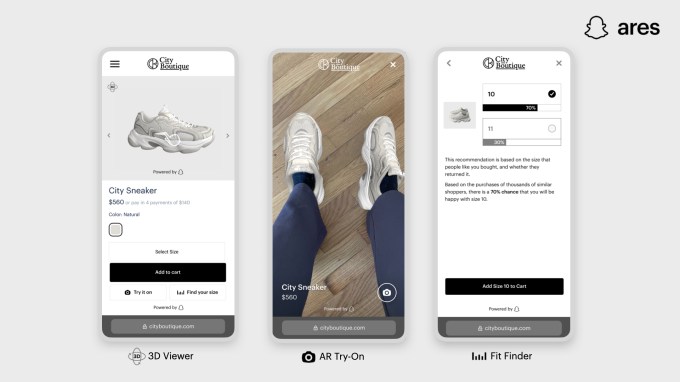

Snap today offered an update on its AR Enterprise Services (ARES), the company’s recently announced initiative focused on providing AR tools and expertise to businesses who want to leverage Snapchat’s technology in their own websites and apps. At its Partner Summit on Wednesday, the company showed partners its Shopping Suite, which includes features like AR Try-On and 3D product viewing, among other things, and announced a new offering called AR Mirrors that aims to bring AR tech to physical screens in the real world.

Coca-Cola is using the tech to make an AR-enabled vending machine and other retailers, including Men’s Wearhouse and Nike, have tested the product, Snap said, noting the tech would now become part of ARES.

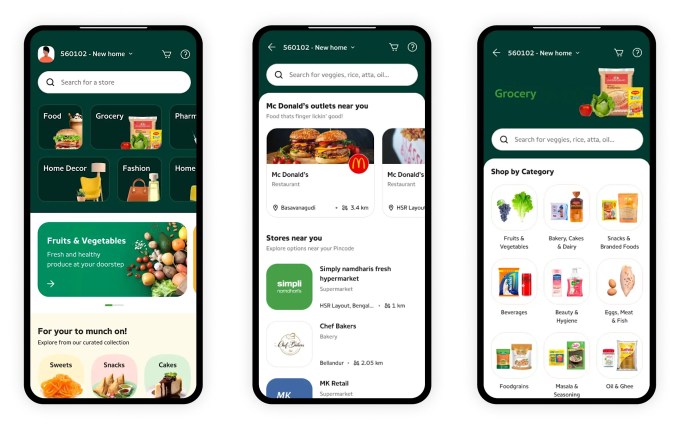

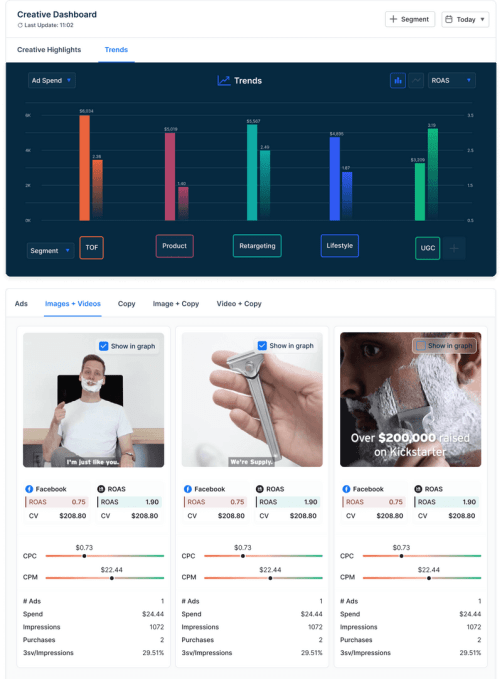

The company first detailed its Shopping Suite during ARES’ official unveiling in March, explaining how businesses can utilize its features on their e-commerce sites and apps. Among the nearly half-dozen features included in the suite are those that let users view products from all angles, get fit and sizing recommendations based on their body shapes, and others to leverage AR experiences to virtually try-on things like apparel, accessories, or footwear. Snap noted customers using the suite of tools included sunglasses seller Goodr, clothing company Princess Polly and Mongolian manufacturer Gobi Cashmere, to name a few.

Snap noted that Goodr found their customers were 81% more likely to add products to their cart after using AR Try-On. They also saw a 67% uplift in conversion for mobile device users, leading to a 59% increase in revenue per shopper. Princess Polly delivered over 50 million fit and sizing recommendations and saw a 24% lower return rate when they used Snap’s technology. Gobi reported Snap’s features led to 4x conversions.

Also demoed today was Live Garment Transfer, a tool that makes AR asset creation easier for retailers by allowing them to upload 3D assets in Lens Studio. The retailers can create a Lens that applies a 3D animated garment on top of what users are wearing in real-time, without special assets being needed.

Image Credits: Snap

Businesses access the Shopping Suite solution via a front-end dashboard and backend infrastructure where they create and manage their AR assets, build AR experiences, manage 3D asset catalogs, and implement the Shopping Suite SDK. Meanwhile, Snap provides an in-house team that helps clients with onboarding and using the suite’s features.

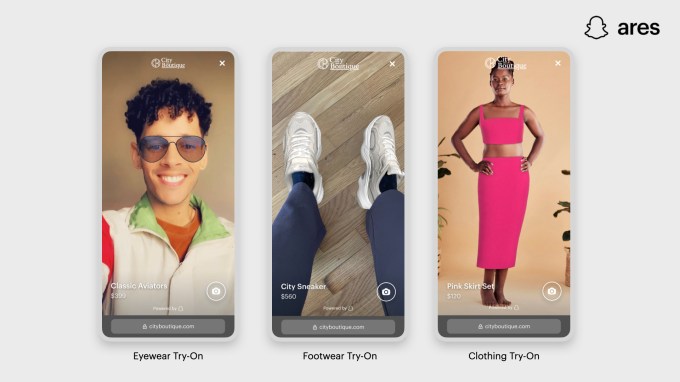

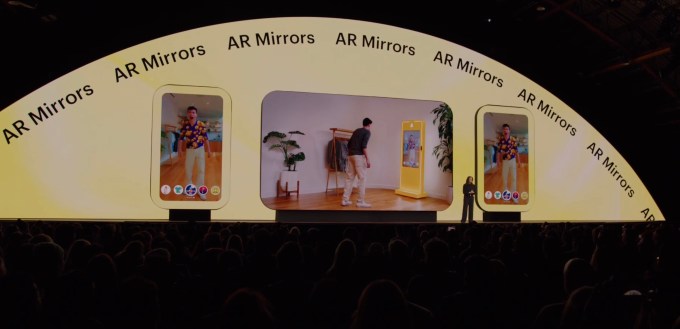

Now, Snap’s ARES business line will expand to include another new option, with the launch of AR Mirrors, announced today.

This offering brings AR features to physical spaces and events, Snap says, allowing customers to play with AR out in the real world — like in physical retail stores, for example. The product is focused on engaging customers and enhancing the in-store experience, though it may not become a significant business given the sort of one-off nature of these types of experiences.

Image Credits: Snap

Snap says Men’s Wearhouse and Nike have used its AR Mirrors in stores. It currently has an AR Mirror in a Men’s Wearhouse store to get shoppers ready for prom and wedding season and says Nike, who was the first pilot tester last fall, will later this year test AR Mirrors for footwear in stores.

The company additionally cited studies that found brands using AR in stores were 82% more likely to be recommended and 85% more likely to inspire future purchases.

Image Credits: Snap

Snap added it’s now working with Coca-Cola on an AR-enabled vending machine where users can step up and use hand gestures to control what’s on the screen. The machine is a prototype but is designed to blend the physical and digital experience together, the company said.

Snapchat’s AR technology comes to the real world with ‘AR Mirrors’ by Sarah Perez originally published on TechCrunch