200k and $500k. He said the firm tends to lead pre-seed deals and participate in seed rounds. Kassiri, who had a brief stint at Berlin-based VC firm Target Global before joining rali_cap earlier this year, had worked closely with Simmons during the duo’s time at Lateral Capital.

With experience at both ends of the spectrum — being an angel investor with Suya Ventures to Target Global, which has more than $3 billion AUM — Kassiri believes founders look for two particular groups of investors on their cap table. First is the multibillion dollar-AUM kind of VC, which can double down in every round and push you towards IPO. And second is operators-cum-investors that bring domain expertise and an expansive network to talent and resources– which is Ralicap’s sweet spot.

“Our goal is to help the founders by opening up LP buffers and a whole community of our LPs to bring value and not necessarily take active board positions,” he said. “We’re here as an enabler to help them go from zero to one. That’s one way we position ourselves.”

Ralicap runs its collective arm on Sydecar. It’s a deal execution software for venture investors that raised $8.3 million from Ralicap and other backers last month. The platform’s CEO Nick Talreja also wears another hat as Ralicap’s legal advisor. Other strategic advisors of the fund include Adia Sowho, the CMO of MTN Nigeria; Rob Eloff, the general partner at Lateral Capital and Sheel Mohnot, the general partner of Better Tomorrow Ventures.

“I’ve been truly amazed to see RaliCap evolve into the strong brand it’s become, rooted in its community of top global fintech operators,” said Mohnot, whose firm backs RaliCap as an LP. “Their pan-emerging market coverage gives them a holistic perspective on industry trends.“

Ralicap’s new fund coincides with the introduction of similar funds launched by firms like Tofino Capital to attract founders at their earliest stages across emerging markets.

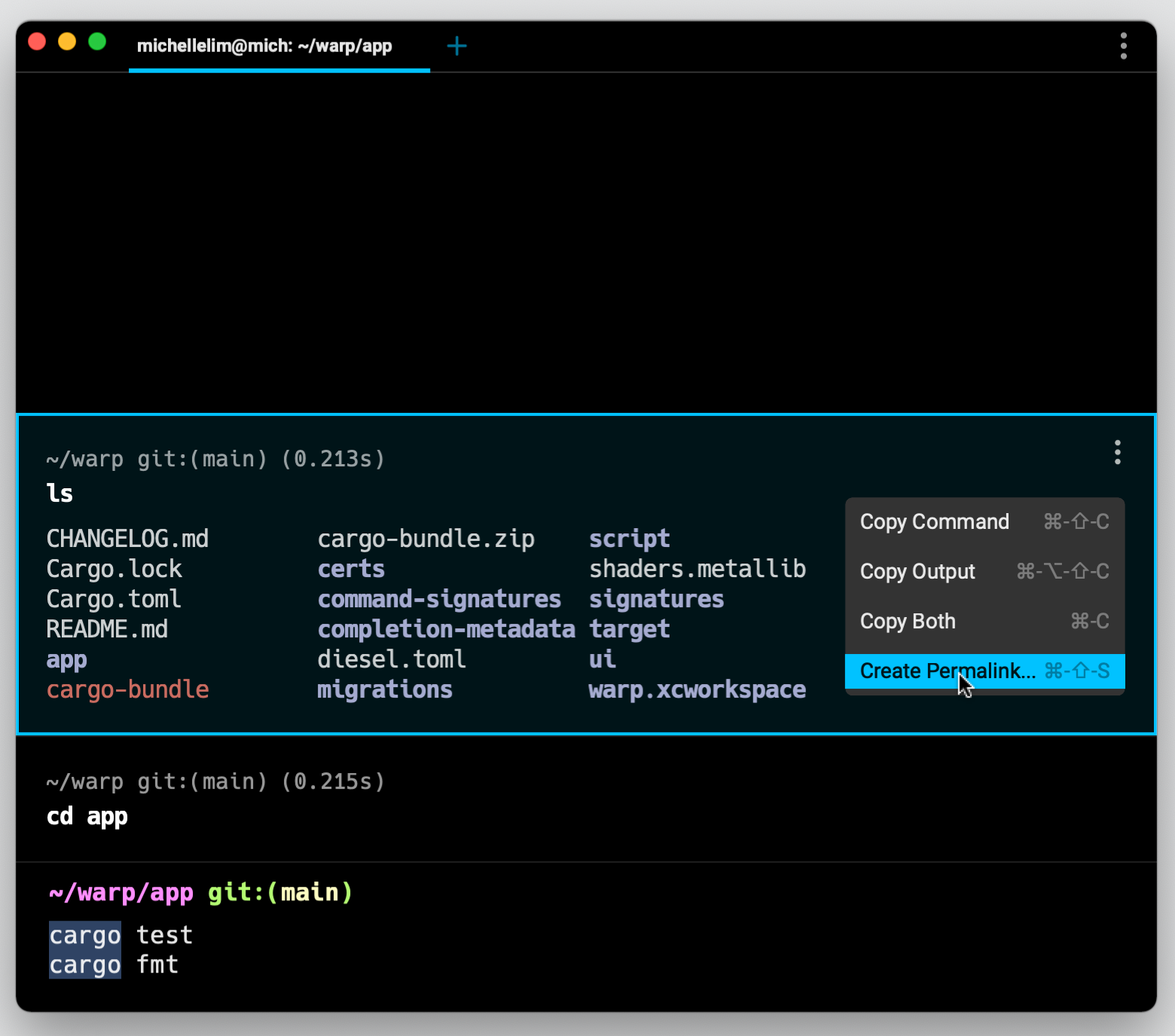

Warp raises $23M to build a better terminal

The terminal often feels like an afterthought, and there hasn’t been a lot of innovation in this space for a very long time. Warp, which is launching its public beta today and announcing $23 million in funding, is trying to change this by building a new command-line terminal that aims to make developers more productive. For now, the Warp public beta is only available on macOS, but the company promises Windows and Linux versions in the future, too.

As the company announced today, it previously raised a $6 million seed round led by GV, with participation from Neo and BoxGroup. It has now also raised a $17 million Series A round led by Dylan Field, the co-founder and CEO of Figma. Other participants in this (somewhat unusual) entrepreneur-led round include Elad Gil, former LinkedIn CEO Jeff Weiner and Salesforce’s co-founder and co-CEO Marc Benioff.

“I’ve been a developer now, for 20 years,” Warp co-founder and CEO Zach Lloyd, who was previously a principal engineer at Google and the interim CTO for Time, told me. “I’ve always been a terminal user. I’ve always thought it was kind of a weird app, to be honest. […] But it’s an interesting app in the sense that it’s ubiquitous. You walk by any developer’s desk and they’re going to have a terminal open. There are only a couple apps like that: the terminal and the code editor. So I thought it was an interesting leverage point for doing something that would have an impact across all developers. And then, if you can get really good at it you actually get a lot of real productivity gains.”

Out of the box, Warp works with shells like zsh, fish and bash. In many ways, the user experience feels reminiscent of a modern text editor, with code completion autosuggestions and menus, for example. But there are also features like cursor positioning, the ability to move back through your terminal history command to command and then copy the output with a single click, built-in documentation and more. Those are features that may seem obvious at first but aren’t really available in today’s terminals. Being able to move the cursor wherever you need it shouldn’t be a new thing in terminals in 2022, but it is.

The Warp terminal does, of course, feature standards like tabs, split panes, keyboard shortcuts and built-in SSH support. With Warp, developers can also share their workflows with the rest of their teams.

While at Google, Lloyd worked on Google Docs and he noted that something he took away from that is that anytime you can take an existing desktop app and add collaboration and teamwork on top of it, you can unlock quite a bit of extra productivity.

It’s maybe no surprise then that collaboration is part of what he hopes will make Warp stand out and be part of the company’s monetization strategy. Currently, the collaboration features mostly center around the ability to easily share commands and their output, as well as workflows, but soon, Warp will also introduce the ability to share.

It’s worth noting that for Warp, the terminal is only the beginning. As Lloyd noted, the company’s mission is to “elevate developer productivity. It’s not to build the best terminal that’s ever existed.” The idea here is to build a platform, with the terminal at the center but also as something akin to a distribution point for doing other things. That may be a code editor, a platform for building apps or for cloud-based development. “But those aren’t the focus to start. I think those are opportunities that open up if we execute really well on Warp,” Lloyd said.

Marc Benioff sure seems to be excited about it. “We are delighted to once again partner with a great entrepreneur, Zach Lloyd,” he said. “Developers will greatly benefit from the genius of Warp.dev.” So is Instagram co-founder Mike Krieger, who is working at a new startup in stealth. “I have been using Warp every day at work,” he said in a canned statement. “My favorite thing is the speed: both in terms of how fast it works and also how fast you feel while using it, especially the excellent typeahead and search. Warp brings terminals into the modern day and I can’t wait to see where they take Warp.”

Glean raises $7M to democratize data insights

You’d think data visualization and exploration is a bit of a solved problem thanks to the likes of Tableau, Sisense, Looker, Microsoft Power BI and their competitors. But for the most part, these tools were developed before every company had a data lake and warehouse — let alone a lakehouse. Of course, that means there is space of more startups in this field to provide a modern experience for building dashboards on top of all of this data. One of those is Glean, which is now coming out of stealth and announcing a $7 million seed funding round led by Matrix Partners’ Ilya Sukhar. A number of angel investors, including Elad Gil, Shana Fisher, Dylan Field, Scott Belsky, Cristina Cordova, Akshay Kothari, DJ Patil and Anthony Goldbloom, also participated in this round.

Glean co-founder Carlos Aguilar was an early systems engineer at Kiva Systems, where he got to work with large data sets from the company’s warehouse robots. It was there that he realized that a lot of teams wanted access to this data, but writing new SQL query for every request wasn’t scalable in the long run. “Even back then I developed this passion for not having to do that,” he told me. “I could build these data apps and then a whole subset of questions would just disappear. But more than that, people were super empowered and now they could do all sorts of things that they couldn’t do before. […] I loved this idea of like taking the complexity, simplifying it and building tools out of it.”

After Amazon acquired Kiva, Aguilar worked there for a few years and then joined Flatiron Health as the first data hire there and while the team was able to build tools to wrangle data there, too, the bottleneck now shifted to building data apps to help the rest of the company get insights from their data as quickly as possible. That meant lots of time building dashboards in legacy BI tools and helping others to use those.

The mission of Glean, Aguilar said, is not just democratizing data but democratizing insights. Being able to dig through data and not just looking at a dashboard is what most users want, he argued, and that is something that a lot of the legacy tools actually do quite well. “There’s a bunch of startups and upstarts, but nothing really gives gets you the powerful sort of interactivity that you get with a lot of these legacies tools still,” he said.

Glean wants to combine this interactivity without the barrier to entry of the likes of Tableau. You still need somebody in a company to know a little bit of SQL and somebody who can model the data, but once that’s done, Glean will automatically try to find the best defaults to visualize this data. The service currently supports Snowflake, BigQuery and PostgreSQL. As Aguilar noted, the company’s focus right now is on data warehouses, in part because this data is typically already cleaned up and ready to be queried.

Once those first steps are done, even non-technical users should be able to easily dig through the connected data and remix a given view for their own use cases, too. As of now, Glean supports all of the standard visualizations (think pivot tables, line charts, bar charts, etc.). And while it may try to democratize this data analysis workflow and many of its users will be non-technical, the company is also building a lot of tools for engineers, including git integrations, a CLI, a native build tools and more.

“We’ve seen a massive revolution in data infrastructure over the last few years. Organizations of all kinds now have access to more data than ever before. But there’s been little innovation in how data teams surface insights to their colleagues. They struggle to keep pace and deliver the business impact expected of them,” said Matrix Partners’ Sukhar. “Carlos and his team at Glean are rethinking the BI layer to solve this problem. The idea is to empower everyone in an organization to dive into data and make sense of it. The team has deep experience building data products at Flatiron Health and we’re excited to work with them on capturing this huge opportunity.”

Looking ahead, the team wants to build more collaboration features to bring an almost Google Docs-like experience to these dashboards — and that is, in part, what the team is going to use the new funding for. “The focus is really on trying to create an incredible experience with a very high level of fit and finish that just feels incredible to use,” said Aguilar. “It turns out, doing that in the data context and with a lot of different personas is a very hard problem. So investing in these core analytics workflows and making that an incredible experience is high on the list.” The team is also looking into building more automation systems and tools to automatically create models from various points in a company’s data pipeline.