Traditionally, companies hold in-person sales kickoffs (SKOs) in January and February to network, educate sales teams about new products and devise strategies for the year ahead.

These days, the convention centers and hotel ballrooms that once hosted those events are dark and quiet.

Even though most employees are vaccinated, companies are still reluctant to send them to in-person events, and in the midst of a pandemic, many workers are reluctant to get on a plane.

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

One recent survey of sales and marketing professionals found that only half of respondents said they were likely to attend an event in H1 2022.

Hybrid events won’t give teams a chance to bond over karaoke, but with a tight agenda and a compelling theme, you can create a virtual or hybrid SKO that people will actually want to attend.

If you lead a sales team, this post shares several strategies for finding a theme that reflects your goals, as well as advice on scheduling, and tips on ways to express your company culture.

Even if your team is spread across several time zones, there’s still time to grab a sandwich and network: after all, Zoom karaoke still counts as team-building.

Thanks very much for reading TechCrunch+ this week!

Walter Thompson

Senior Editor, TechCrunch+

@yourprotagonist

With a $22B run rate, does it matter if Google Cloud is still losing money?

Image Credits: Lyu Liang/VCG via Getty Images

“You’ve got to spend money to make money” is a cliché, but if you’re building a company that hopes to compete in the cloud, it’s a fact.

This week, Google Cloud reported $5.5 billion in revenue for Q4 2021, but “that was the good news,” reported Ron Miller and Alex Wilhelm.

“The bad news was that Google Cloud accrued operating losses worth $890 million at the same time.”

Given such high stakes, industry watchers don’t seem overly concerned by these ongoing losses, however.

“Businesses of this nature require a lot of upfront investment and buildout of infrastructure and often don’t break even for several years,” said John Dinsdale, chief analyst at Synergy Research.

3 ways web3 recruiters can improve their hiring game

Image Credits: motorenmano (opens in a new window) / Getty Images

You wouldn’t hire a plumber to redo your wiring, and you shouldn’t hire a web3 developer if you’re building a team for your metaverse startup.

Investors are swooning over startups in these sectors, but a fat pre-seed check is not a hiring strategy.

Making matters more difficult, most developer talent is focused in a few verticals, and any offers you make must compare to incentives from companies like Apple and Microsoft.

“Engineers don’t want to only be putting out fires, they want to create and pioneer projects,” says Sergiu Matei, founder of remote talent platform Index.

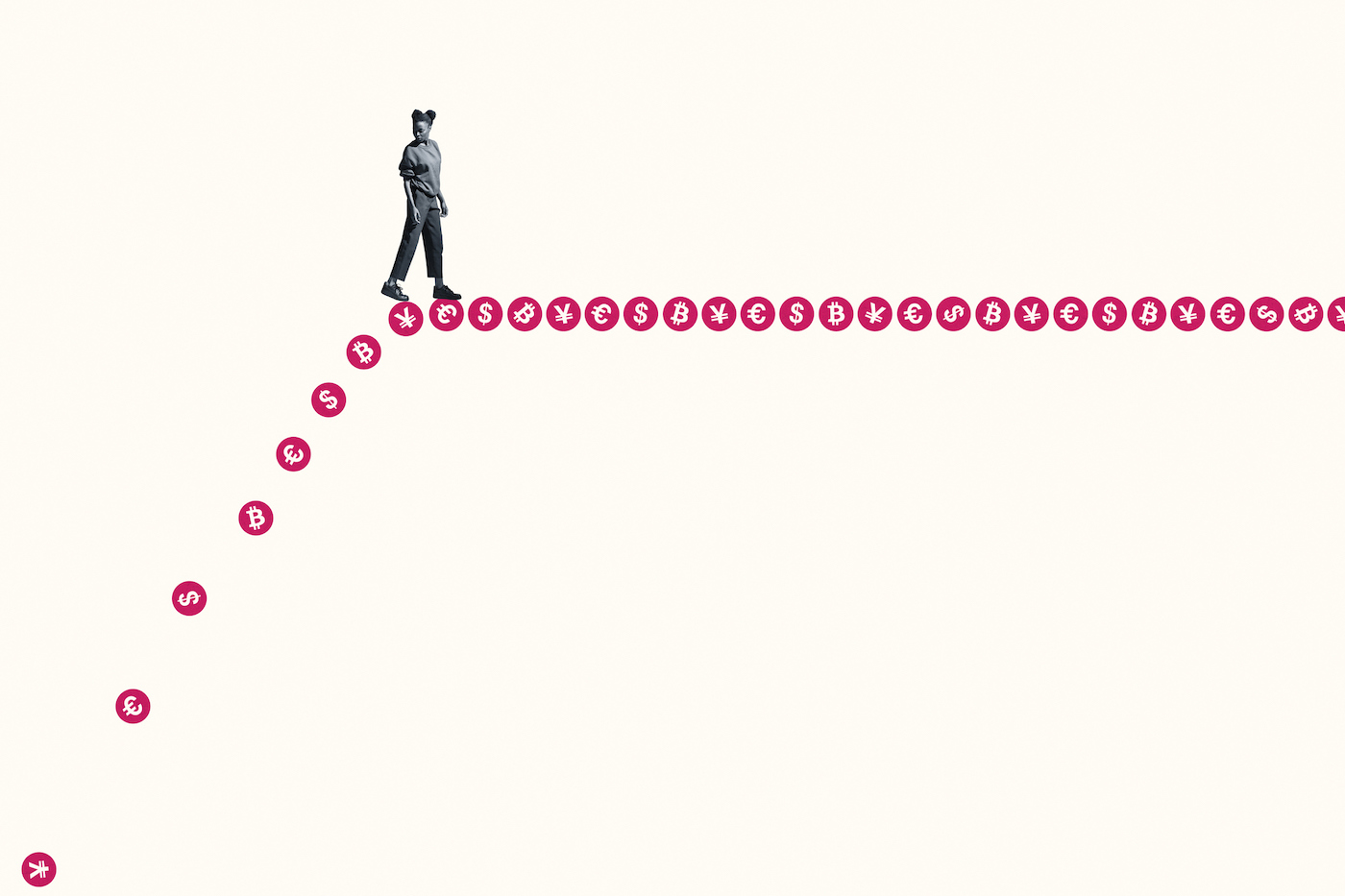

Despite bumps, crypto investment starts 2022 with a roar

Image Credits: Nigel Sussman (opens in a new window)

The crypto market hasn’t had a good year so far, with Bitcoin losing nearly a fifth of its value, and other tokens seeing similar declines.

But VCs don’t seem to mind. In fact, funding for blockchain startups has already exceeded $4 billion so far in 2022, and investors seem intent on keeping up the pace, wrote Alex Wilhelm in The Exchange.

“Sure, SaaS valuations are coming back to Earth, and some investors are taking things a bit more slowly than before — at least so we’re told — but that newfound, or perhaps reforged, conservatism does not appear to be taking hold in the crypto market.”

Fintech outperformed the market in 2021, and it’s set to do even better

Image Credits: NatalyaBurova (opens in a new window) / Getty Images

Public technology companies had a banner year in 2021, but fintech firms significantly outperformed the major stock indexes, according to a report by Matrix Partners.

Dana Stalder and Matt Brown from Matrix outlined the most interesting fintech trends of 2021 for TC+, and explained why they believe the sector will fare better than the broader market in 2022 as well.

“Fintech’s consistent outperformance signals that the changes brought about by COVID-19 – including shifts toward e-commerce, online payments and digital interactions over physical ones – are here to stay.”

The MariaDB SPAC deal could prove to be a key test for unicorn exits

Image Credits: Nigel Sussman (opens in a new window)

SPACs had a great run. But nothing lasts forever.

However, open source relational DB provider MariaDB’s SPAC deal may be a bellwether for startups too expensive to be sold, but not yet mature enough to IPO, wrote Alex Wilhelm in The Exchange.

“MariaDB is getting a pretty good price for its equity and a bundle of cash to boot. The transaction indicates that unicorns and companies near that valuation mark with mid-double-digit ARR can find a SPAC partner that will take them to the public markets far in advance of when they might be able to on their own.”

3 views: What does ‘Line Go Up’ tell us about the state of the NFT art market?

Image Credits: Bloomberg (opens in a new window) / Getty Images

Collectors spent $22 billion on NFTs in 2021, up from $100 million the year before.

Last month, Canadian videographer Dan Olson released a two-hour video about his strongly held views on web3 and blockchain technology titled “Line Goes Up — The Problem With NFTs.”

I asked John and Alex to share their thoughts on Olson’s video as a point of departure for discussing the state of the crypto industry in general. Here’s where we ended up:

- Walter Thompson: NFTs are scarcely minimum viable products

- John Biggs: A shakeout has to happen for the tech to take off

- Alex Wilhelm: I just don’t want your NFT

11 ways to make personalized shopping more effective and profitable

Image Credits: ounes Kraske (opens in a new window) / Getty Images

My favorite story from my time working in retail: helping a familiar customer find a book they were looking for, even though the only detail they could remember was that it had a blue cover.

I reflect on that moment whenever I consider how essential personalization is for online sellers. E-commerce platforms should use every signal they can detect to triangulate shoppers along the customer journey, writes Vitaly Alexandrov, founder and CEO of Food Rocket.

Alexandrov takes us on a deep dive of the online shopping space, sharing marketing tactics and data insights that make mundane shopping experiences more memorable.

“There is no longer a question of whether or not you should offer personalized digital experiences. Anything less is a death knell to your brand’s long-term success.”

As public tech valuations fall, are startup investments evolving quickly enough?

Image Credits: Nigel Sussman (opens in a new window)

When a stock’s value falls 10% or more from its most recent high, it’s called a correction. This week, shares in Facebook, PayPal, Spotify, Snap and other high flyers saw double-digit percentage declines.

In yesterday’s edition of The Exchange, Alex Wilhelm looked at public tech valuations and concluded that the ground is shifting underfoot.

“Why? Investors had valued a host of companies like their pandemic bump was more akin to their new reality. However, it turns out that a lot of pandemic growth wasn’t free — it came at the expense of later growth.”