Thousands of pitch decks, and only a handful of winners. Such is the math of the VC industry right now, what with an explosion of startups and dreams of glory launching every year. VCs are overwhelmed with pitches, which means that crafting the perfect deck and connecting with a reader in the few seconds you have their attention is critical.

So what do you do to build a deck that can’t be ignored? To answer that question, we assembled a group of three exceptional venture capitalists on the Extra Crunch stage at TechCrunch Disrupt 2021 who have probably read more decks collectively than any group of humans should ever be expected to. Mar Hershenson is founding managing partner at Pear VC, Mercedes Bent is a partner at Lightspeed, and Saba Karim is the head of global startup pipeline at TechStars.

In our discussion, we covered what’s changing with pitches as the world moves toward a hybrid in-person and virtual pitch model, discussed how deep tech startups should think about pitches, and then we wrapped by exploring how each panelist reads decks — and what that portends for founders who don’t want to be ignored.

We got right into the crux of the matter at the top of the panel: What does reading pitch decks feel like in 2021? For Hershenson, there’s just always more under the sun:

I would say the volume of pitches that we receive has increased and continues to increase at some form of exponential rate. For us, we have to become far more efficient at sorting and reading through these decks. The actual reading of the individual deck hasn’t changed, but the rate and volume have increased dramatically. (Timestamp: 1:01)

Bent noted that the bar has gone up for the quality of decks that she reads.

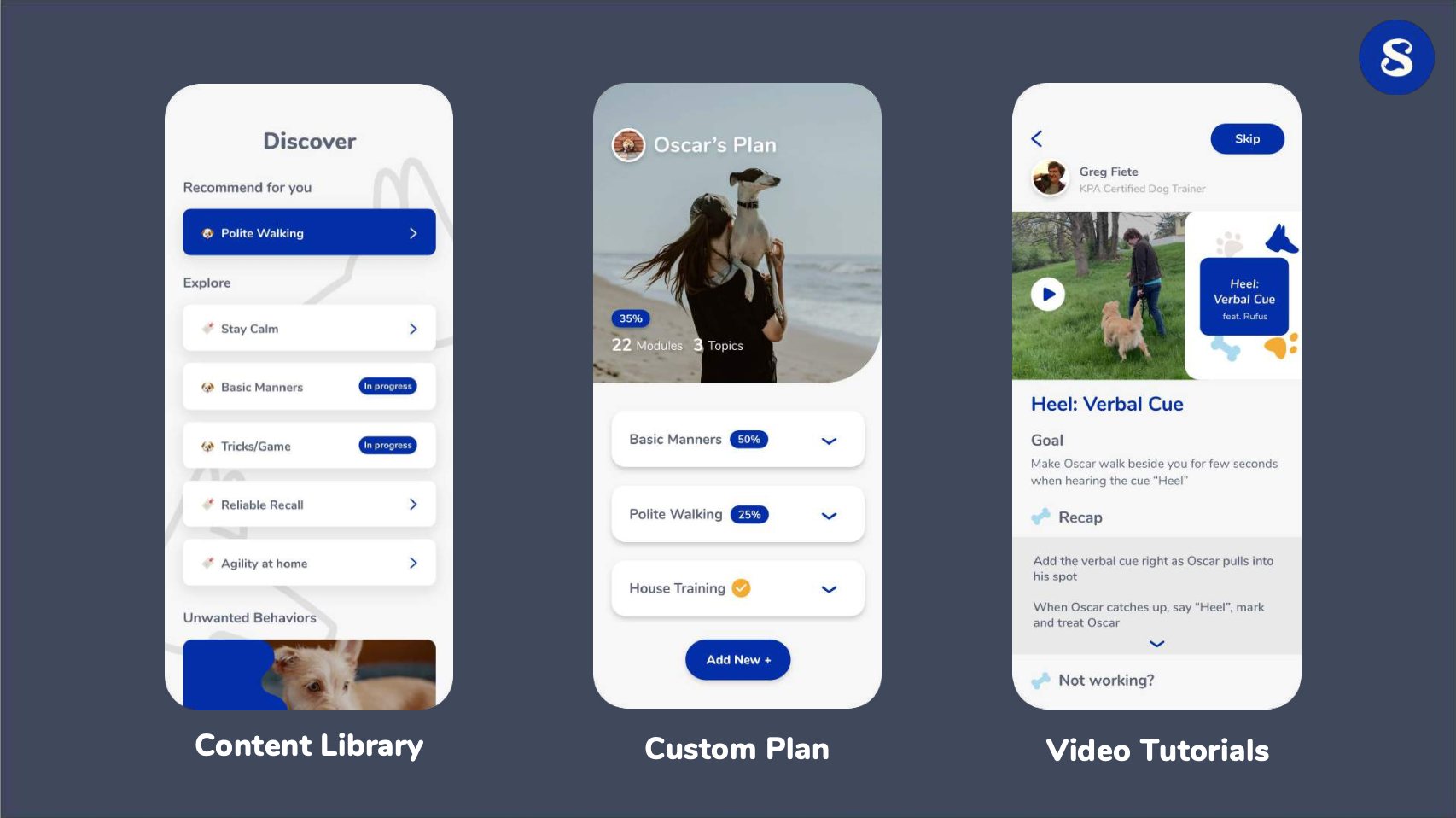

The decks are getting better and better in terms of design. I think more and more people have realized that the visual representation of your deck is just as important as the material and the content that’s in there. There’s these instinctive milliseconds that an investor looks at your deck and almost makes a snap judgment about whether it’s even in the realm of something they want to look at it. Unfortunately, it shouldn’t be like that, but we’re human. So I’m seeing decks that are super polished, and I don’t know where everyone is getting these great graphics from, but they’re amazing. (Timestamp: 1:48)

Most pitch decks are based off templates, and therein lies a key trade-off: How much should you rely on a template versus being “original,” but different and perhaps harder to read? Karim noted that sometimes originality can pay off:

The best pitch deck that I got in a different format would be from a company that recently got into TechStars — it was actually a podcast version of their pitch deck that had my face on it. I went into Apple Podcasts and it said, “Hey, Saba, here’s my pitch.” That was amazing! But the second or third time that happens, it might not be as impressive because I’ve seen it before. (Timestamp: 3:41)

Hershenson pushed founders to consider keeping to the standard templates because it can help VCs focus on what makes each business unique.

For us, having the pitch in a format that we are able to consume in an efficient way is super important. There are a lot of templates online, we all know the key points that need to be hit on in a deck. So your job as a founder is to hit those in a deck of 10 to 15 slides and kind of do the hard work of synthesizing your business in a short format. I think you can be original, but sometimes being original is to your detriment.

I can tell you my own story. When we were first fundraising for Pear, we decided we were going to be really original: We’re going to use Prezi to send decks to LPs. And that was just totally the wrong call, because it’s almost like, “What did they just send me?” (Timestamp: 4:29)

One of the interesting dynamics that has shown up in the last year has been the rise of Notion as a form for fundraising. Responses from our panel were muted. Hershenson said Notion isn’t an excuse for not being succinct.